Everybody: "great time to buy corporate bonds!" But is it?

And let's learn a bit about the equity risk premium, how bonds are priced, and which (stocks or bonds) are the better bet right now.

Did you know that the bond market is larger than the stock market?

That’s okay, most people don’t. Unless you’re a professional trader or pension fund manager, you probably don’t spend too much thinking about bonds.

And who can blame you? They’re the “boring” asset. They pay “coupons”, which is the least attractive word in the English language.

Bonds are so boring that when filming “The Big Short”, the producers had to bring in Margot Robbie just to keep us all from falling asleep.

But that all changed until the Fed hiked rates from almost zero to about 5% right now.

The immediate result – and one that probably shocked most non-professionals: one of the biggest crashes in bond history.

Wait, so how can bonds crash if interest rates are going up, right?

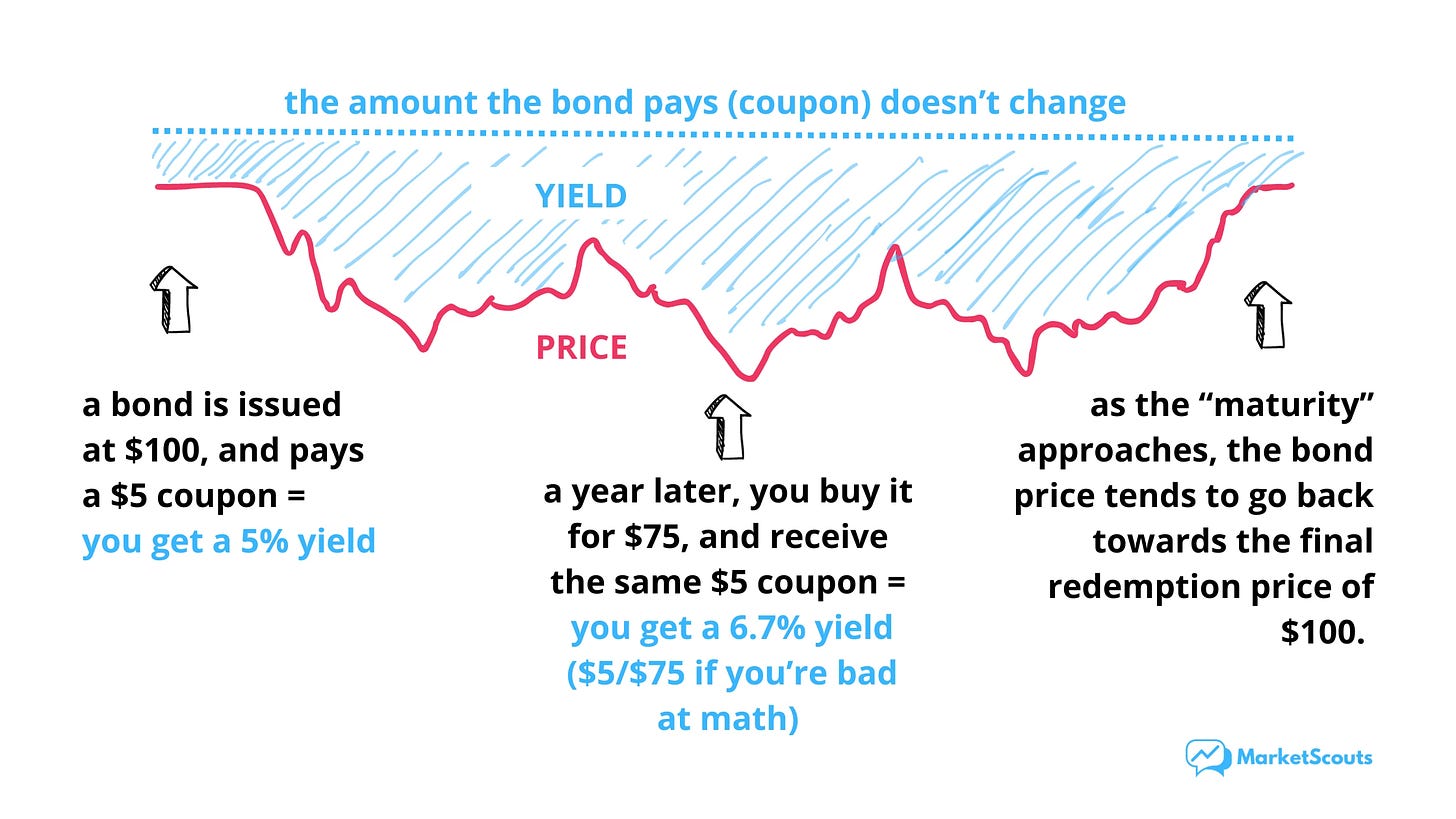

The crash happened because bonds are not “fungible” – you can’t exchange one with another the way you do with stocks.

