How to invest when nobody has any idea what to invest in

Let's backtest some popular portfolios and see which one might be suitable for a market that's stuck between fear and greed.

It might seem that the markets are doing great right now: the S&P 500 just had a great week (and is up 16% on the year), bitcoin is up more than 113% on the year too, and even bonds bounced back a little.

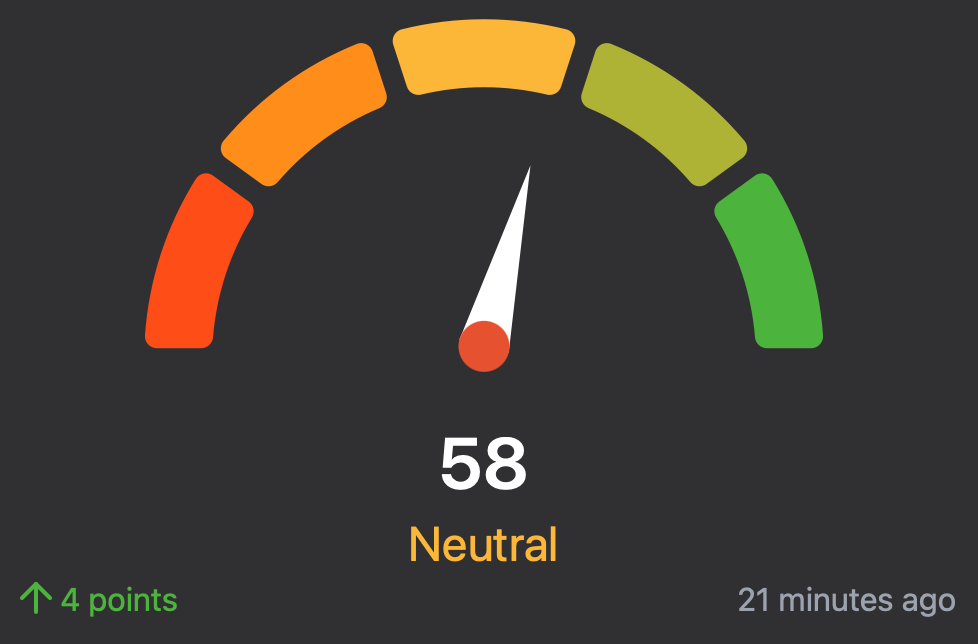

So why is the Fear and Greed market indicator stuck in “neutral”?

Financial media gives answers that are all over the place:

Reuters: “Traders bet that cooling inflation will allow the Federal Reserve to start cutting rates by May”

CNN: “Federal Reserve Chair Jerome Powell is leaving the door open for additional interest rate hikes to defeat inflation”

WSJ: “Cathie Wood investors are worrying about the wrong thing. Deflation is the real risk.”

Seeking Alpha: “Ray Dalio warns of WW3, doubles down on China stocks”

Goldman Sachs: “2024: The Hard Part Is Over”

This is of course the usual noise. But dig a little and you’ll see that investors do seem on the sidelines:

volume is low

volatility (the VIX index) is also low

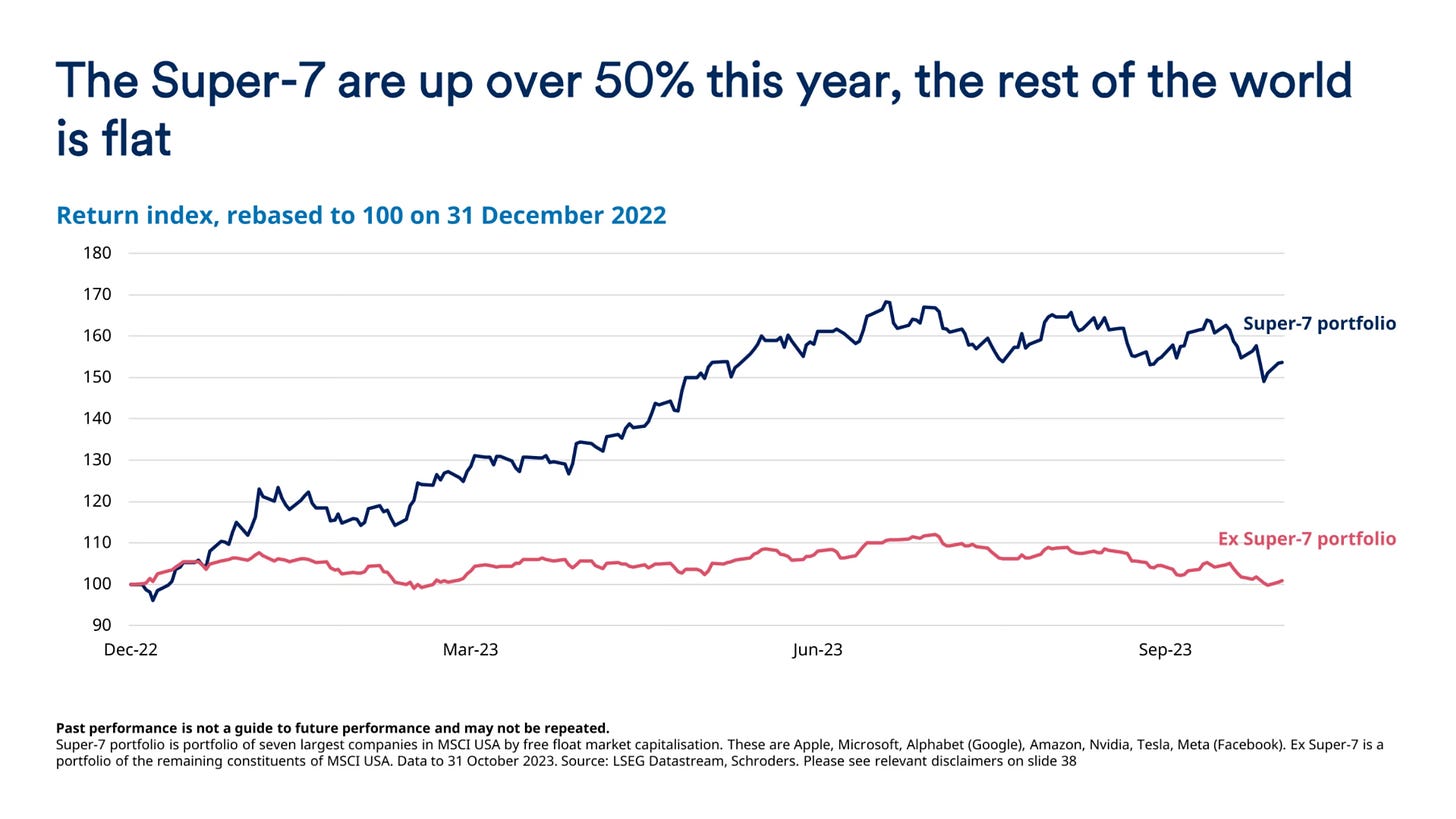

and if we ignore the largest 7 companies in the S&P 500, the rest 493 are surprisingly flat for the year:

What now?

Let’s say we’re concerned that the market is going to experience some sort of crash in the near future. We’re not forecasting here – we just want to make sure we don’t lose too much capital.

