The best countries to invest in this year, according to science

Forget about GDP growth. According to a recent study, another indicator seems to be most correlated with a country's stock market performance.

TLDR:

1. Why China's economy has boomed but its stock market has disappointed: according to some very interesting research, country-wide stock market returns have little to do with GDP growth.

2. Which indicator to look at instead of GDP growth, and how to find it: the same research suggests that you should look how fast companies' profits are growing, as well as how they pay dividends.

3. Which countries are expected to have the best stock market performance this year based on those indicators.China's economy has boomed but its stock market has disappointed. Why?

Have you lost money betting on Chinese stocks? You’re not the only one. Over the past decade, Chinese stocks have lost more than 40% of their value.

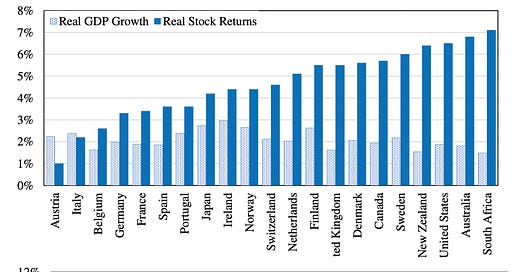

But how is that possible? China’s economy almost doubled over the past 10 years, growing far faster than the US or Europe. Japan’s economy even shrank!

And yet the actual stock returns from all of these markets blew China’s out of the water – especially the US. Just look at the performance of the ETFs tracking these countries:

Clearly you can’t just look at a country’s economic growth and assume that you’ll become rich if you bought its ETF.

What actually makes stocks go up

Volkswagen was the world's most valuable company, for a day, in October 2008.

GameStop went from $300 million in market cap to almost $100 billion for a day in 2021, too.

Now this happened without any significant change in the actual, underlying business of Volkswagen or GameStop. It was all “sentiment”.

In the short term, any stock can have any price.

But over the long run, the most important factor that drives stock prices up is corporate profits.