For example, a share issued by Apple three years ago = a share issued by Apple today. But a corporate bond issued three years ago by Apple and offering, say 1%, isn't going to be the same as a bond issued now, when Apple has to offer at least 5% to attract investors.

So a bond ETF made up of “older” bonds is naturally not going to be interesting for anyone, unless it’s on a discount at least as big as the current yield.

Basically, anyone selling a bond offering 1% when other bonds are offering 5% needs to lower the price until the yield (coupon/price) is actually 5%.

That’s why you’ll often hear that “yield is the inverse of price”. Here’s what that means:

The equity risk premium challenge

Anyway, right now this rapid rise in bond yields puts us investors in an interesting situation.

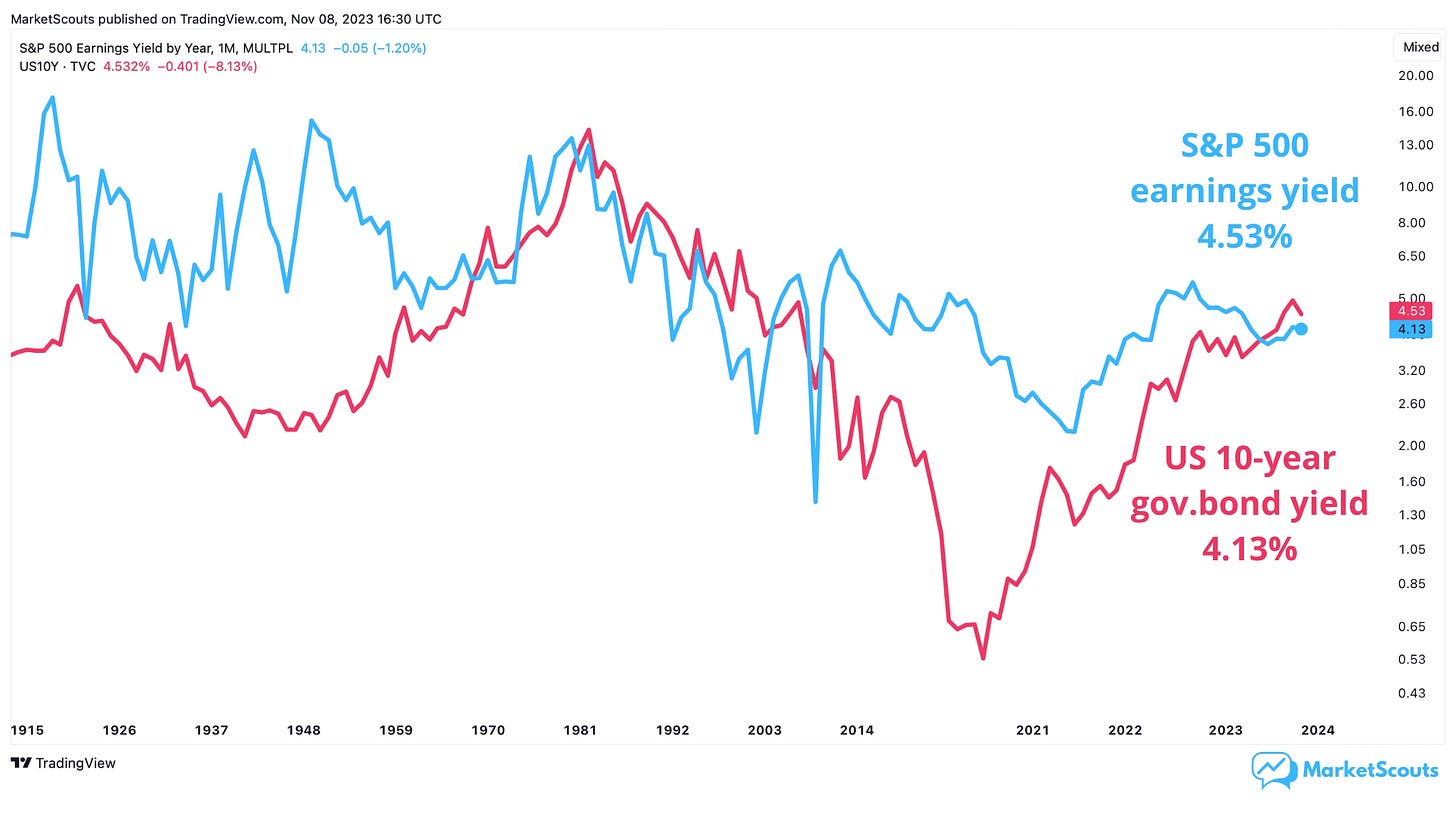

Right now the earnings yield for the S&P 500 is around 4-5%. Which means that stocks are a bit expensive and that if we buy them at these prices we should expect to only get about 4-5% in the future.

That’s because what we can expect to get from owning stocks is based on their earnings yield: how much profit companies actually make compared to their market price.

Sure, in the short term the price can go up and down like crazy, but over the long term, investors demand profits.

Why does this matter?

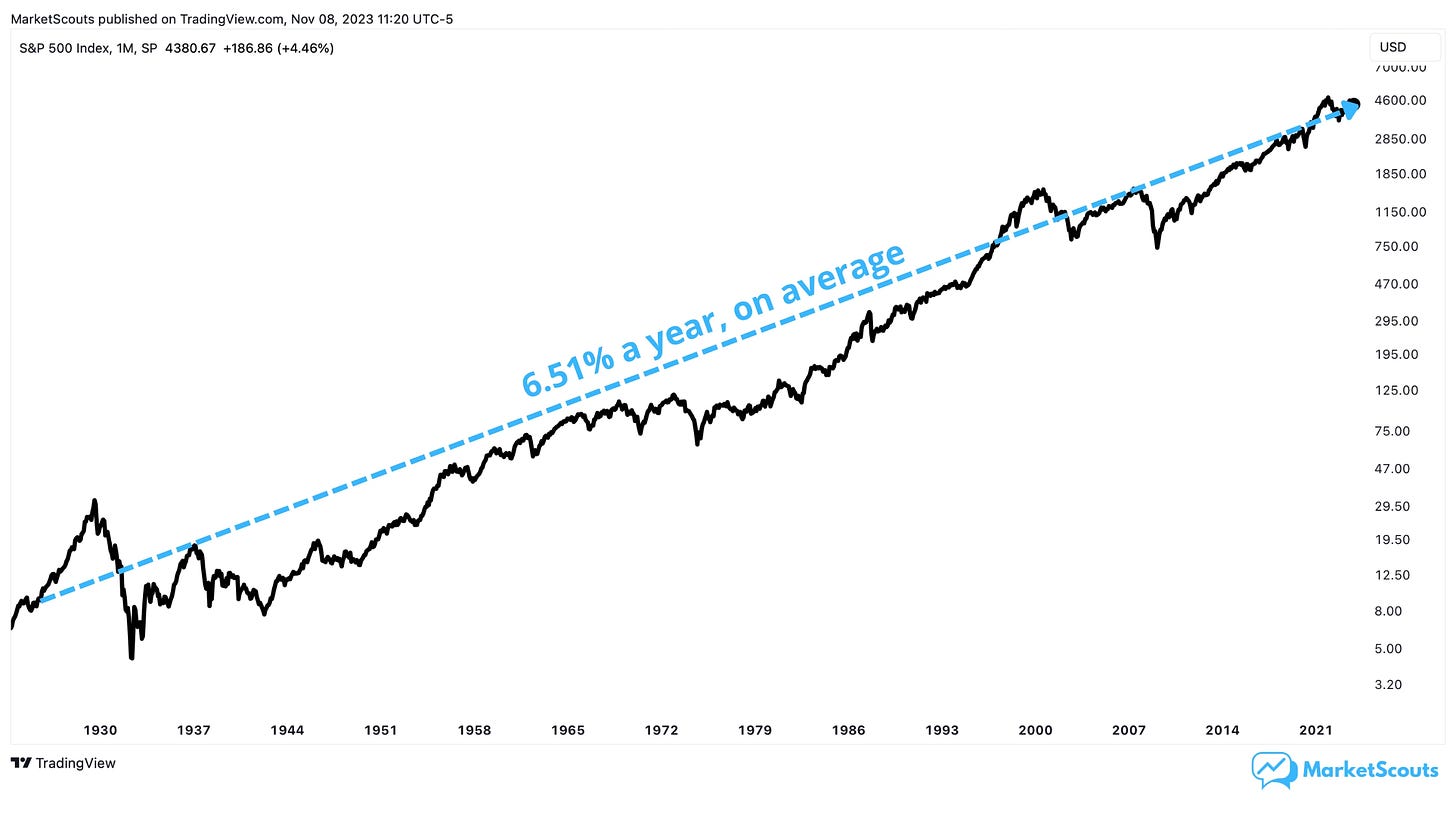

Well, first of all, this is lower than what it used to be: the long-term yearly return of the S&P 500 has been 6.51%, on average, for the past 100 years.

