VinFast: from +320% to -86% in 2 months. What can we learn?

How can a car company that sold less than 20,000 cars this year be priced as the world's third most valuable car company, even for a few days?

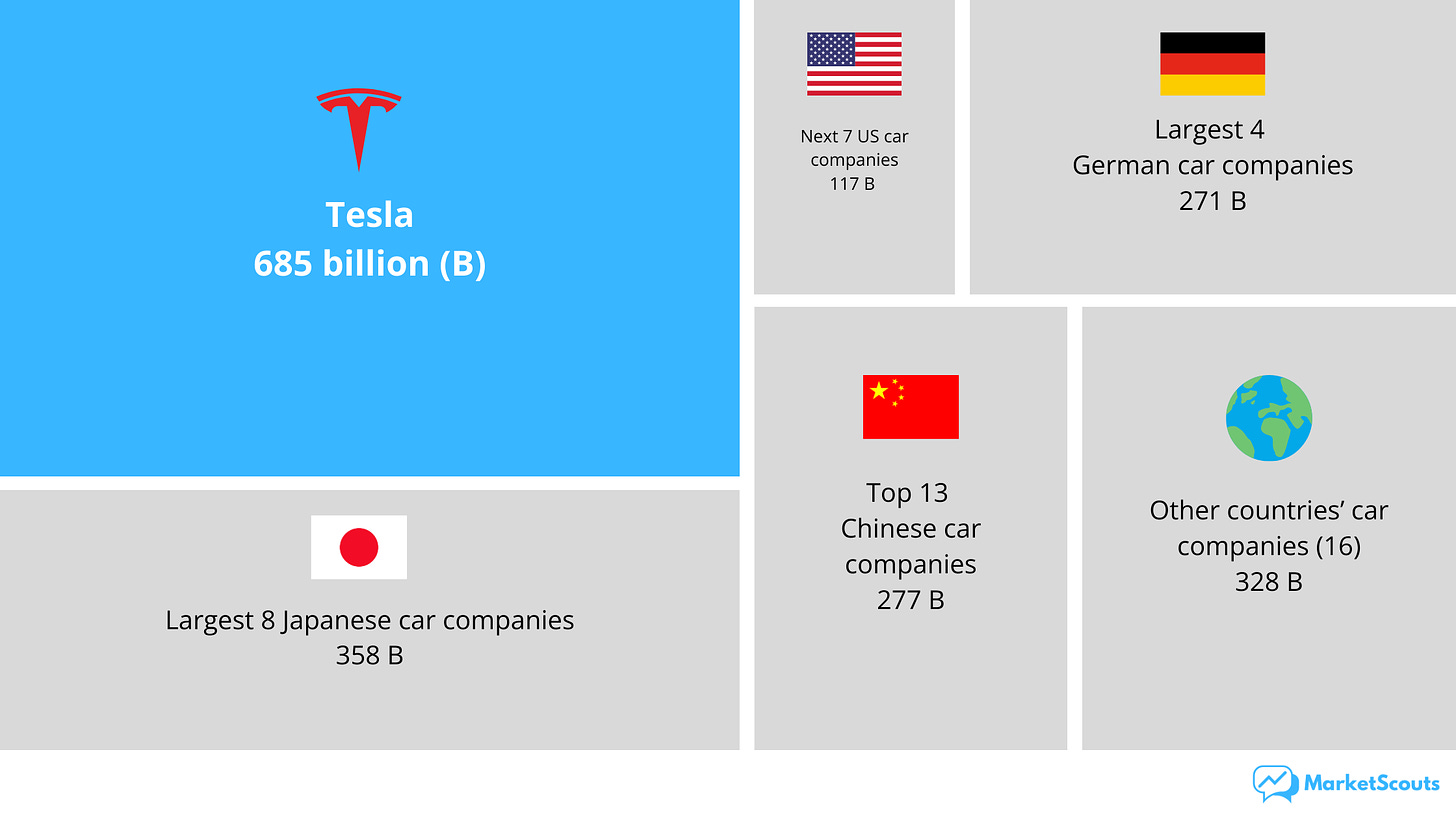

So far Tesla is the undisputed king of the auto world – at least when it comes to its stock. It has almost 34% of the total market capitalization of the world’s top 50 automakers:

That’s just stock market cap, though. In terms of actual car production, though, Tesla was never the leader: last year it sold about 1.3 million cars. Toyota sold about 10.5 million.

And that’s fine – Tesla investors have always bet on the fact that the company is growing fast. Which it has – but other EV automakers have too.

