Inverted US yield curve again: recession alert?

A new paper suggests the inverted yield curve indicates something else. Not something great, though, but something else.

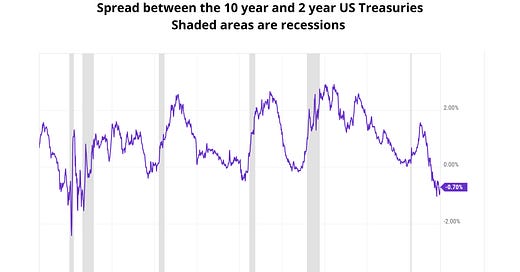

The “inverted yield curve” is by now a classic recession indicator, and it’s been flashing again – for a year now, actually.

However, a new paper argues that it doesn't necessarily mean a recession is coming. Not a classic one, at least: the paper suggests the US is experiencing a sort of “rolling recession” that affects different sectors at different times.

Interesting concept, let’s dig in and see what this means for us investors.

What is yield?

First, let’s quickly talk about what “yield” means.

Yield is basically how much you earn from an asset, per year – compared to the price of that asset.

A company pays dividends from profits (if it has any). Divide the dividend by the price of the stock – that’s dividend yield. If the stock goes lower but the dividend stays the same, obviously the yield gets bigger.

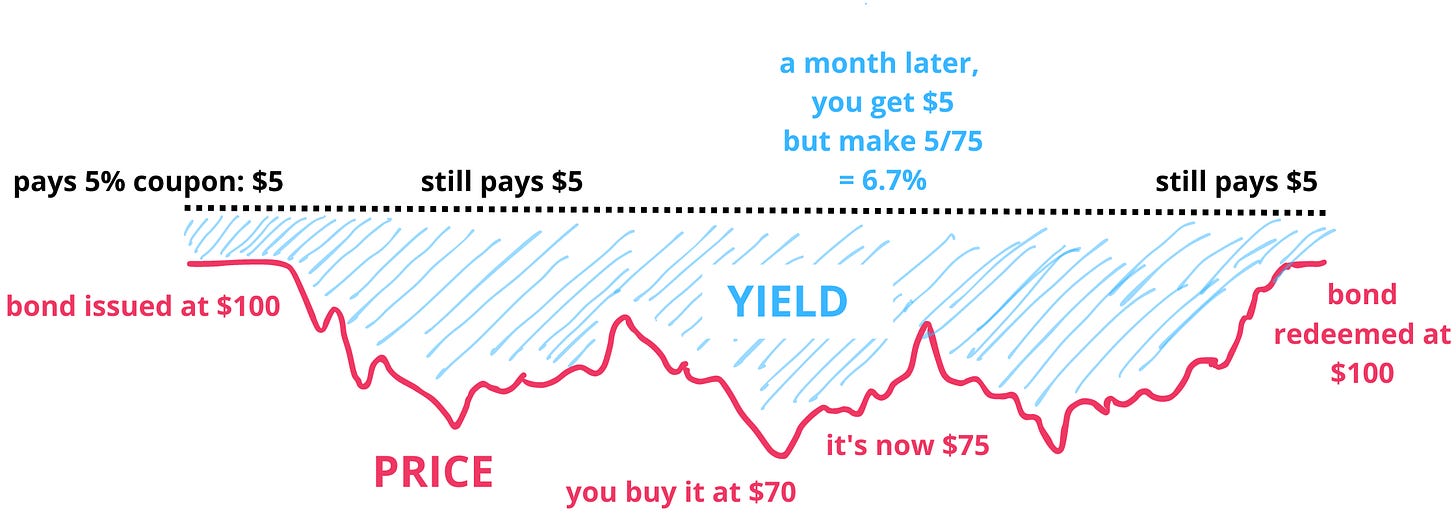

Same with bond yields. A bond is basically a loan, and it pays interest – that’s called the “coupon”. If for whatever reason bond investors sell the bond and its price goes down, its interest stays the same, of course – but now the yield is up.