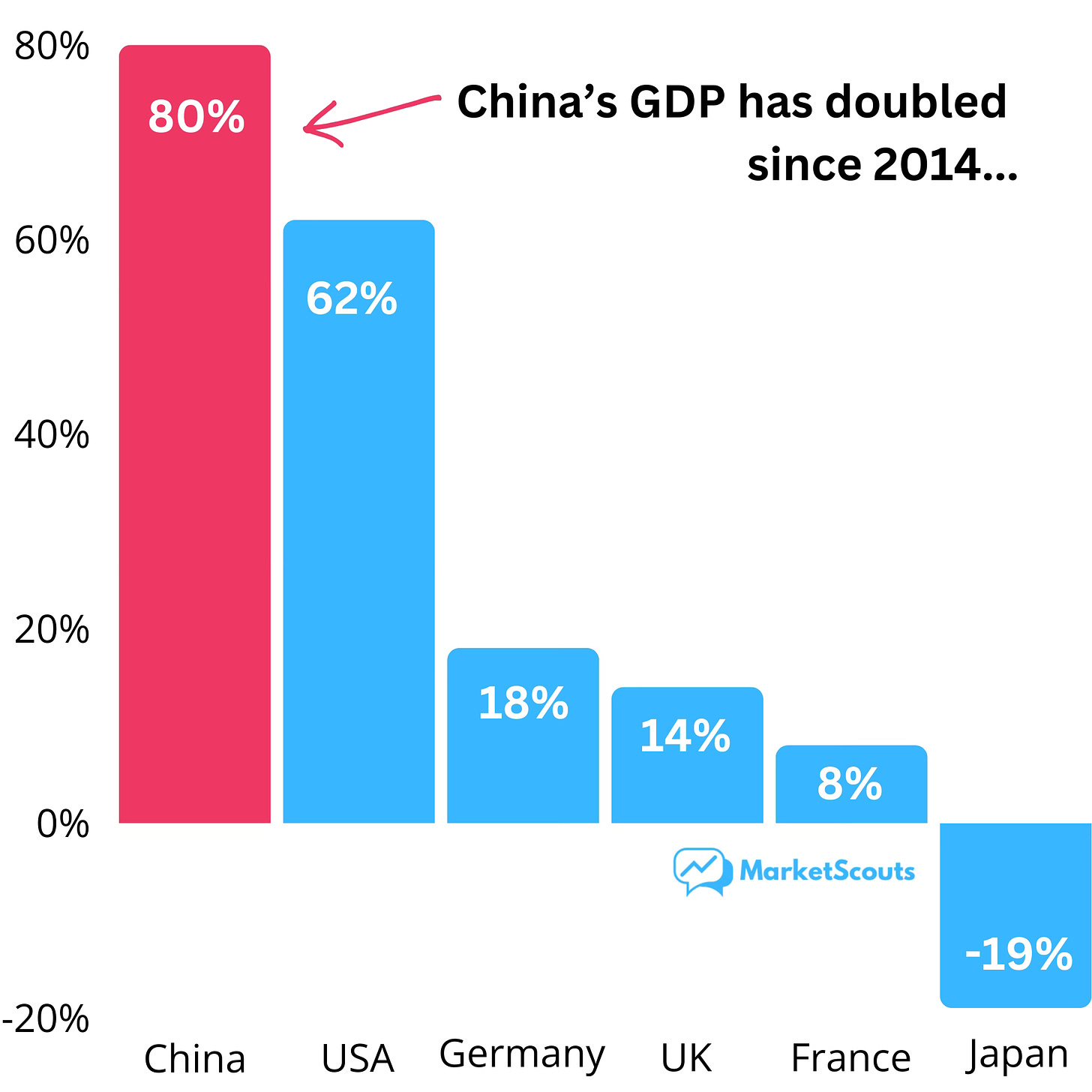

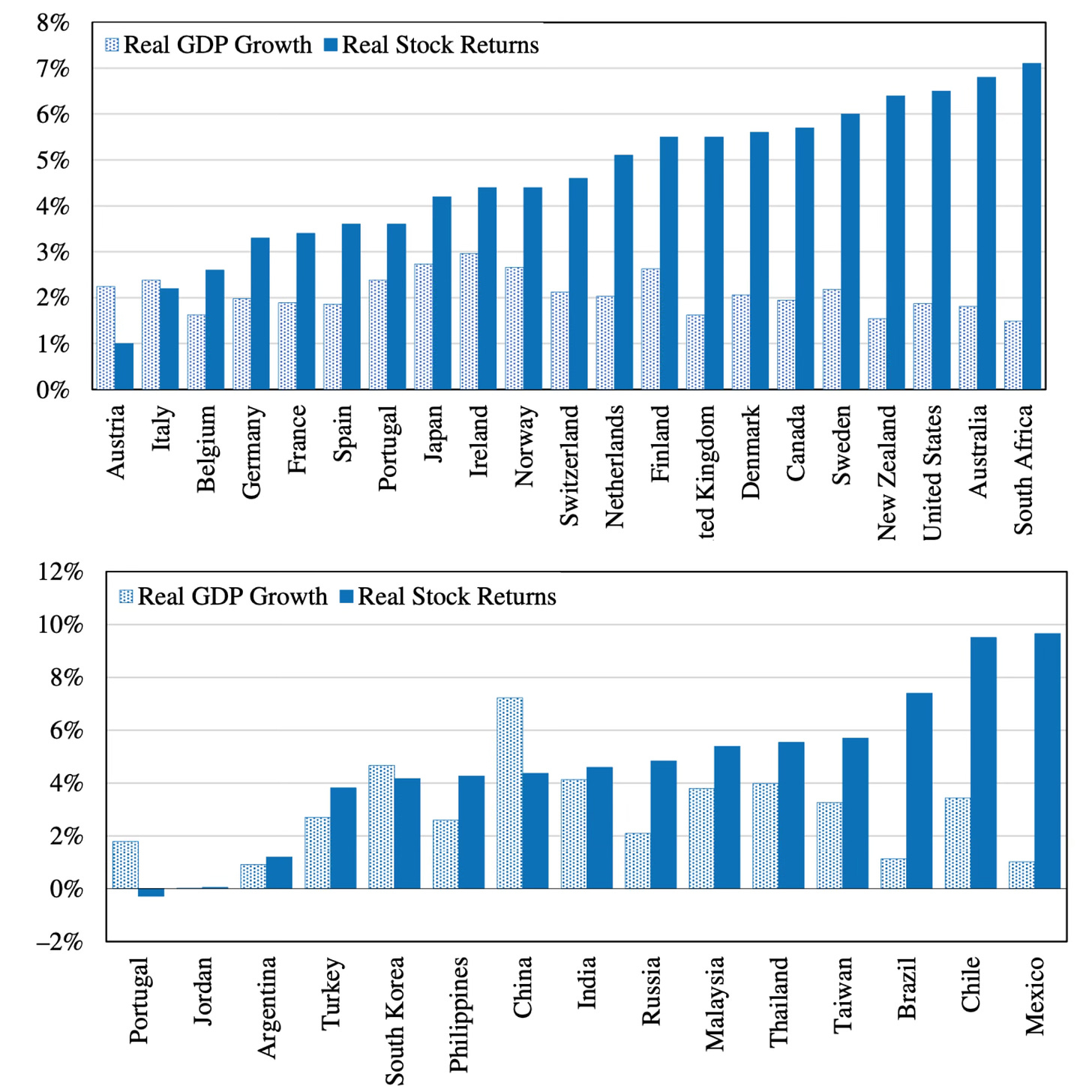

We know this because of a recent study from the University of Florida, which looked at the correlation between GDP growth and stock market performance for both developed and emerging markets.

