What 4 studies say about the 2024 rate cuts and stock returns

Investors waiting for rate cuts are hoping for a return of the good old “cheap money” days. Data says we're in for a bumpy ride.

TLDR:

1. Why investors care about interest rates: it's all about valuation, what alternatives investors have ("TINA"), and what interest rates say about the economy and earnings expectations.

2. What data says about what happens when interest rates are cut: and what can investors expect?

3. What should we do next? (Or at least what I plan to do next).Why do investors care about interest rates?

We know what happens when we see interest rate hikes – both stocks and bonds tend to crash. This was the case in 2022, for example, when a spike in inflation worldwide forced most central banks to hike interest rates.

That’s history by now – with inflation cooling down, most investors are expecting rate cuts soon, and the market is “pricing it in” as a really positive thing for stocks. We’re back at all-time highs.

But why do investors care so much about interest rates, anyway? There are a couple of answers to this question.

First, interest rates are a key piece when calculating the valuation of a company.

That’s because, when we calculate the valuation of a stock we basically compare the future cash flows to the interest rate.

The formula is less theoretical than you think.

You can think of it as saying that we have two options: either buy the stock that pays cash flows, or buy super safe Treasury bonds that pay a risk-free interest rate.

Which brings me to the second reason why investors keep an eye on interest rates: TINA.

TINA stands for “There Is No Alternative”. Basically, when interest rates are low or even zero, as they’ve been up until 2022, all risky asset prices (stocks, gold, property, bitcoin, etc) tend to go up. The only way to earn a return on your money is to invest in risky assets – not keep them in a high-yield savings account or buy a bond.

Which is why risk-loving investors are waiting for rate cuts now and hoping for a return of the good old “cheap money” days.

The last reason why investors care about interest rates is that they can be a signal about the economy.

Most central banks raise interest rates to cool down inflation – and lower them to “stimulate” the economy, usually in response to a slowdown, unemployment, or maybe even a crisis like the one in 2007.

But while low interest rates are good for stocks, a bad economy isn’t. That’s because stock market performance is all about corporate profits – and consumers not buying iPhones because they’re unemployed isn’t going to increase Apple’s profits.

But let’s not get too theoretical – let’s have a look at what data has to say about rate cuts and stock market returns.

What does the data say?