But despite what the market cap graph above says, Tesla is not even the world’s largest EV producer.

That title now belongs to BYD, a Chinese EV company.

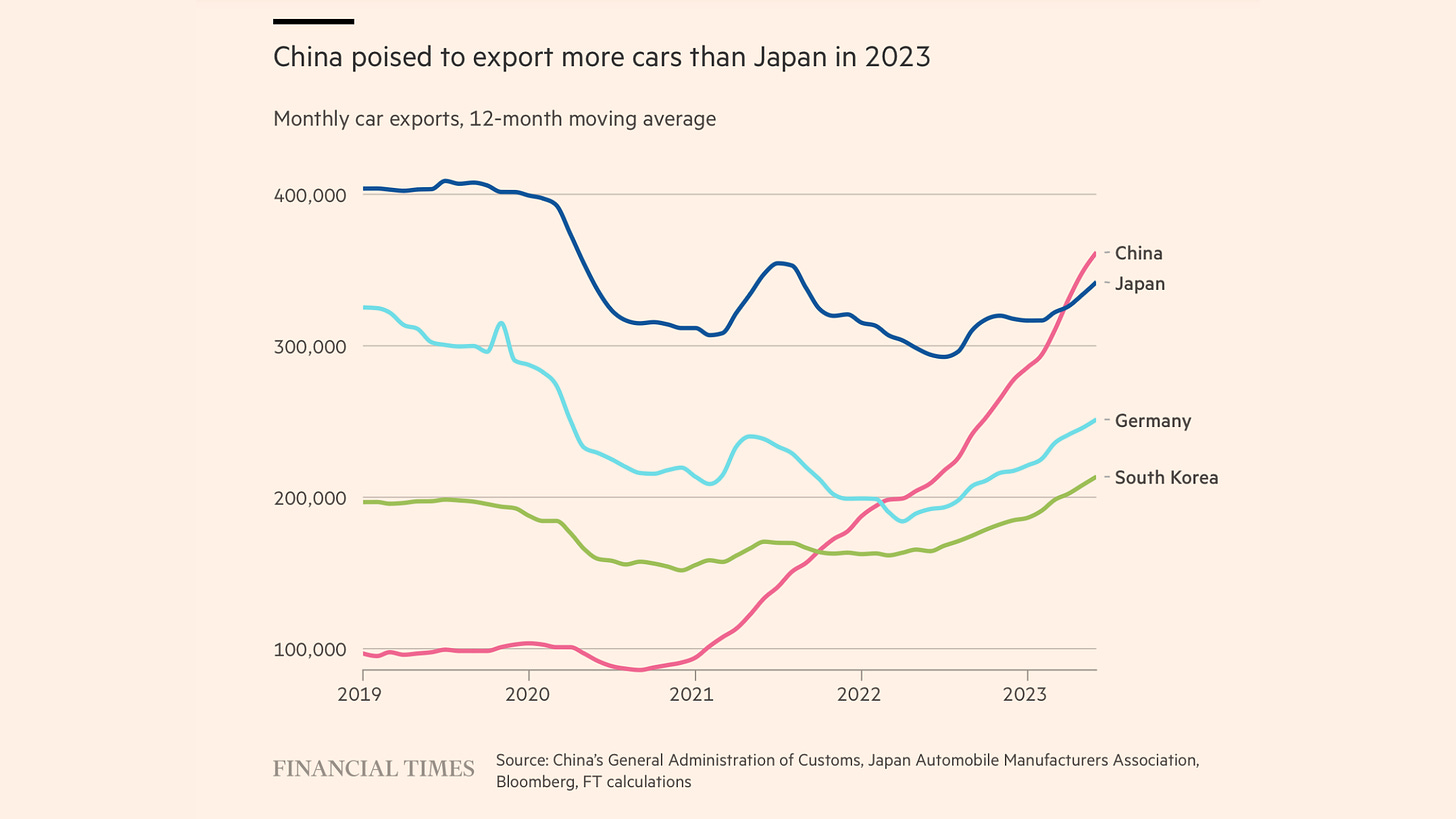

You might have missed it, but in the past 3 years China has quietly become the largest car exporters, especially in the EV segment.

For the time being, though, Tesla is still the darling of EV investors.

That’s for a number of reasons: foreign investors are still wary of putting more money into China, Tesla has loyal fans, Elon Musk is great at hyping them up, and so on.

But still, we would have expected at least the second EV automaker by market cap to come from China. Buffett himself invested in BYD!