The result? Low, “statistically insignificant”, correlation:

What actually seems to matter? EPS (earnings per share) and DPS (dividend per share) growth – which the authors found to be highly correlated with stock market performance:

“Investors would do well to focus less on broad measures of economic growth, and place more attention on countries with higher corporate earnings growth and a history of returning that growth to equity investors through increasingly generous dividends.”

This is a big piece of the puzzle if we want to understand why Chinese stocks basically had a “lost decade”.

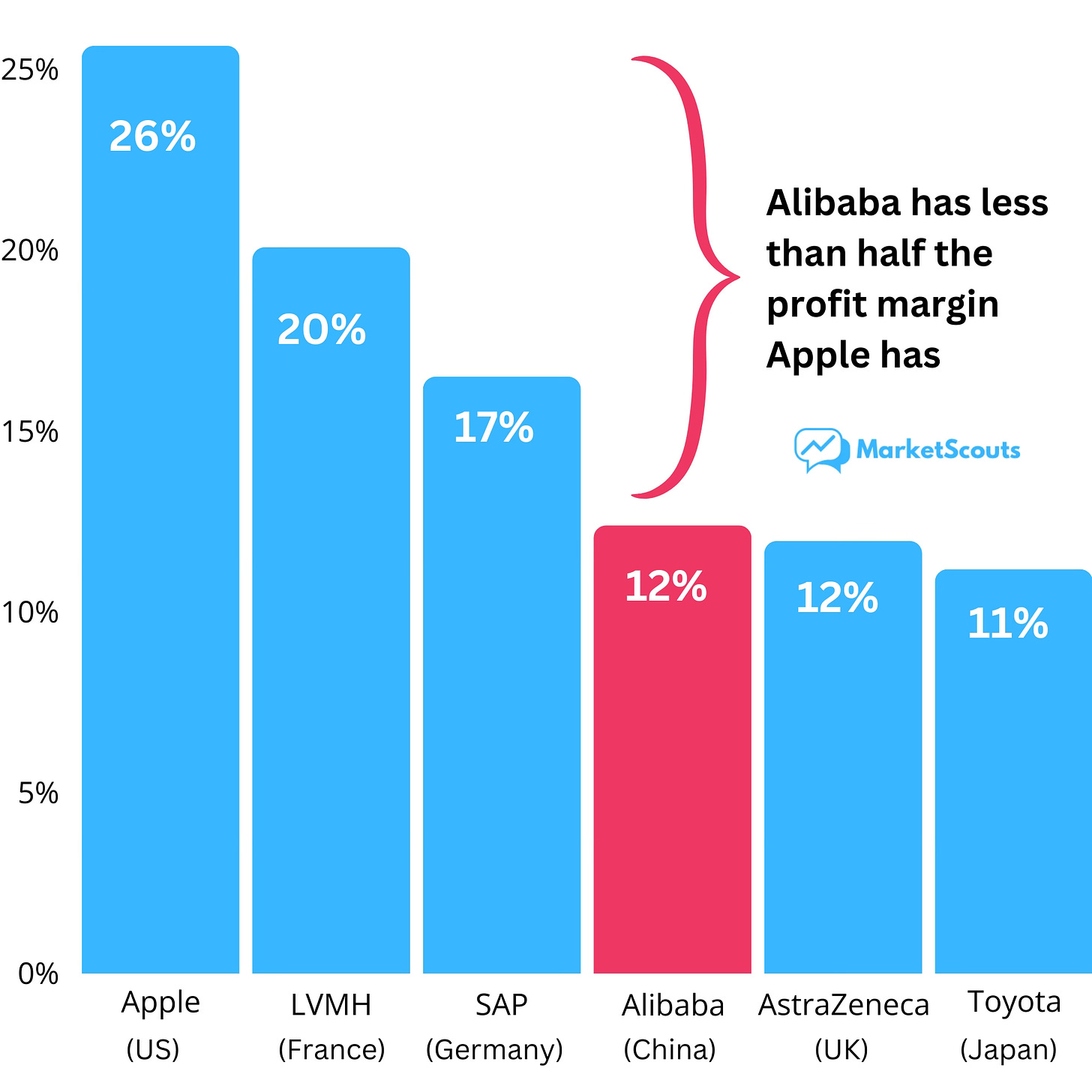

On one hand, Chinese companies just haven’t been that profitable.