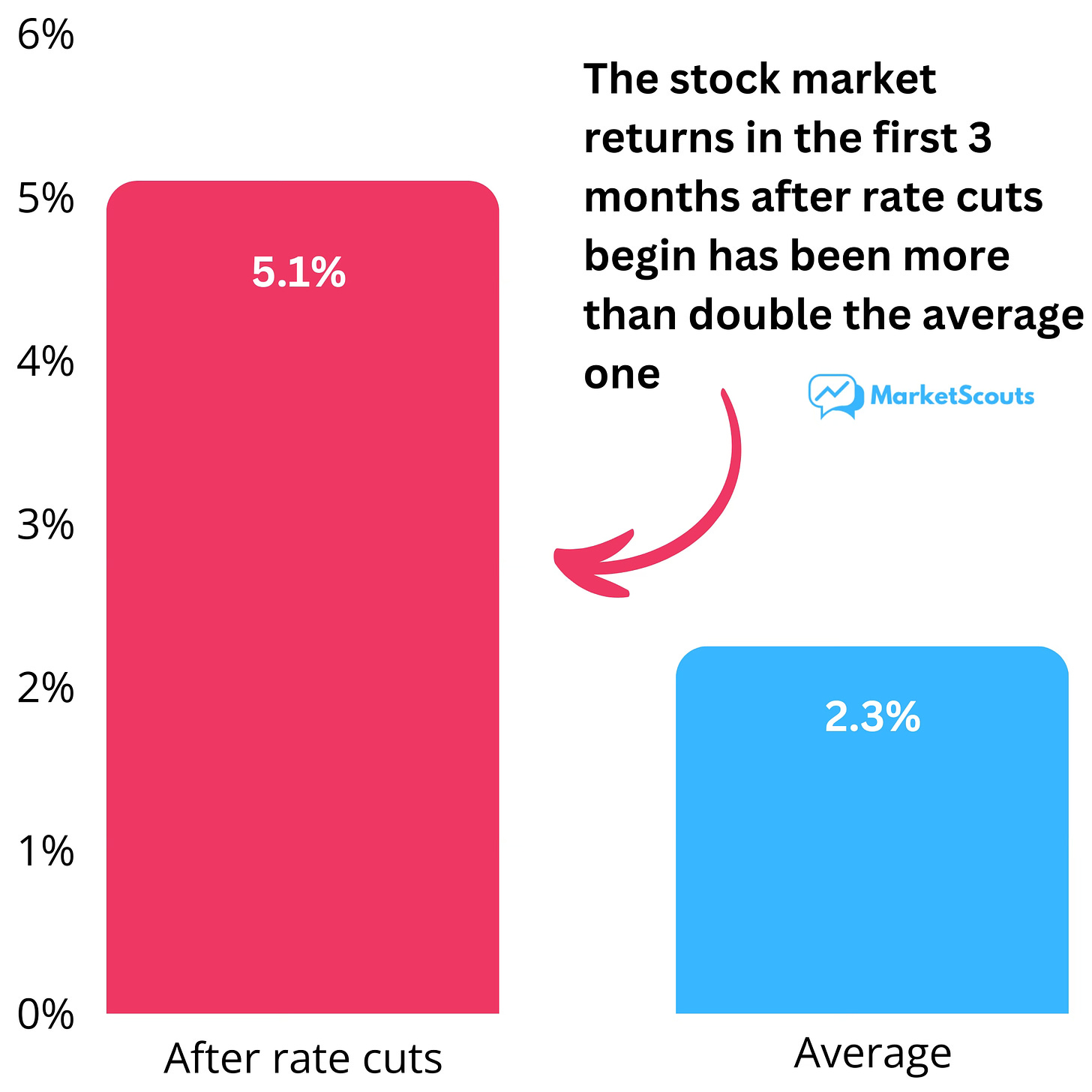

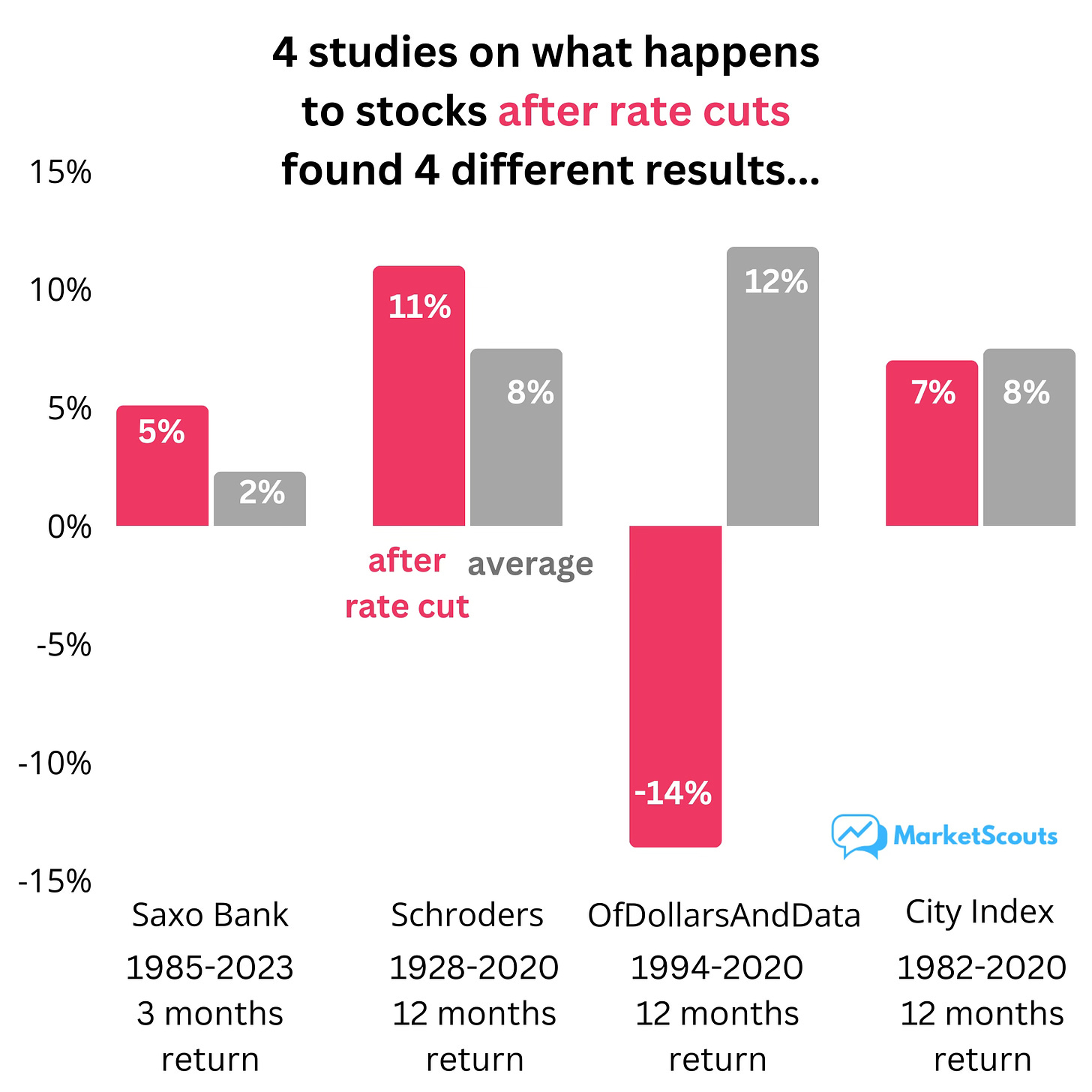

The first example I found was a study from Saxo Bank.

They looked at 9 rate cute cycles from 1985 onwards, and found that interest rate cuts are rarely seen as negative, and that US stocks tend to rise in the first 3 months after a rate cut cycle has begun. Not only that, but the average S&P 500 gain in these three months was 5.1%. That’s much higher than the average 3-month S&P 500 return of 2.3%.