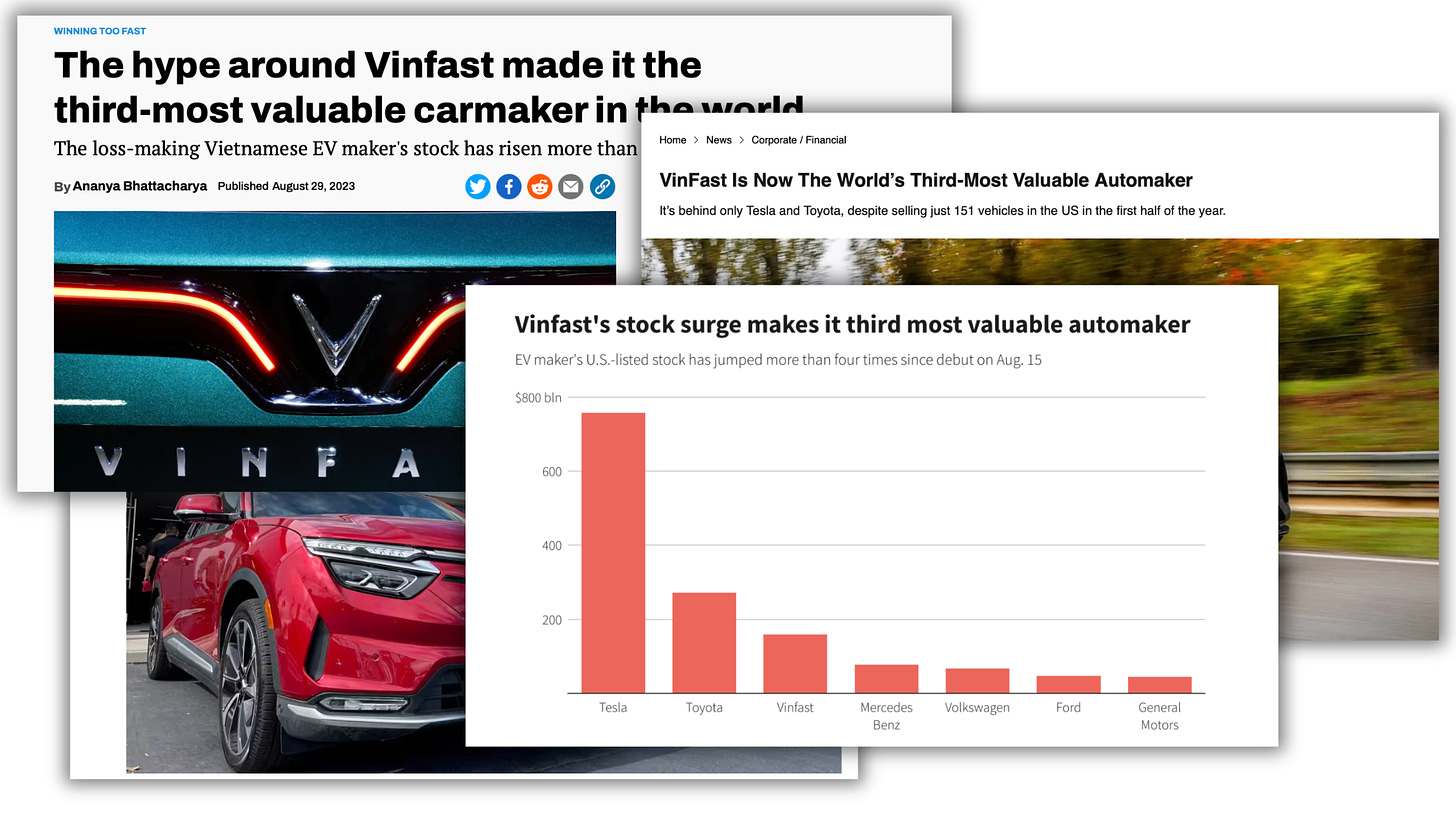

So you can imagine our surprise when we saw that it was not a Chinese company but Vinfast, a relatively unknown electric car company from Vietnam, that briefly became the #2 “pure EV” automaker, just behind Tesla.

