Is 2024 the comeback year for Chinese stocks?

After a decade of disappointment, are the numbers interesting enough to justify taking a risk on China?

TLDR:

1. Why are investors leaving China? Fear about Taiwan becoming the next Ukraine (and China becoming the next Russia), fear about the property bubble popping, and fear of taking the wrong career risk.

2. 7 reasons why China could be a great bet this year. Fast growing corporate earnings, potential space to grow dividends, pension reform, "buy when others are fearful", deflationary shock and the pop of the property bubble, the Economist cover indicator, and incoming stimulus.Why are foreign investors leaving China?

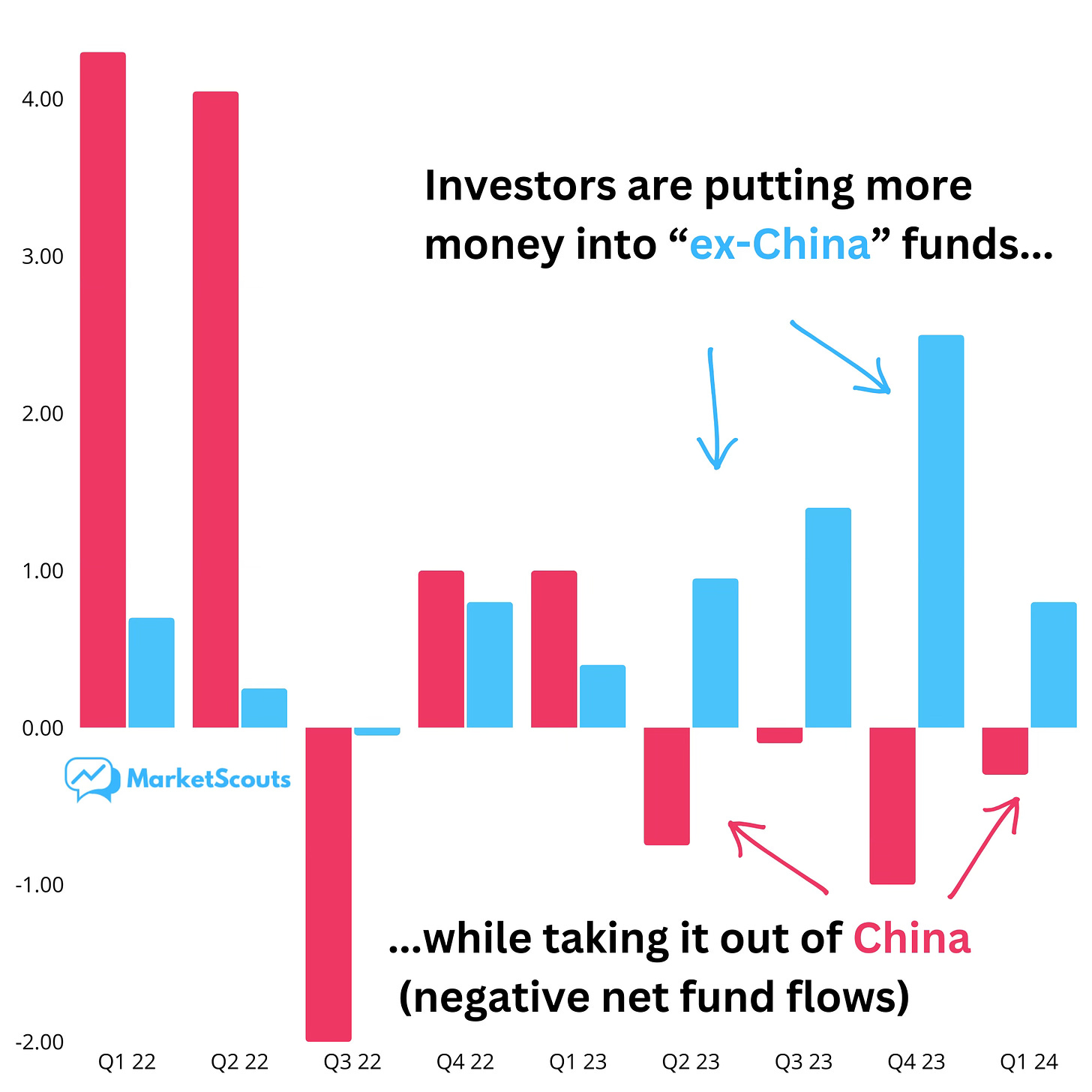

Right now, it seems that after almost two decades of “giving China a chance”, foreign investors are ready to leave.

Many top US pension funds are cutting China from their portfolios. Everyone is moving their money from ETFs tracking emerging markets (“EM”) into ETFs tracking emerging markets minus China (“EM ex-China”).