Take a look at the profit margin of the largest holding in each of the ETFs we looked at:

Even if we compare apples to apples – US companies and their direct Chinese counterpart – things aren’t pretty:

The only exception is Chinese banks – but that’s because of how the government guarantees them a high net interest income margin. A story for another time…

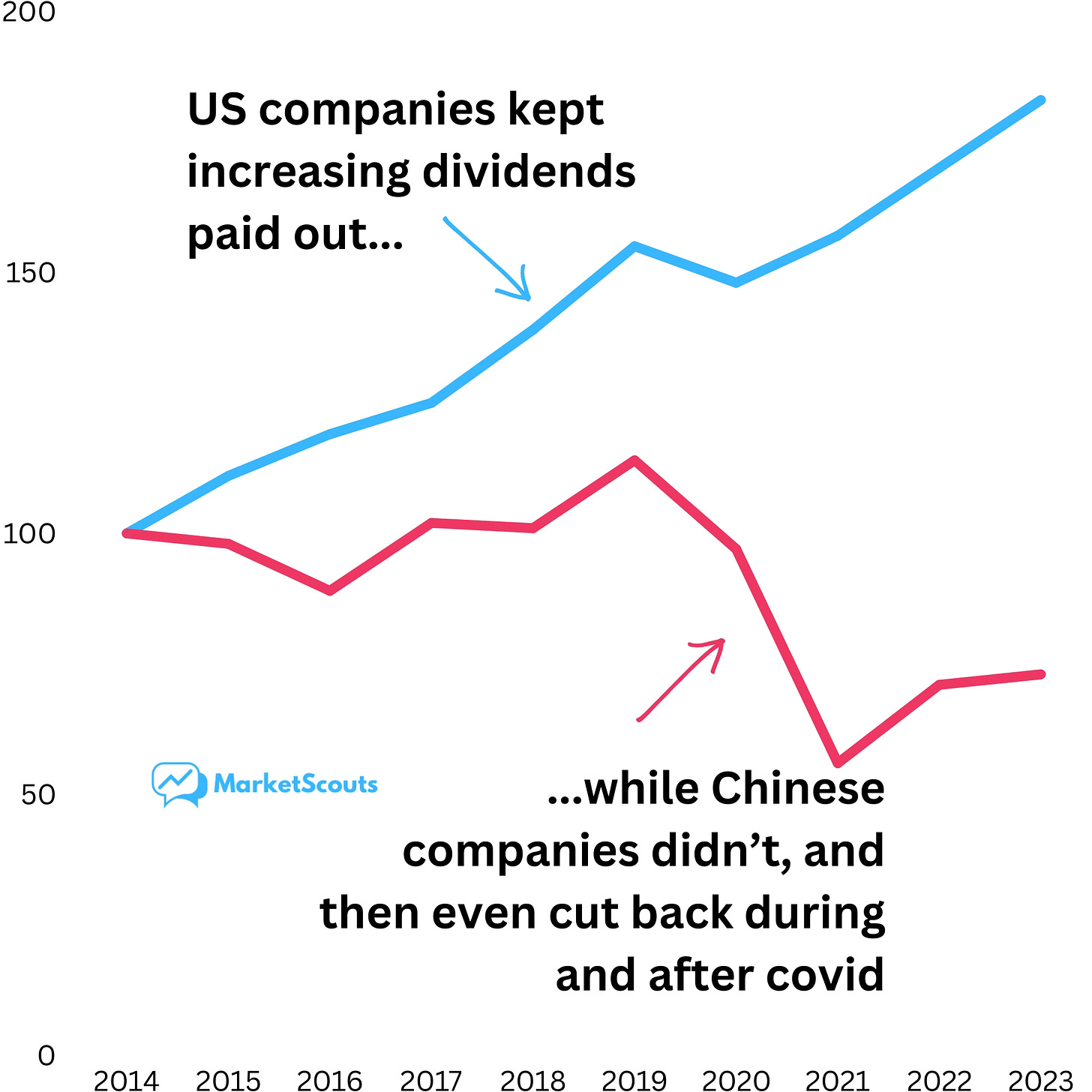

On the other hand, Chinese companies don’t pay growing dividends either.

We saw in the study that dividend growth was the second factor correlated with stock market returns. Chinese companies haven’t been generous here:

Based on this study, which countries are the best ones to invest in this year?