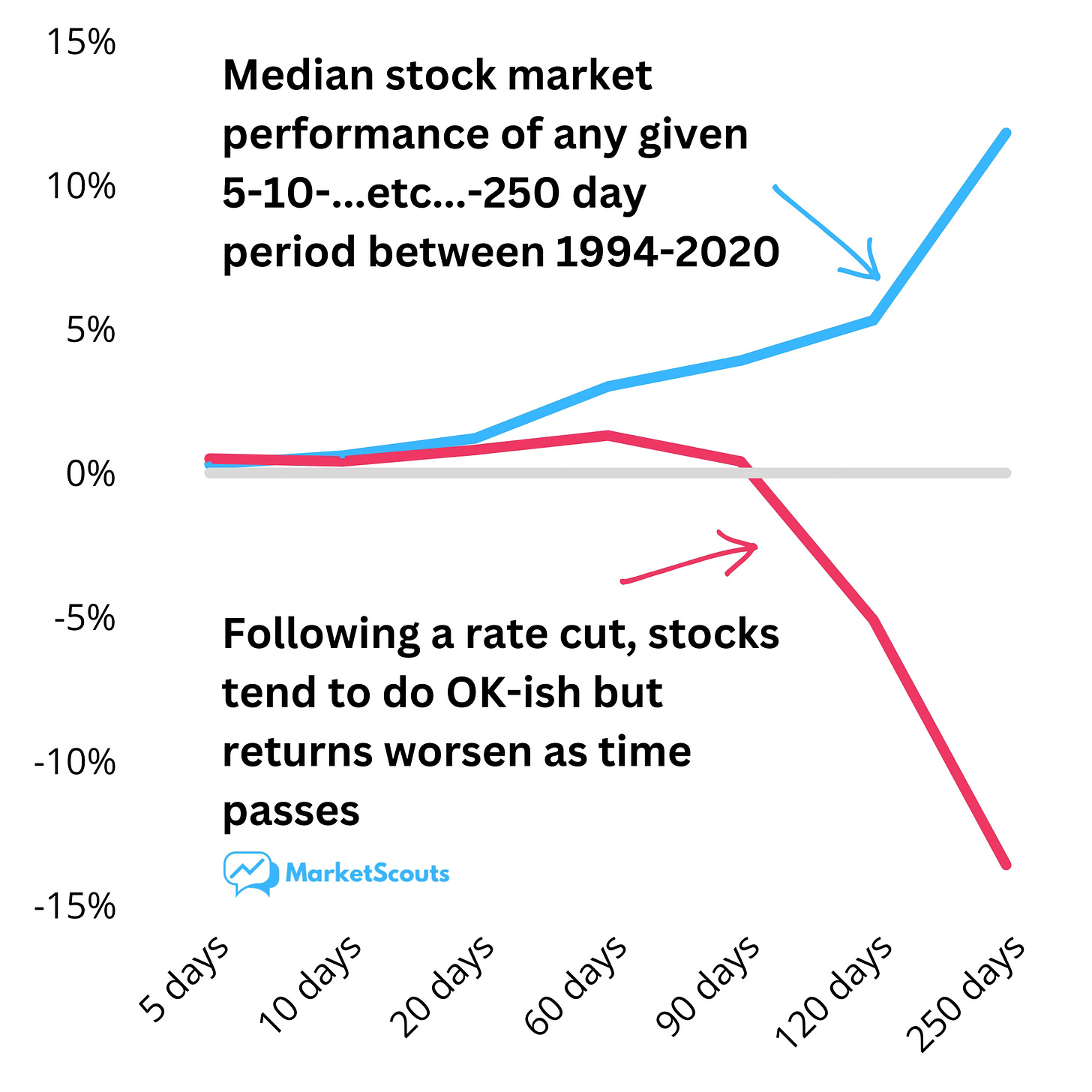

The second study I found was Nick Maggiulli’s research. He’s the Chief Operating Officer and Data Scientist at Ritholtz Wealth Management and he also writes a great blog called OfDollarsAndData.

He looked at both cuts and hikes for the federal funds rate since 1994, when the Fed started publicly announcing their rate changes, to 2020. That’s 77 rate changes in total.

His finding? Fed rate cuts are usually followed by subpar U.S. stock performance. And as time passes, performance worsens even more.

