What are stocks? A really complete guide

Everything you need to know about stocks: what they are, how many kinds there are, how to buy them, and how they're different from other investments.

Stocks are a kind of investment that represent you owning a piece of a business. Owning stock in a company entitles the owner to a proportion of the company’s net assets and profits equal to how much stock they own.

The “net” there is important: it means what’s left after debts are paid. And that sometimes is an issue for stockholders. But we’ll talk more about that in a minute.

First, let’s answer some frequently asked questions about stocks.

Why do companies issue stocks?

There are two reasons why companies issue stocks.

First, they need to raise money for various purposes, such as funding expansion projects, research and development, or paying off debts. When a company first sells stocks for the public, the process is called “going public” and it’s done through an initial public offering (or IPO). But a company can issue shares after an IPO too.

The second reason is so that insiders can go from being “paper rich” to actually rich.

You can’t buy a private jet with shares only. You either get a loan using your shares as collateral (if the bank agrees, and at the price they set), or you sell your shares to someone else, either another investor or the public.

For example, WeWork was founded in 2010, but it only went public in 2021. In the first few years, the founder, Adam Neumann, had no easy way to turn his shares into money.

He was technically a billionaire, but had barely any cash. Which meant that he had to take loans from JP Morgan Chase, using his shares as collateral, in order to finance his lifestyle:

Going public makes it easier for previous investors, employees, and founders to turn their wealth “liquid”.

What is an IPO?

An Initial Public Offering (IPO) refers to the process of offering shares of a private company to the public.

Usually this is done through a new stock issuance, meaning a new batch of shares that the company creates and which dilutes the previous investors but allows new investors to buy in.

What is a shareholder?

A shareholder is anyone who owns at least one share of a company's stock. It can be a person, a company, or some institution.

By the way, “shareholder” is the same as “stockholder”.

What rights do you have as a shareholder? Well, let’s say you own 10% of Apple shares.

Do you own 10% of Apple’s assets, like buildings, inventory of brand new Macs and latest iPhones? Not quite. Apple the corporation, a separate legal entity, owns 100% of its own assets.

What you own is 10% of Apple’s shares, which still gives you a few rights:

to receive 10% of the dividends that Apple pays;

to vote in meetings;

and to receive 10% of whatever’s left if the company is sold or goes bankrupt.

How do you make money from stocks?

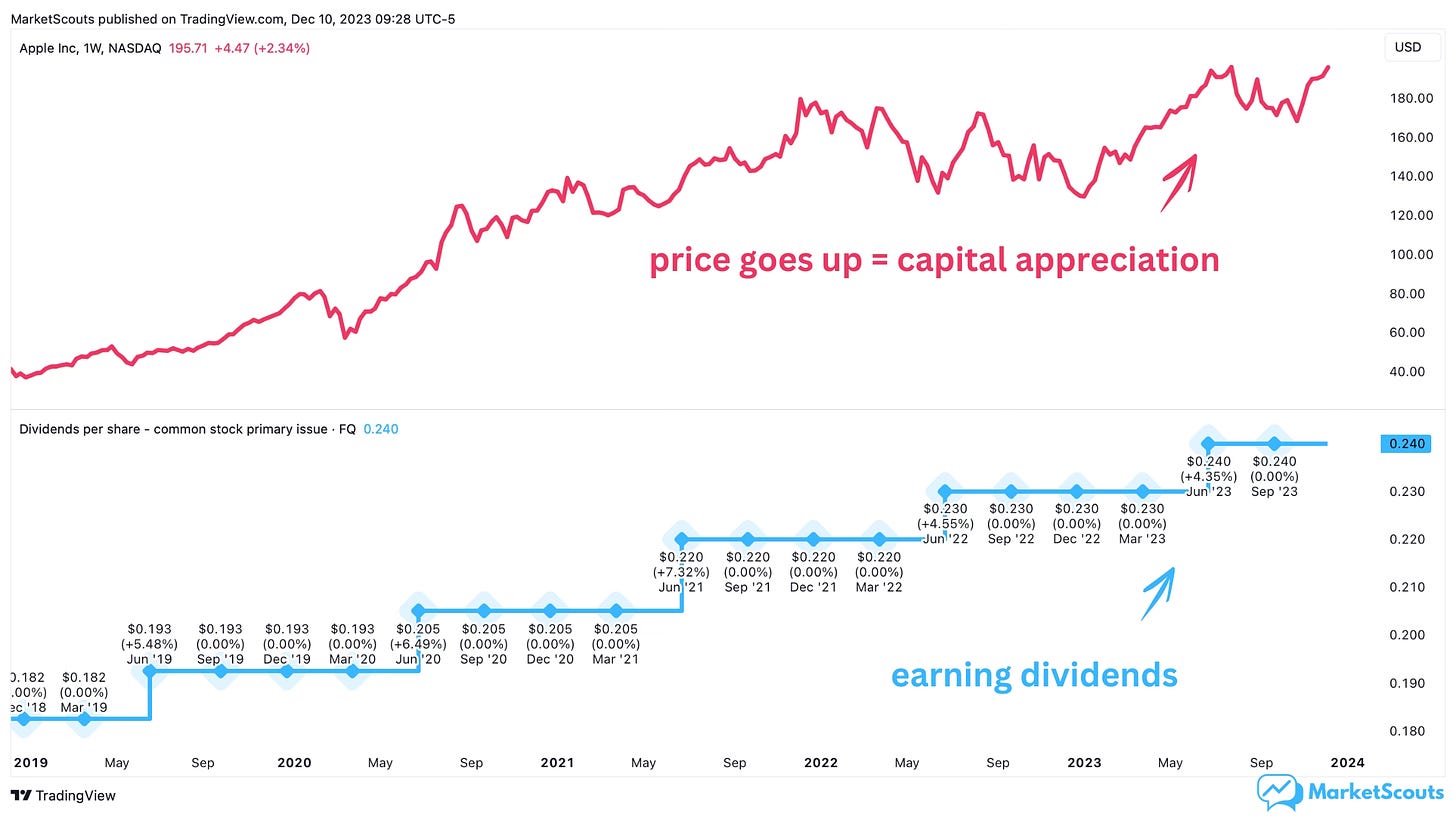

There are two ways investors make money from stocks: one is from dividends, and the other is from capital appreciation.

Dividends are pieces of the profit that the company pays to its shareholders. So if Apple has 15 billion shares outstanding and declares a dividend of $0.5, then shareholders will get $0.5 for each share of Apple that they own.

Capital appreciation is an increase in the share price. What this means is that you can sell them for a profit, as they’re now worth more than when you bought them. So if you bought a share of Apple in 2013 for $17, and in 2023 the price is $189, then if you sell it you’ve made $172. That’s your capital appreciation.

