Are these 3 stocks with rising earnings and falling prices a buy?

Johnson & Johnson, Halliburton, and Volkswagen. Undervalued stocks, or falling knives?

So far in our P/E series, we have talked about the correct ways to use this popular indicator, as well as some of the common mistakes people make when relying on it.

We also wrote about how a mix of rising earnings and dropping stock price can mean that a company could be considered undervalued, making it a good purchase.

So let’s test if this strategy works in the real world.

We’ll chose three stocks, more or less at random, as long as they fit three criteria:

their price is either down or fairly flat year-to-date,

their earnings are significantly up,

and they have a large market cap, with plenty of coverage from professional analysts.

This last one is important because we want to understand how in the world a company can be truly undervalued if everyone is doing their homework.

We managed to narrow our search down to three interesting opportunities: Johnson and Johnson, Halliburton, and Volkswagen.

Let’s see what we find.

Opportunity #1: Johnson and Johnson

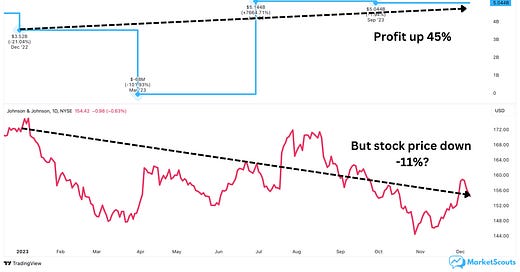

Johnson and Johnson seems to be a classic P/E mismatch: its net income (profit) is up 45% for the year while the share price is down 11%.

JNJ has also increased its quarterly earnings per share by 50%, from $1.35 to almost $2 per share.

As a result of this mismatch, Johnson and Johnson’s P/E ratio is 29.4 – far below its peer average of 48.

Why is the stock down?

First, Johnson and Johnson has several pending lawsuits stemming from their talcum powder products as well as their contribution to the opioid crisis. Together, JNJ might be on the hook for about $12 billion.

Second, JNJ also owns a series of drug patents that are expected to expire in the upcoming year – including some of the company’s most important patents such as Stelara, its highest-earning drug. In 2022, Stelara accounted for $9.7 billion in sales, more than 10% of JNJ’s entire revenue of $94.9 billion.

Is Johnson and Johnson truly undervalued?

Let’s look at the lawsuits first.

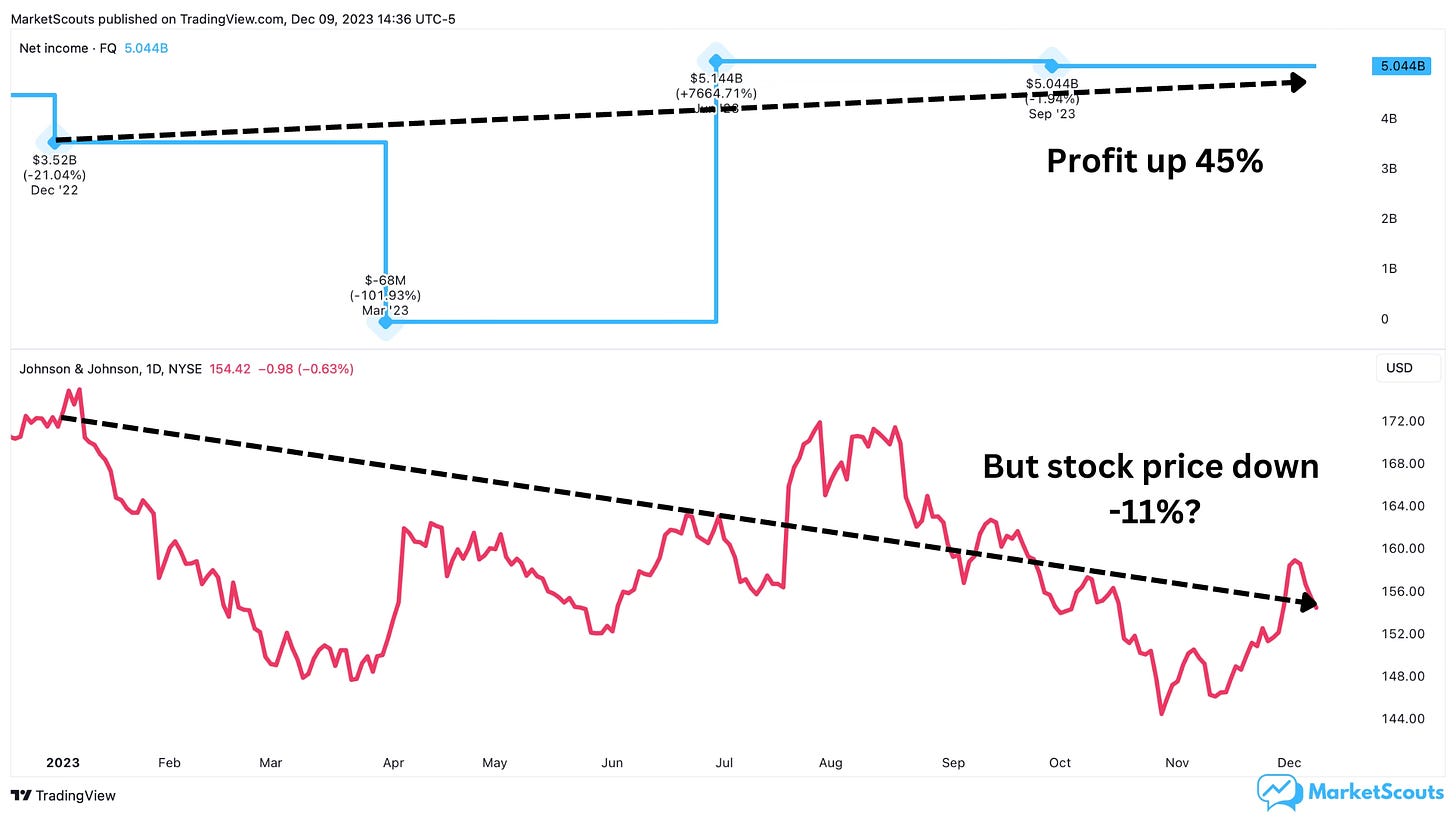

Although they may have damaged Johnson and Johnson’s brand image, the $12 billion settlement the company would have to pay is well covered by their $35 billion operating cash flow, which also covers its debt ($30 billion).

To make things smoother, it’s even considering a “bankruptcy strategy” although this doesn’t mean the company winding down – merely entering a process to restructure its finances so that it can clear its debts.

Second, the patents.