That’s why you need to remember that for bonds, yield and price move in opposite directions:

What is the yield curve?

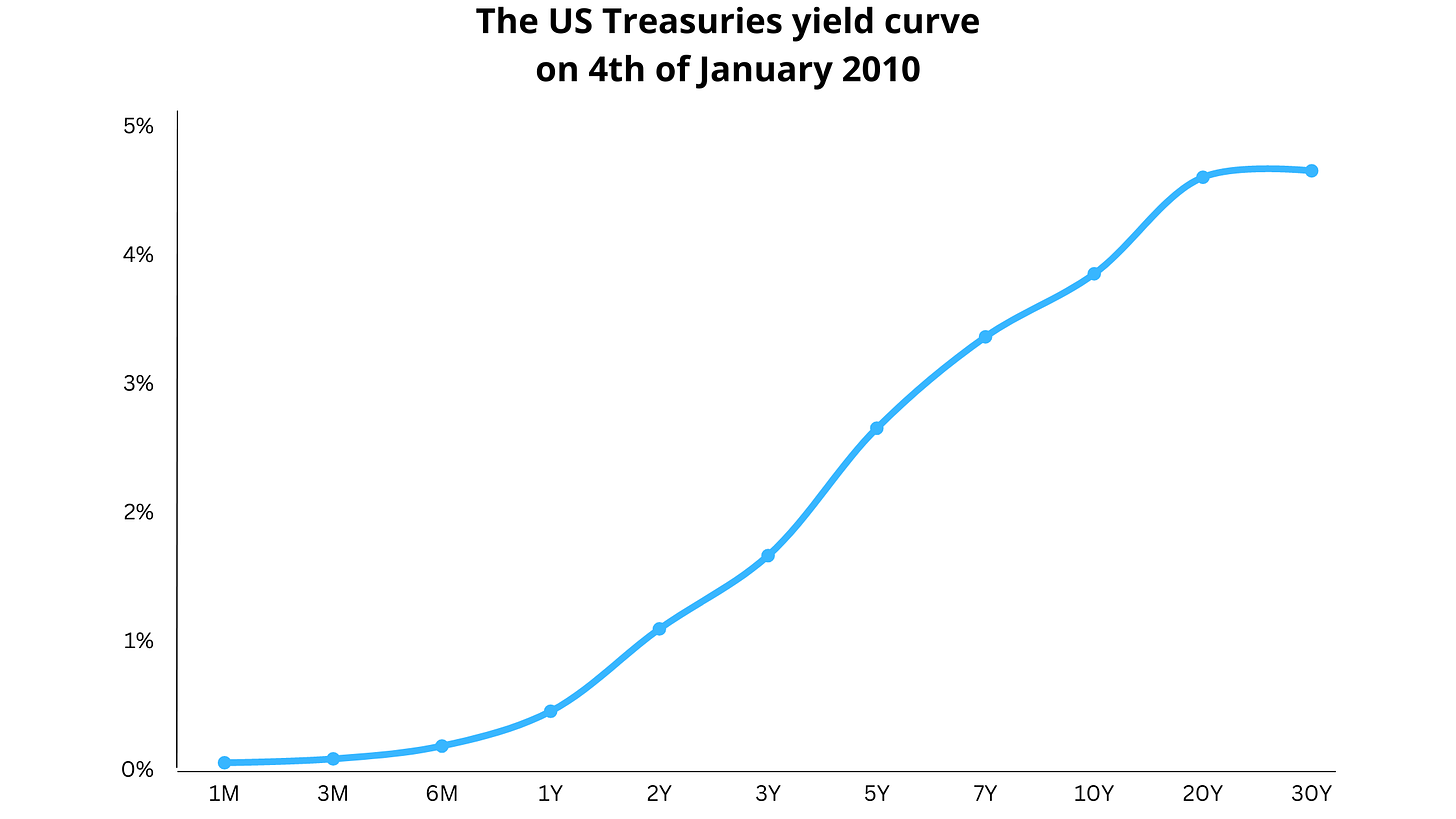

The yield curve is just a simple graph that plots the yields for bonds with the same “credit quality” (they’re just as safe) but different maturity dates. “Maturity” means when the bond is due and needs to be repaid by the government or company that issued it. When media talks about the yield curve, it’s usually the yield for US Treasuries.