What are stock dividends?

Stock dividends are just like regular dividends with the difference that instead of getting cash you get more shares in the same company.

What makes stocks go up or down in price?

The main thing you have to remember is that as a shareholder you are entitled to a portion of the company’s profits.

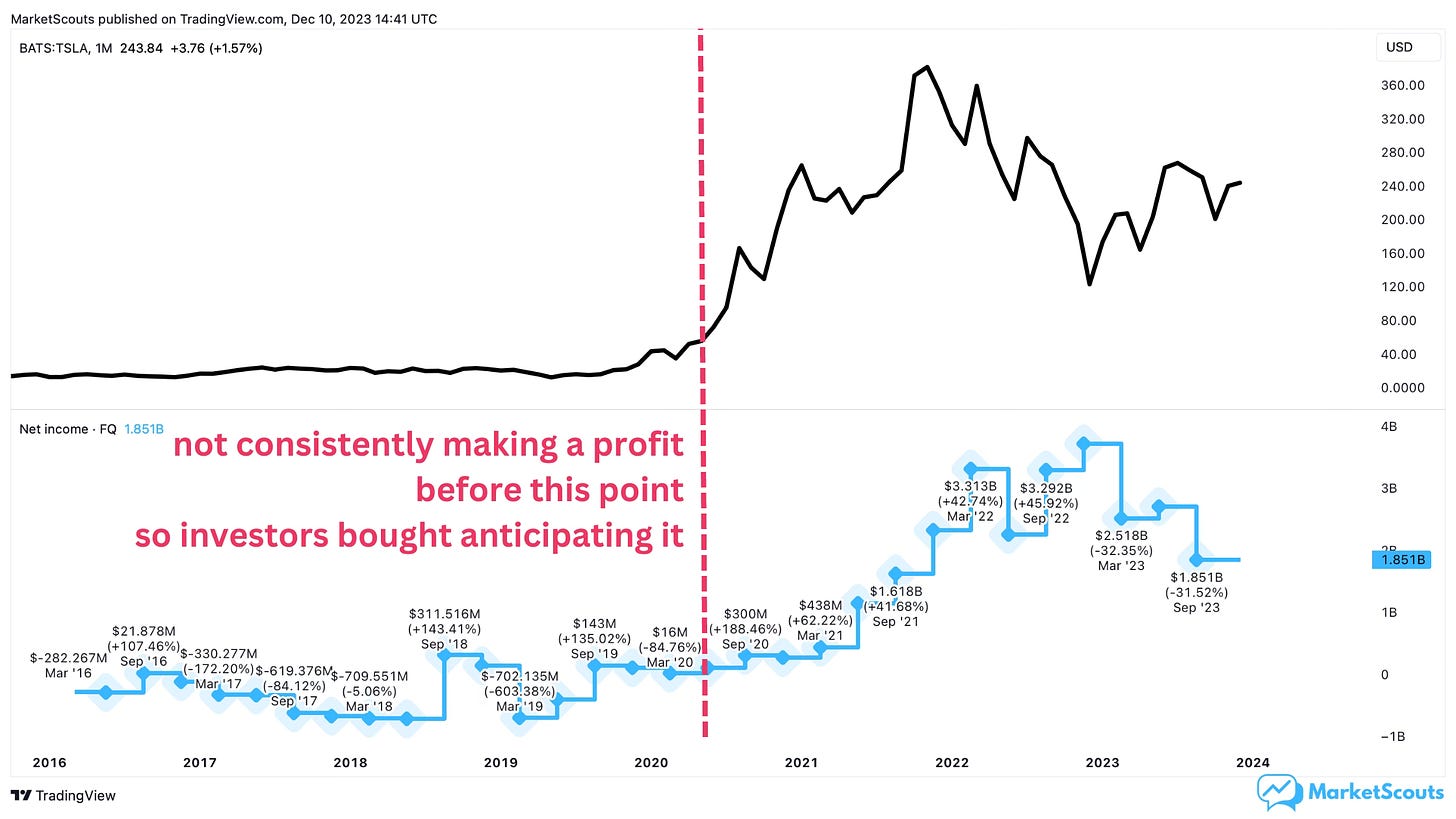

So any movement in the share price is based entirely on how much profit the company is making, and also on how much profit it’s expected to make in the future.

Sometimes a company makes profits in a simple, steady way that’s easy to forecast. Think of a retail chain like Walmart. To grow profits, they need to either open more stores, charge more, or cut costs. Or a combination of these. But whatever they do, it won’t double their business overnight.

But when a company comes along that’s growing at astonishing rates then the market is willing to pay more. Sometimes even if the company isn’t making any profit right now, like Tesla for the first few years after its IPO.

A drop in expected future profits can also cause a stock price to crash. This is why we can sometimes see companies that beat their earnings estimates but not the market’s hopes for those earnings – and therefore see their stocks go down.

What are the risks to owning stocks?

We mentioned previously that corporations are independent legal entities. This means that corporate property is legally separated from the property of shareholders (you), which limits the liability of both the company and the investor.

If the corporation goes bankrupt, a judge may order all of its assets to be sold but a shareholder's assets (your assets) are not at risk. The court cannot force you to sell your shares, nor can it force you to pay the debts of the corporation you invested in.

So really the only risk is that the value of the investment can drop, or even go to zero. Sometimes that happens.