But disappointment is only one reason. There are many more.

For starters, investors fear a potential “2022 moment”, where China invades Taiwan just like Russia did with Ukraine. If you owned Russian stocks during the invasion, you’d be stuck:

Will this happen in China?

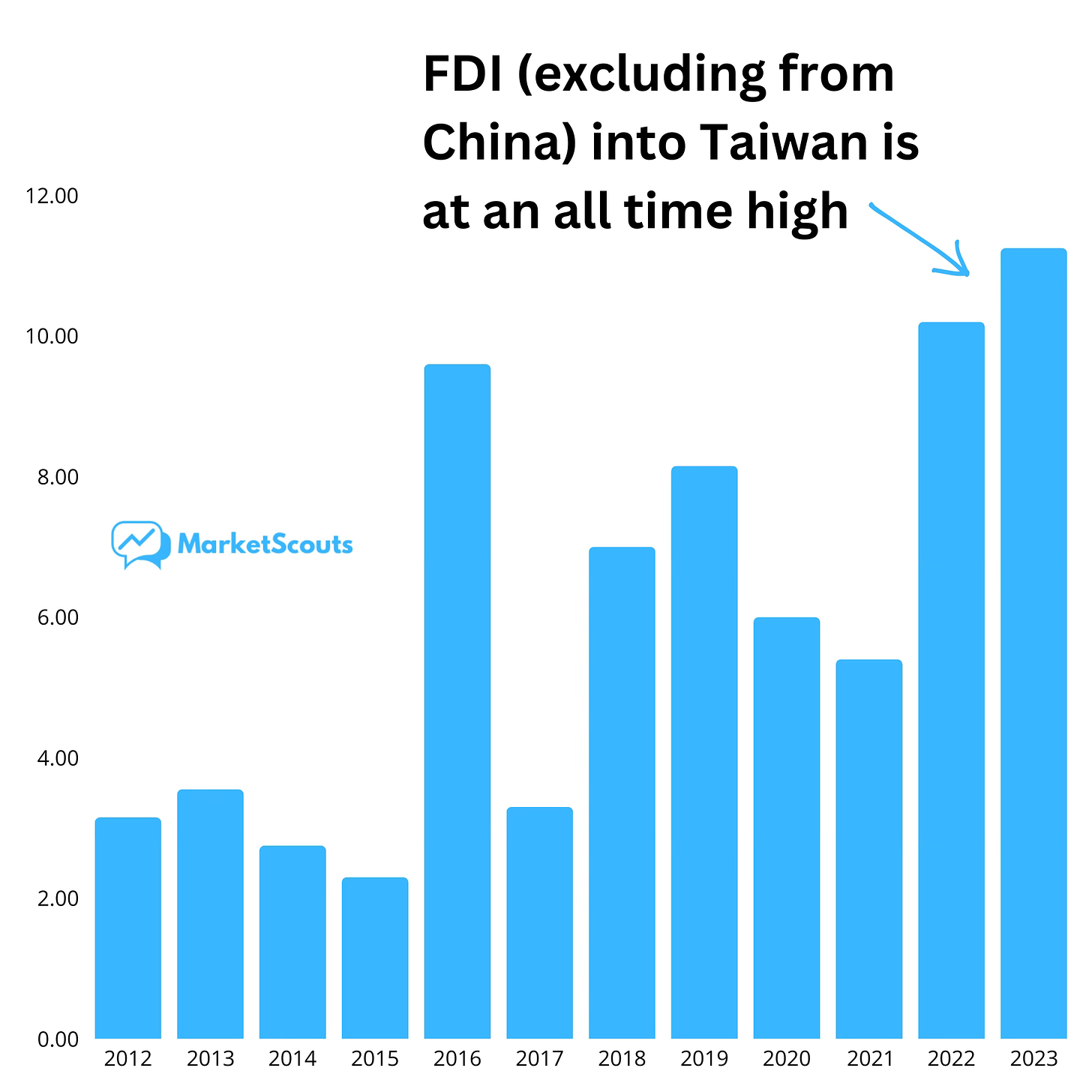

Well, nobody knows what the future holds, but as someone who’s lived in both Taipei and Shanghai, I do want to stress that China’s relationship with Taiwan is very different from that of Russia and Ukraine. Taiwan and China are much more economically linked. Taiwan even used to be one of China’s main foreign investors, at least until 2020.

The Chinese government also seems to not want to take Taiwan “by any means”. The biggest victory for the CCP is if Taiwan joins China willingly. CCP has to prove that its governance model is so good, all people who are ethnically Chinese want to live under it.

But the main point is actually this: if foreign investors were truly concerned about Taiwan, they wouldn’t invest in it with this much excitement!

