Bitcoin is up 152% YTD. How to be Zen about it

The recent rapid rise in Bitcoin’s price will bring investors back to it. Let's figure out how to be mentally prepared for investing in it – or not.

Whether you like Bitcoin or not, today it’s become an asset class owned by millions around the world.

Its price is once again up for the year, in what some say is the beginning of a new crypto bull run.

Which got us thinking, what’s the best way to go about it? What’s the best way to not give in to either panic or FOMO while dealing with something as volatile and as publicly hyped as crypto?

A little while ago we talked about how investing with an Islamic lens can actually help you achieve higher returns when investing in stocks.

For crypto, we realized the answer might be Buddhism. Here’s why.

What Buddhism is all about

Buddhism is a spiritual and philosophical tradition founded by Siddhartha Gautama, known as the Buddha, around 2,500 years ago in India.

It centers on the quest for enlightenment and the alleviation of suffering through the Four Noble Truths, which identify the nature of suffering, its causes, the possibility of its cessation, and the path to attain that cessation, known as the Eightfold Path.

Buddhism emphasizes meditation, mindfulness, and ethical living to achieve inner peace and liberation from the cycle of birth, death, and rebirth (samsara).

Principle 1: Non-attachment

Non-attachment says that suffering is caused by attachment to desires, including material wealth. We feel this one is especially relevant to investors in highly volatile, risky assets like cryptos.

Let’s think a bit about the crypto boom in 2017. What happened there was a rush in the value of digital currencies, particularly Bitcoin. The boom attracted investors with the promise of high returns.

Who can blame them? Bitcoin was up 1291% in 2017!

According to a viral headline at the time, “Everyone Is Getting Hilariously Rich, and You're Not.” Talk about FOMO.

But if cryptos are known for one thing, it’s extreme volatility. To use a Buddhist concept, crypto is a financial market completely defined by impermanence. The impermanent nature means that prices can change rapidly and unexpectedly. This is of course true of all financial markets, but it is especially true of the cryptocurrency market.

In 2018, right after the boom, Bitcoin lost -73%.

So how can non-attachment help if you’re looking at the crypto market now?

First, a Buddhist mindset keeps a long-term perspective and avoids attachment to short-term gains. The market is impermanent and unpredictable.

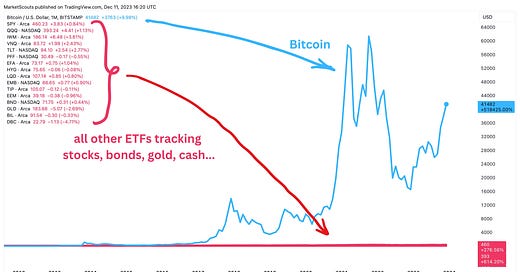

One way to help you gain this mindset is to use a logarithmic (log) scale for your crypto charts. On the log scale, the short-term ups and downs are smoothened, allowing you to keep the long-term growth in mind.

Second, Buddhism also says that material wealth is impermanent, and the fear of losing it can cause suffering.

Consider the fleeting nature of crypto gains: in 2017, the price of Bitcoin increased by almost 1,300%, only to fall by over 70% the following year.