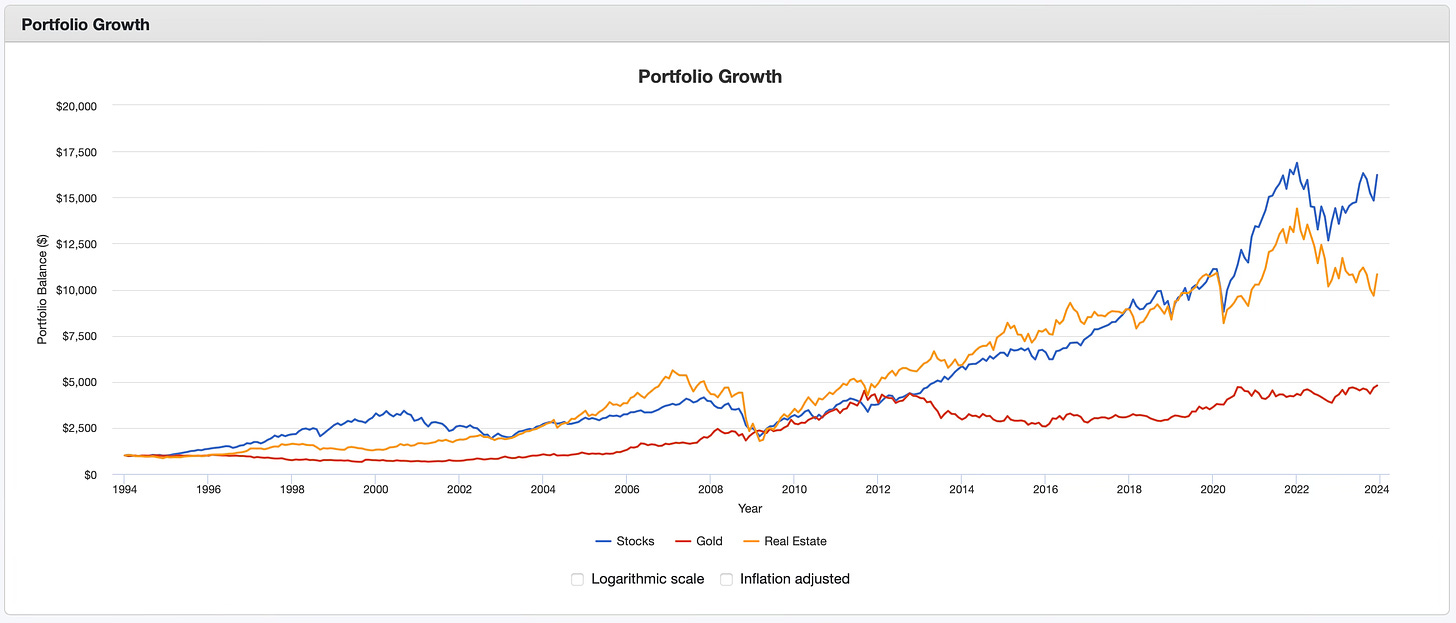

But taken as a whole, stocks have outperformed most other investments over the long run.

Are stocks and shares different?

Not really. One piece of stock is called a share.

So let’s say that Apple trades at $200. If you buy $400 worth, you would say that you bought two shares of Apple stock. Or that you own stock in Apple.

But, to be fair, in the US people do say “I bought one Apple stock”, whereas “I bought one share of Apple” is mostly something British investors would say.

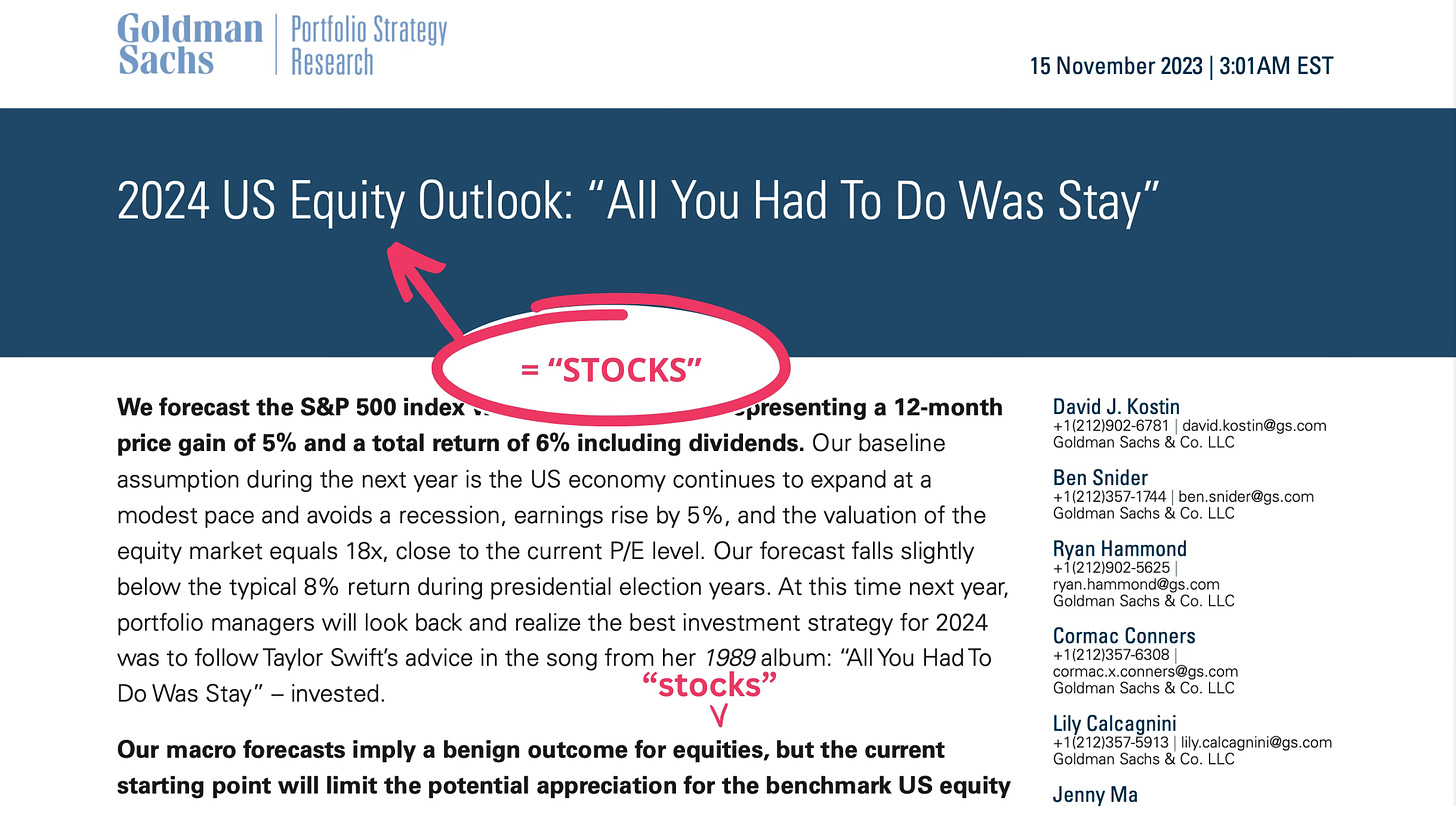

Are stocks and equities different?

Stocks and equities are exactly the same thing.

But the word “equity” (singular) is a bit different. Equity is how much you actually own in a company, regardless of how it’s set up. Shares are pieces of a company ownership that you can buy and sell. You can’t do the same with partnership shares, for example.

The word “equity” is also used to mean “how much of the company is funded through shares” in various indicators, such as Return on Equity, or Debt to Equity.

In any case, when you read some Goldman Sachs report talking about how equities are doing great, rest assured – they’re talking about stocks.

How many kinds of stocks are there?

There are two main types of stock: common and preferred.

Common stock shares give you voting rights along the usual gains from price increase and dividends.