Another long-term concern is that China’s population is aging fast, which will put pressure on its economy. Which it is. But so is Japan’s. And that hasn’t stopped investors from putting their money there.

But these are long-term concerns. The main fear right now is that the Chinese property bubble is collapsing and it will take down the stock market, maybe the economy with it. Basically what happened in 2009 in the US – on steroids.

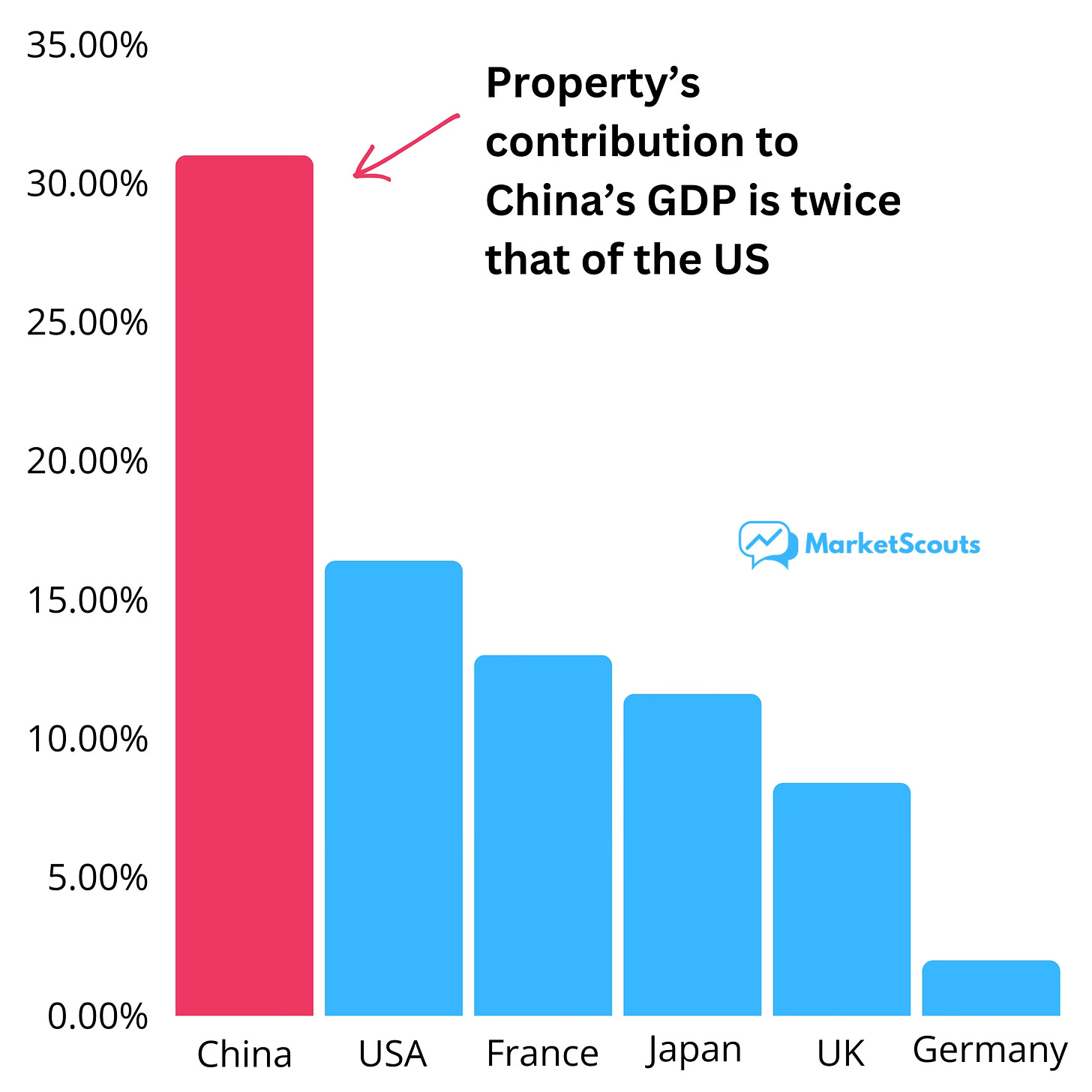

Now, China does indeed have a massive property debt problem. Property contributes around 31% to China’s GDP – higher than most countries.

The “pop” of the property bubble in China is dangerous, yes – but I believe professional investors are taking the wrong side here.

Speaking of professionals: it’s much easier to earn fees for investing in markets that are growing fast than in markets that are uncertain. Nobody will get fired for buying Nvidia in 2024, but they might if they buy China.