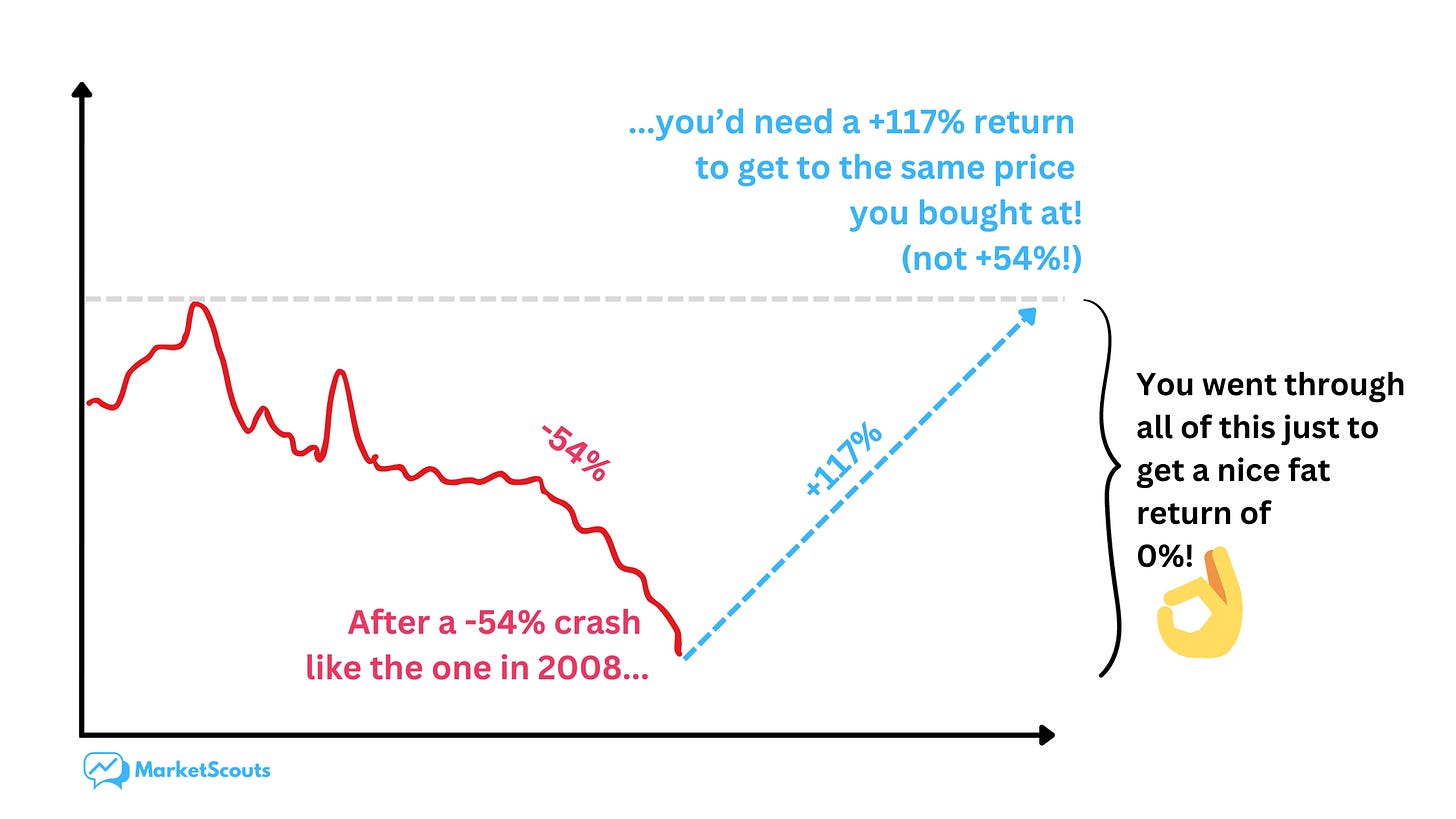

This part is the most important one: it’s much harder to “get back up” than to lose money on the way down.

Now at this point you might want to sell everything and go 100% into cash. And I don’t blame you. But staying invested is the only way to win – cash will only be eaten away by inflation.

So I thought we’d look today at a kind of portfolios that are diversified and ready to do well in a lot of situations. They’re called “lazy portfolios”.

What are lazy portfolios?

Lazy portfolios are basically a mix of investments that require almost no extra work from you. Many investors like lazy portfolios for a couple of reasons:

They’re great for busy people.

They’re also built from low-cost ETFs. Those fees add up otherwise.