Analysts say that Johnson and Johnson has a well-diversified drug pipeline, and future growth remains optimistic as they await 52 drugs to be approved. These new patents are expected to offset the cost of loss associated with expiring ones.

JNJ also spun off its consumer health division as a separate company called Kenvue earlier this year, and they hold the majority stake. Kenvue owns popular brands such as Band-Aid, Listerine, and Tylenol. The company is financially strong, with a healthy cash flow and an attractive dividend yield. As a smaller and more agile company, Kenvue can pursue higher growth and deliver more substantial returns in the long run. And as the majority shareholder, JNJ is going to be the main one to profit.

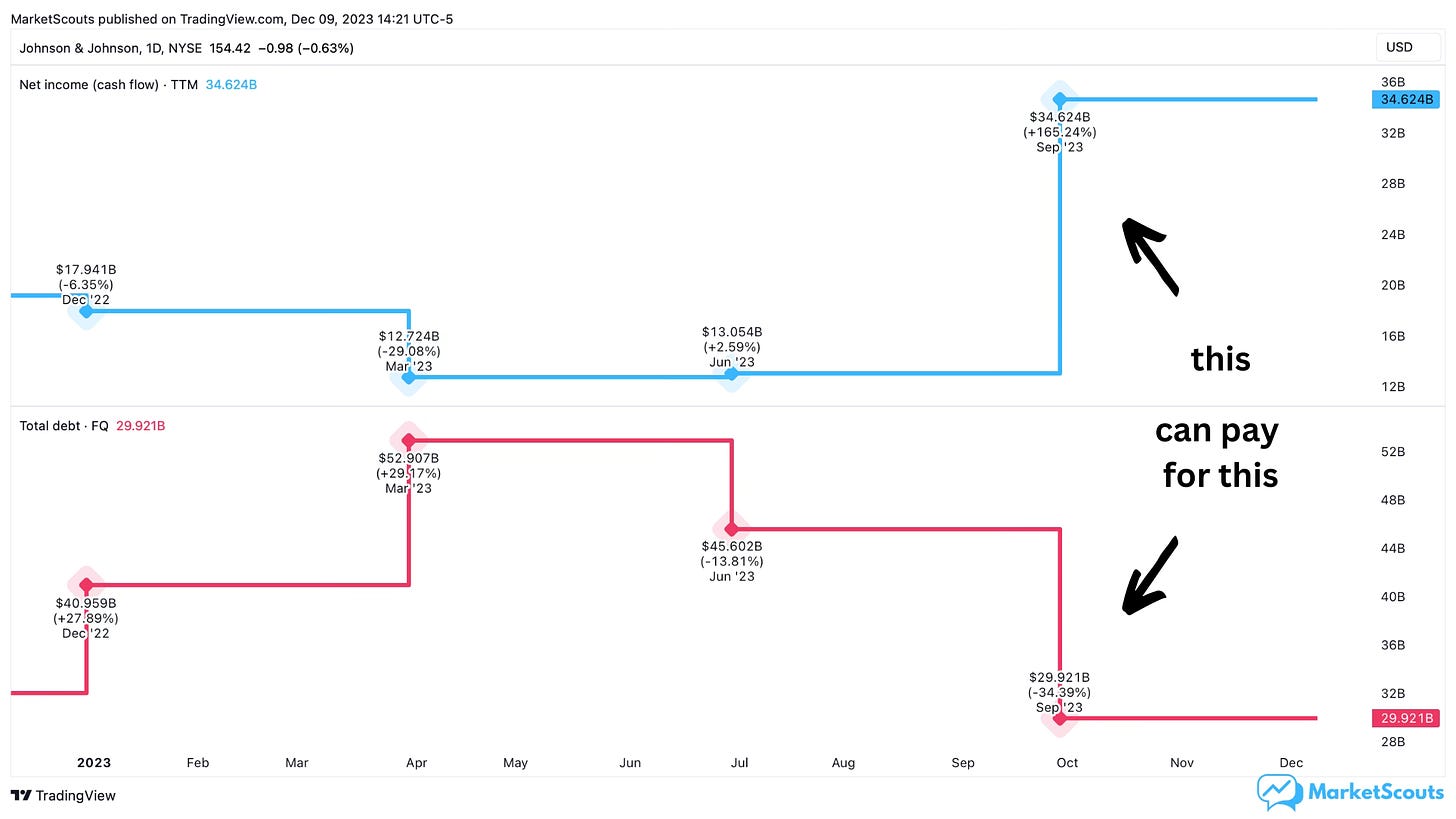

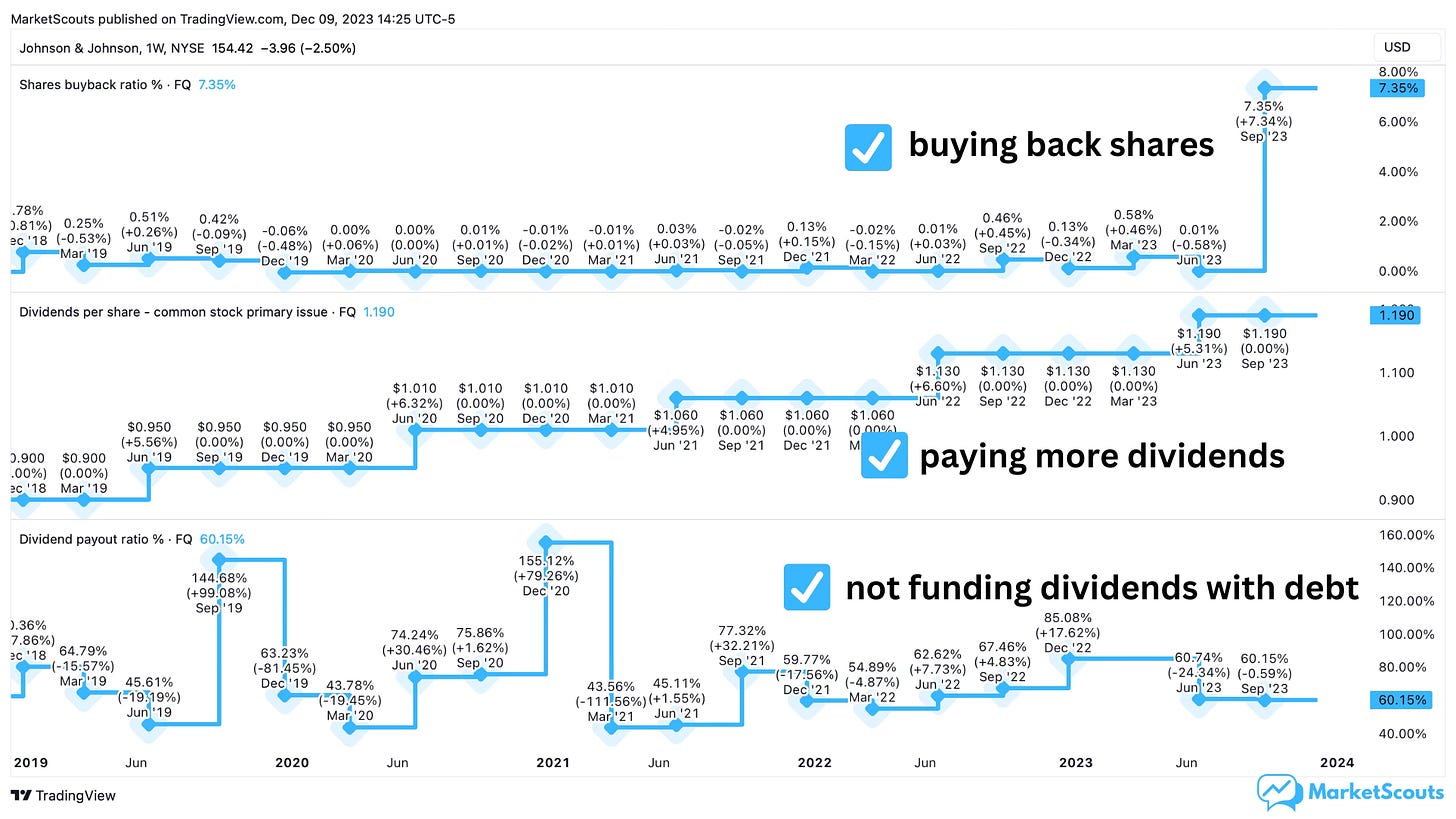

On top of all this, JNJ has continued to increase its dividend payments and buy back shares without resorting to taking on too much debt to do it.

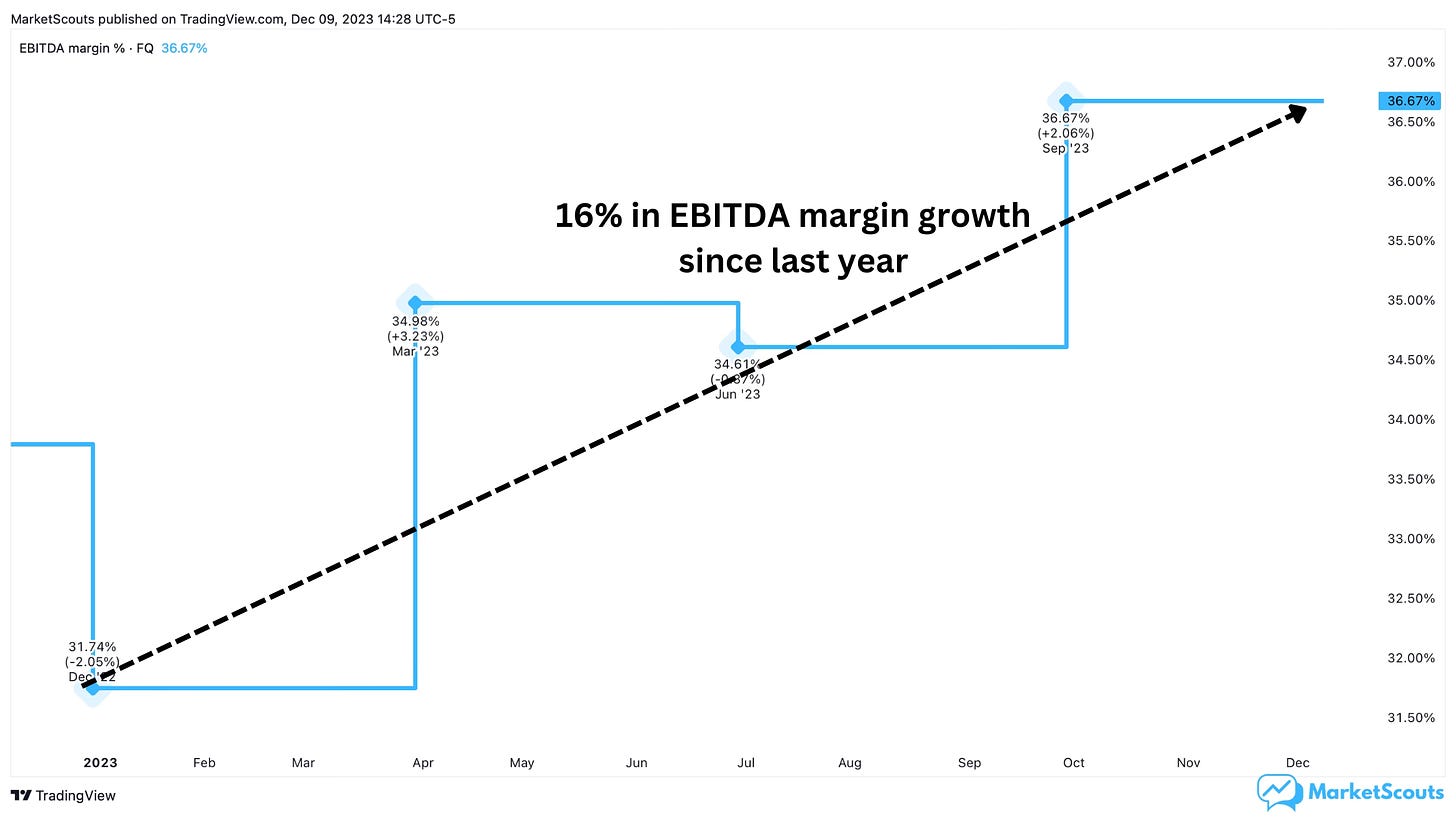

As a kicker, its EBITDA margin (or how much profit they make compared to revenue) has also been growing since last year.

So when we consider all of these things, we can say that JNJ is indeed undervalued.

Our “rule” of buying when price is going down and earnings are going up seems to be validated, too.

Let’s look at the next example.