Preferred stock shares do not offer voting rights but have a higher claim on assets and earnings than common ones, which means that they receive dividends before common shareholders. Preferred shares also have priority if a company goes bankrupt. In the event of a bankruptcy, owners of preferred shares are paid first. If there’s anything left, of course.

What are small, mid, and large cap stocks?

Small, mid, and large cap stocks are simply different categories of stocks based on how large the market capitalization of their issuing companies is.

Small cap stocks are usually from companies between $300 million to $2 billion.

Mid cap stocks are somewhere between $2 billion to $10 billion.

Large cap stocks are companies with market caps starting at $10 billion.

What is a penny stock?

A penny stock used to mean a stock trading at less than $1, “for pennies”. Nowadays, a penny stock means any stock with a price of less than $5 per share and which trades “over the counter”, meaning not trading on a US stock exchange like Nasdaq or NYSE.

What is a fractional share?

A fractional share represents less than one full share of ownership in a company. Many investing apps like Revolut, Robinhood, or eToro allow you to trade fractional shares so you can invest as little as you want. So if Apple’s share price is $189, you can still buy a small piece of it (a fraction) using only $1.

What is an ADR?

ADR means American Depositary Receipt, and it’s a way for foreign companies to have their shares traded in the US markets. It’s also a way for you to invest in foreign companies without having to open an account with a brokerage there.

For example, in India only Indian investors can buy local company shares. However, some Indian companies also issued ADRs, so American investors can buy these if they feel the Indian market is interesting.

What is a ticker symbol?

A ticker symbol is a mix of letters and sometimes numbers that represent securities (stocks, bonds, funds, etc.) that are publicly traded. Using a ticker makes it easy for everyone to know which security we’re talking about.