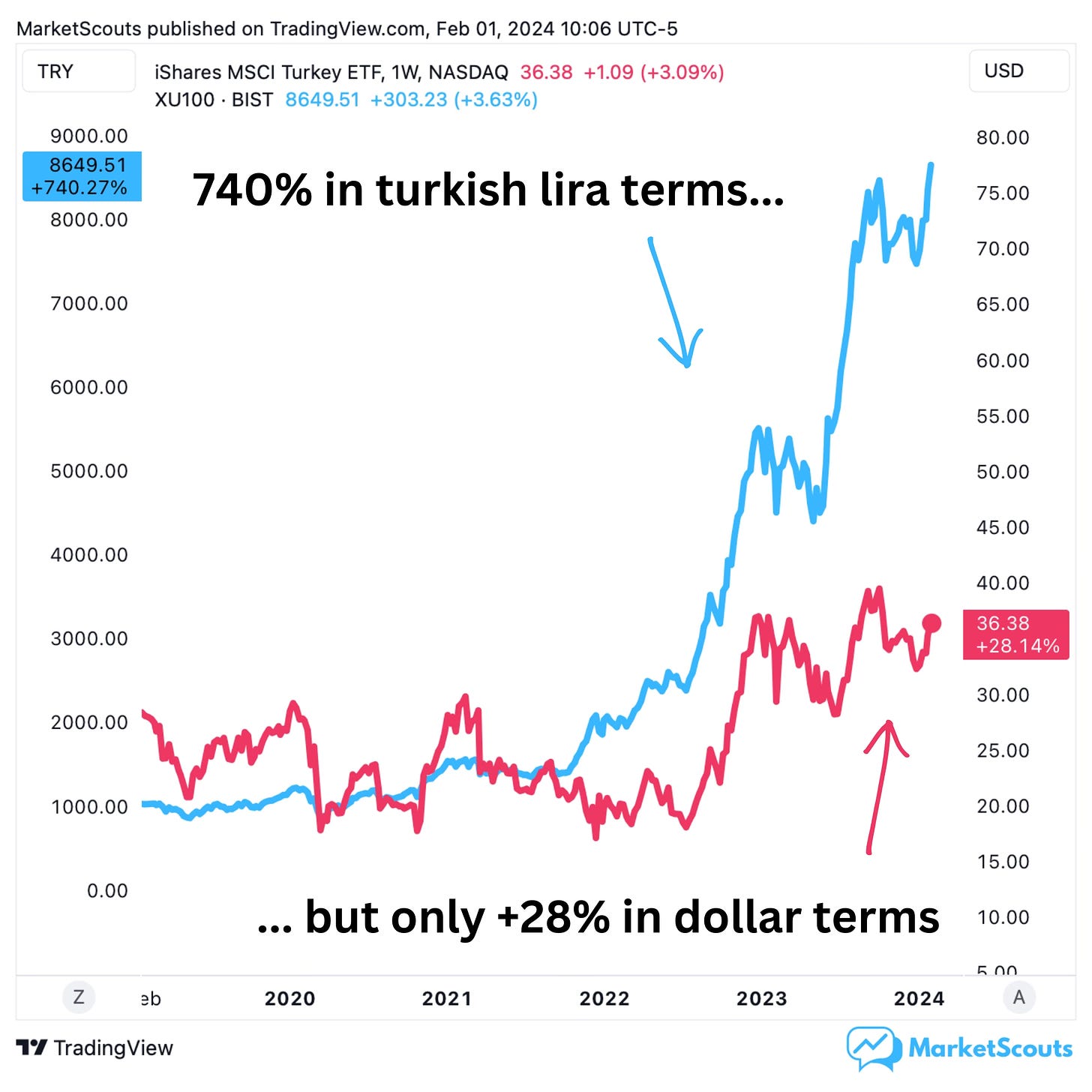

Right from the beginning, 3 out of the top 10 countries are going through extreme inflation: Argentina is projected to see 200% inflation this year (at least before reforms kick in), Turkey 36%, and Nigeria 21%.