If we look at the yield curve graph, a normal one goes up from left to right: short-term bonds provide less income to investors because holding an investment for a shorter time involves less risk.

You can also think of it as a chart of the interest rates that buyers of government debt demand in order to lend their money over various periods of time.

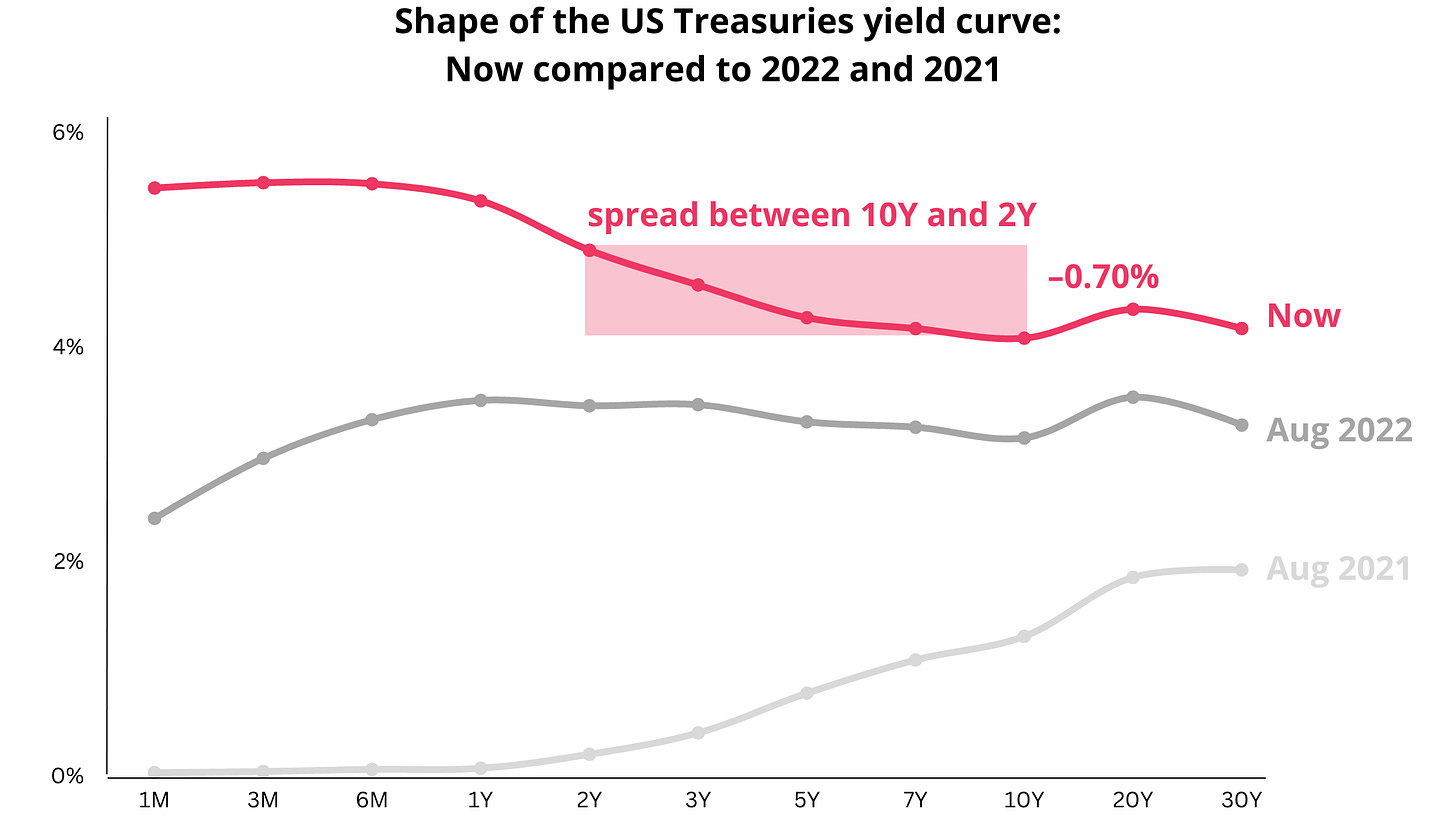

But sometimes that changes – and the yield curve starts to flatten and then even “inverts”.

In this case, you now – weirdly – earn less on bonds that you plan to hold for longer, and is a sign that something in the economy is not quite right.

Why is an inverted yield curve such a big deal?

To be fair, most everyday investors probably never even know what the yield curve looks like, unless it inverts – in which case it’s all over Bloomberg.

The reason why an inverted yield curve makes the headlines is that it’s been a fairly reliable signal that a recession is on the horizon.

In fact, for every recession since 1960, an inverted yield curve took place roughly a year before, with just one exception.

How does the yield curve look like today?

Behold:

Obviously something is off.

It might be a sign that investors worry that aggressive interest rate hike by the Fed could slow the economy enough to tip it into a recession – in which case they move into "safe haven” assets like long term bonds, bidding up their price and lowering their yield.

It could also be a sign that investors think that, after a period of rapid rate increases, the Fed will be forced to reverse course. Essentially it’s a way of saying that bond buyers bet that the Fed will have to respond to a potential drop in spending by lowering borrowing costs.

So is there a recession coming?

Some analysts think so.

Usually it takes about 15 months on average for the economy to enter a recession after the yield curve inverts. If that’s true, we’re due for a recession roughly in October (15 months after the current inversion started).

Some believers also think that the yield curve inversion itself can trigger downturns by undermining confidence in the economy. A sort of “bank run” effect but at the economy level…

Others argue that we shouldn’t be too scared.

For example, in 2019 the yield curve inverted again. A short recession did follow, but that was due to an event completely outside the economy – the coronavirus. Bond investors might have good instincts, but they’re not wizards.