Opportunity #2: Halliburton

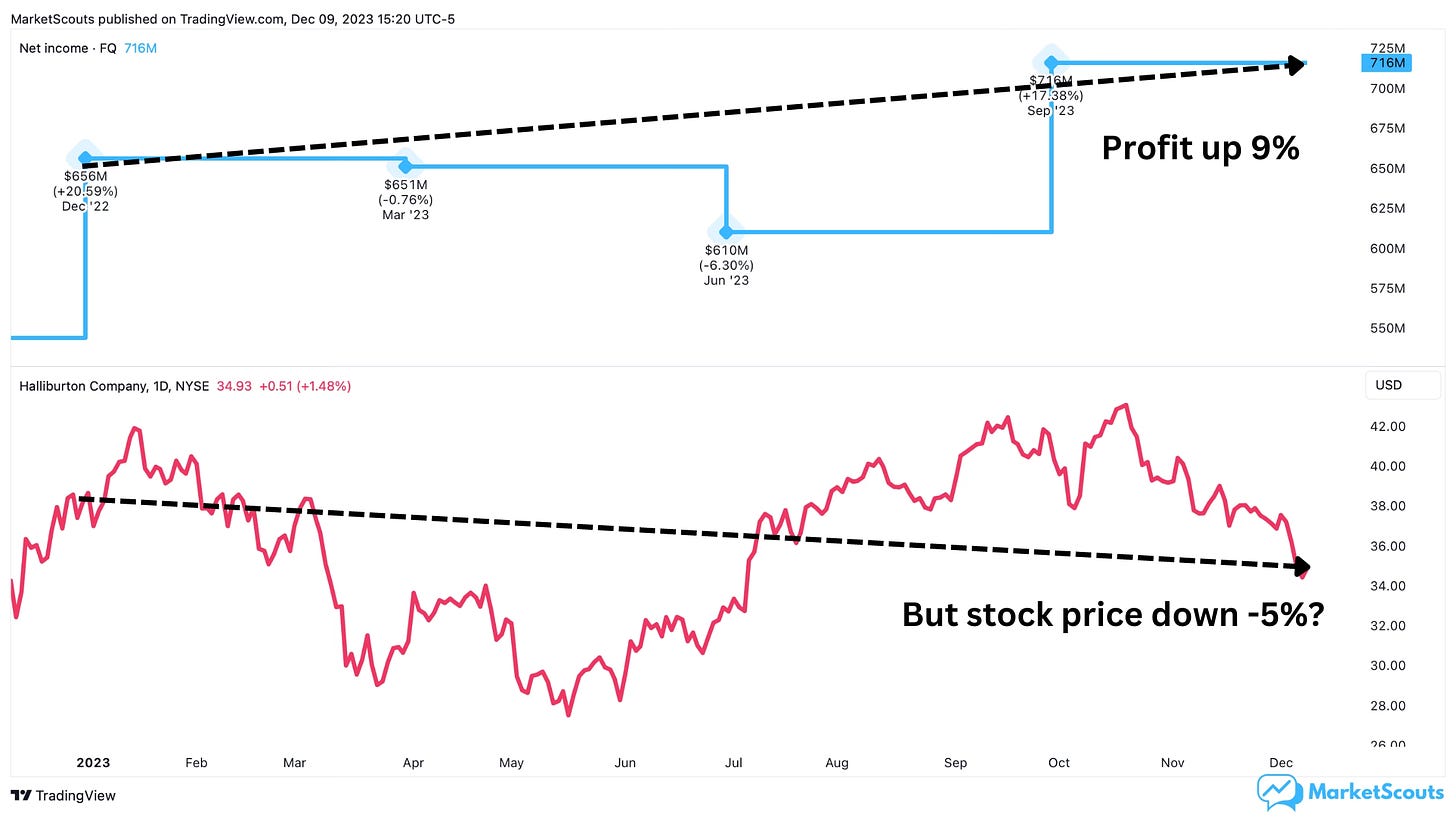

Halliburton, an oil company, is experiencing something similar: a 9% increase in net income but a 5% drop in the stock price.

Their 12.0 P/E ratio is also below the 18.5 industry average and 17.9 peer average.

But let’s dig deeper and see if Halliburton is really undervalued, and why.

Why is the stock down?

Oil and natural gas prices have been declining steadily since the beginning of 2023, dampening investors expectations this year. Halliburton didn’t generate cash flow for Q1 2023, indicating a slowdown from the highs of 2022.

Then there’s the ESG bit. Halliburton has faced quite a bit of backlash for their unsustainable business model and previous reluctancy to shift towards ESG principles.

And Halliburton is not alone in this situation. This has been the common response towards oil companies in recent years. Some investors are concerned about the long-term future of the oil and gas industry, as they believe that the world is transitioning to a low-carbon economy.

Is Halliburton truly undervalued?

On one hand, these investors are right – we need to do more to avoid a climate catastrophe. If it’s even possible at this point.

But on the other hand, we also need to keep in mind two things.

First, most experts believe that it will take at least several decades to fully transition away from oil and other fossil fuels.

Second, even as electric cars are getting popular, we still need plastics and all the other stuff that’s made from oil. In fact, about 60% of oil is used to make things other than gasoline.