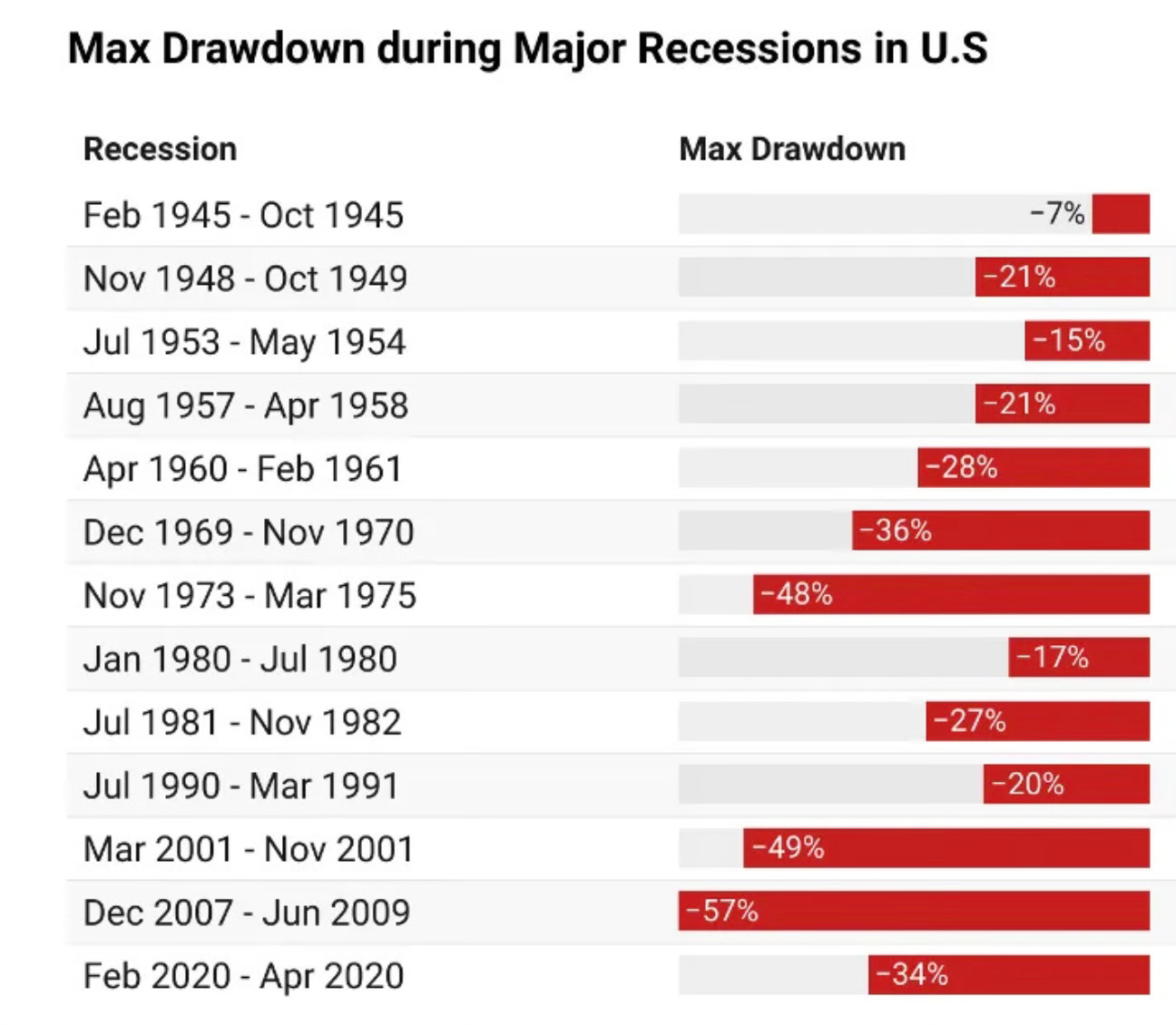

They also tend to have lower drawdowns (“paper losses”) compared to the overall stock market – when there’s a crash.

Finally, they’re also easier to stick with. This is my favorite reason – they can save you from panicking and selling for a loss.

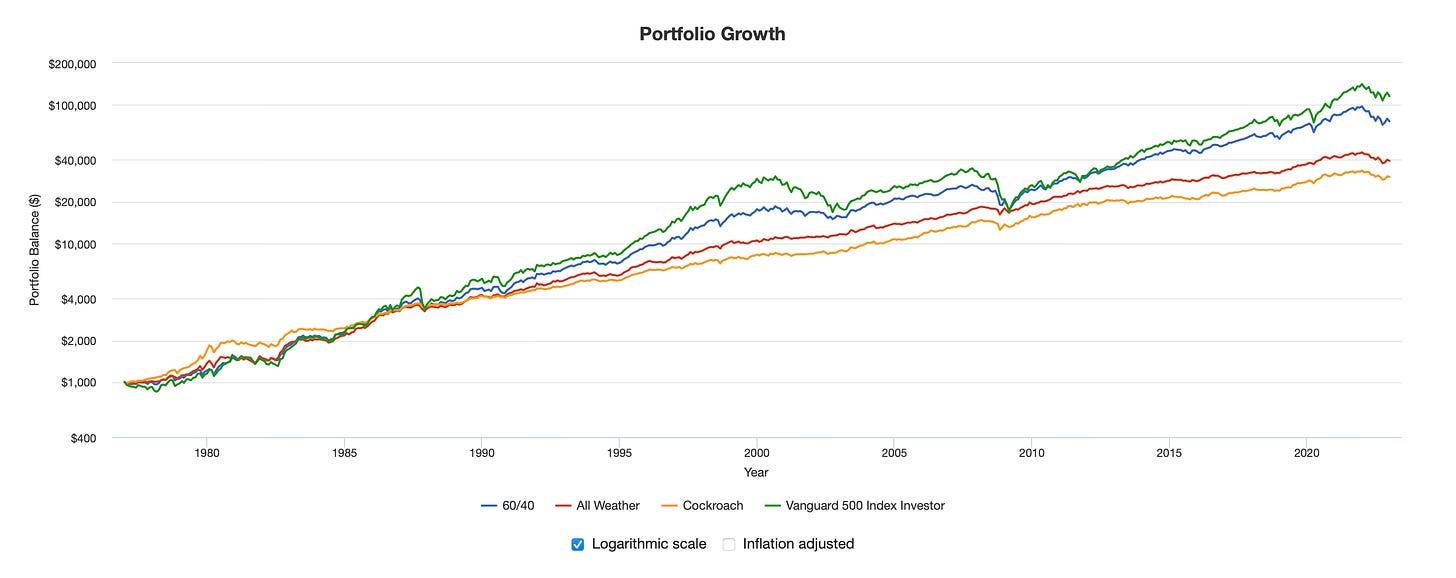

So let’s pick some popular lazy portfolios and use Portfolio Visualizer to backtest them against everyone’s favorite benchmark, the S&P 500.

How good are lazy portfolios in uncertain times?

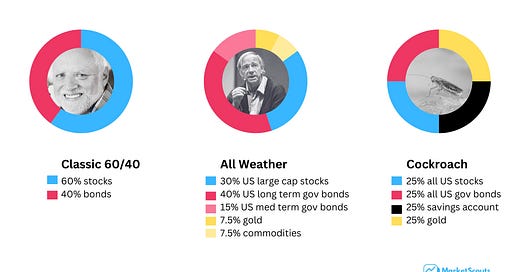

The lazy portfolios we’ll look at today are:

the Ray Dalio All Weather Portfolio (top favorite on LazyPortfolioETF.com)

the Cockroach portfolio: a portfolio that focuses specifically on minimizing drawdowns.

has a great series of posts on it.and the classic 60/40 portfolio.