That’s because being “contrarian” has real career risk for professional investors:

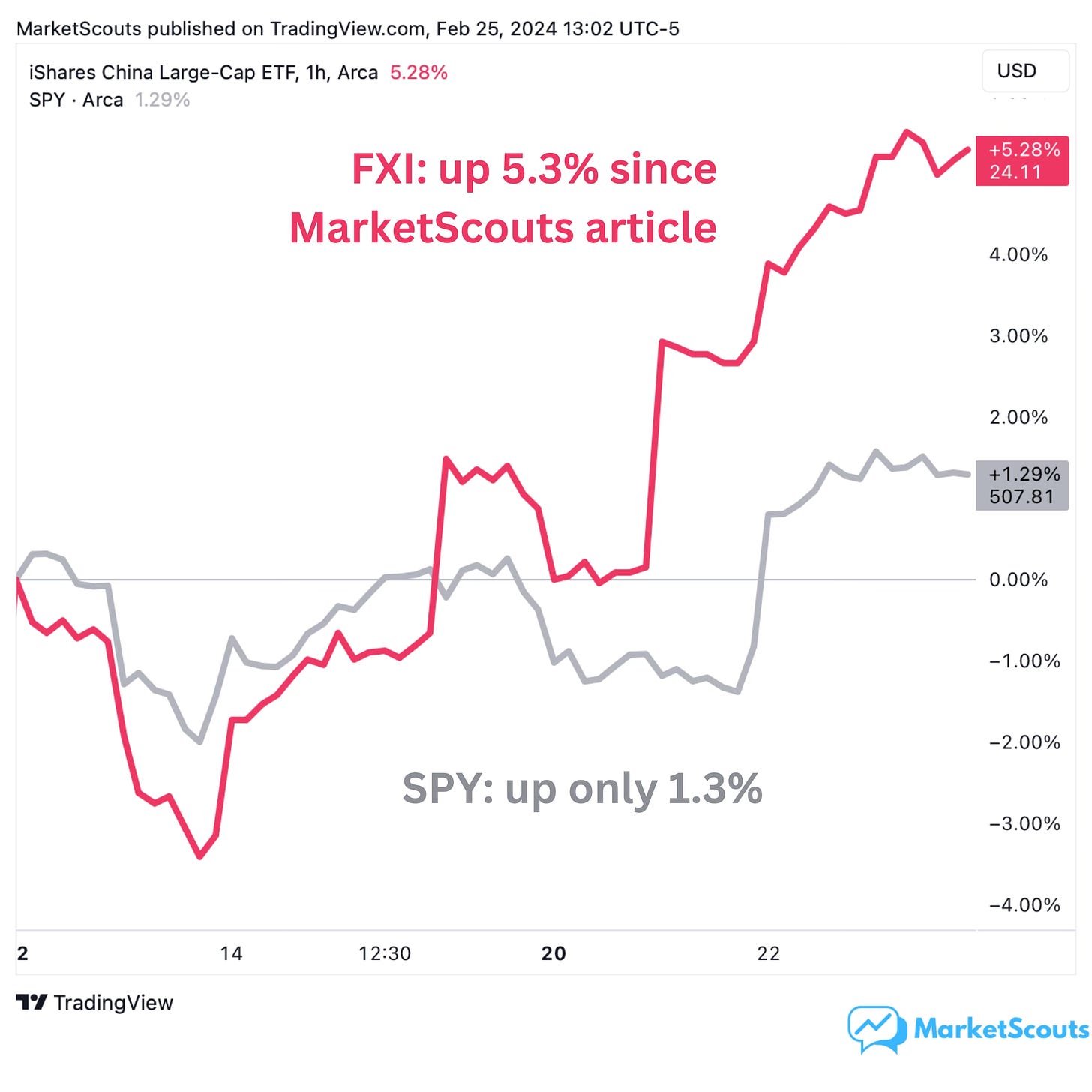

In any case, as I went two weeks ago through 45 countries based on the indicators I mentioned then (earnings growth and price to earnings), China stood out as one of the most interesting bets for 2024.

So after publishing that article I decided to buy some FXI (iShares China Large-Cap ETF) right there and then. Like Nassim Taleb says:

“Don't tell me what you think, tell me what you have in your portfolio.” – Nassim Taleb

So far it seems like it was a good decision.

Now, I’m not saying I made the right choice. I either bought the dip or caught a rapidly falling knife in a treacherous bear rally. Ouch. Hopefully the first. But my point remains: there’s something there, so it’s time to dig deeper.

7 reasons to invest in China in 2024

Reason #1: fast-growing earnings

Earnings are the main reason why you should invest in a company – which is why earnings growth rate matters much more than GDP growth when it comes to investing in a country.