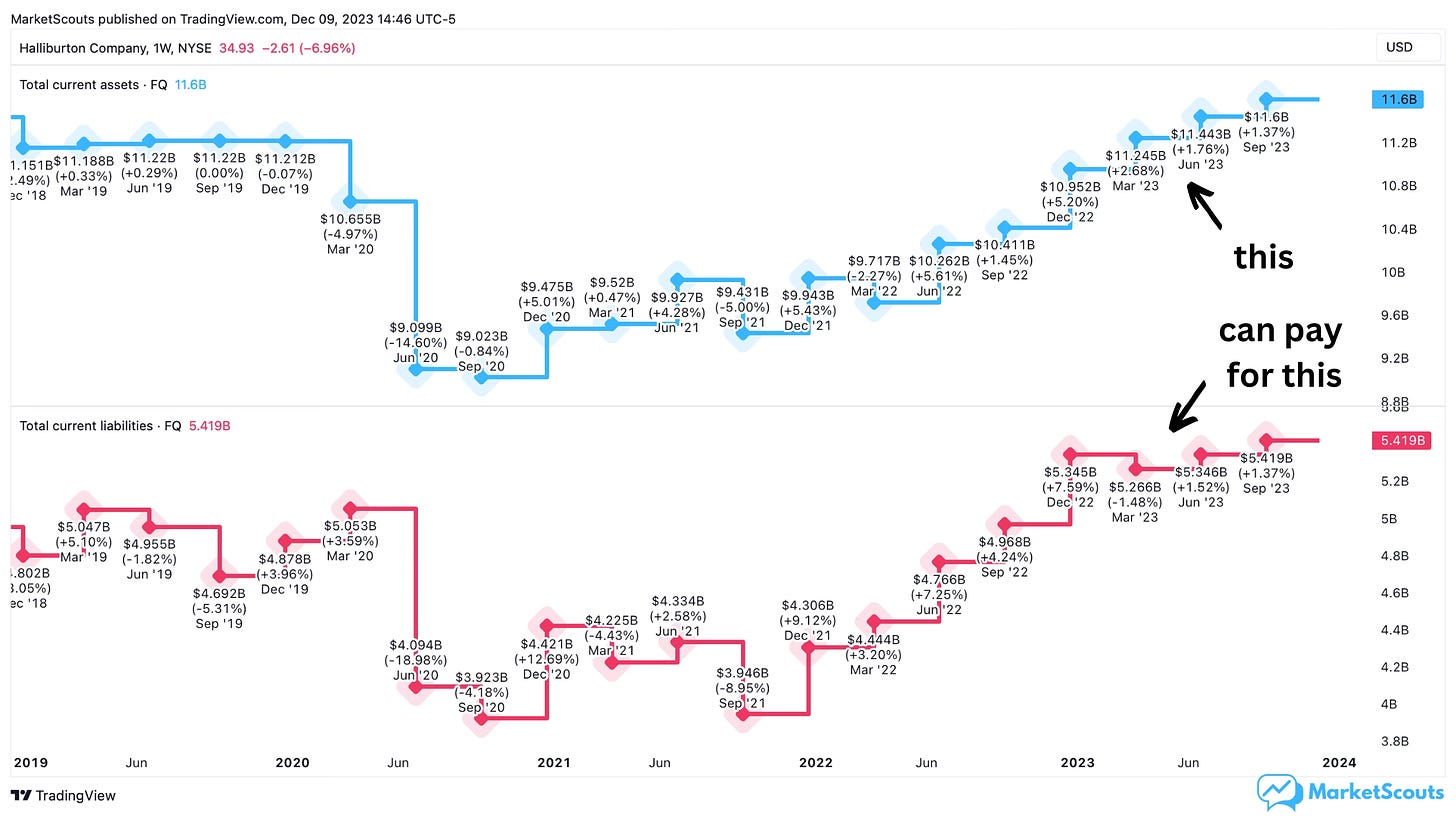

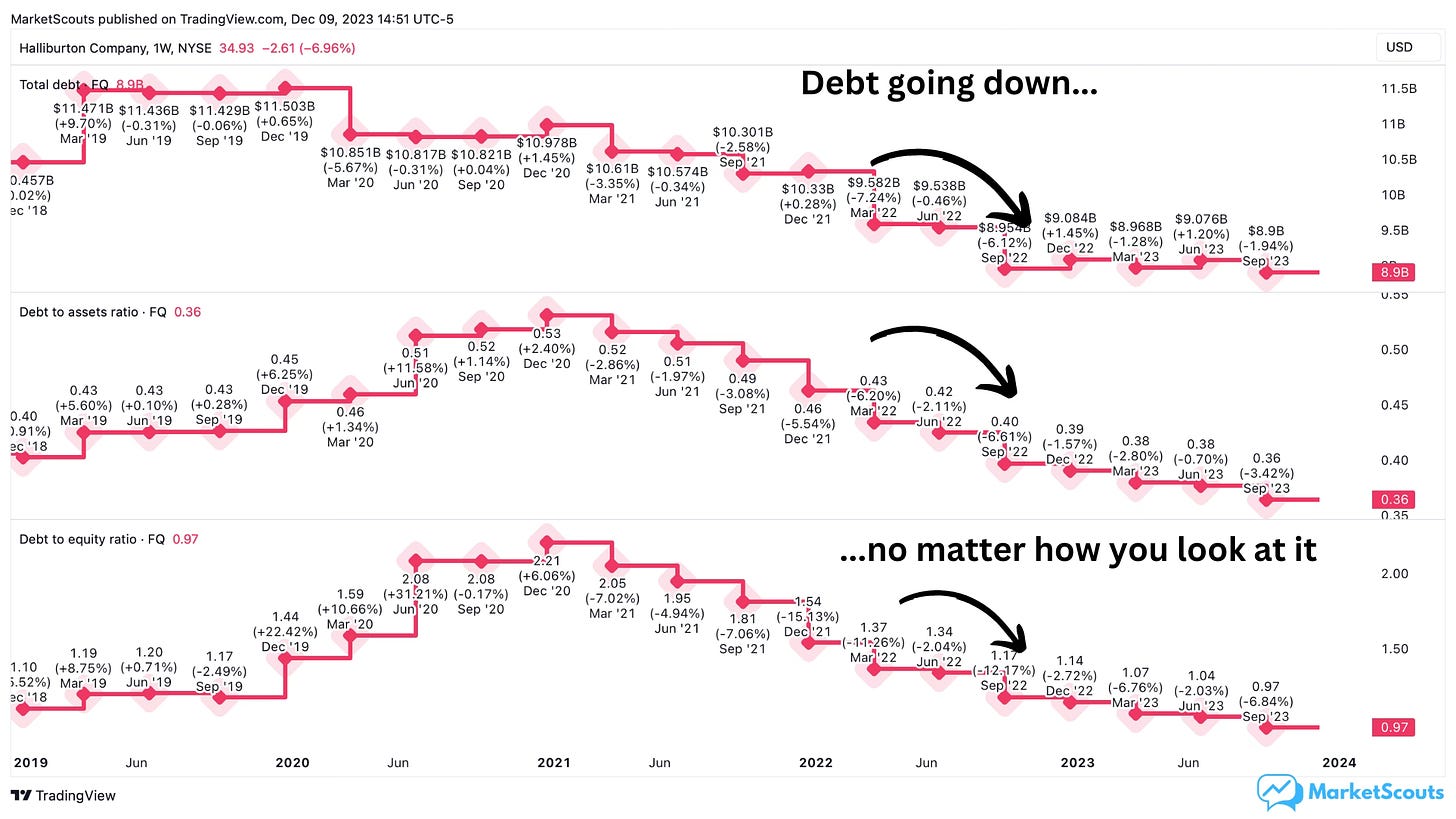

But this is perhaps a bit too “macro”. Let’s look at the company’s actual financial health. Here, Halliburton seems to be in great shape. Its current assets cover its current liabilities:

Its total debt is also decreasing, as they continue to pay it off:

Next, let’s not forget that all commodity producers live or die by the price fluctuations of the commodities they make.

In this case, Goldman Sachs expects crude oil prices to average $95 per barrel in 2024, compared to this year’s $94 per barrel. However, Goldman Sachs also notes that there is a risk that prices could rise to $110 per barrel if there is a supply disruption. Bad news for fight against inflation, but certainly good news for Halliburton.