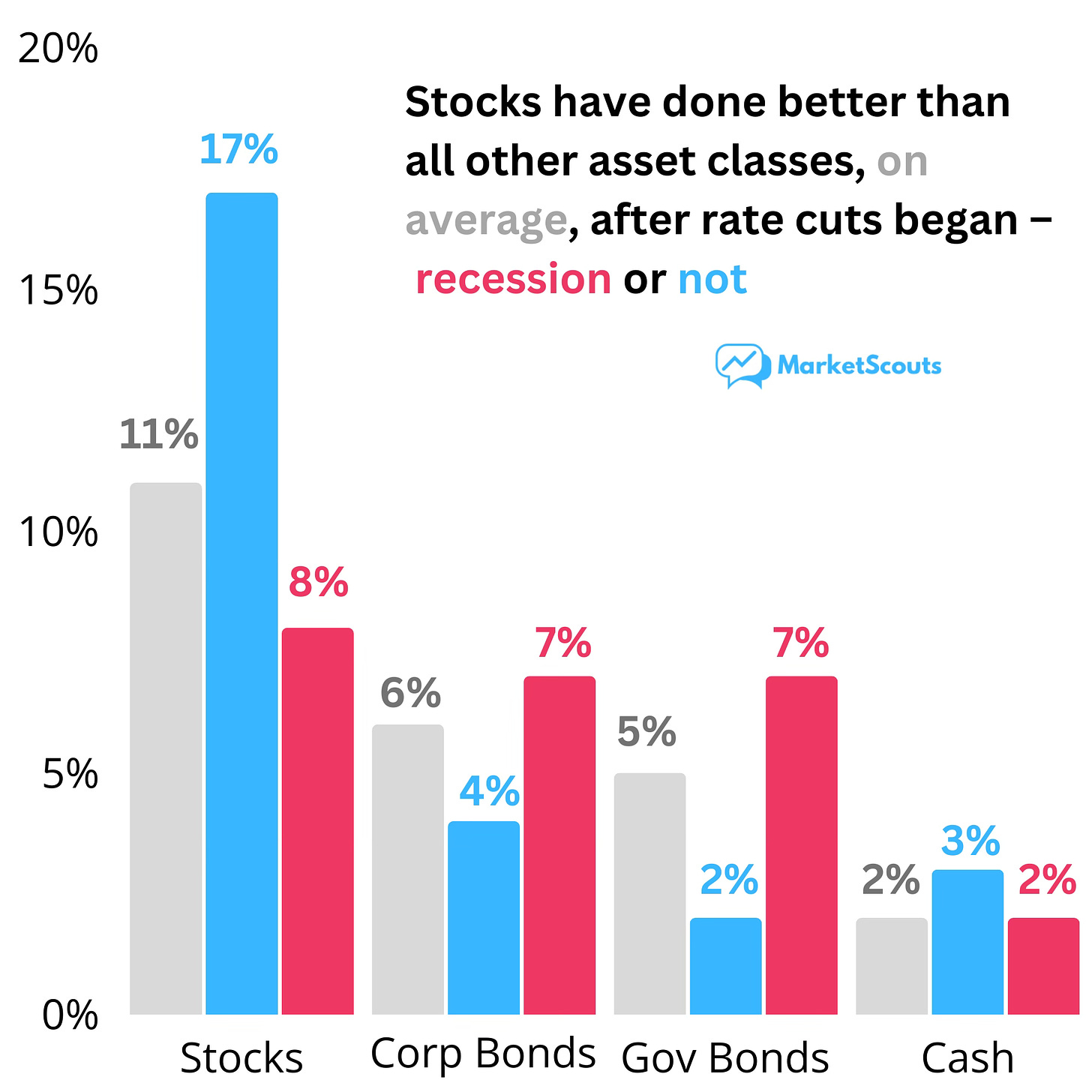

The third study I found is from the UK investment group Schroders.

Their team went back even further, to 1928, and looked at 22 rate cuts, and found that, on average, investors can expect to see a good year for bonds – and an even better one for stocks. That’s been the case even in recessions:

Notice how these studies all talk about “average” and “median” (another kind of average if you’re bad at math). But that’s not the only thing that matters. We also need to know just how much the actual returns vary. How big is the volatility following rate cuts?