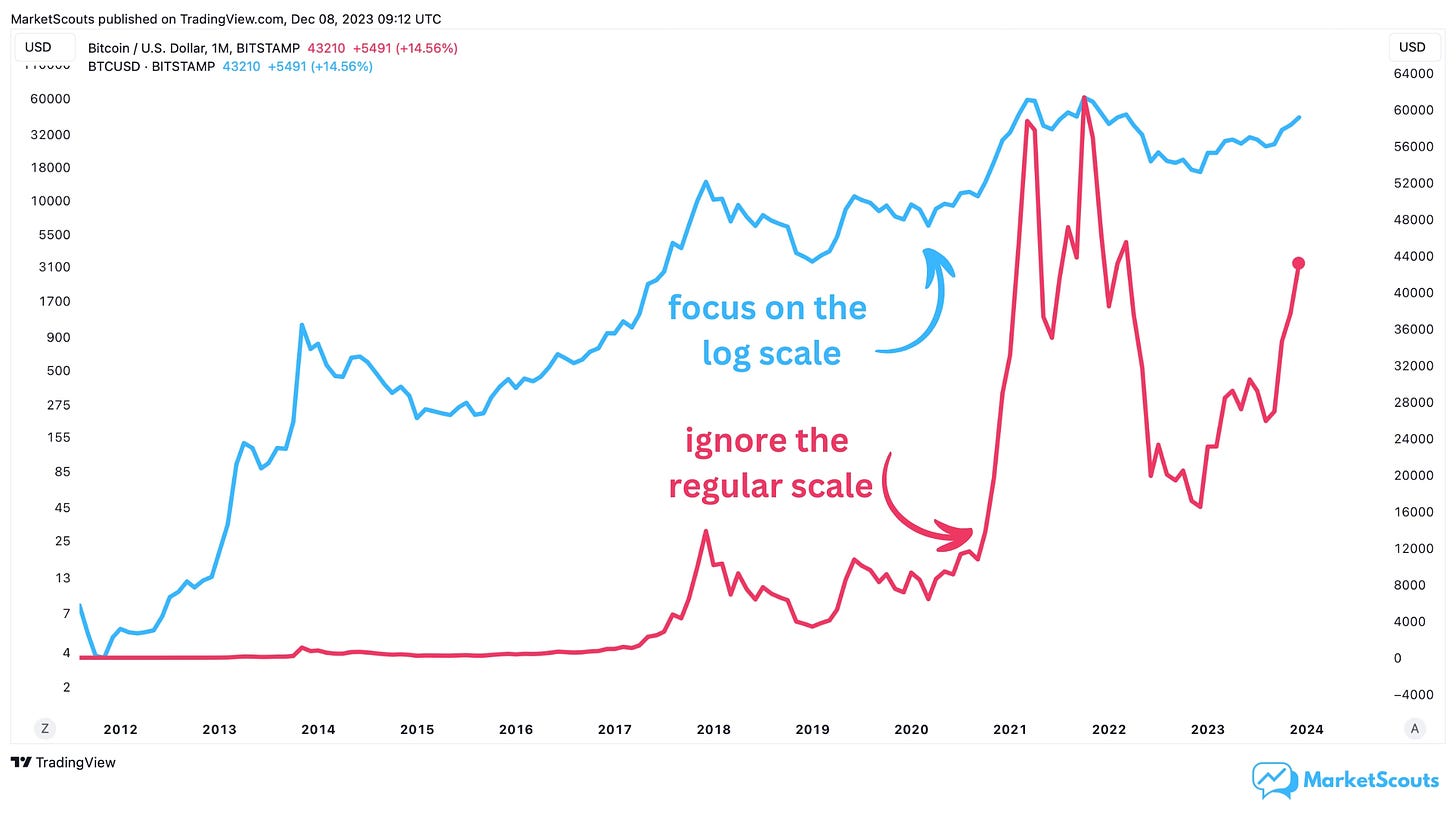

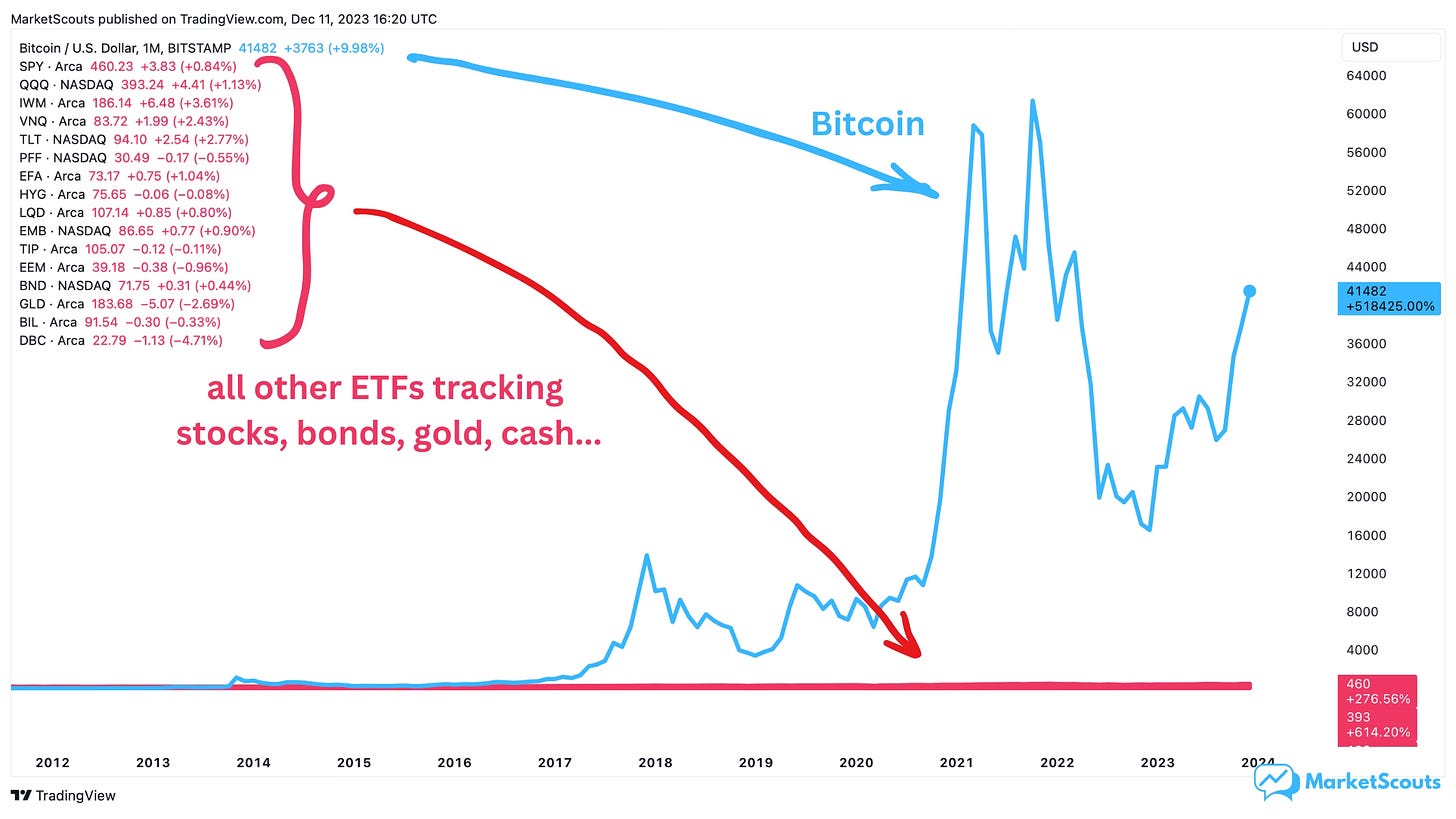

But over the past decade, it’s still been the highest-performing asset class. And the best asset class almost every year, too.

And that growth compounds. Since it got started, Bitcoin has left pretty much any other asset class in the dust.

But Bitcoin (and other cryptos) might not be able to keep this up forever. There's definitely a ton of reasons why crypto as a whole “might not make it”.

First, the price seems to have been heavily manipulated.

University of Texas finance professor John Griffin, who has a 10-year track record of uncovering financial fraud, proved in a research paper that at least half of the 2017 crypto boom was due to coordinated price manipulation.

Second, the incentives are usually in favor of crypto startup teams cutting corners in order to grow as fast as possible.

In the words of David Gerard, a prominent crypto critic and author of several books on the topic, “the secret ingredient for the success of crypto projects is crime”. This has led to exchanges collapsing (MtGox), more exchanges collapsing (FTX), fraud (Celsius), and more fraud (Terra/Luna). And these are just a handful of examples.

Finally, the previous boom in crypto happened during a time of low or even negative interest rates, which is when investors “go a little crazy”. They basically have no alternative but to gamble. But interest rates might stay higher for longer as central banks try to keep inflation under control.

And even if crypto becomes the next big asset class, it doesn’t necessarily mean that the tokens you invested in, including Bitcoin, will dominate.

Look at how the list of top 10 cryptos has changed over time:

Ethereum went from not existing in 2014 to being the second most valuable crypto just two years later. Litecoin went from being the third most valuable one in 2014 to number 17 almost a decade later.

In crypto, things change drastically – and fast!

So looking at the crypto part of your portfolio like a lottery ticket instead of investing, regardless of what you actually feel about it, might be there way forward.

In other words, think of what you’re comfortable losing.

Only 30% of your portfolio, max? Then only put that into crypto. You can even pick a lazy portfolio that’s meant to survive anything, such as the Cockroach Portfolio, and adjust it so it also has a crypto piece in it.