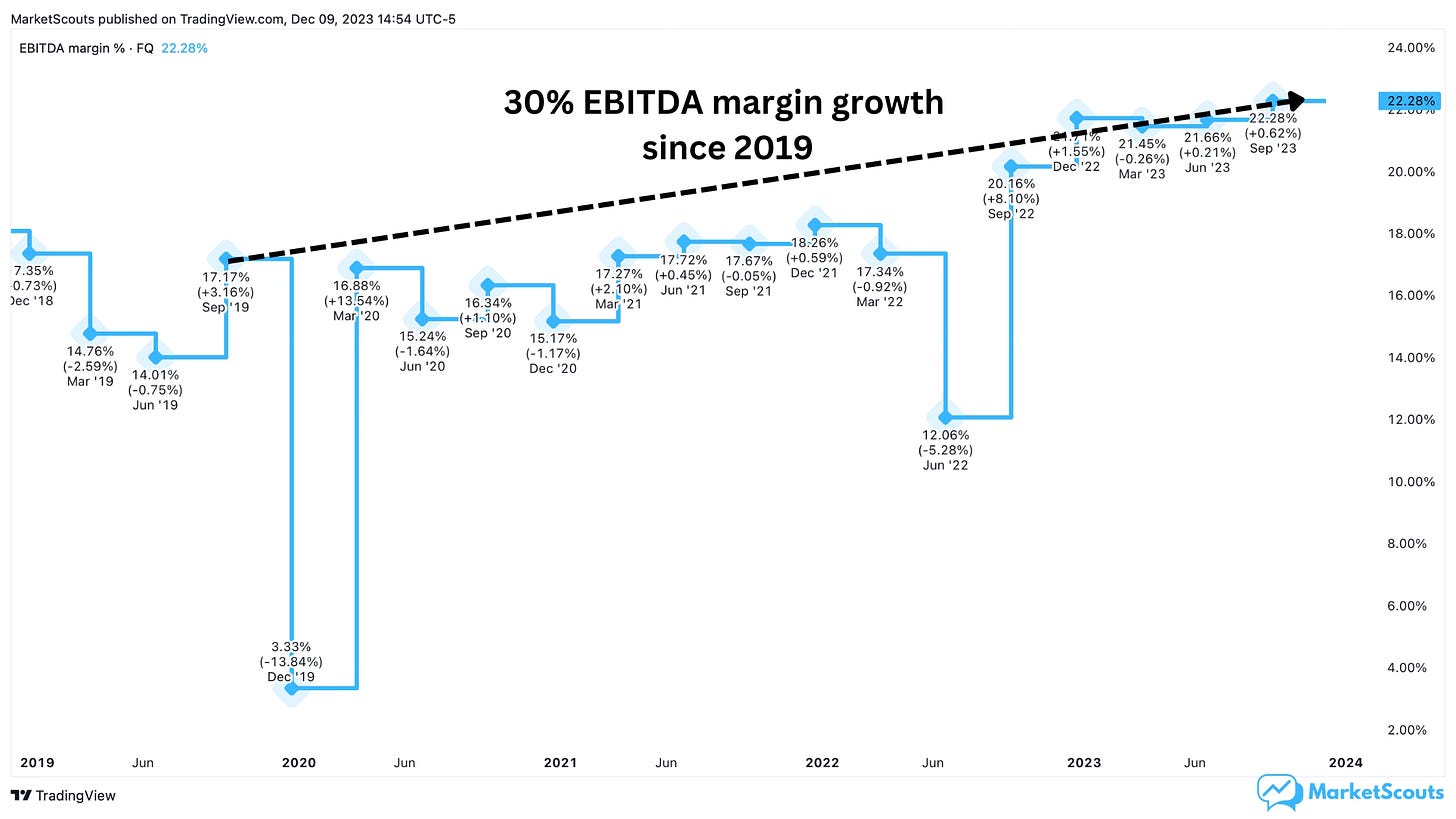

And Halliburton is already very efficient at making the most out of their oil production: their EBITDA margin has grown every year since 2019, for a total of 30% growth.

Overall, Halliburton seems to be a well-positioned company with strong growth prospects, a low valuation, and a strong balance sheet. The company is also committed to sustainability and environmental stewardship, and as they continue to make strides towards this goal, investor confidence and brand image should increase.

Another win for our “rising earnings, dropping price” filter.

“Opportunity” #3: Volkswagen

We’re sure the quotation marks are a big spoiler in terms of what we found.