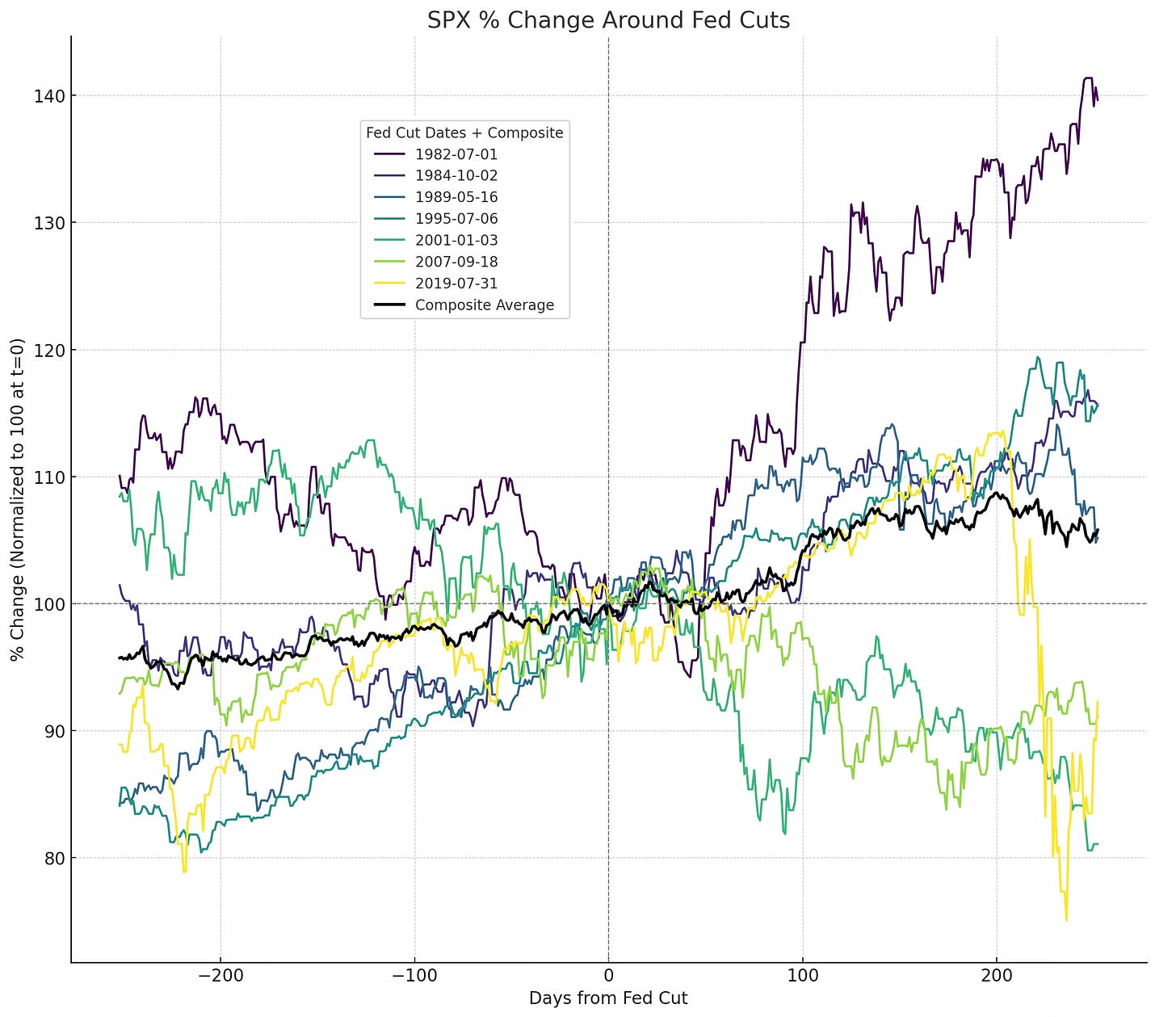

Luckily, a study from City Index and StoneX looked exactly at this.

They found that the S&P 500 has low volatility leading into the first cut of a new cycle. Once that rate cut cycle starts, volatility skyrockets, with S&P 500 returns over the next year ranging from -20% to +40%.

What should we do next?

Overall, the studies above are a bit of a mixed bag:

That’s what happens when you look at the stock market and choose different time frames – almost any result goes.

Still, a few lessons stand out.

First, the market tends to already price in the rate cuts, before they happen. Once rate cuts actually start, returns tend to be lower than average.

The reason is probably a combination of “buy the rumor, sell the news” and “the economy’s in trouble, sell everything”. The Fed doesn’t cut rates to please investors – it cuts in response to a slowing economy, which also means lower corporate profits. And as I’ve mentioned in the previous MarketScouts post, stock market returns are all about profits.

This also explains why the Schroders study found that, if the Fed cuts rates but there is no recession, stock returns are much higher than average.

Second, expect a bumpy ride once rate cuts begin.

Don’t let the “calm before the rate cuts” fool you into thinking the landing will be soft. It might be for the economy, but not always for the stock market.

Third, diversify.

Different asset classes will behave differently. Stocks will crash if rate cuts are started because of a recession – but bonds could do well because they’re seen as a safe haven. And in any case, all asset classes tend to beat cash on average – even if their return will not always be as strong as before the rate cuts started.