Second, it’s also really close to what you can get from “risk-free” US government bonds:

Third – and this is where it gets really interesting – many large, cash-rich companies like Apple and the other “Magnificent Seven” tech companies (Apple, Microsoft, Alphabet, Nvidia, Meta Platforms, and Tesla) offer over 6% on their bonds.

So why do we care about the difference between the returns on stocks and bonds?

Well, this difference between the expected return on stocks (which we know by looking at the earnings yield) and the yield on bonds is called the “equity risk premium”.

It tries to measure how much investors expect to “get paid” in order to deal with stocks (equities) when they can just invest in risk-free bonds.

The lower it is, the more it makes investors ask themselves: “Why should I bother with the ups and downs of the stock market when I can just buy bonds, sit back, let coupons compound, and relax in a bubble bath?”

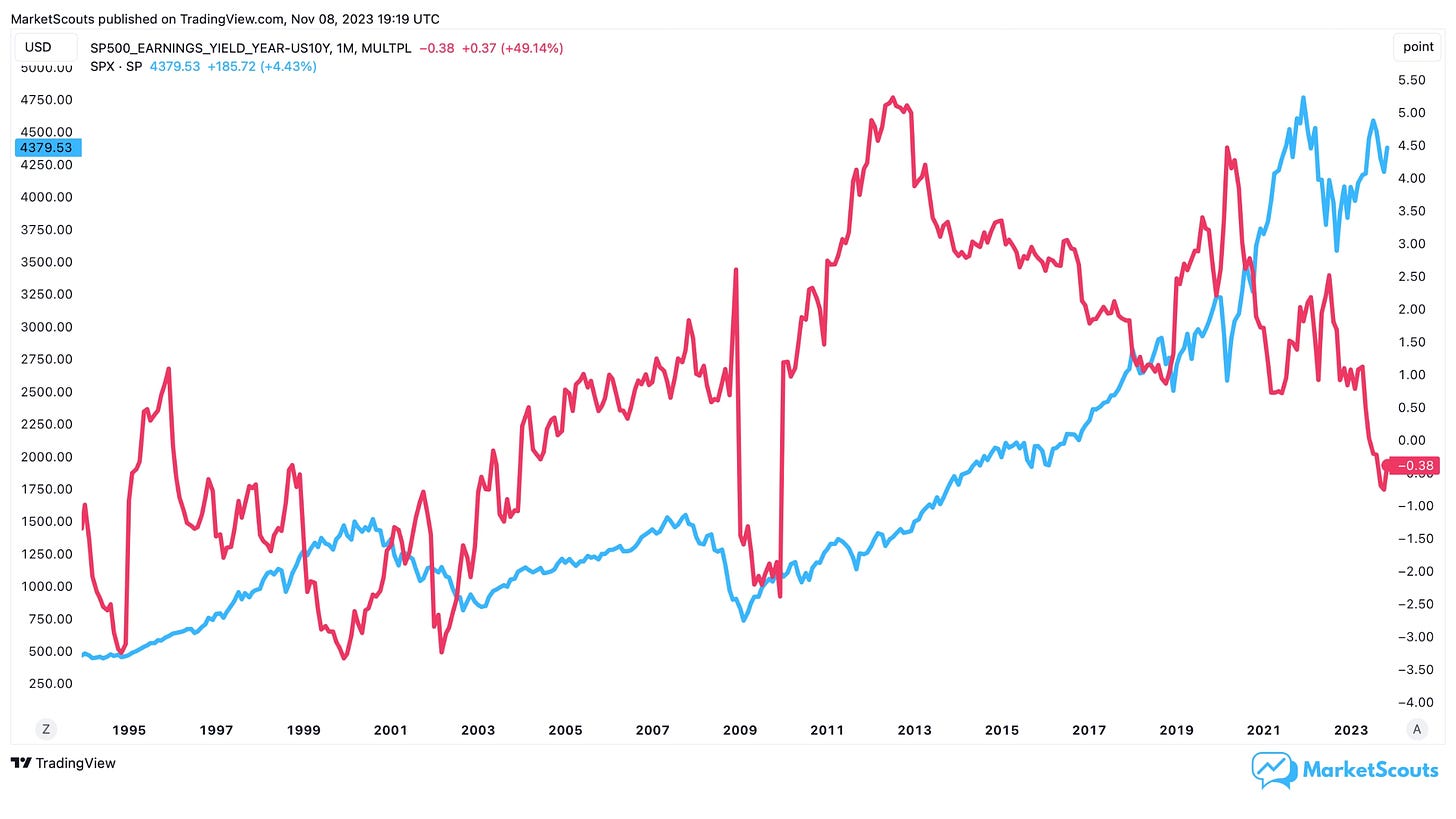

And right now, the equity risk premium is at one of the lowest levels of the past 20 years:

At the same time, many investors see the S&P 500 as too expensive, and are wondering if buying the dip in bonds wouldn’t be a good idea: “We just had one of the greatest crashes in bond price history. Why would you not take advantage and buy the dip?”

Now, of course, corporate bonds in general aren’t risk-free, but some argue that a bond issued by a company like Apple or Google is probably more solid than one issued by the US Government. At least when it comes to its ability to pay it back.

This is the latest theme that most finance media tries to sell us:

So let’s unpack it, and see if we should we all sell our stocks and buy the bonds of these companies instead.

Corporate bonds are not that bad right now…

Well, corporate bonds are definitely “on sale” now:

So if you want to “buy the dip”, it might be a good short-term trade – as long as interest rates don’t go much higher. Because in that case the price of any bonds you buy will continue to fall.

…but stocks are still better long-term.