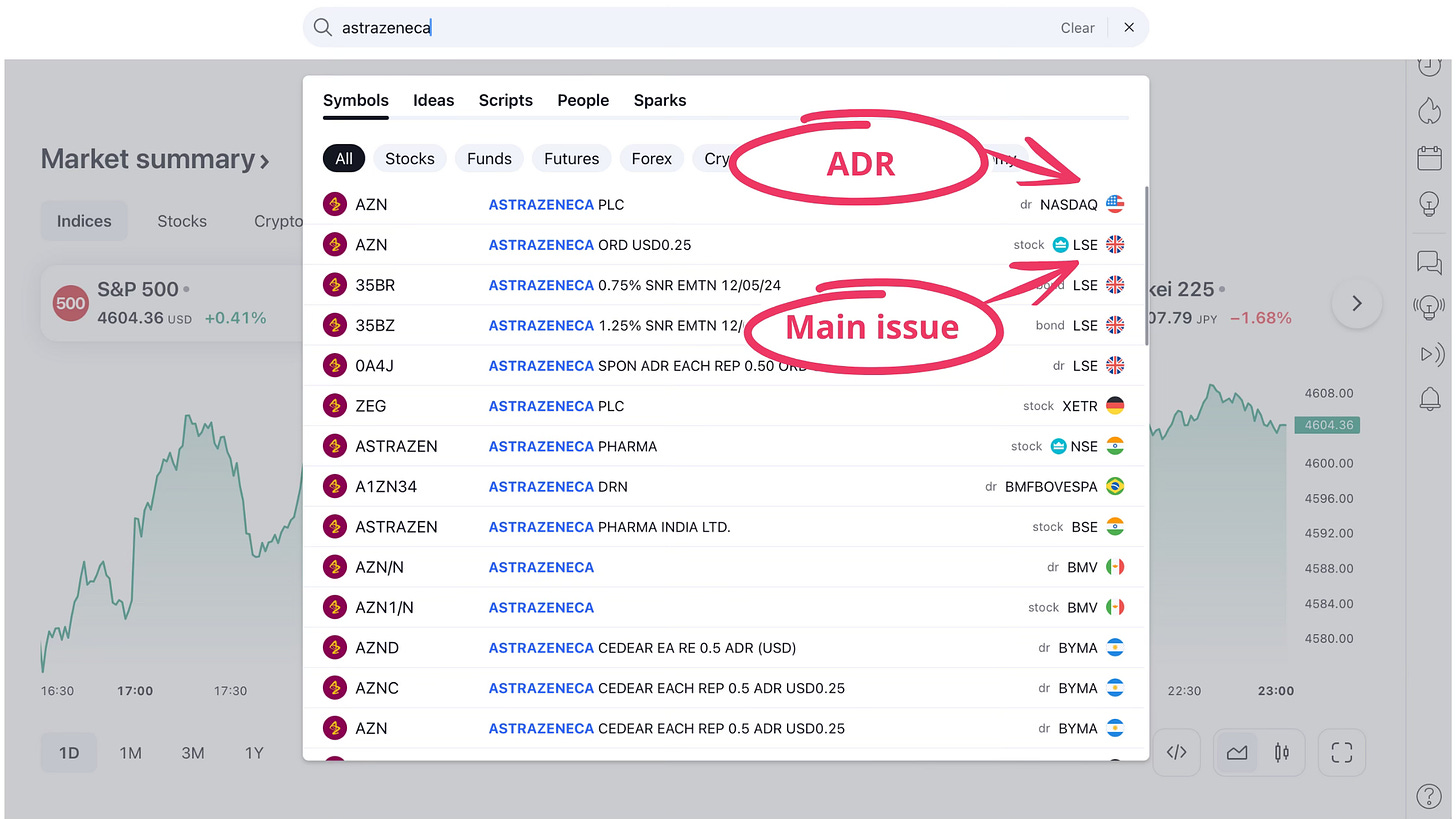

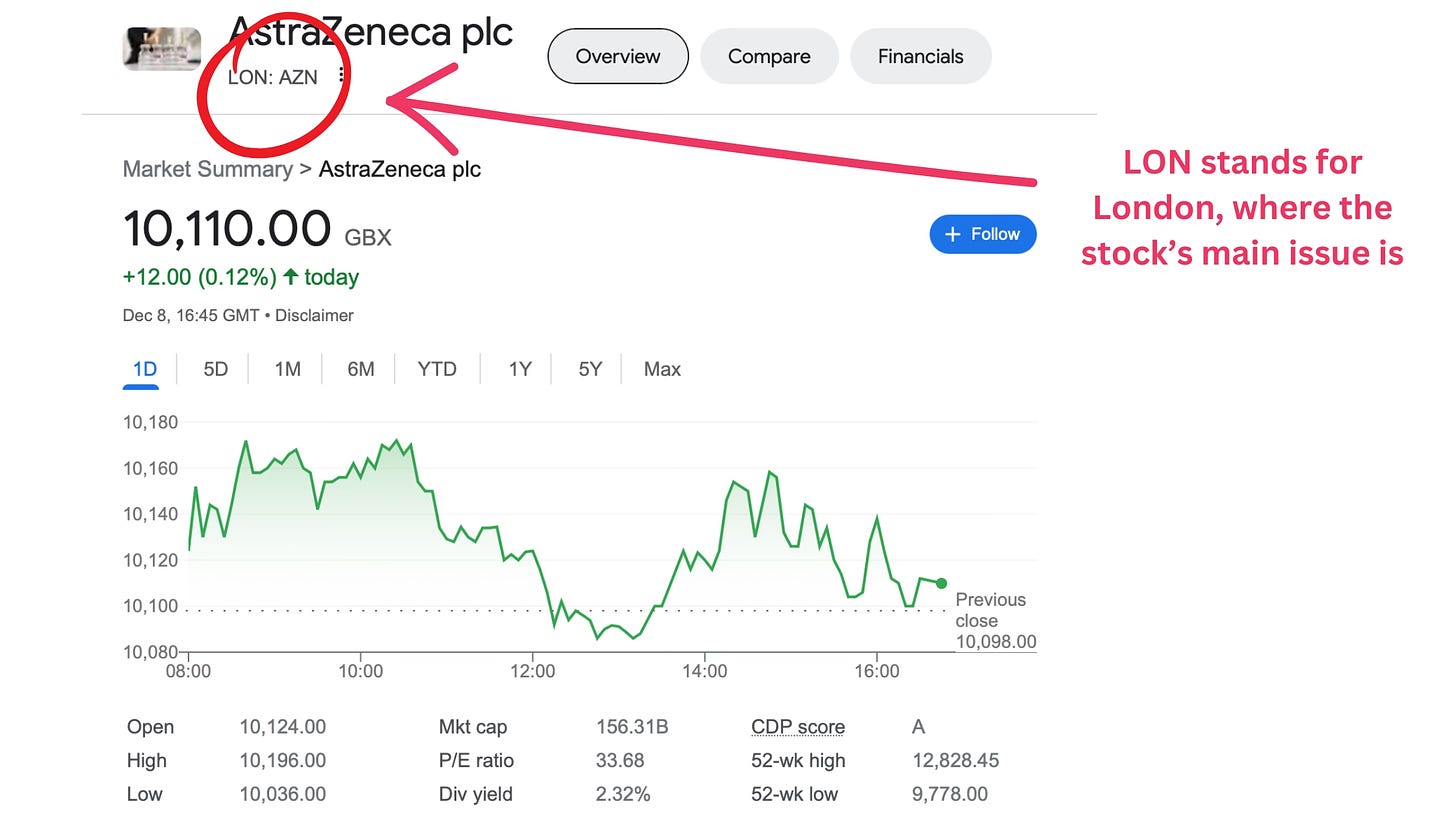

For example, the ticker symbol for a stock like AstraZeneca will be different for its main stock issue in London versus its ADR in New York.

That’s why you might also see stock tickers using the stock exchange ticker in front of them, like this

What is a stock ETF?

A stock ETF (Exchange-Traded Fund) is a type of investment fund that holds a diverse portfolio of stocks, typically tracking a specific index, sector, or theme.

ETFs are traded on stock exchanges, just like individual stocks.

Investors are drawn to ETFs for three things things.

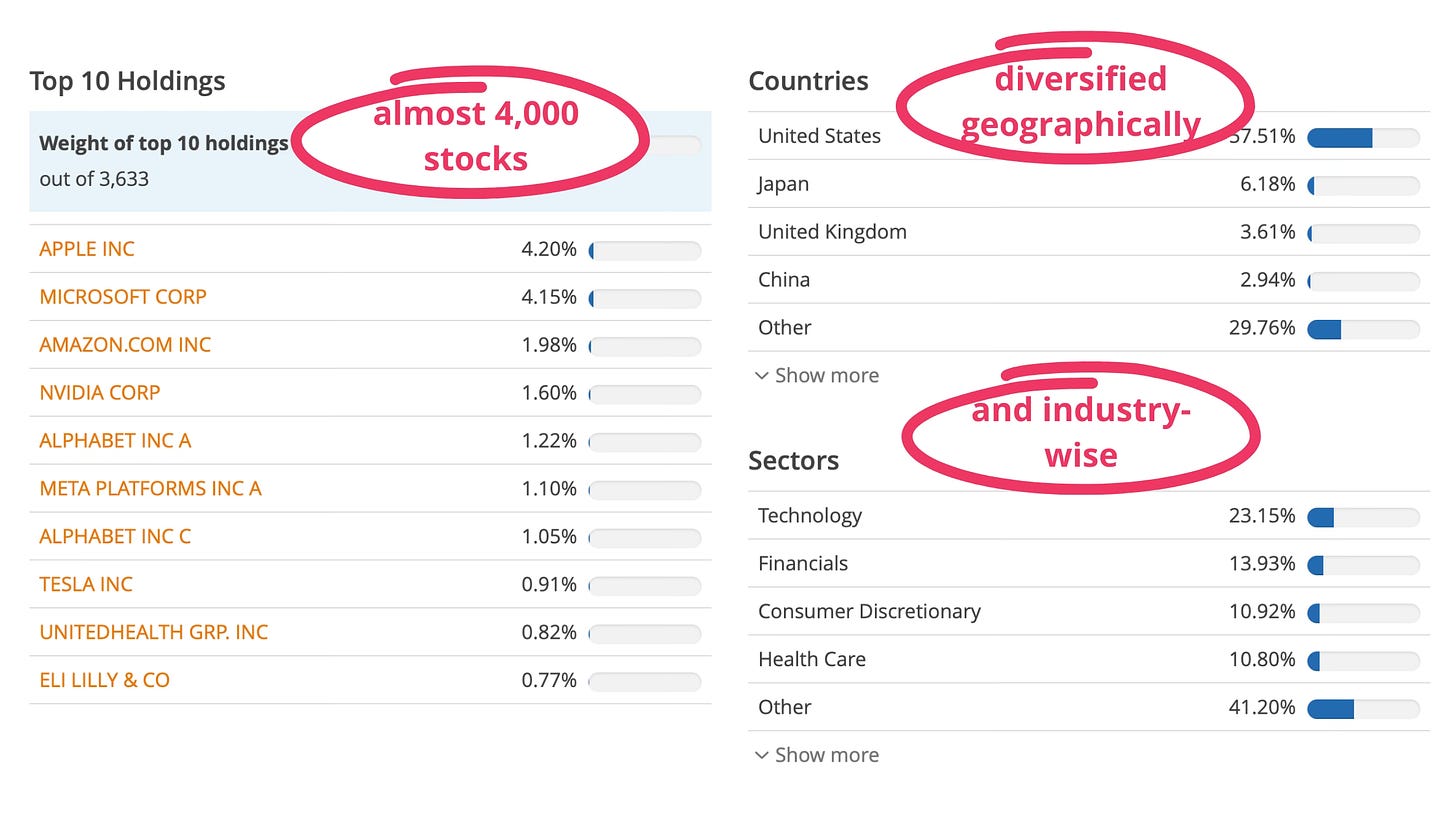

First, their diversification – some ETFs hold hundreds or even thousands of stocks. Take the “Vanguard FTSE All-World UCITS ETF (USD) Accumulating”. It holds almost 4,000 stocks from pretty much every developed and emerging market, and from each industry.