Here’s what they’re made of:

Let’s start in mid 1970s, on the eve of one of the largest waves of inflation seen in the US:

It’s easy to look at this chart and say “I’ll pick the green line, please”. But that assumes that we started investing at just the right time – and managed to stay invested for almost 50 years.

That’s a long time. Let’s look at a few more realistic options:

we’ll invest $10,000 right at the start of a major crisis: the 1970s inflation wave, the 2000 dot-com bust, and the 2007 crisis. Worst case scenarios.

we’ll also contribute $100 monthly. Right on payday. As you should!

we’ll also stop after 10 years, which might be a more realistic timeline for most investors. In terms of expectations, at least.

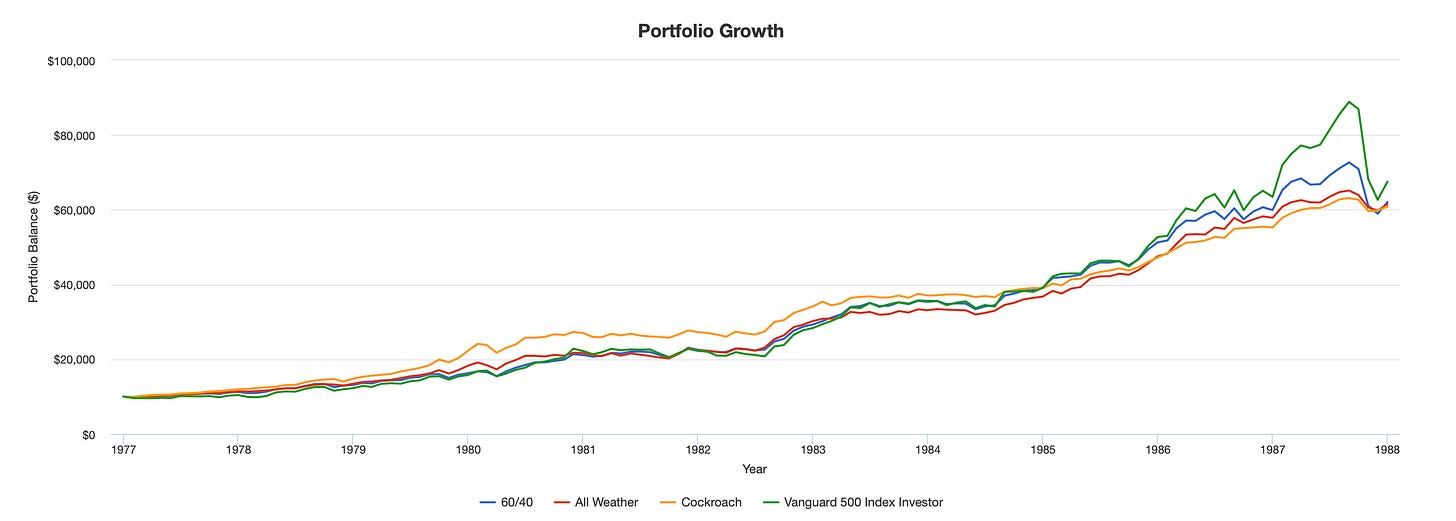

First, the 1970s-1980s inflation wave:

Interestingly, the Cockroach portfolio did much better than the portfolios made of stocks or bonds.

That’s down to its high gold content but also to the fact that the yield on cash savings was actually quite good. As the Fed was trying to quash inflation, interest rates for deposits went up. As did gold.

Also, take a look at that drop there at the end. The S&P 500 went down -25% in two months. Meanwhile the Cockroach went down only -5%.

So if inflation is going to be around for a longer time than we think (as some are saying), then the Cockroach portfolio might be the way to go.