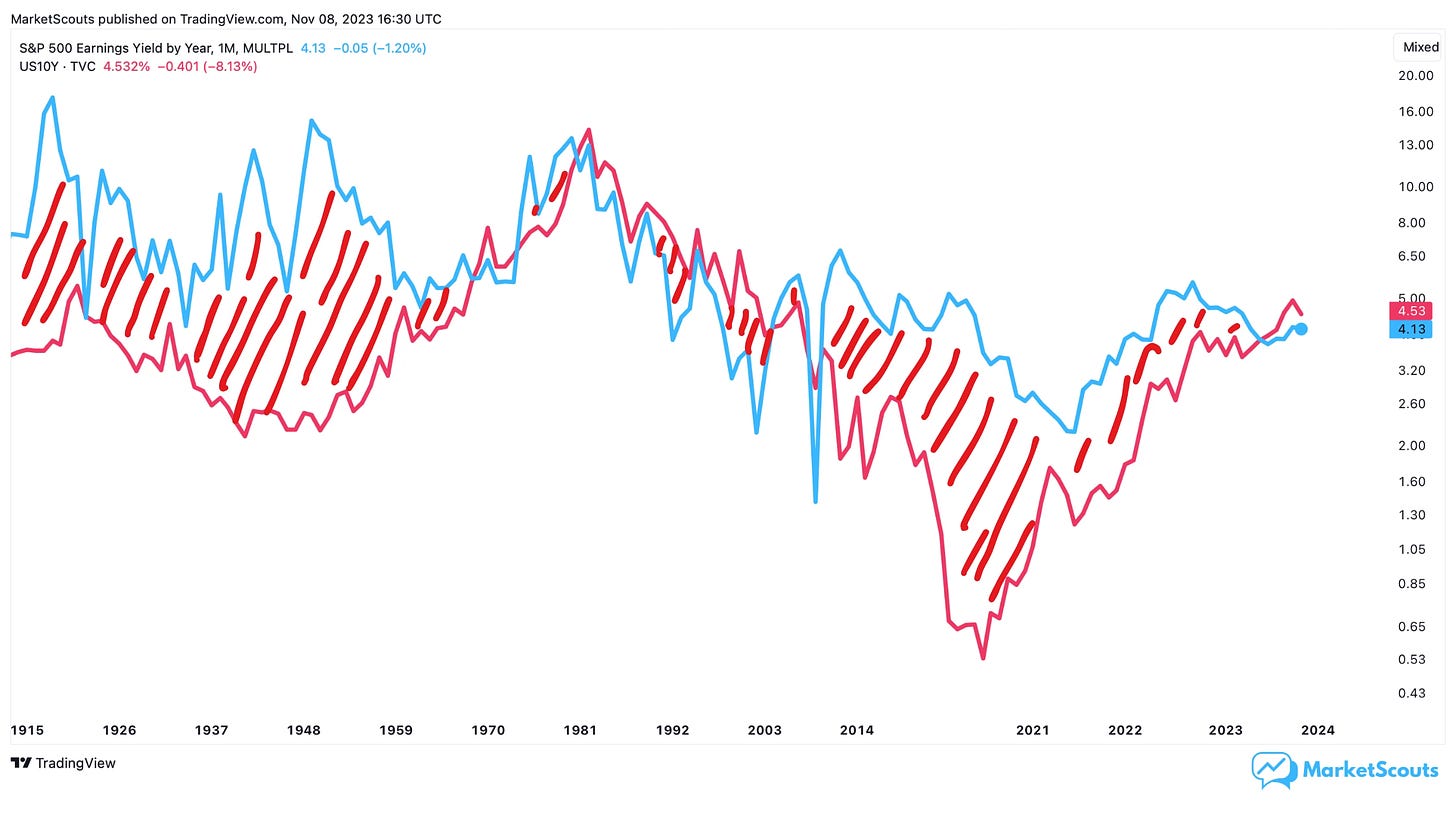

First, equity risk premiums don’t tend to stay this low for a long time.

Think of it this way: if you’re making 4% in stocks but could be making 6% in bonds, well, you’re going to sell those stocks and buy bonds until stocks become so cheap you have to buy them again.

And if there’s a recession and the Fed lowers rates, stocks are going to look attractive again. Low interest rates are steroids for the stock markets.

Plus, look at the historical data. When equity premiums drop fast the market tends to be choppy. But eventually that changes.

Next, earnings can grow, bond coupons do not.

If inflation is 6% then your 6% bond yield doesn’t mean anything.

A company can raise their prices to account for increased costs or inflation. It’s a business. They have customers – paying customers. Customers who can be charged more if need be.

This means that a company’s earnings can protect you somewhat from inflation, but bonds can’t. Except inflation-protected US government bonds (TIPS) but that’s another story.