Second, ETF fees (called “expense ratios”) are much lower compared to funds that pick stocks actively. Most ETFs range between 0.2% to 1% per year.

Finally, some of them also reinvest dividends automatically, making it easier to compound your returns. The ones that reinvest are called Accumulating (or Acc), the ones that don’t are called Distributing (or Dist).

These benefits give investors an easy way to invest into the whole market or a specific industry without worrying about picking individual companies.

How are stocks different from warrants?

Stocks and warrants are both financial instruments that you can buy and sell, both issued by publicly listed companies, but they differ in their nature and the rights they confer to investors.

Stocks represent ownership in a company and grant you with voting rights and a share in the company's profits through dividends.

Warrants are a kind of option that give the holder the right (but not the obligation) to buy a specific number of shares at a predetermined price before a specified expiration date. Warrants often have a shorter lifespan and are usually issued by the company itself.

While stocks are a long-term investment, with their value tied to the company's overall performance, warrants are riskier, more time-sensitive, and really more suitable for a short-term trade than anything.

How are stocks different from bonds?

Stocks and bonds are quite different.

Stocks represent ownership in a company, giving shareholders a claim on its assets and a share in profits through dividends.

On the other hand, bonds represent debt, and are issued by governments, municipalities, or even corporations, in order to raise capital.

When you buy a bond, you’re basically lending money to the issuer in exchange for regular interest payments and the return of your money (“principal”) when the bond expires (“maturity”)

Unlike stocks, bonds provide a fixed income and are generally considered less risky, making them attractive to investors seeking stability and regular income.

Also, bondholders are also creditors, meaning they’re given legal priority over shareholders in the event of a bankruptcy. Basically, if the company is forced to sell assets, bondholders are going to be made whole first. Shareholders are last in line.

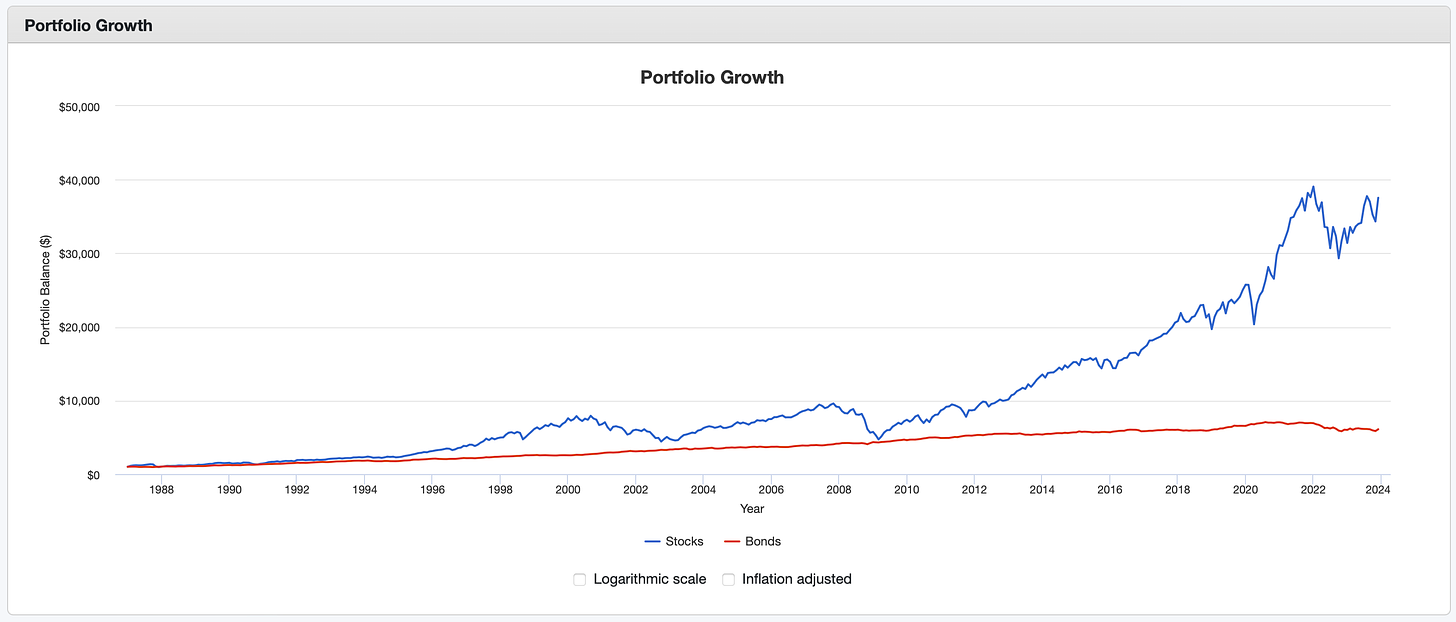

That’s not to say that bonds are safer than stocks – only in extreme scenarios. Over the long term, stocks are more volatile but they do tend to outperform bonds. That’s because as the economy grows, companies grow with it – and stocks let you actually participate in that. As long as corporations’ earnings grow faster than what bonds pay in interest, then stocks are still the better bet.

How are stocks different from options?