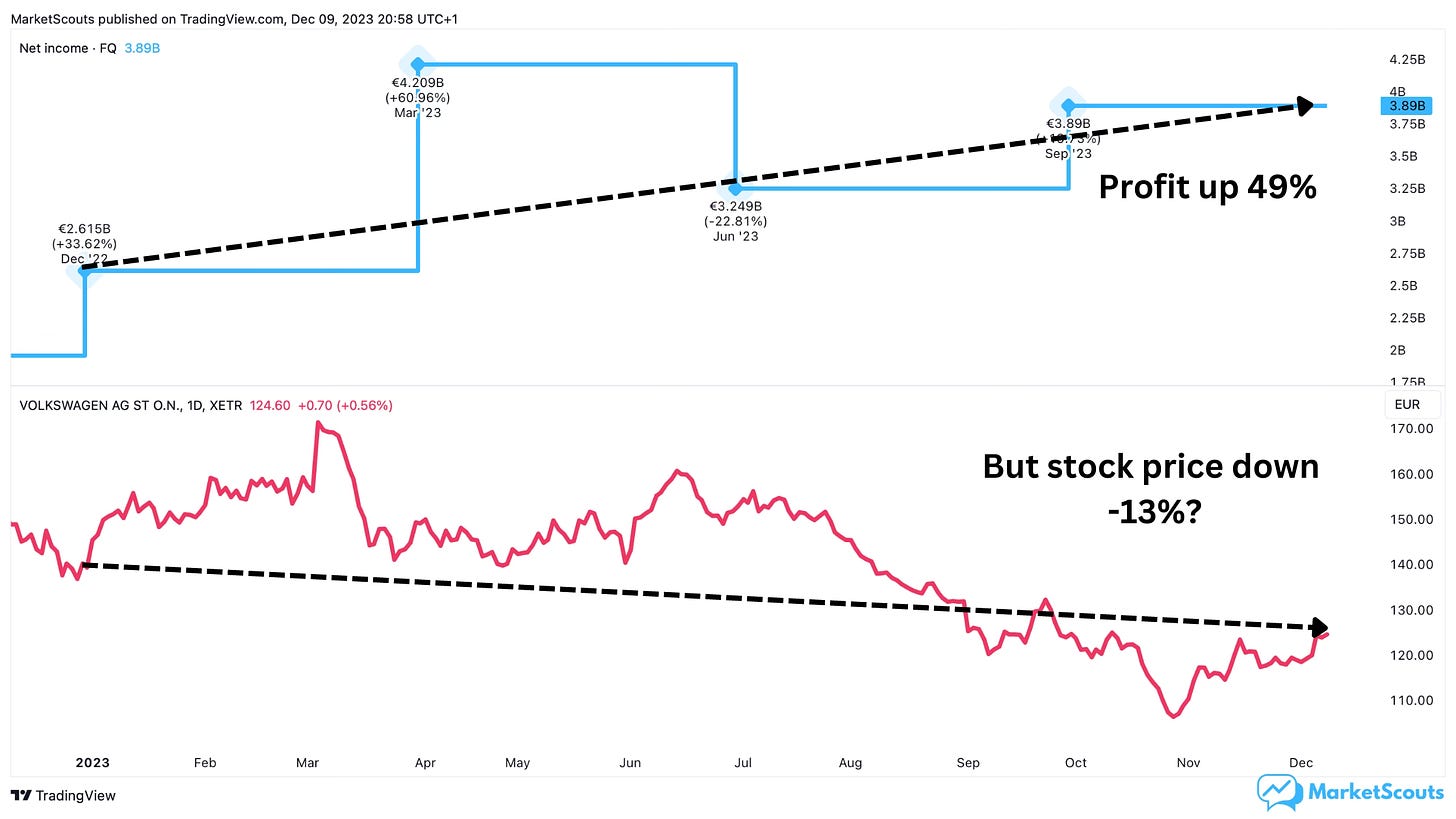

Volkswagen's 4.4 P/E is far below the automobile 13.4 industry average, and its stock has dropped 19% YTD and 29% in the past five years. This is despite a growth in net income of 49% since last year.

Seems like a great deal, right?

Why is the stock down?

For the last seven years, Volkswagen has been on a decline. The reason?

Well, there’s more than just one.

To begin, Volkswagen engaged in deceptive practices to circumvent emissions regulations in the United States back in 2015.

This scandal caused a significant loss of trust in the company, leading to billions of dollars in fines and penalties – and damaged their reputation, eroded consumer trust, and caused a significant drop in sales.

But that’s getting to be old news. More recently, the economic slowdown and supply chain issues caused by the pandemic also have affected Volkswagen's sales.

The company is more reliant on sales in China and Europe than some of its competitors, and these markets have been particularly affected by the economic slowdown.

The list of “reasons to avoid the stock” doesn’t stop here.

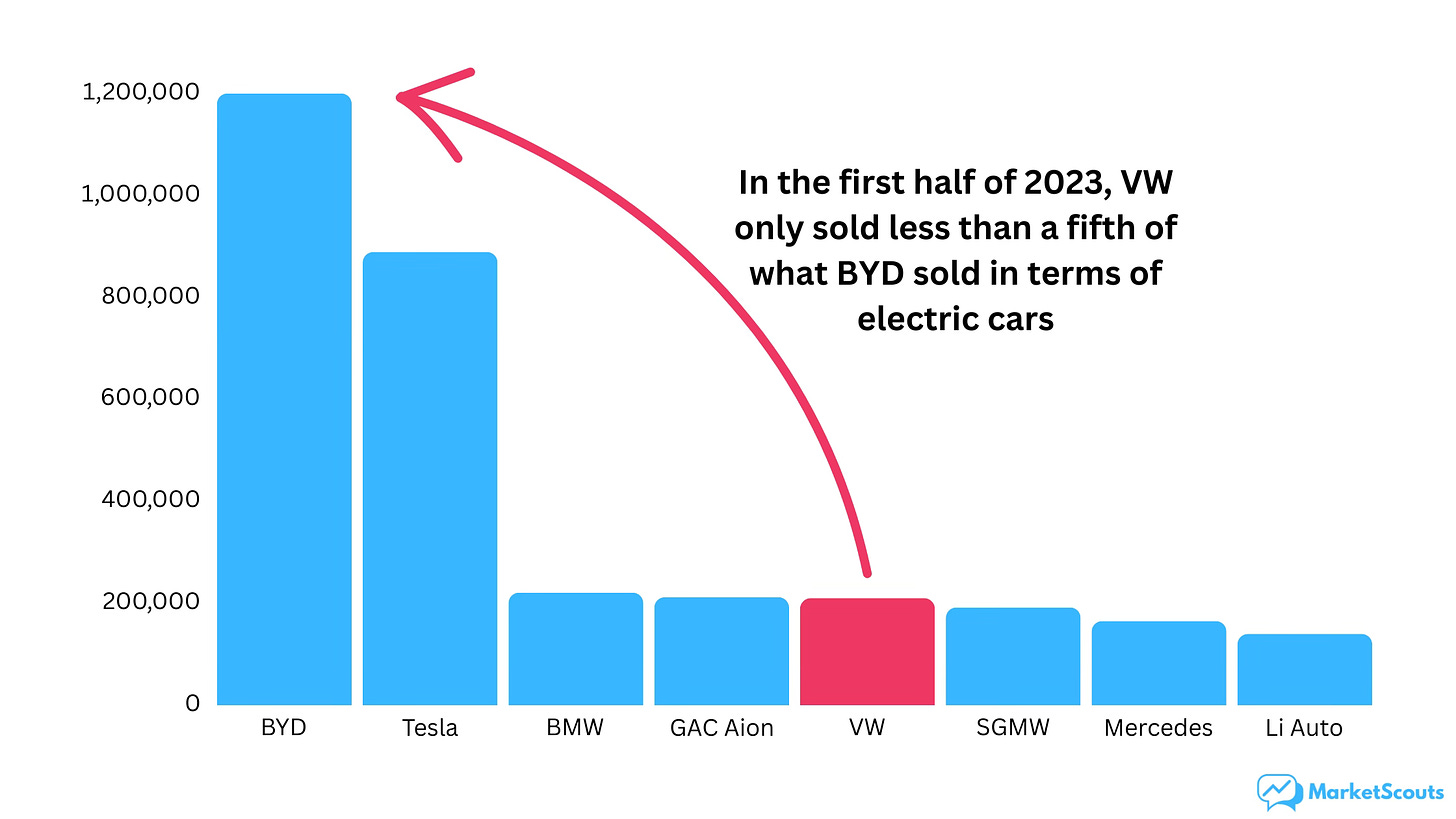

Its recent investments in electric vehicles (EVs) are not paying off, with Volkswagen far behind both pure EV companies and traditional automakers when it comes to sales of electric cars.

Moving on.