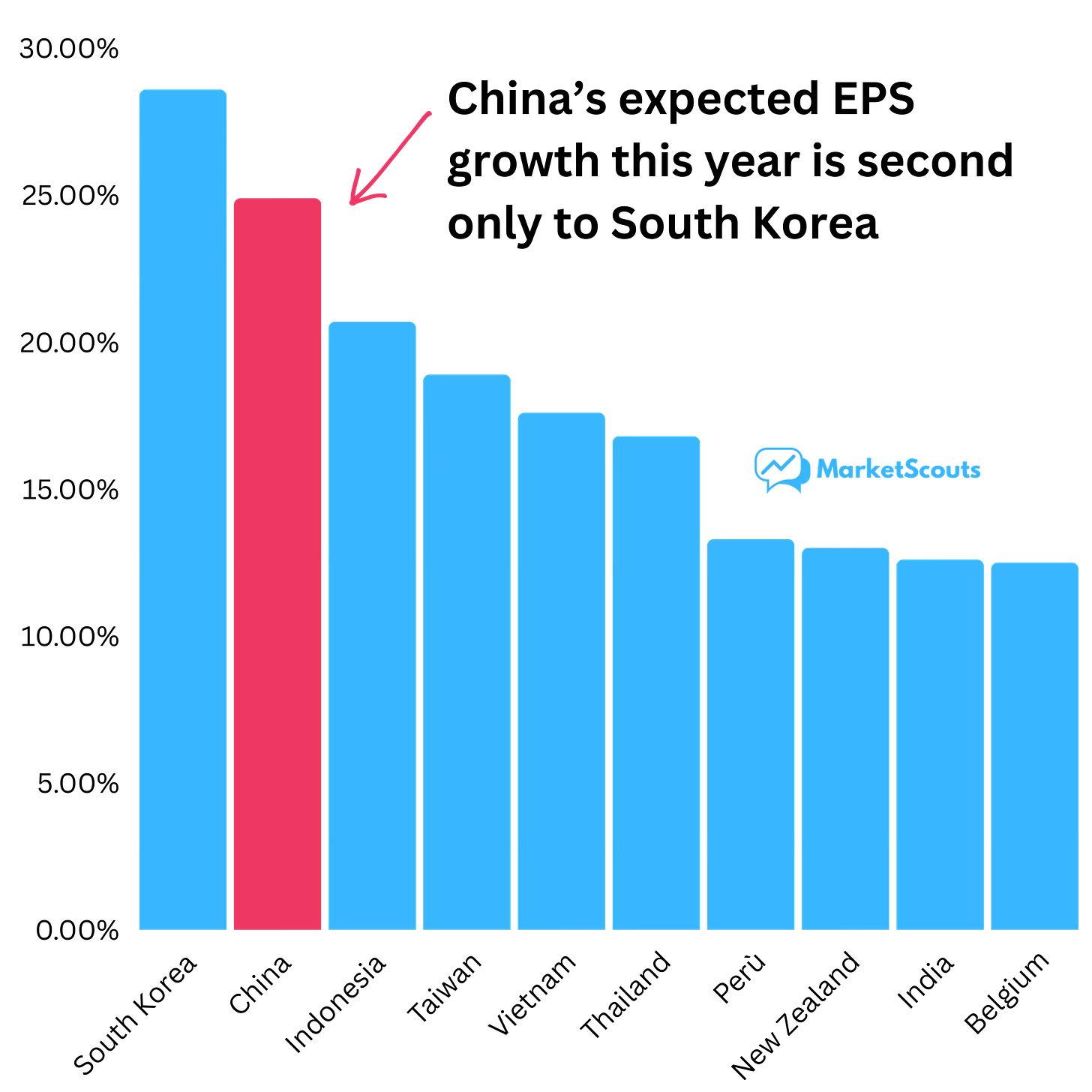

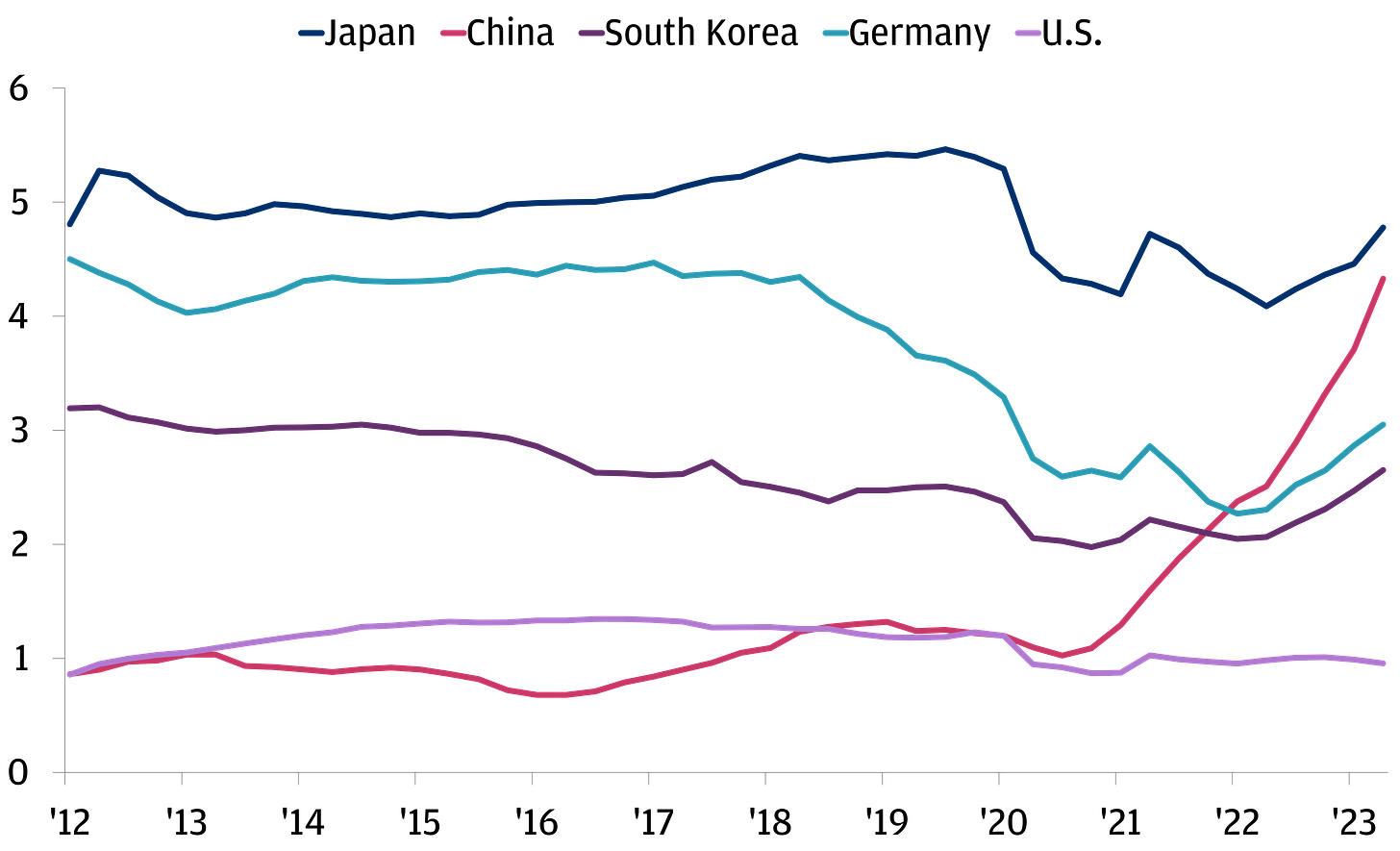

I’ve already mentioned this reason two weeks ago. Analysts believe that Chinese EPS (earnings per share) growth this year will be second only to Korea:

You might argue that professional analysts have been wrong before. But so what? Even if the results come in, say, 20% under the forecast, that’s still a much higher rate of EPS growth than from pretty much anywhere else. Plus, this forecast comes from the same analysts who are extremely bearish on Chinese stocks now – so if anything, I expect the actual results to be even higher than this.