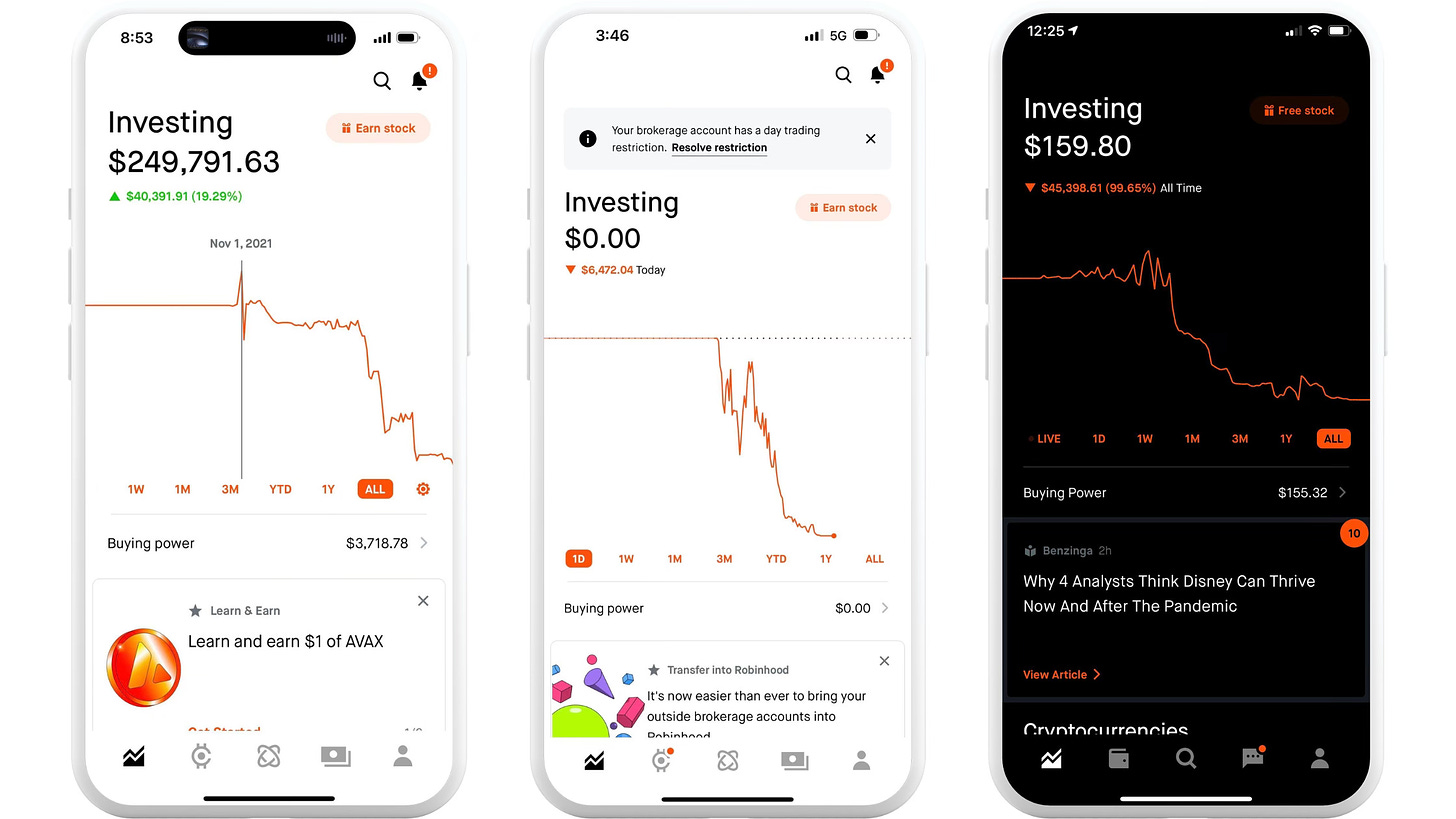

Stocks and options actually very distinct instruments, even if Robinhood makes them seem almost identical.

Stocks represent ownership in a company.

Options, on the other hand, are “financial derivatives” that give the holder the right (but not the obligation) to buy or sell a stock at a predetermined price (called the “strike price”) within a specified time frame.

Options come in two main types: call options, which grant the right to buy, and put options, which grant the right to sell.

The main reason why some investors prefer options is that enable you to trade with leverage, which means you can control a much larger position with a smaller amount of capital. You can use leverage with stocks as well, but most brokerages or apps limit the amount to 1:5 or 1:10. 1:10, for example, means that you can buy $10 for every $1 that you put down. With options, you can reach 1:100 or more.

The problem with this sort of leverage is that you really feel all the motions in the market. If you bought $100,000 worth of Apple using 1:100 leverage, you basically only put down $100 as collateral.

If the stock moves 1% in the wrong direction, your collateral is wiped out and your position closed. Congratulations, you lost all your money.

How are stocks different from cryptos?

Stocks and cryptocurrencies (“cryptos”) are very different kinds of investments.

Stocks represent ownership in a company. That part should be clear by now. They’re also traded on traditional stock exchanges and are subject to quite a few regulations.

Cryptos, on the other hand, are entirely digital or virtual tokens that operate on decentralized blockchain technology. Popular cryptocurrencies like Bitcoin and Ethereum are not issued or regulated by any central authority, and their value is driven by factors like supply and demand and market sentiment.