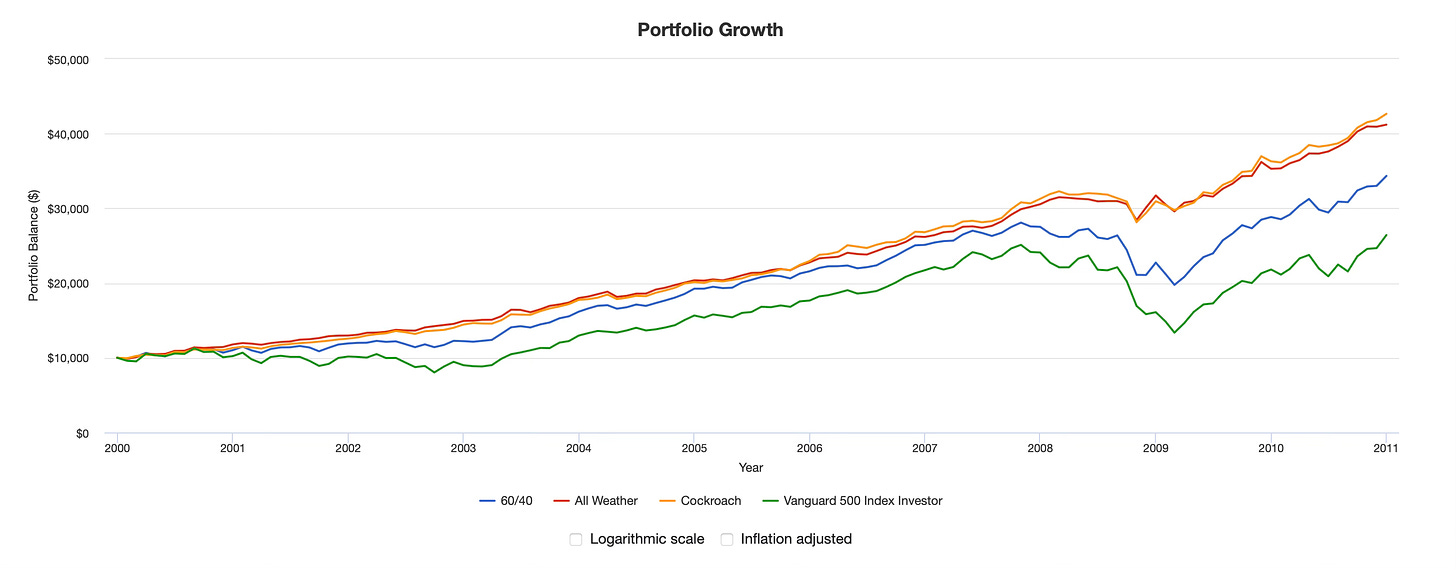

Next, the 2000 dot-com boom and bust:

Again, surprising results. This is why choosing the time frame matters: it’s easy to say that stocks only go up – but that’s only true for the very long term.

The Cockroach portfolio is the winner this time too. But I am shocked – not only did the average stock market investor get to “experience” two crashes (one which halved their portfolio), but that extra dose of risk didn’t even amount to anything.

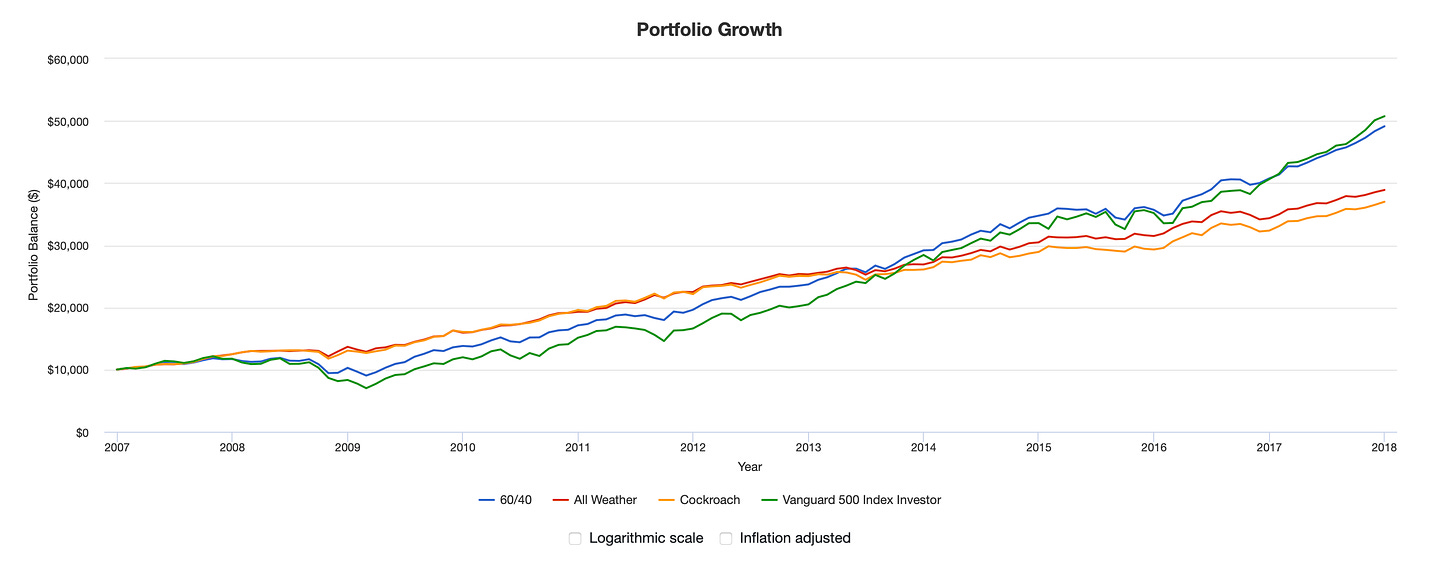

Let’s go to 2007:

Finally, some good news for stock market investors. The S&P 500 wins this time, although it did take almost 7 years for it to catch up to the Cockroach – “thanks” to that -50% drawdown in 2008-09.

So what should we do?

