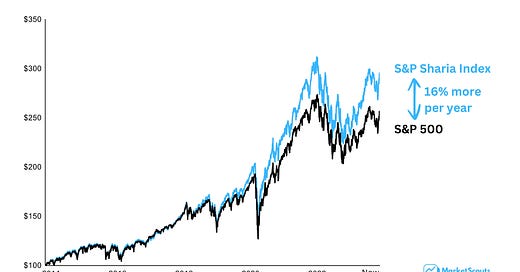

A version of the S&P 500 that beats it by 16% a year?

Let's look at a filter most investors ignore, simply because they never thought about it as an option: Sharia compliance.

Did you know there’s a version of the S&P 500 that made an additional 16% every year, on average, for the past ten years?

Meet the S&P 500 Sharia Index.

If you would have bought $100 worth of it in 2013, would would have almost $40 more today than if you just stuck with the S&P 500:

Normally when you see a version of an index beating the main index, it’s usually because that version is more volatile. If you want higher returns, then you have to accept more painful drawdowns along the way.

In English, this means: “when the market goes down, your more volatile ETF goes down even more.”

So let’s see if that’s true.

If we use Portfolio Visualizer to compare an ETF tracking the S&P 500 with an ETF tracking Sharia stocks between 2020 and now, we get:

an almost identical crash during the 2020 panic

a crash only slightly larger than the S&P 500’s (less than a 3% difference).

but a 3.4% higher return, on average, per year.

Put simply: yes, we do get slightly more volatility, but the larger returns more than make up for it.

A bit of background on Sharia funds

Sharia is Islam's legal system.

Its rules are based on the Quran, Islam's holy book, and also on the Sunnah and Hadith – the acts and teachings of the Prophet Muhammad. Whenever an answer can’t be found in these sources, religious scholars may give rulings that act as guidance on specific topics.

Islamic investing is different from other investment approaches due to its strict adherence to Sharia law. Sharia law says that financial risk must be shared, wealth should come from moral businesses, and investments must yield social benefits – not just profits.

This means avoiding usury (riba), excessive risk (gharar), gambling (maysir), and any industries deemed forbidden (haram).

In practice, this means that Islamic funds filter out entire industries:

conventional finance (non-Islamic finance banks, insurance, etc),

alcohol and tobacco,

pork related products and any other activity related to pork and non-halal food (halal means meat prepared according to Muslim law),

entertainment (casinos, gambling, and adult entertainment),

and also weapons, arms, and defense manufacturers.

But this is not all. Islamic funds and indexes usually also take an extra step, and look at specific companies’ financial health in order to make sure that each stock is Sharia compliant.

For example, the FTSE Global Equity Shariah Index, on top of the industries above, also filters out companies that:

have a debt-to-assets ratio > 0.33,

own cash and other assets that earn interest > 0.33 of total assets,

have accounts receivable and cash > 0.5 of total assets,

or earn income from interest (and other non-compliant activities) > 5% of total revenue.

Basically, what these indexes do is start with a major index, like S&P 500 or FTSE All World, and then remove companies involved in different industries, or which have too much debt, and so on.

So if this is the S&P 500:

Then creating a Sharia-compliant version would be something like this:

Sharia funds have grown in popularity in recent years due to several factors:

The large and growing Muslim population in many countries worldwide, such as Turkey, Indonesia, and Malaysia.

The rapid growth of Muslim economies, such as Indonesia and the United Arab Emirates.

Many countries, such as the United Kingdom, have large Muslim diasporas.

In the UK for example, Sharia funds are one of the six options people can choose from in the National Employment Savings Trust (NEST), the government's workplace pension scheme.

And did Sharia investment funds outperform conventional funds in recent years! For example, the NEST Sharia fund in the UK returned 94% over the past five years, while the next best performer, the High Risk fund, saw a gain of only 34%.

Why did Sharia funds do so well?

There are many reasons why Sharia funds did so well for the past few years.