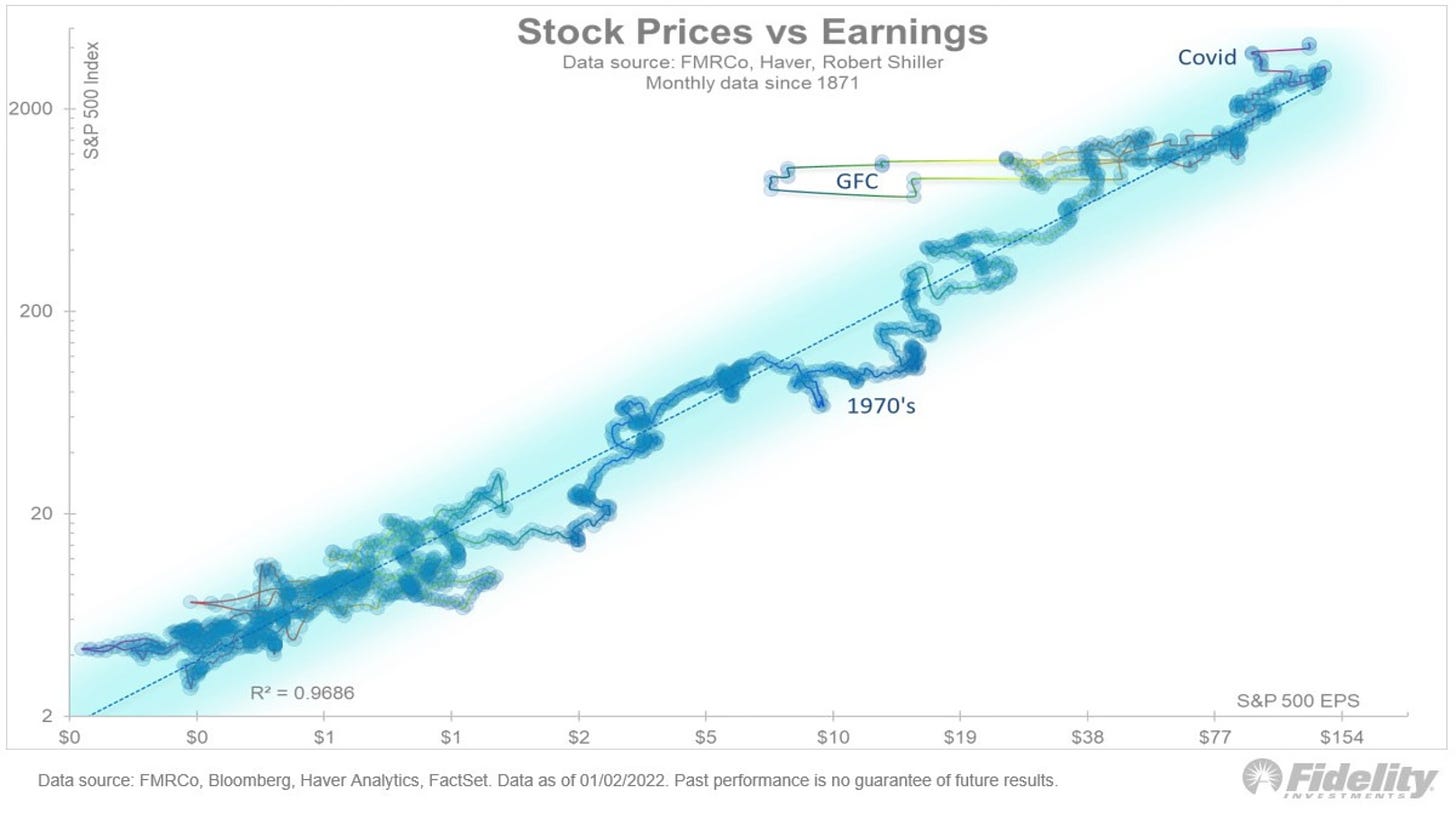

If earnings grow, stock prices grow too

A company can either “distribute” its earnings yield as dividends, or reinvest it, maybe pay off debt or do something else important that increases the company’s worth.

But whatever they do with it, you somehow “get” the value of the earnings: either as dividends or as a rise in the stock price.

Over the long term:

Return from stocks = earnings growth + distributed earnings (dividends)

Either way, stock prices are all about earnings. Take this chart from Fidelity Investments:

In the case of the SP500, we have an earnings growth that has averaged 4% over the last roughly 15 years, and a dividend of roughly 2%, which brings us to the 6% we saw on the chart at the beginning of this post..

So, if “Magnificent Seven” corporate bonds pay 6% interest, stocks don’t make sense only if we think they won’t grow earnings by more than 4% per year.

And if inflation keeps rising then, as we’ve seen, quality companies can increase their prices to match. And if inflation falls, then interest rates can also fall, and companies can use this flow of “cheap money” to grow. Or at least buy back their stocks or juice earning growth through cheap leverage.

It’s much easier to compound returns from stocks

The problem with bonds is that they expire. They have a “maturity”. Did you notice that “10-year” best to the bonds we were looking at? That’s how long you can get that nice yield for.

So if you’re thinking long-term, you have to account for this – you won’t be able to reinvest and compound as easily with bonds.