High inflation is a dangerous area. Take the Turkish stock market. Over the past five years, Turkish stocks have boomed – in TRY (Turkish lira) terms. In dollar terms, the market barely moved:

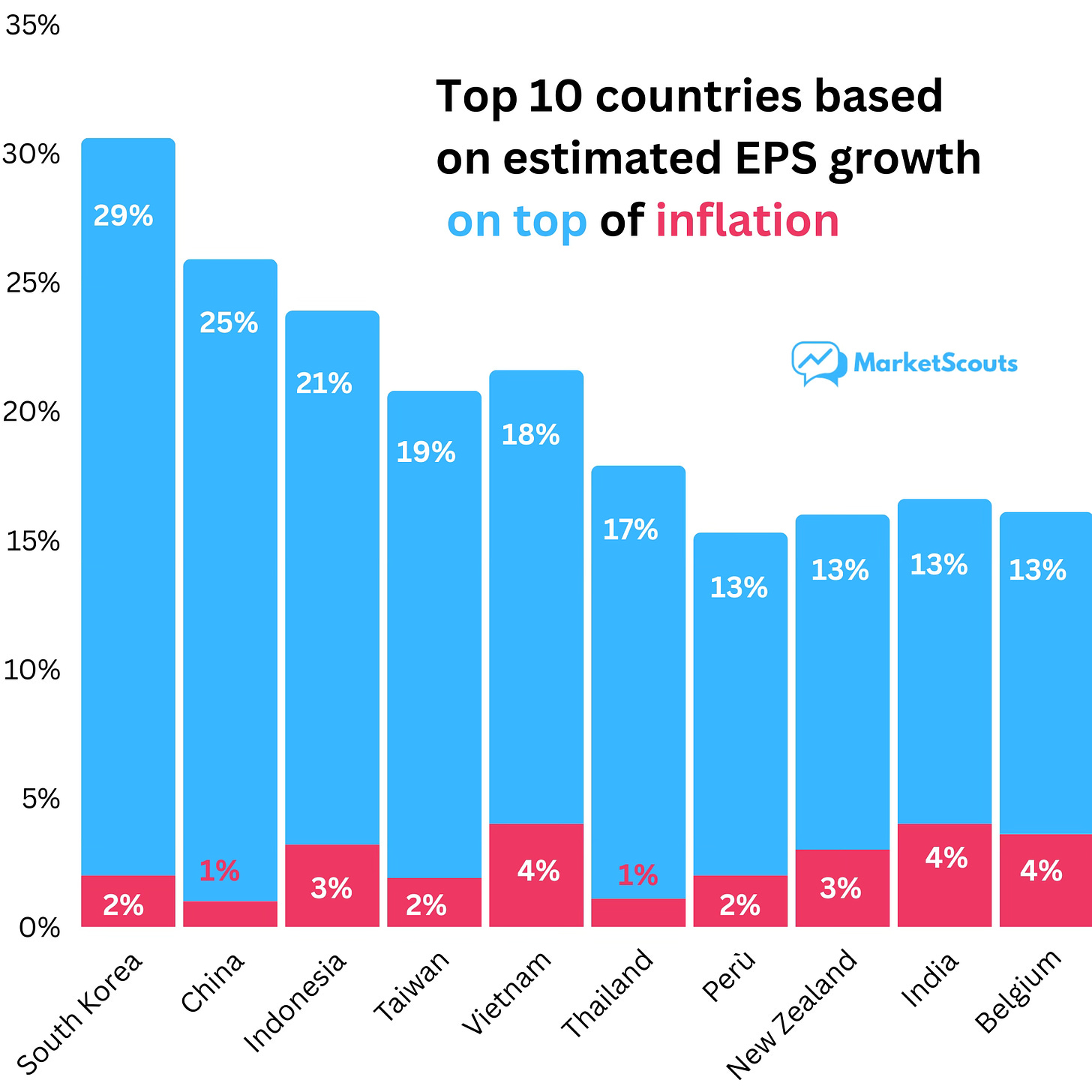

So to make things easy, let’s look at countries based on “estimated earnings growth minus inflation”.

We want companies with strong pricing power – more than enough to offset any inflation:

Now, this list is useful enough as it is, but for long-term investing, we have to also think about valuation.

I’ve talked about previously about how studies show that P/E ratios can be a good long-term indicator of the returns you can expect from the stock market. If you’re wondering if the S&P 500 is overvalued, check that article out.