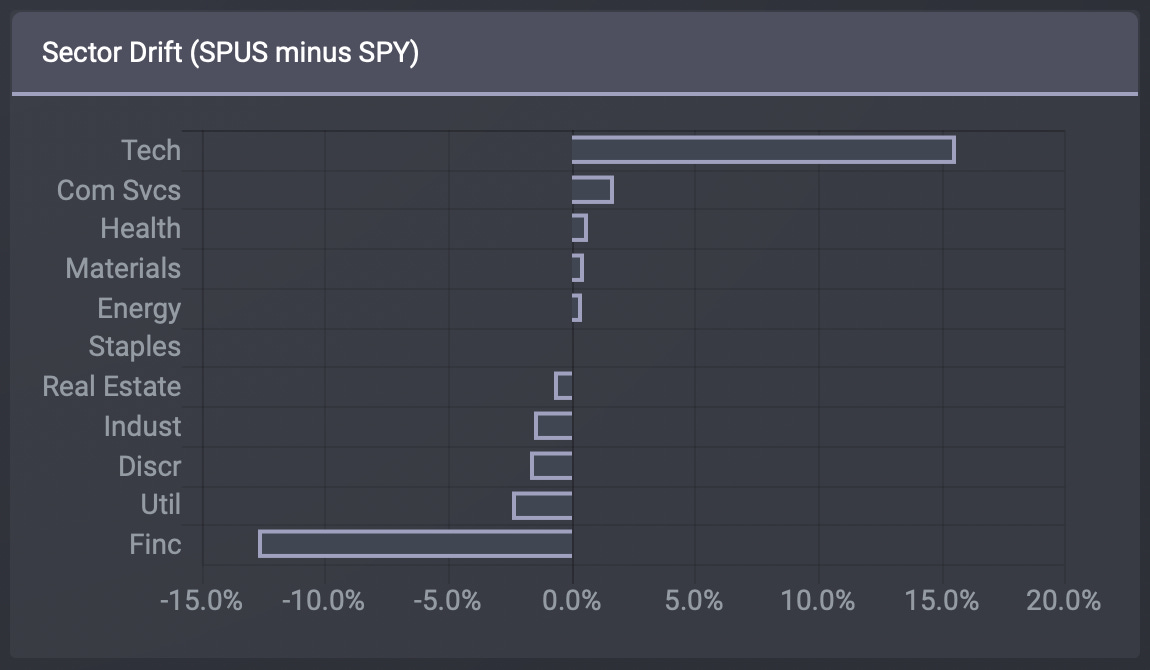

Owning more technology companies is the first reason.

If we use the ETF Research Center overlap tool to look at the overlap between the S&P 500 and the S&P 500 Sharia Index, we see that they only overlap about 57%.

And what’s left is heavily tilted towards technology:

The other reason was down to not owning banks and highly leveraged companies.

As interest rates increased, many banks came under pressure. If you don’t understand how that happened,Robert Reich has a great explanation of why Silicon Valley Bank and others like it failed.

Rising interest rates also put pressure on companies with large amounts of debt, especially debt with variable interest or debt coming due and which needed refinancing.

Sharia funds avoided both of these from the start.

And in the case of Sharia pension funds, there was another reason. Conventional pension funds are usually diversified and are made up of a combination of stocks, bonds, cash, property, and so on. Sharia funds are typically 100% invested in stocks.

And we all know how stocks have done over the past decades.

What next?

Will Sharia funds continue their hot streak?

Hard to say. But they seem to be in a decent position:

in a continued high inflation scenario, staying away from companies earning or (worse) paying interest can be nothing but good.

in a stagflation scenario of low growth, high inflation, and high unemployment, Sharia-compliant companies at least get to focus on the real economy. Might be a cushion.

in a recession or financial crisis, Sharia funds avoiding banks is also good.

and if we return to a bull market and the days of high growth and low interest rates, Sharia funds high concentration of tech stocks can really send them flying.

I’m not saying go ahead and buy Sharia-compliant stocks or a Sharia ETF. But a faith-based rule certainly is an interesting and easy to apply “quality filter”.

Faith is also something deeply personal – yet most people don’t really think of how their faith could help them come up with a simple, easy to stick with rule. And one that works even if you’re not religious, or if you belong to a different religion.

If it works, it works.

But there’s another reason why I wanted to introduce you to Sharia investing.

I personally know no non-Muslim investor who ever even thought of a Sharia ETF or a Sharia stock screener. Not one.

I have a private pension in the UK. Yet the only person in my previous company who ever chose the Sharia fund option was one of our interns (now a manager), who happened to be Muslim.

The funny part is that he didn’t even know it was an option – he just presumed it was a choice between the usual “High Risk”, “Low Risk”, etc.

I – a non-Muslim – had to tell him about it.

When we catch-up, we still joke that I saved his soul. 😇

That’s why over the next weeks, once a week, my colleagueRenee Krupnik and I will dive into each major world religion and look at how they approach investing.

Worst case, you’ll find a new stock or ETF screener. Best case, you’ll get that andlearn something new about another culture.

And in a world that seems a bit more fractured every day, that can’t be a bad thing.

If you found this post interesting, please leave a comment. I’d love to know if you ever looked into Sharia funds, or if you ever used it as a stock or fund screener. I know I wish I did!