LazyPortfolioETF.com also has a few other lazy portfolios with Bitcoin in them:

Third, if you’re looking at investing in something as volatile as crypto, also look into mindfulness. Training yourself to be present here and now can help you make rational decisions amidst these wild price swings.

If you don’t know where to start, download an app like Calm, Breathe, or Headspace. Or simply watch the Netflix “Guide to Meditation”. It’s pretty good.

Principle 2: inner peace

Buddhism seems to favor a passive approach to any sort of investing. But until recently, passive investing in bitcoin and other cryptos wasn’t easy to do:

you had to find a trustworthy exchange – tricky, considering that the largest one (FTX) collapsed last year, and its rival (Binance) has just been hit with a massive fine and is under close scrutiny.

you had to figure out which of the 5,000+ cryptocurrencies and tokens are uncorrelated enough, and which even have any chance of surviving.

you had to do it all by yourself, which meant wasted time, higher fees, and the even the risk of losing access to your coins.

Now things are changing. Using a passive approach to crypto is getting easier and easier.

First, eToro launched a few “crypto smart portfolios” that track indexes made of the largest cryptocurrencies. For example, their smart portfolio built together with Index Coop contains about 32% Bitcoin, 28% Ethereum, and a mix of tokens for metaverse, NFT, and decentralized finance protocols.

Second, a bunch of Bitcoin and Ethereum ETFs are coming on the market.

Third, depending on where you live, you might also be able to add crypto to your retirement plan monthly contributions. For example, in the US, Fidelity Investments launched a 401(k) crypto option in 2022.

There is another advantage to passive investing: buying a crypto ETF from a reputable firm and in a regulated investment app is probably much safer than keeping your money in some offshore exchange that might collapse any minute.

Most people think that the biggest risk in crypto is the price going to zero. Not true – in fact, there’s plenty of interesting projects out there built by real, smart, dedicated teams.

In crypto, the biggest risk is counter-party risk.

Counterparty risk basically means seeing the price of your favorite token go “to the moon” but then being unable to profit from it because the exchange collapsed, or is stopping withdrawals, or the founder faked their own death and ran away with the money.

Counterparty risk can even be with you as your own counterparty (since you’re in charge of storing the keys, passwords, etc) : some people decide that the safest way to hold crypto is to keep it “off an exchange”, meaning they’ll just store themselves the keys that unlock their crypto wallet.

Most people don’t even cut their own hair. Expecting people to “be their own bank” turns out the way you’d expect.

Yes, even the chief technology officer of a crypto company lost the keys to their Bitcoin stash.

Principle 3: ethical living

This is where crypto and Buddhism seem to fight.

Buddhism is a philosophy that advocates for high moral standards, and bans “business in weapons, business in human beings, business in meat, business in intoxicants, and business in poison”.

On the other hand, cryptos have been linked with a pretty significant amount of crime.

Crypto has been directly linked to funding North Korea’s nuclear arms program.

Crypto stablecoins have been directly used in financing human trafficking and literal slavery, where people are kidnapped, tortured, and forced to scam other people via online romance scams.

This is a photo of one such compound in Cambodia, where victims are lured with the promise of work, before being sold into forced labour.

Crypto play-to-earn games have induced poor people from poor countries to sink whatever savings they have in get-rich-quick schemes.

For example, in the Philippines regular people quit their jobs and gotten into debt to buy tokens so they can play Axie Infinity, an NFT-based game which supposedly would enable them to earn an income – only for the token price to crash months later.

Is there a middle way? We would suggest a few things:

First, avoid stablecoins: they seem to be the most connected to crime, as they offer criminal gangs easy and anonymous ways to transfer money

Second, invest in tokens that use proof-of-stake or some other technology to secure the blockchain, except proof-of-work. Proof-of-work, used by Bitcoin, consumes a ton of energy. Alternatives like Ethereum, Avalanche, Solana, Cardano, and the projects built on top of them might be more ethical.

Third, use a highly regulated exchange, like Coinbase: they’re more likely to do the kind of KYC (know your customer) and AML (anti money laundering) checks that an ethical investor would expect

Finally, avoid illiquid digital assets like NFTs: art traditionally has been a favorite medium for laundering money. Digital art that is traded on unregulated exchanges? Even more so.

But we would suggest you also take a “Zen” approach to this. The reality is that you never can know for sure where your money is going, even in traditional finance.