Reason #2: room to increase dividends

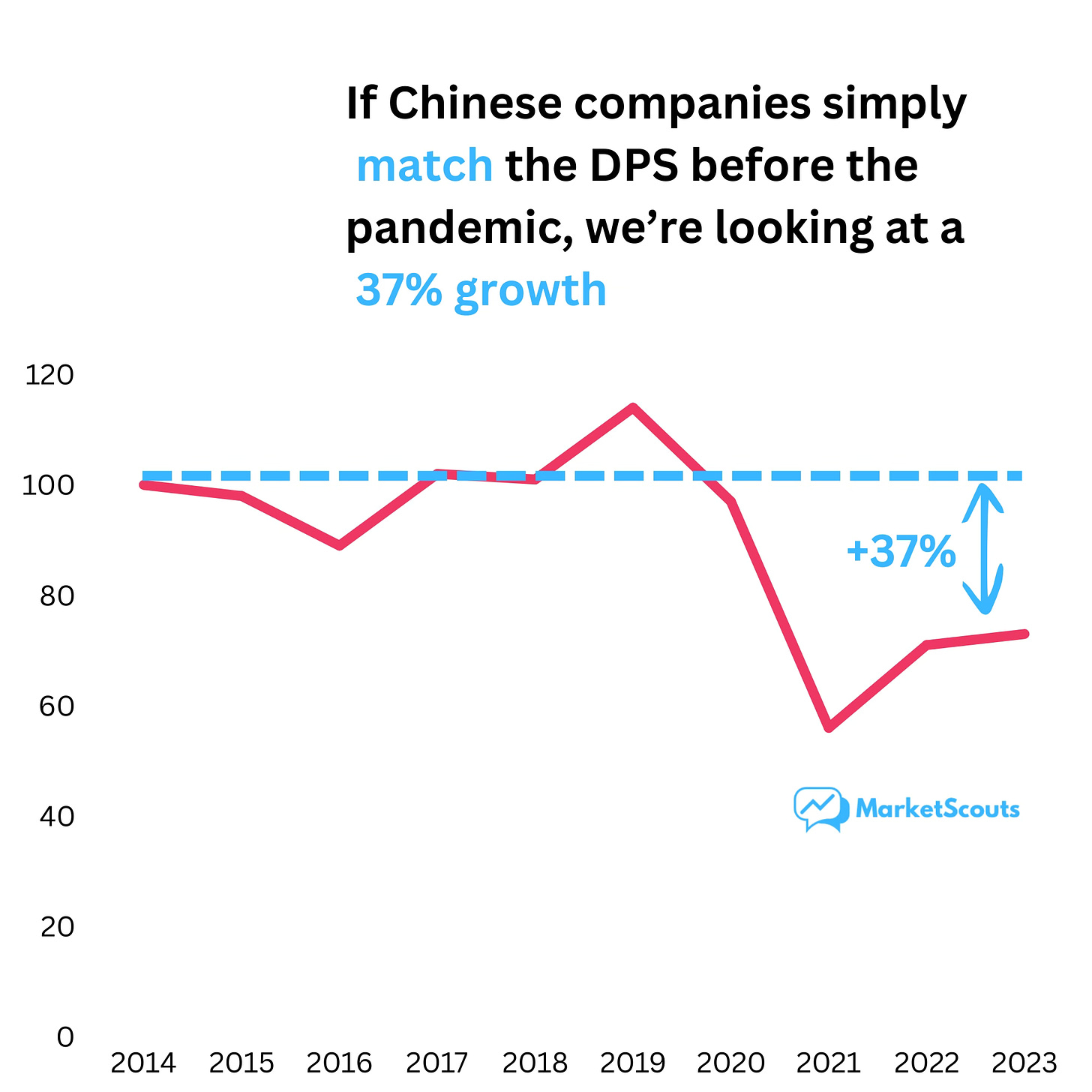

With profitability comes options. Chinese companies could do lots of things with these profits, but if they get back to paying dividends at the same DPS (dividend per share) ratio as before the pandemic, we could look at a real growth spurt:

Will this pull stocks up? Hard to say in the short term. In the long term, though, DPS growth is the second most important factor that influences stock market performance. The real question is: will Chinese companies increase dividends per share every year, or just once or twice, and then keep it flat there?