There is a certain kind of finance influencer out there who keep banging on about the same thing: “zoom out: the stock market always goes up in the long term.”

But there are three important things to keep in mind:

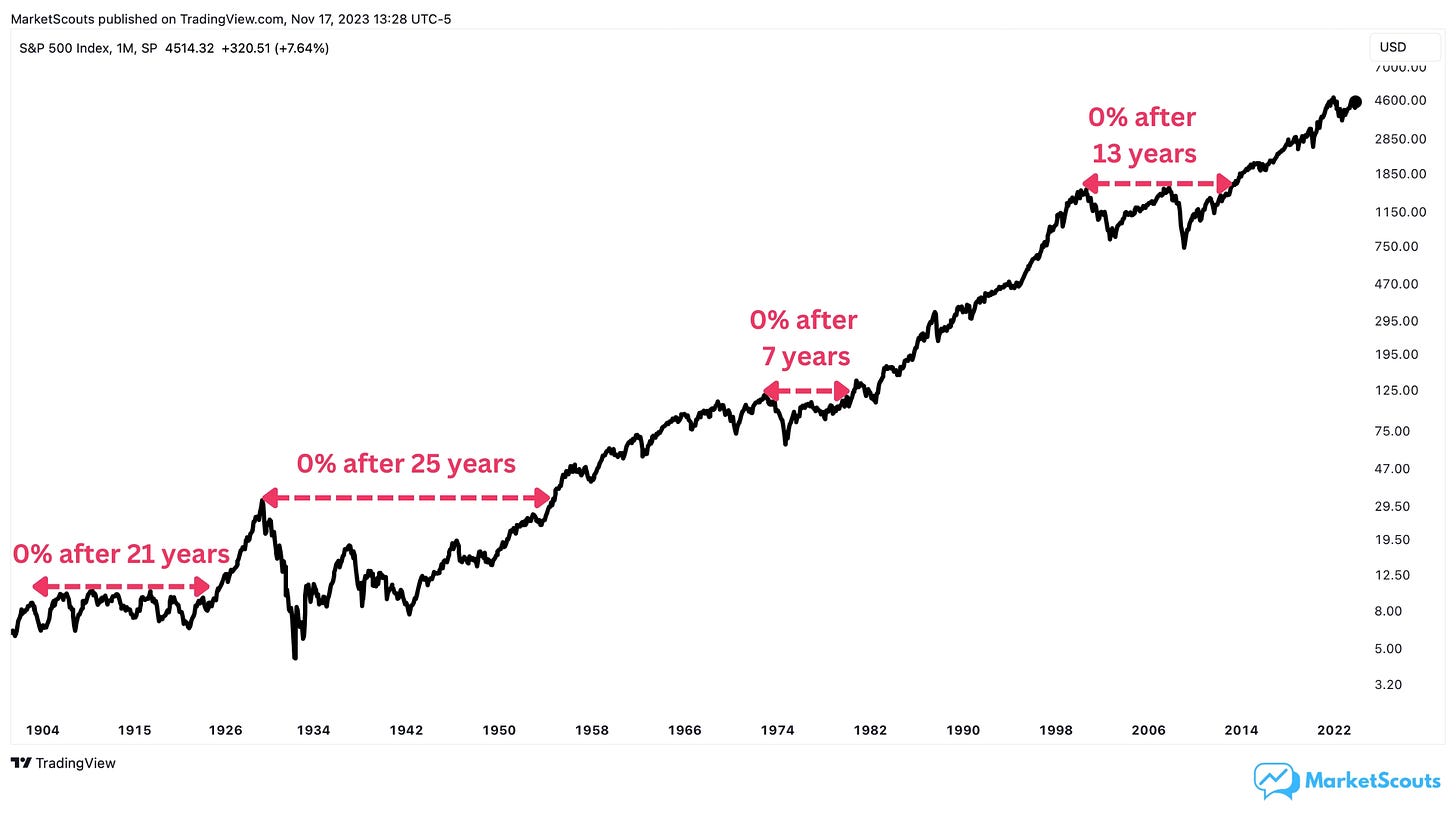

The timeframe matters

You can’t “zoom out” forever. Let’s say you invest now expecting to use that money, say, for retirement in twenty years. How do you zoom out if there’s a -50% crash six years before retirement?

Zooming out works best if you start investing really early. In this case, sure, buy more volatile, riskier assets (stocks, cryptos). You have time to “bounce back”.

Markets change

If you invested a big chunk in US stocks at the wrong time, you could have looked at 10-20 years of almost 0% returns.

But hey, nobody invests that way.