It even briefly became the #3 most valuable automaker – with a market cap higher even than Ford, Volkswagen, and BMW:

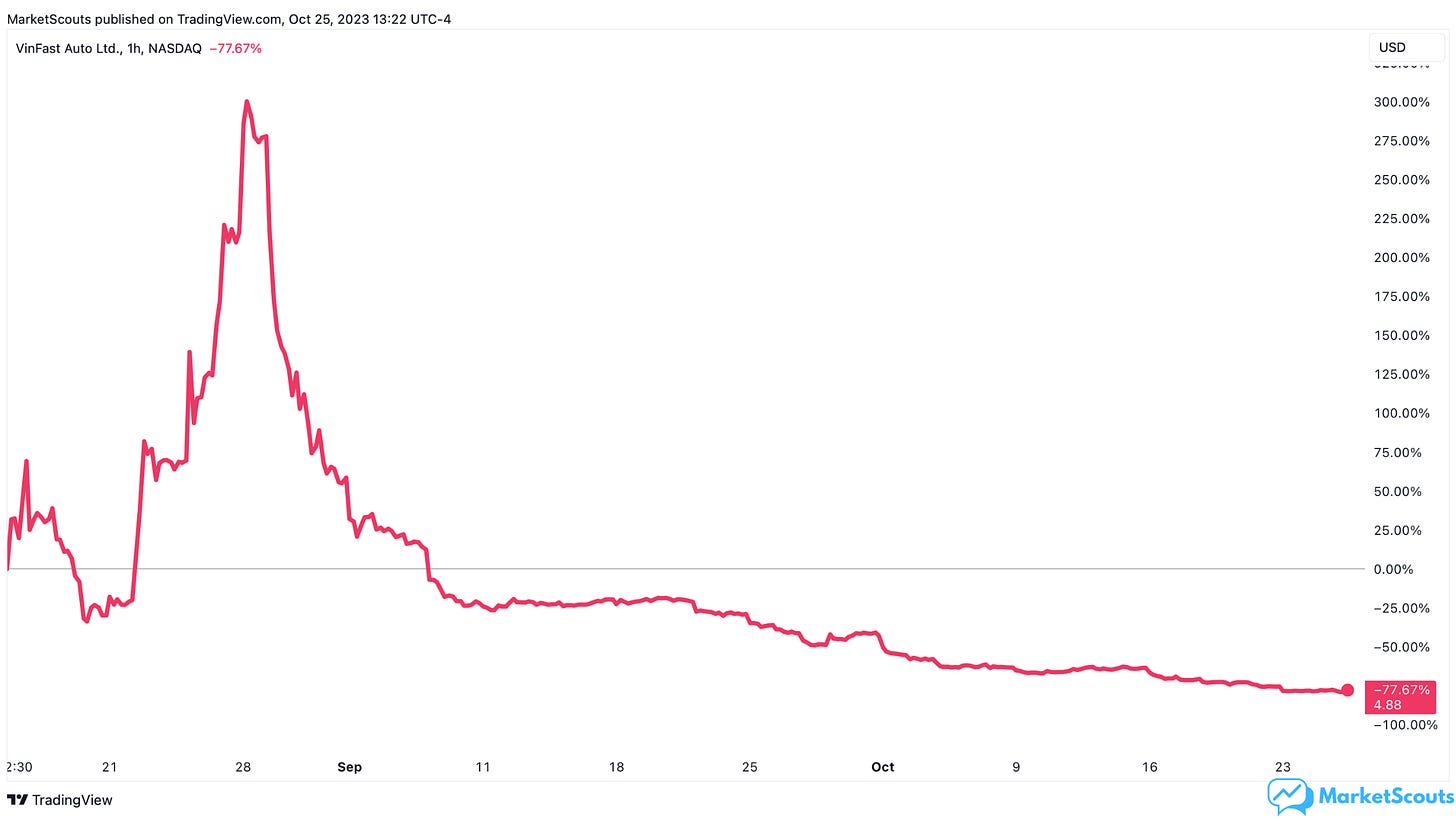

That all changed on August 28th, when it crashed from its peak price of $93/share – and hasn’t stopped falling since.

Right now it’s trading just under $5.

So many questions: was the IPO overpriced? What drove the hype? Is this what we should expect from every IPO? Are all Vietnamese companies’ stocks so volatile?

And how can a car company that sold less than 25,000 cars last year be priced as the world's third most valuable car company, even for a few days?

Let’s try to understand what happened – and what we can learn from this.

What is VinFast?

VinFast Auto Ltd. is headquartered in Hai Phong City, Vietnam, and is actually a subsidiary of the Vingroup Joint Stock Company. Vingroup itself is owned by Vietnam’s richest billionaire.

It makes pretty much everything EV-related, from electric cars and buses to e-scooters. Here’s how they look like:

It also offers spare parts and aftermarket services for all of these.