Reason #3: private pensions are coming

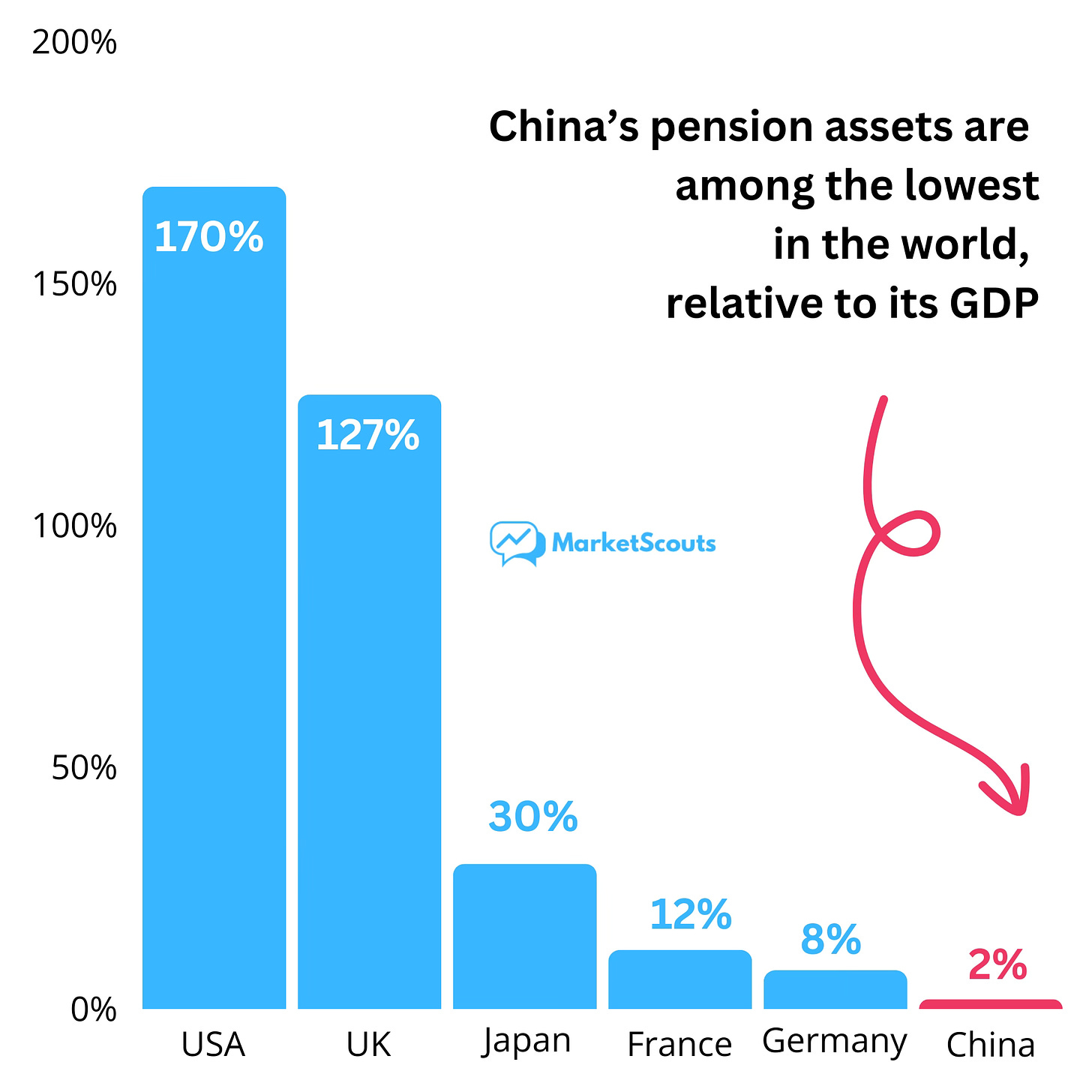

You might not realize it, but developed countries like the US and UK have an “always-ready” buyer for stocks and bonds: pension funds. No matter where prices go, these funds buy every month – as employers pay salaries and contribute to retirement funds like 401(k)s in the US and private pensions in the UK.

China, despite its fast-aging population, used to have none of that.

But all that is changing. China just launched the first ever private pension scheme in September 2022. KPMG, one of the big 4 accounting firms, believes that the Chinese private pension market could be a US$3.8 trillion market by 2030. That’s a 4x increase in the next six years!

And a big chunk of that would go… straight into Chinese stocks.

Reason #4: too cheap for most people

I’ve shared a while back a few interesting studies which found that most investors avoided the best investments because they looked “like trash”.

Well, this certainly seems the case with China. First, the main ETF tracking its stock market index is in the top 10 cheapest worldwide in terms of absolute P/E ratio.

Second, its P/E ratio is also near all-time historical lows. In the last 25 years, it’s rarely been as cheap as this.

Reason #5: shock therapy

The Chinese property bubble is really bursting. But this “shock deleveraging” is usually only bad in the short term. In the long term, it can result in real productivity gains. It happened in 1929 America. It happened in 2009 Iceland. You can read more about how these crises resulted in decades of real growth and productivity in “The Price of Time”.

The property bubble will also create a US$5 trillion hole in the economy that will need to be filled with something else. The good part? there are already signs that this hole will be patched by something else. For starters, the EV sector. China is already the fastest growing exporter of electric vehicles. And that’s only one of the fast-growing industries where it’s positioned to dominate for years to come.

Reason #6: The Economist Cover Indicator

In 2016, two analysts at Citigroup looked at 44 covers of The Economist magazine that seemed to be particularly optimistic or pessimistic. They found that covers with a “strong visual bias” tended to be contrarian 68% of the time after 1 year. In other words, 68% of the time, they were very wrong. This is now jokingly called The Economist Cover Indicator.

But guess what? Two weeks ago, The Economist published this little number:

Reason #7 (the big one): stimulus

The Chinese government seems to understand that it needs to do two things: let the property bubble pop in a “controlled” fashion, and restore investor and consumer confidence. Will it succeed? I don’t know – but I do know that it will try. Hard.

It’s already banning short-selling. It’s telling banks to start lending again. It’s even discussing cutting rates. None of this is a solution. But neither is letting the market and economy completely collapse.

We are in the Year of the Dragon, after all.

Do you agree with the points in this post? Do you believe the Chinese stock market will drop even lower? Are you buying the dip or staying away? Leave a comment.