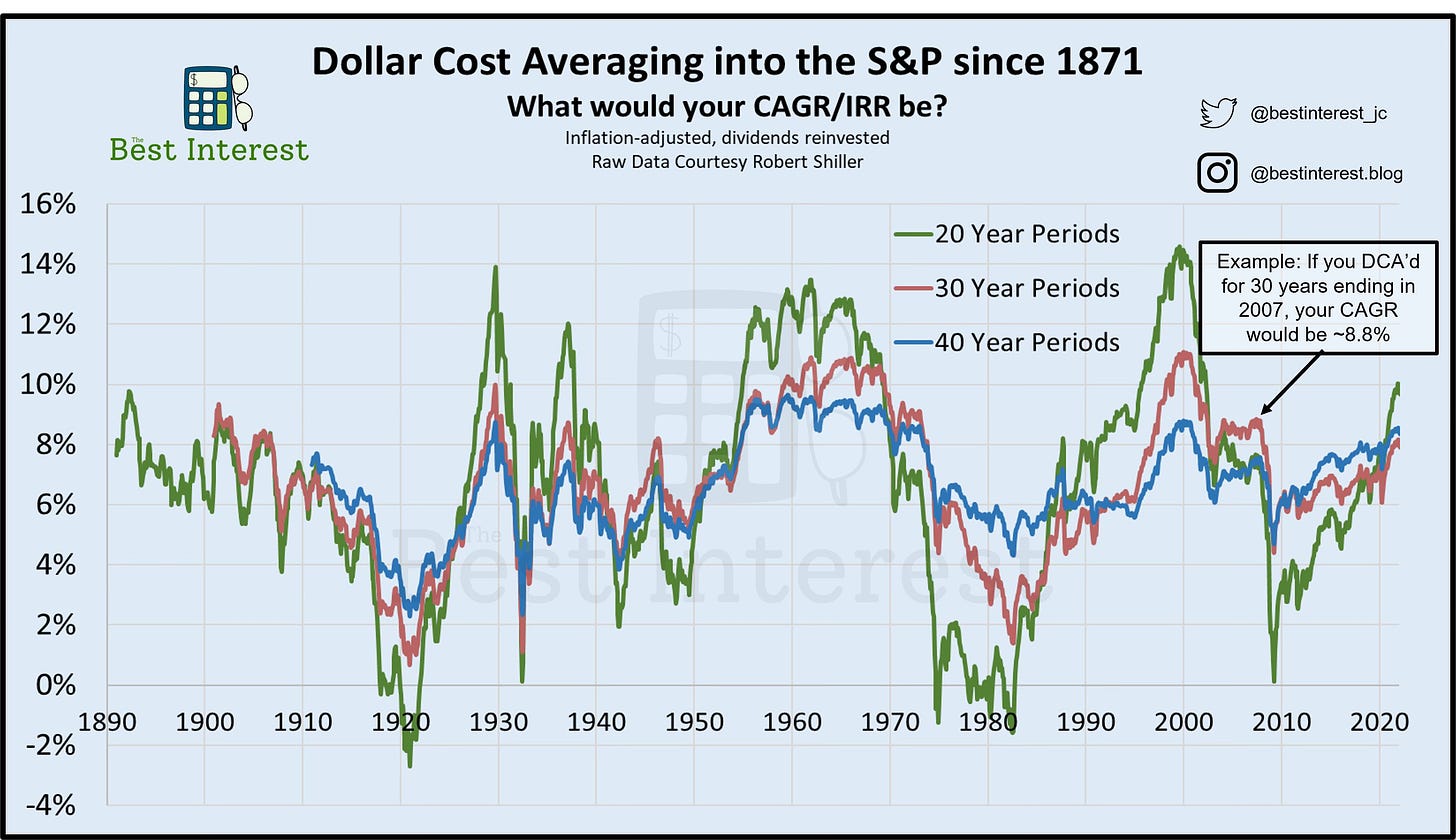

Most people DCA (dollar cost average) and contribute a bit from they paycheck every month.

Luckily, Best Interest (nominated for “Best Personal Finance Website 2022”) looked at this already:

To translate what this chart says: unless you dollar cost average every month for at least 40 years, there is a big risk you can actually end up with less money than you started with!

One way to solve this is with low volatility portfolios like the Cockroach one.

The other is to not look only at one country. Why use just US assets in these portfolios? Why not something like an ETF tracking the MSCI All-World Index?

Investing has more to do with emotions than numbers

It’s easy to talk about crashes but it feels different when you’re in them.

Be honest: would you have continued to contribute monthly? Or would you have panicked, sold everything, then put the money in a savings account?

But let’s not only look at the crashes. What would you have done after seeing this 2018 headline?

Would you have maintained your investing strategy? Or would you have sold everything and put it down into Bitcoin – just as the price fell?

If this is you, maybe do put a small percentage into risky investments. The best strategy protects your portfolio from losing capital, no matter how you lose it: market crashes, inflation, or FOMO (“the feeling of missing out”).

This post isn’t financial advice. But I hope it made you think about what you’re trying to achieve with your investing strategy.

Please leave a comment – I’d love to know more about how you feel about the markets right now and how you’re currently investing.

Great post! I had never heard of the cockroach portfolio! 🪲

Great post and really interesting links to tools.