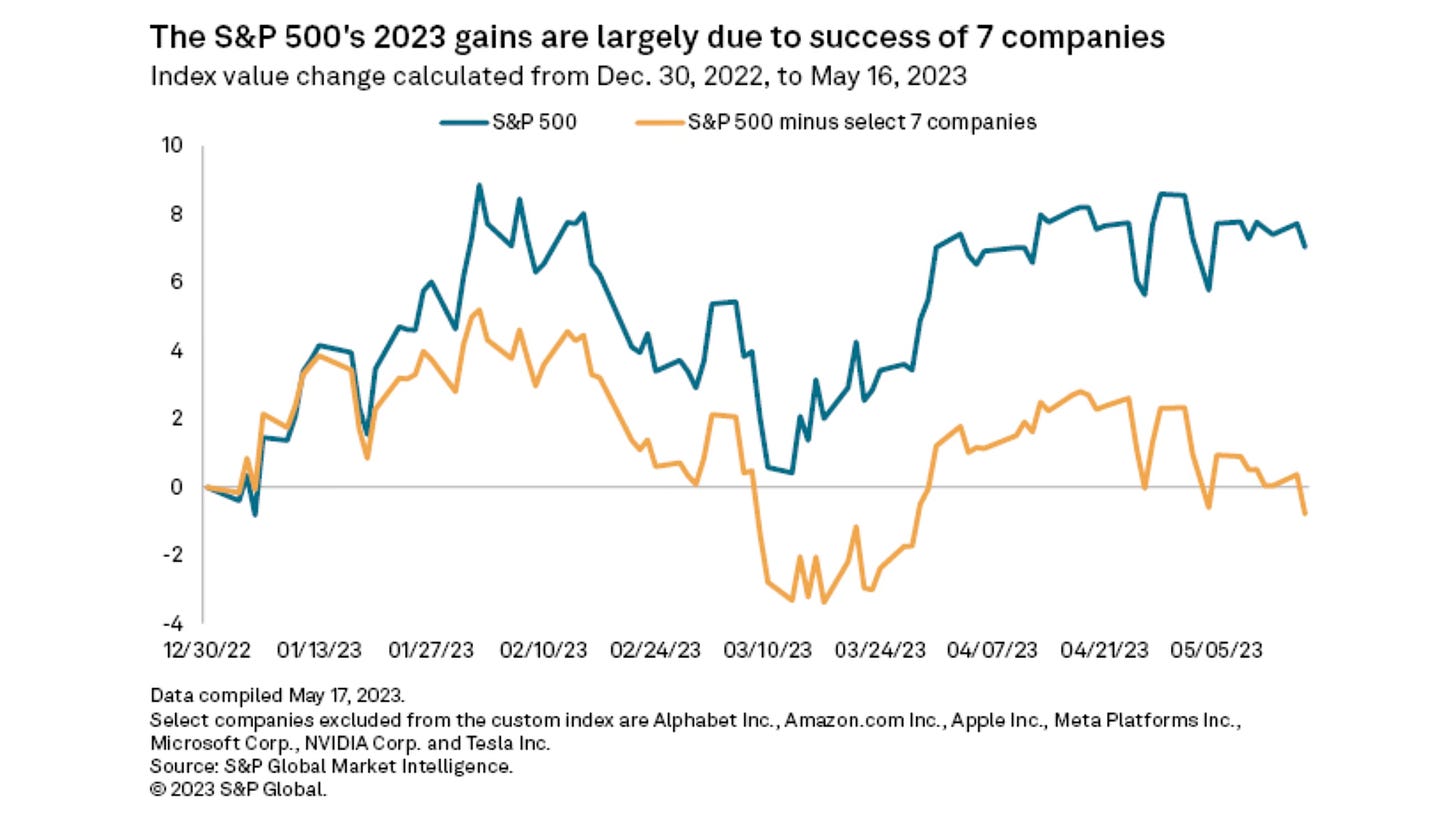

Stock prices are also “in a dip” (if you know where to look)

Many stocks are also at low prices. Not only it’s mostly the US market being positive this year, but even in the US, it’s mostly a few incredibly large companies “propping up” the market because of their solid earnings growth.

This chart is a few months old but you can see the opportunity here:

So many quality stocks globally are still at 10 year lows or more. Which means that, just as with bonds, you can get great companies at great deals now. If their valuation “normalizes” or they increase dividends, you won.

Now what?

This really comes down to your belief about a few things:

First, where you see inflation and interest rates going

The main reason to stick with stocks today is inflation. Some believe that the US Government huge deficit guarantees high inflation in the coming years. Others argue that inflation comes in waves. Either way, though, stocks are the only one that can offer protection.

Second, how well you can time things

We are still in an environment of rising interest rates. Bonds might be attractive now, but if interest rates keep rising, then you’ll lose – you bought the “wrong” bonds.

Again, think of that yield chart. Lots of bond portfolios, which were considered safe, crashed quite a bit in the past two years.

But that’s not to say that bonds are not really really attractive right now.

The best scenario for bonds right now is if a recession happens. That would be bad for stocks in the short term but would probably prompt the Fed to lower rates – instant win for your bond portfolio. Some argue a recession has already happened, by the way.

So maybe the smart option here is to leave your money in a money market fund and when a “sale” happens in stocks, buy them hand over fist.

Finally, please bear in mind that this is not a recommendation to buy corporate bonds or money market funds or stocks. We talk about various stocks, funds, and securities because they’re interesting or can be used to teach a lesson about investing. None of the posts we publish are intended to be taken as individual investment advice or a recommendation to buy or sell any specific stock or other security. We can’t even guarantee that our information sources are 100% accurate. The only purpose of these posts is to teach you how to do research and figure this stuff out for yourself.

U.S. bond market is valued at some $50 trillion.

I'm not a fan of bonds. In fact, I don't like their low ROI potential at all tbh. Like you said, it's much easier to compound returns from stocks.