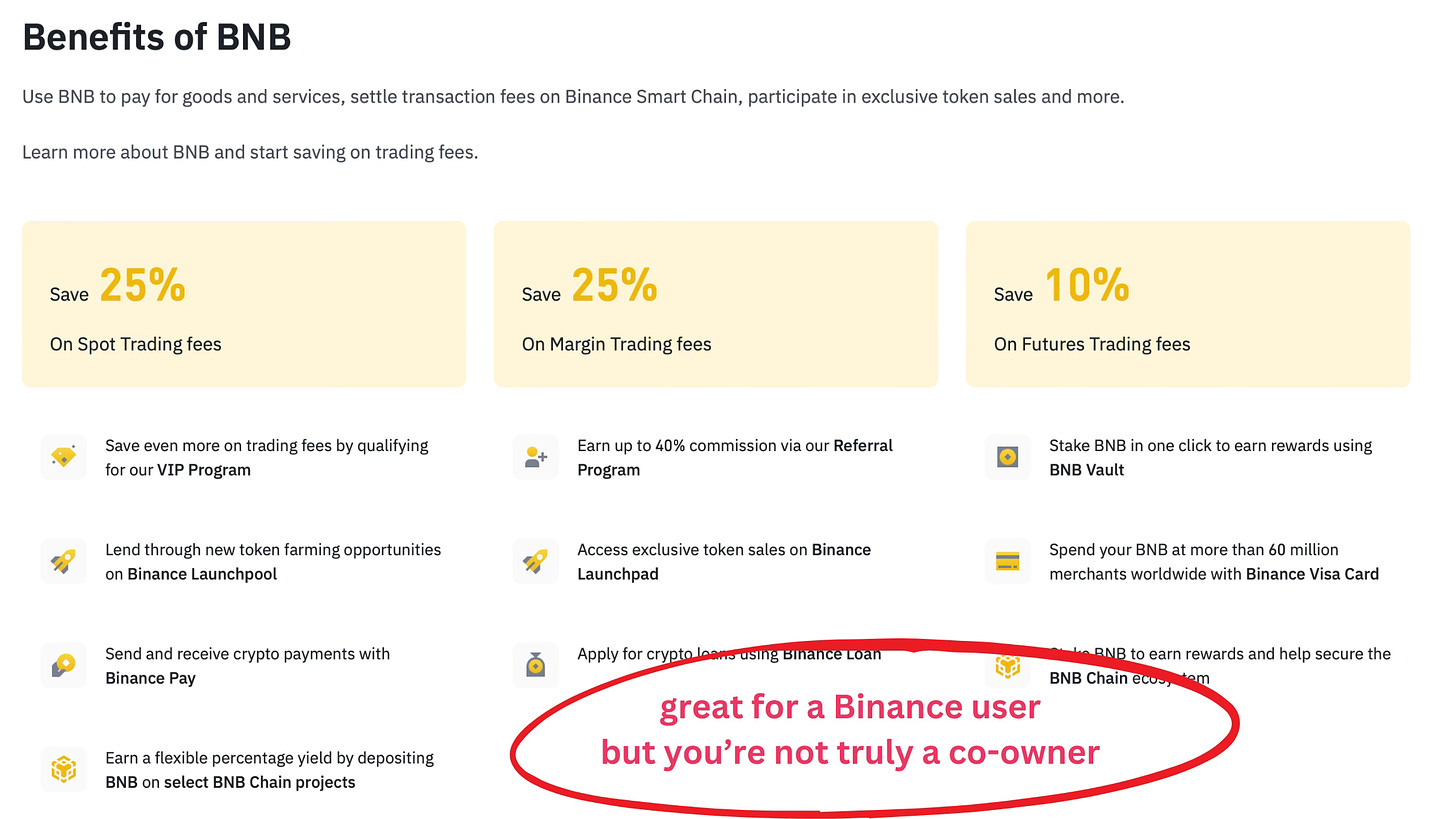

However, some cryptos are issued by companies. For example, Binance, the largest crypto exchange worldwide, issued a token called BNB, which gives holders discounts on trading and other bonuses. However, unlike a stock, you have no legal rights if you hold BNB. Binance can decide to change what BNB is used for at any point. You certainly have no claims on Binance’s profits or assets.

They’re more like arcade tokens in that sense. Great if you use Binance, interesting to speculate and trade, but you’re not truly an investor in Binance.

Where can I buy stocks?

Companies of all sizes can issue shares, but only the shares of publicly traded companies can be bought and sold publicly, meaning on stock exchanges. Like the name says.

The two main stock exchanges in the US, for example, are the New York Stock Exchange (NYSE) and the National Association of Securities Dealers (NASDAQ).

You don’t need to worry about that. Nowadays the majority will do it through a brokerage app like Schwab, Robinhood, Interactive Brokers, and many others.

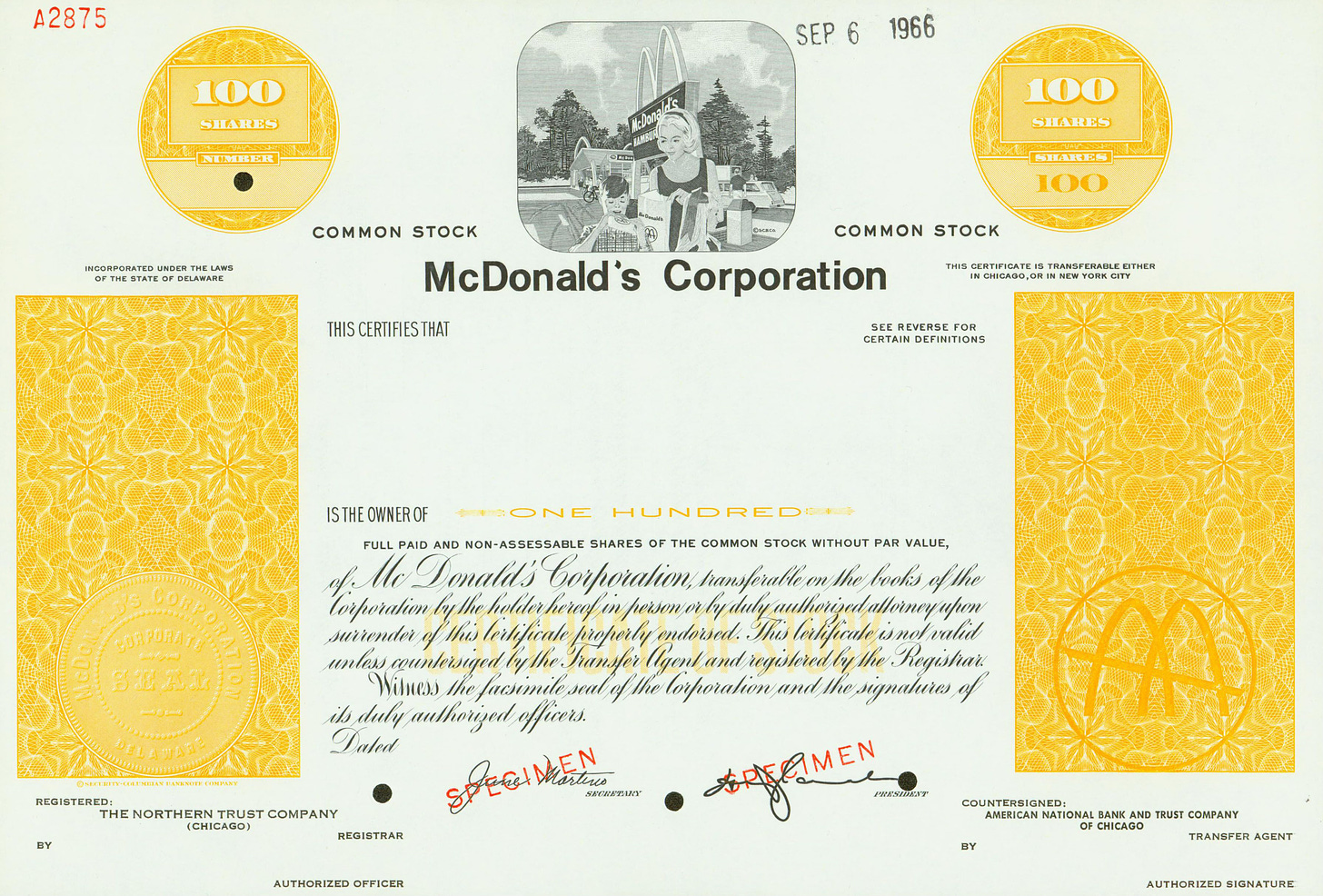

But hey, if you’re feeling nostalgic, you can always buy a paper share certificate like this from a collector:

If you enjoyed this guide, please subscribe to MarketScouts. We’ll send you a few emails a week showcasing interesting investment ideas, strategies, guides, and tools.