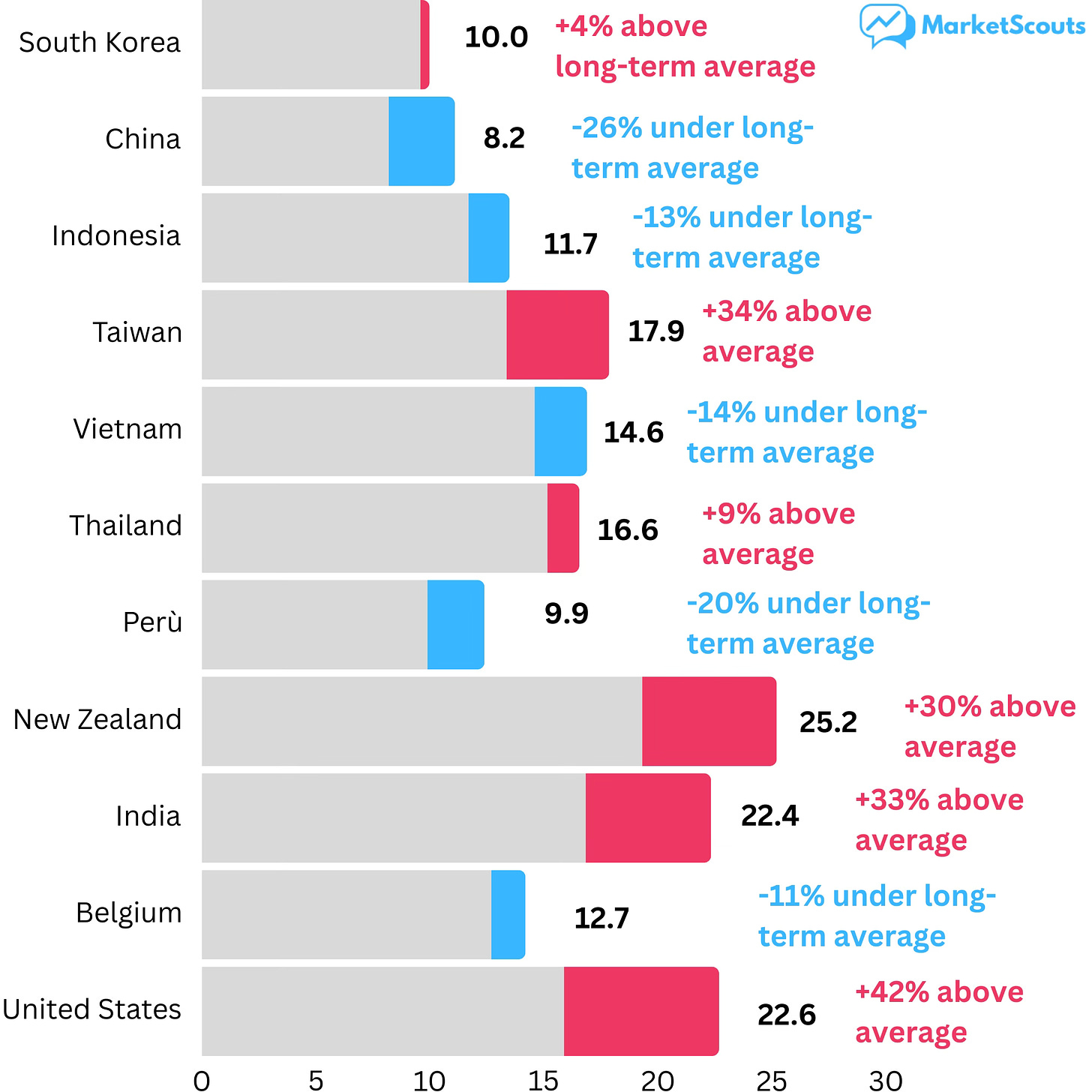

So let’s look at the P/E ratios for the ETFs tracking the MSCI indexes for these countries. I’ll use data from worldperatio.com – it’s a nice clean website.

This is how the P/E ratios of these countries looks like, including how far above or below their long-term average (20 years) they are.

Blue = cheap, red = expensive:

The US is there for comparison purposes only. Clearly quite expensive. But China seems incredibly cheap considering how fast corporate earnings are forecasted to grow this year.

How to invest using this data?

I believe there are three ways to do it.

First is just what we did now: put EPS growth first, valuation second. Our portfolio would then be made up of South Korea, China, Indonesia, Vietnam, Peru, and Belgium.