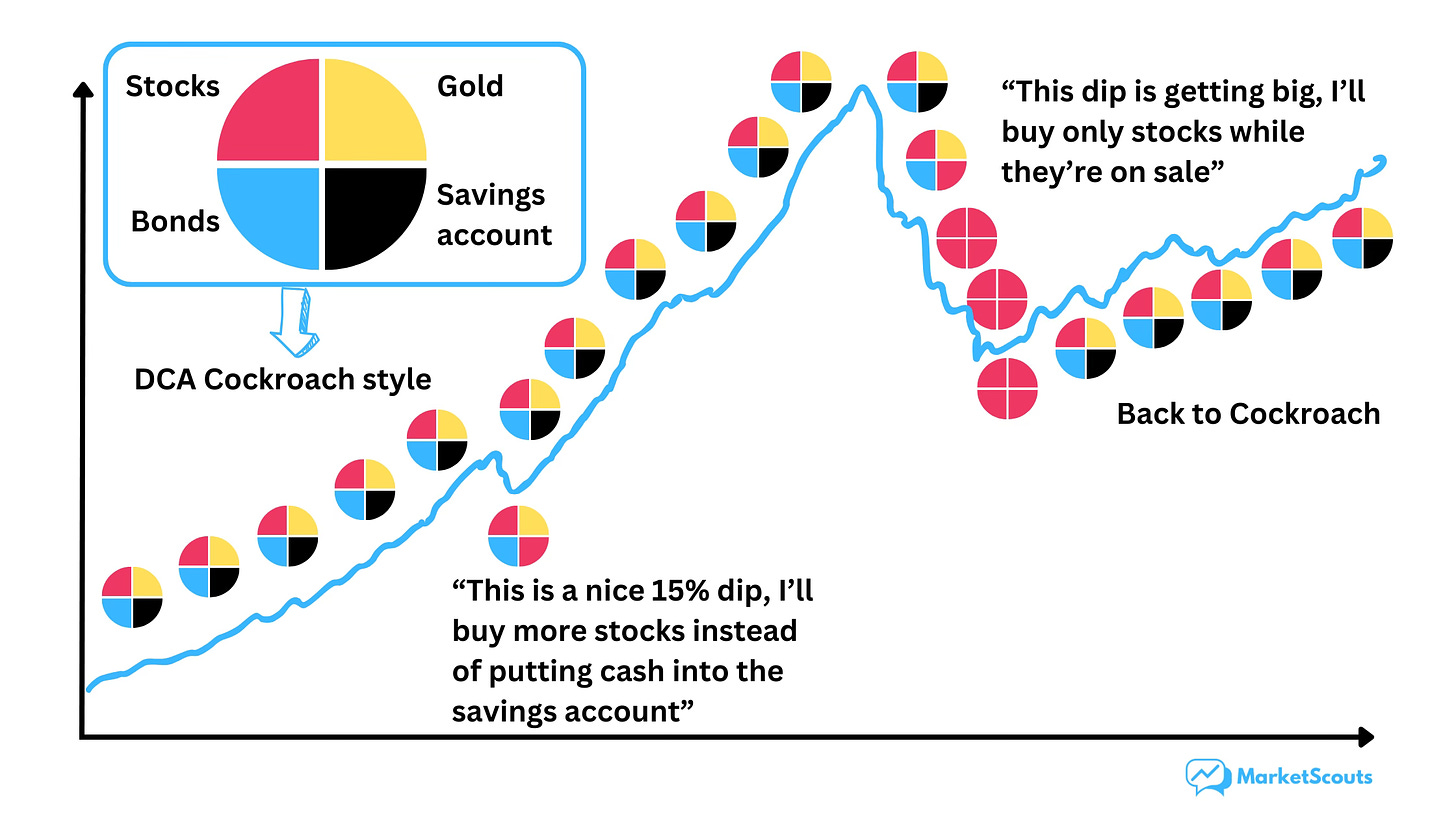

One of my favorite ways to build a portfolio is to start with the Cockroach Portfolio, keep DCA (dollar-cost-averaging) into it every month, rebalance twice a year, and adjust if I see a big dip or find a really undervalued stock or fund.

I can’t and won’t give you specific advice on what to do – nobody can predict the markets. But what I personally plan to do is do exactly what I said above – invest every month, diversify, and focus on opportunities if and when I see them.

My approach in one chart:

One more thing about diversification: nobody’s forcing you to just buy the S&P 500. Most of its returns in 2023 came from just a handful of companies – Apple, Microsoft, and the other “Magnificent Seven” – while the other 493 barely moved.

There are plenty of fast-growing, profitable, and deeply undervalued companies outside of this index, both in the US and abroad. In my previous post I started researching which countries to invest in. In my next one I’m going to dive into some of these countries and look at the ETFs covering them (and the companies inside those ETFs) one by one:

Stay tuned, and if you liked this post, consider sharing it with a friend!

Do you cover Canada?