Others believe that the massive way in which the Fed and the other central banks have intervened in the economy, by lowering rates and buying assets, has made the yield curve unreliable anymore.

Are we already in a recession and don’t know it yet?

A new paper by Yardeni Research makes the point that an inverted yield curve doesn't necessarily mean a recession is ahead. Instead, the yield curve should be seen as an indicator for a process, not a recession.

The author of the paper also believes that the US is currently experiencing a "rolling recession" that affects different sectors at different times.

Normally when we think of a recession, we picture a downturn affecting the entire economy all at once. But Yardeni believes that housing and retailing could already be in a recession all by themselves, as consumers pivot from buying goods to buying services.

If this is true, then the yield curve is sort of half right.

The paper makes another interesting point: that instead of looking at the inverted yield curve as an indicator of a recession, we should look at it as a signal that Fed’s policies are too tight and risk triggering a crisis.

Obviously, that’s less useful for investors, but it would be interesting to see how the Fed reacts to an inverted yield curve.

Considering it’s been this way for a year, will they change course, even if inflation is above the long-term 2% goal?

What should investors do?

First, it’s not the worst idea to be a little cautious. The inverted yield curve might have failed once or twice, but overall it has a good track record. If a recession does happen, having the ability to buy unloved stocks (that other investors are trying to get rid of at any price) matters.

Second, picking individual stocks instead of buying the whole index might also be a good idea. There are plenty of companies that do well (or less bad) even in recessions.

Third, look abroad. Yes the US is the largest economy in the world and a US recession affects everyone, but each country has its own dynamics. Some companies in fast-growing markets might do well regardless.

Only 2 months until October!

Scary article? Then go ahead and share it with your friends. We’re at the very beginning so every share counts.