VinFast sells its products mainly in Vietnam but also in the US. How many does it sell, though? Are they any good? More on this below.

Why did VinFast gain 320% in the first two weeks after its public offering?

Well, a number of things:

there was probably still some excitement around EV stocks, helped by the fact that investors were betting on lowering interest rates (we’ll talk more about this in a second)

there is also a larger story about how high-end manufacturing is moving from China to other places, especially Vietnam. Apple, for example, makes its iPhone there now.

most importantly: VinFast released only a tiny, tiny amount of shares to the public.

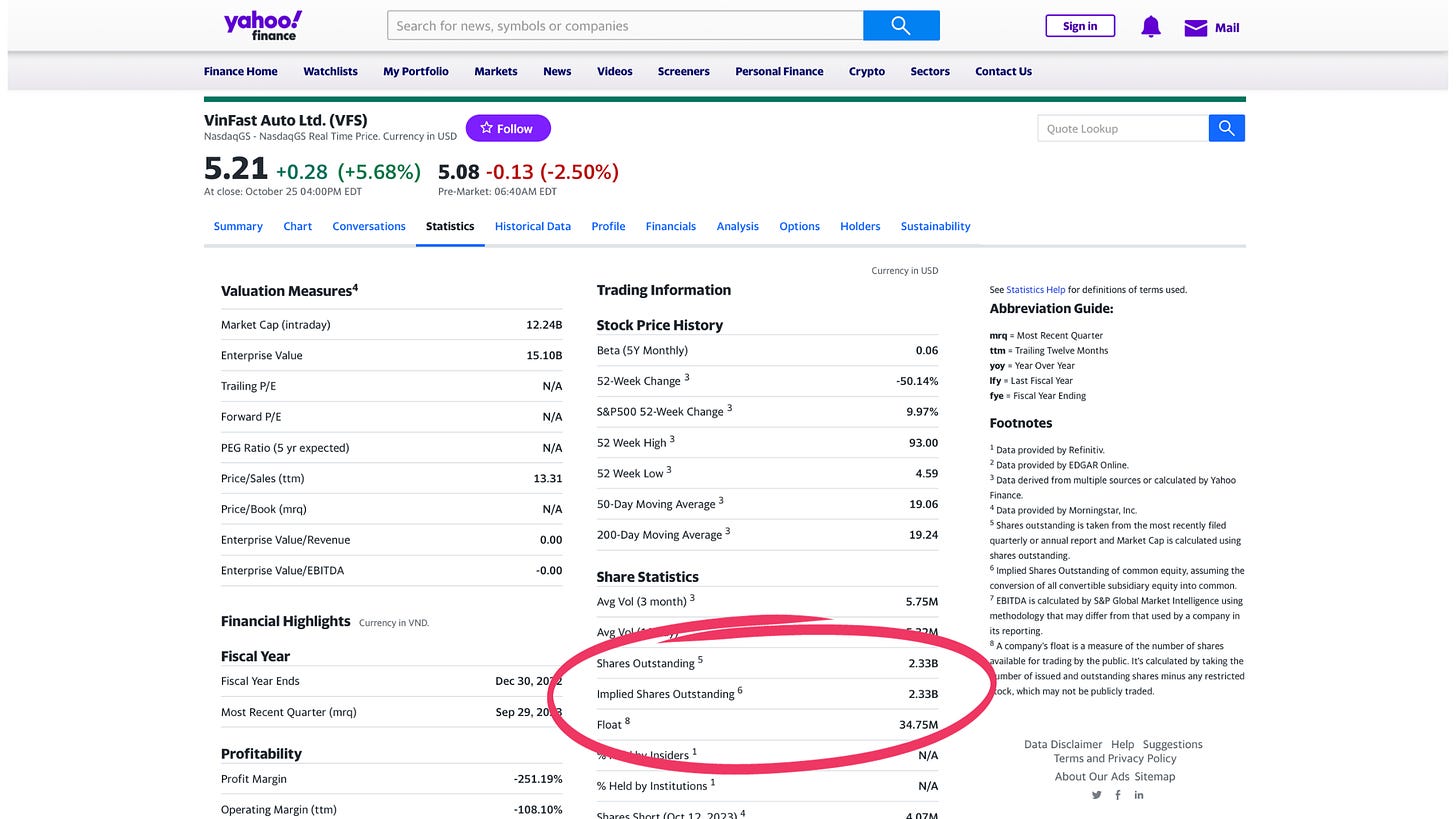

How tiny? Well, there are 2.3 billion VFS outstanding shares. But only 4.5 million VFS outstanding shares are free floating on the US stock market.