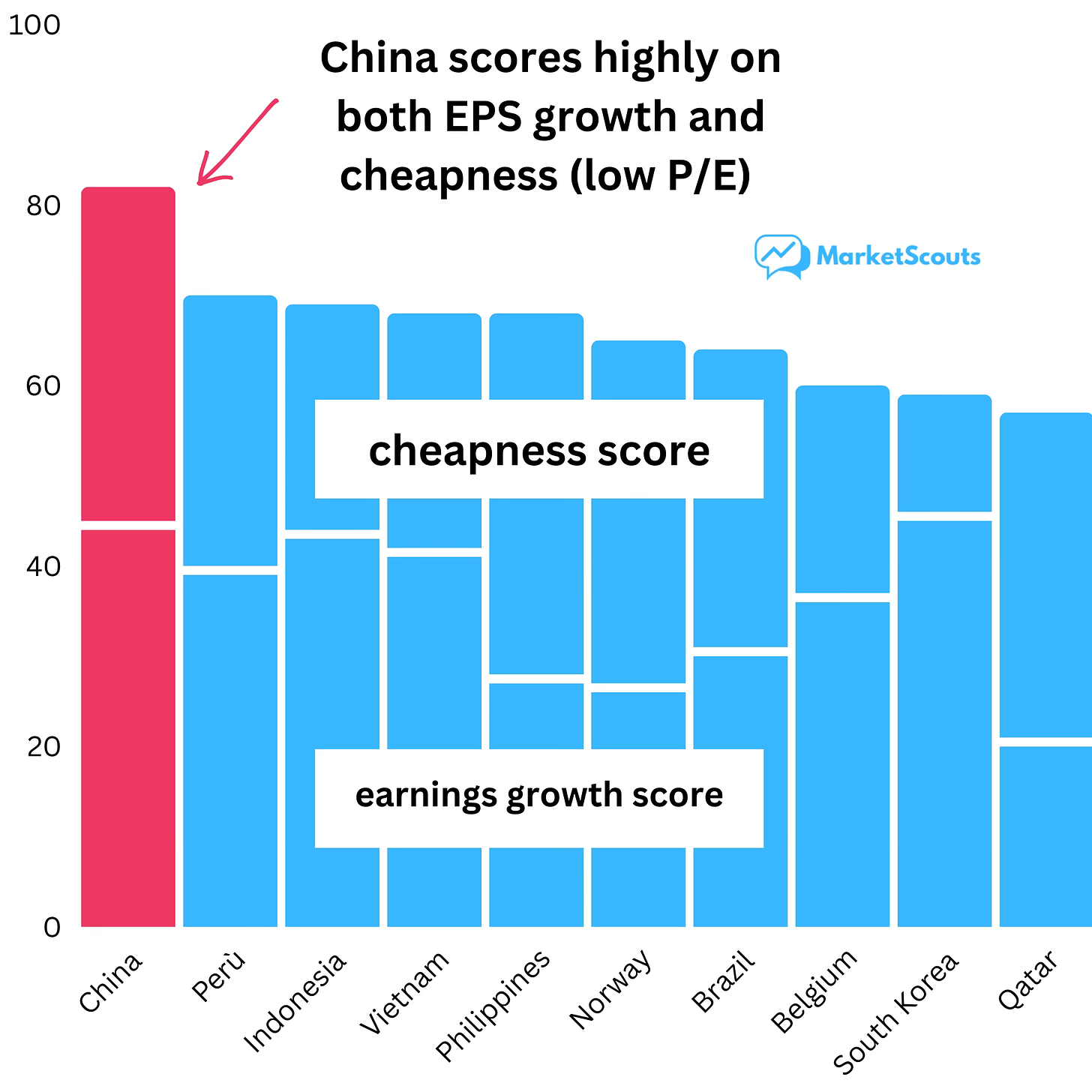

The second way is to have a “pure approach”: mix the top countries by EPS growth with the top countries by “cheapness”, or how much lower the P/E ratio is versus the long-term average. This can make sense – studies show that most investors consistently avoid companies when valuations are extremely low, and then miss out on returns. A portfolio that maximizes both profitability and cheapness would be an interesting “barbell”.

Surprisingly, China would be chosen… twice.

The third way is to assign a score based on EPS growth and another based on the P/E ratio, and then select countries based on the combined score. This way we “average out” the results a bit, but at least we have both the “cushion” of earnings growth and cheapness:

2024 really seems like “the year to get back into China”.

The timing, I have to say, is interesting. Most professionals are taking their money out of China:

Even Ray Dalio and his hedge fund, Bridgewater Associates – who have been urging investors to buy Chinese stocks since 2017 – have apparently cut back their positions by up to 60%.

Is this the contrarian signal we need?

In any case, I’m not saying go and buy FXI or any other China market ETF.

My guest contributors and I talk about various stocks, funds, and securities because they’re interesting or can be used to teach a lesson about investing. None of the posts we publish are intended to be taken as individual investment advice or a recommendation to buy or sell any specific stock or other security. We can’t even guarantee that our information sources are 100% accurate. The only purpose of these posts is to teach you how to do research and figure this stuff out for yourself.

But China definitely merits a second look. Between 2014-2015 I actually lived in Shanghai, consulting for international hotel chains, but after reading “China’s Great Wall of Debt” I just couldn't see how investing there made sense. Much has changed since then. Expect a deep dive next.

I’m also curious about Norway, Vietnam, Indonesia (lived there last year too), and South Korea, so I plan to tackle them in my following post.

If you found this post interesting, please leave a comment. Is 2024 the year to invest in China? How about the other countries on this list?