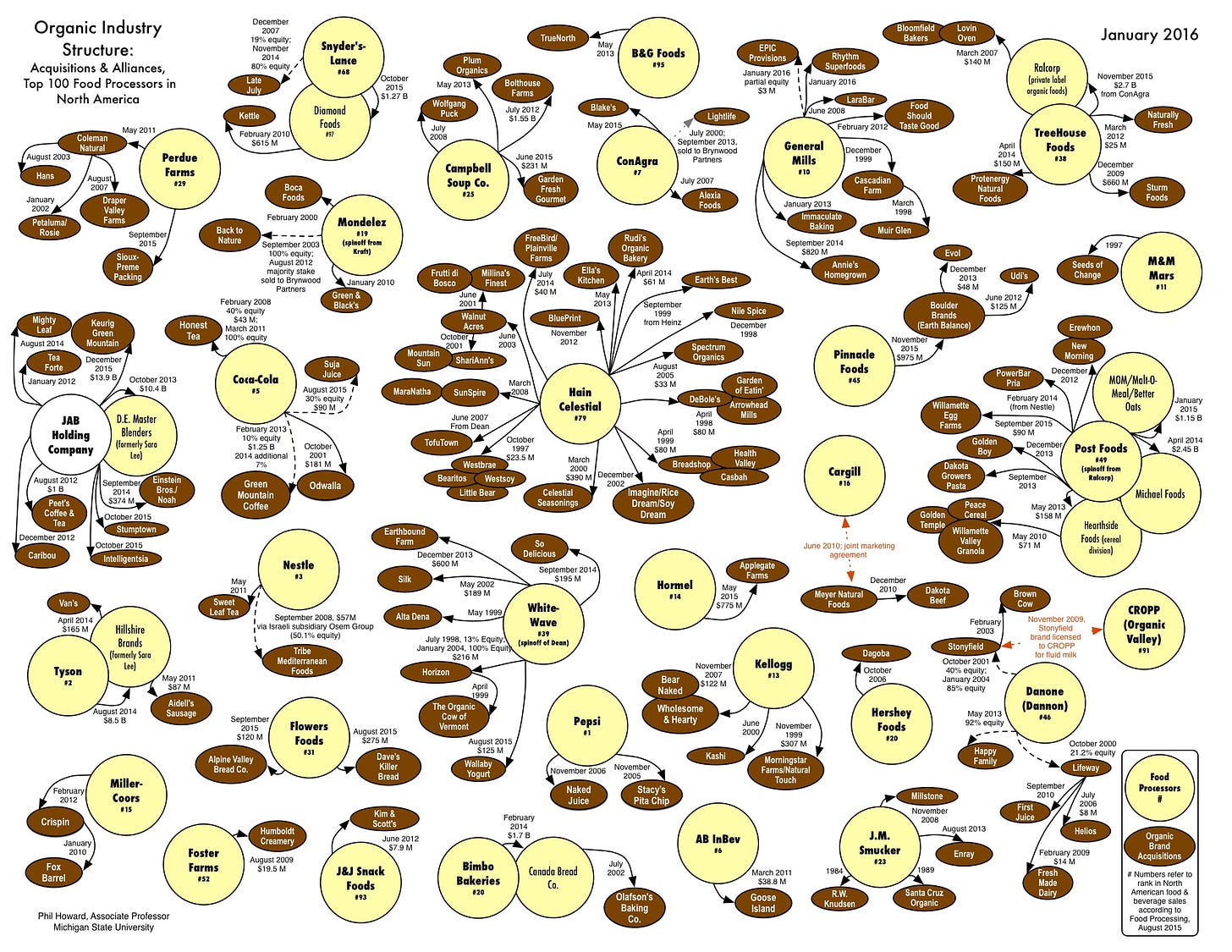

Just look at this chart of who owns seemingly “mom-and-pop” organic companies:

We hope you enjoyed this post. Bitcoin and crypto in general is such a contested topic, with a thousand very different and very strong opinions. Which is why, in trying to figure out a strategy for it, we turned to the one philosophy that puts detachment first.

We plan to continue this series on how to apply the wisdom of various philosophies, religious or not, to investing. Expect some posts on Taoism, Confucianism, Christianity, agnosticism – even the Jedi religion.

How are you building your own, personal philosophy for investing? Which principles do you rely on?

The price crashing 10% after publishing this proves the whole point of the article 🥲🧘