Let us rephrase that so it’s clearer: 99.7% of VinFast is still owned by its billionaire founder Pham Nhat Vuong, Vietnam’s richest man.

Having such a small amount of shares available for trading can make a stock truly prone to wild swings.

Think of it this way: a stock’s price is driven by supply and demand. With such a small supply, even a small increase in demand can “pump up the price”.

In fact, VinFast's General Director actually admitted that VinFast deliberately released a limited amount shares in order to raise capitalized value.

…and why did VinFast lose 86% in the two months since?

Three reasons:

“Higher for longer” interest rates

The way VinFast went public

VinFast’s disappointing results

Let’s look at them one by one.

First, investors have been betting on a “soft landing” for the economy and a fast slowdown in the inflation. Which would mean the Fed could lower interest rates and bring back “the money printer”.

We’ve talked before about how so much of the bull run of the past two decades has been simply a function of extremely low interest rates.

Basically, low interest rates stimulate investing in two ways: unleashing a flow of “liquidity” (=free money), and making it seem as if “there is no alternative”. Financial journalists even gave this a name: “TINA”.

On August 28th the Fed ruined any hopes of TINA coming back this year.

With inflation not slowing down as much as hoped, the Fed expressed concern about it, and signaled the need to keep interest rates higher for longer.

As a result, all three main US market indexes (S&P 500, Nasdaq 100, and DJIA) went down over the next 30 days:

How does this relate to VinFast, you ask?

Well, highly speculative stocks like new EV companies can benefit the most from lowering interest rates – and fall the hardest when “liquidity tightens”:

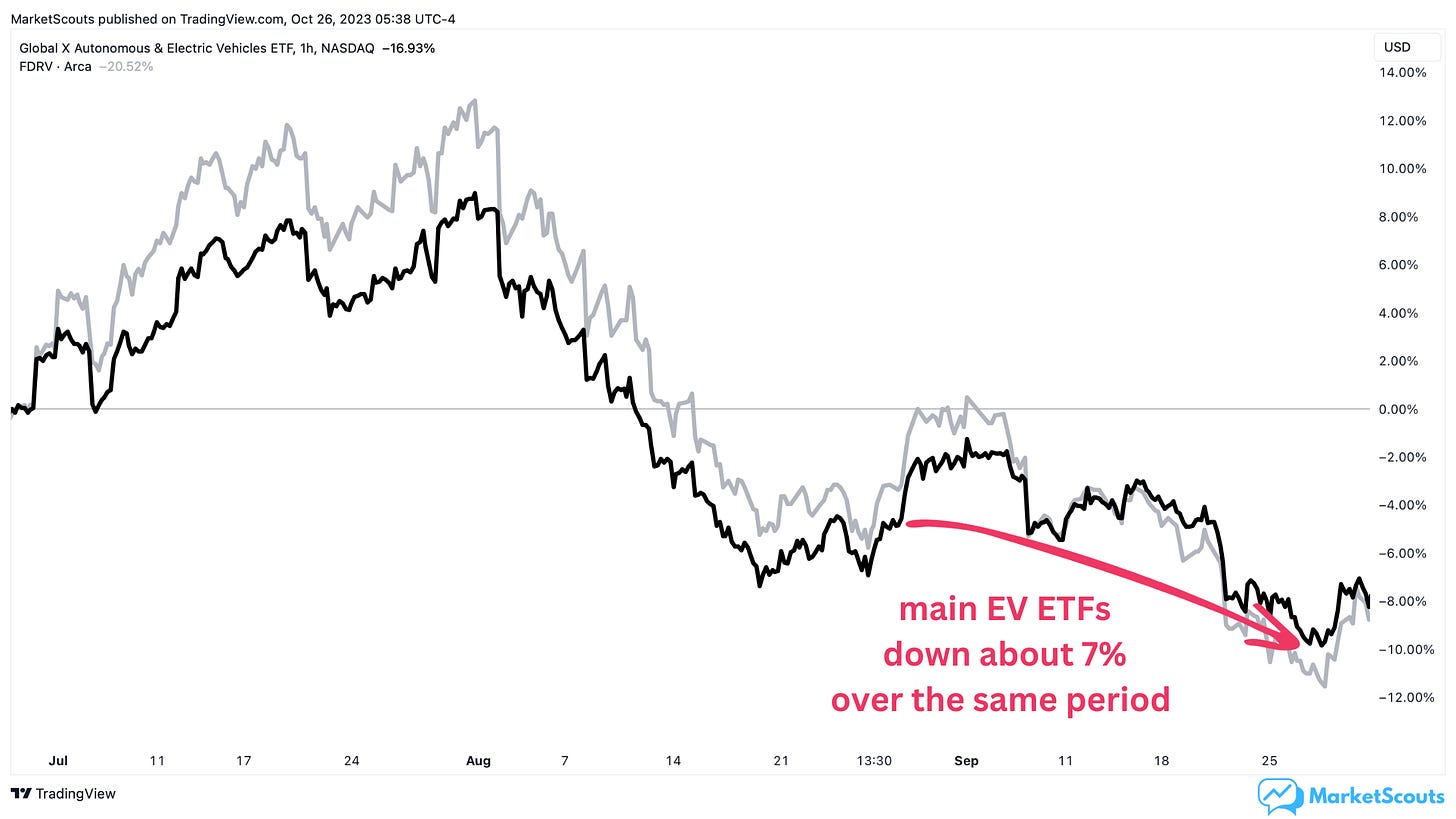

Let’s look at some of the main ETFs tracking EV stocks. Over the same 30 day period, they’re down over 7%:

It might not be as obvious that the fall is larger, but that’s only because these sort of ETFs tend to go up and down more than the main market indexes. They’re more volatile.

Which brings us to the next reason that VinFast dropped so much: the way it went public.

Selling so few shares to the public initially might have seemed like a good idea. It certainly pumped the price up.

But remember this quote from The Price Of Time:

“Volatility is the inverse of liquidity” – Edward Chancellor

The fewer the shares available for trading, the more volatile the stock is.

With not many VFS shares available, it became tough to buy or sell VFS shares without “messing up” the price. This can lead to bigger price differences, more price ups and downs, and slower transactions for VFS investors during price drops.

In other words:

“When everyone is rushing for the exit, the size of the door matters” – Nassim Taleb

The way VinFast went public also brings us to the final reason why its stock tumbled: disappointing results.

Do a bit of googling and you’ll read that VinFast went public via an IPO. That’s actually not correct: VinFast went public via a reverse SPAC merger.

Companies choose SPACs because they’re easier than IPOs. In an IPO, you need to disclose all sorts of information before you sell shares to the public.

In a reverse SPAC merger, you basically merge with a “company” that’s really just an empty shell – but a shell trading on the stock exchange. 😉

This doesn’t necessarily mean that a company going public this ways is a bad deal. But it does mean that there might be stuff under the hood that you don’t know about.

There was a small boom in Chinese companies reverse listing in the US a few years ago, and it ended very poorly. Netflix has a great documentary on it:

Back to VinFast.

As more people looked into the company, a few things became worrying:

VinFast sold far too few cars, and its growth rate wasn’t that good either: it sold 24,000 cars in 2022 and 11,300 in the first half of 2023. This tiny volume and slow growth can’t justify it being valued more than Volkswagen, Ford, or General Motors – whose sales are in the millions.

To make things worse, more than half of the electric vehicles it sold in 2023 turned out to have been to another subsidiary of the same Vingroup. That’s a red flag no matter how you look at it.

Lastly, its sales to the US have stalled too: its first shipment of cars to the US in December was heavily delayed, plus some of its cars had to be recalled, after the US National Highway Traffic Safety Administration warned of a software error that could increase the risk of a crash.

So, what is the lesson investors can take from VinFast’s rollercoaster ride?

We think there are many lessons here: maybe avoid reverse mergers and SPACs; or be wary of investing in IPOs generally. But one lesson in particular stands out right now:

Be extremely careful when you see a low free float ratio.

It can pump the stock when the market’s feeling optimistic, but also quickly bring it crashing down when the market gets spooked.

To find it, just go to a site like Yahoo! Finance. There you’ll see “float” and “shares outstanding”. Simply divide float by shares outstanding to get the free float:

But hey, maybe you don’t really think that a low free float ratio is that dangerous.