In October 2023, Volkswagen AG also reported a $2.7 billion hedging loss, contributing to a 7.5% decline in its operating profit for the year's third quarter. The hedging loss was caused by the company's bets on future raw materials prices, such as steel and aluminum. These bets backfired when the prices of these materials fell unexpectedly.

On top of all of these issues, or maybe as a result of them, Volkswagen’s financials aren’t the prettiest.

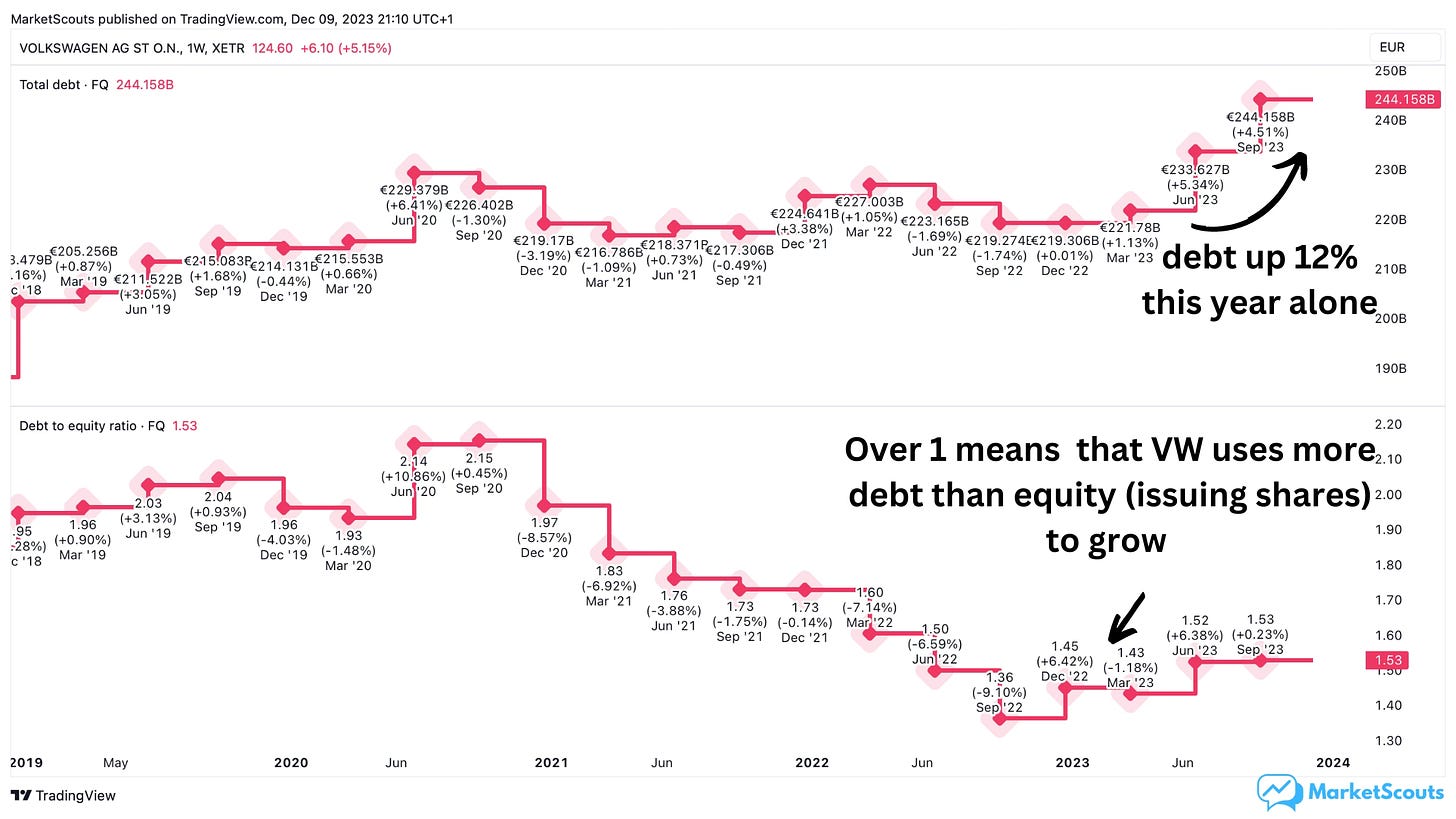

Although their short term assets exceed their short and term liabilities, they are a highly debt leveraged company, with a debt to equity ratio of 1.53.

To make things worse, their cashflow doesn’t cover their debt or their dividend payments and their EPS has declined.

Is Volkswagen truly undervalued?

Based on its P/E ratio alone, sure. It seems that way.

But the company’s setbacks have seriously affected its growth potential. Volkswagen is also behind its rivals in terms of electric vehicle development, and this will definitely hurt it in the future. The company also needs to figure out a way to improve its operations so it can generate higher cash flows and pay off debt.

Yes, Volkswagen owns many brands that are still loved by customers. Yes, it’s really cheap right now. But we’re not sure that the recent bump in net income is sustainable – yet.

We’ve said this before: the market isn’t stupid, it’s just afraid of something you don’t know.

What’s the lesson here?

As we wrap up this post, please keep in mind our disclaimer: we talk about various stocks, funds, and securities because they’re interesting or can be used to teach a lesson about investing. None of the posts we publish are intended to be taken as individual investment advice or a recommendation to buy or sell any specific stock or other security. We can’t even guarantee that our information sources are 100% accurate. The only purpose of these posts is to teach you how to do research and figure this stuff out for yourself.

Now, these companies were more or less random picks from a list of stocks with low P/E ratios. As we looked at them, it turned out that each one of them was undervalued. At least “technically”.

But this is where we need to be really careful when selecting our investments based on quick and dirty indicators.

There's always a reason why the P/E ratio is low.

Out of the three companies we looked at, two actually turned out to be truly undervalued – meaning we can have some hope that the price is only on a temporary “sale” and that eventually it will catch up with the company’s actual underlying business.

In their case, the P/E was low due to issues that could easily be solved, such as a temporary increase in debt or simply being in an industry that’s fallen out of favor.

With Volkswagen, the P/E ratio hints at problems that are much more complex and that have been drawn out over half a decade.

But hey, we did find two interesting opportunities out of a random pick of three.

That’s not a bad hit rate, and it shows the power of the P/E ratio when used as a starting point.

If you found this post useful, please leave a comment. We would like to know how you use the P/E ratio. Is it your main stock screener? Or do you not pay too much attention to it? What other indicators do you use?

You guys are killing it. Absolutely love your data visualization techniques to back your argument for Halliburton, Volkswagen and JNJ. Great job!!