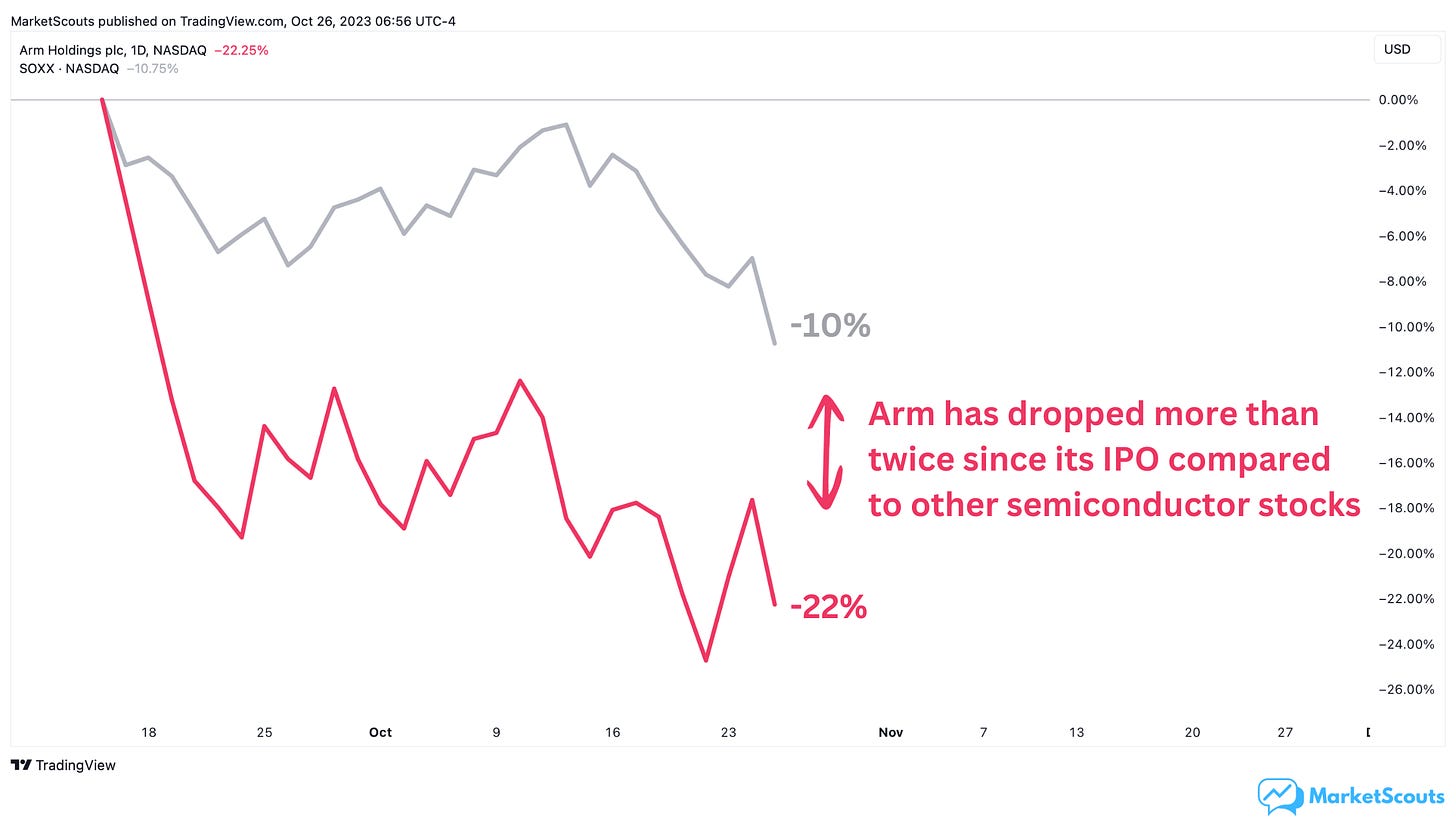

Here’s another example: consider Arm, a “hot” chip designer which saw its stock price soaring right after IPO – only to come crashing down.

Sure, this was somewhat due to souring interest in semiconductors.

But look at how much more Arm fell compared to the iShares Semiconductor ETF:

Now, was Arm’s IPO overpriced? Maybe. Did Arm’s owner, SoftBank, have a bad track record? The Financial Times certainly thought so.

But whatever the reason, its low 9.3% free float certainly did not help.

And that’s really the point here: liquidity influences stock prices more than most investors care to admit.

Liquidity can be influenced by many things, from free float (for specific stocks) to interest rates (the market as a whole). And liquidity in turn can make stocks more volatile (when it’s low) or steadier (when it’s high).

You can’t escape this relationship.

Also, this is not a recommendation to buy or short VinFast, so bear in mind this disclaimer: we talk about various stocks, funds, and securities because they’re interesting or can be used to teach a lesson about investing. None of the posts we publish are intended to be taken as individual investment advice or a recommendation to buy or sell any specific stock or other security. We can’t even guarantee that our information sources are 100% accurate. The only purpose of these posts is to teach you how to do research and figure this stuff out for yourself.