Best 4 tools to track and copy top investors in 2023

Good artists copy, great artists steal. Use these 4 tools to copy your favorite top investors, insiders, and politicians. Part 1 of our series on "How to figure out what other investors are doing".

Everybody and their mom knows about Warren Buffett and his fund, Berkshire Hathaway.

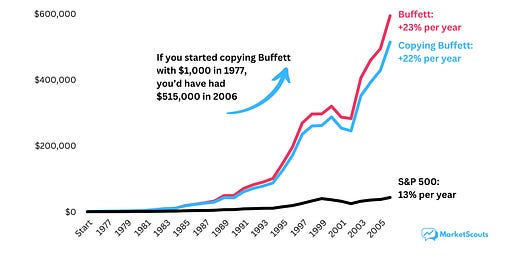

According to a 2008 study, if you copied Berkshire Hathaway’s investments a month after they were publicly disclosed, you would have beaten the S&P 500 by about 10%, on average, every year from 1976 to 2006:

Of course, this is a strategy that works fine until it doesn’t.

We’ll look at the pros and cons of copying famous investors, and how to actually do it, in the next post.

First let’s talk about some tools that actually help you do it.

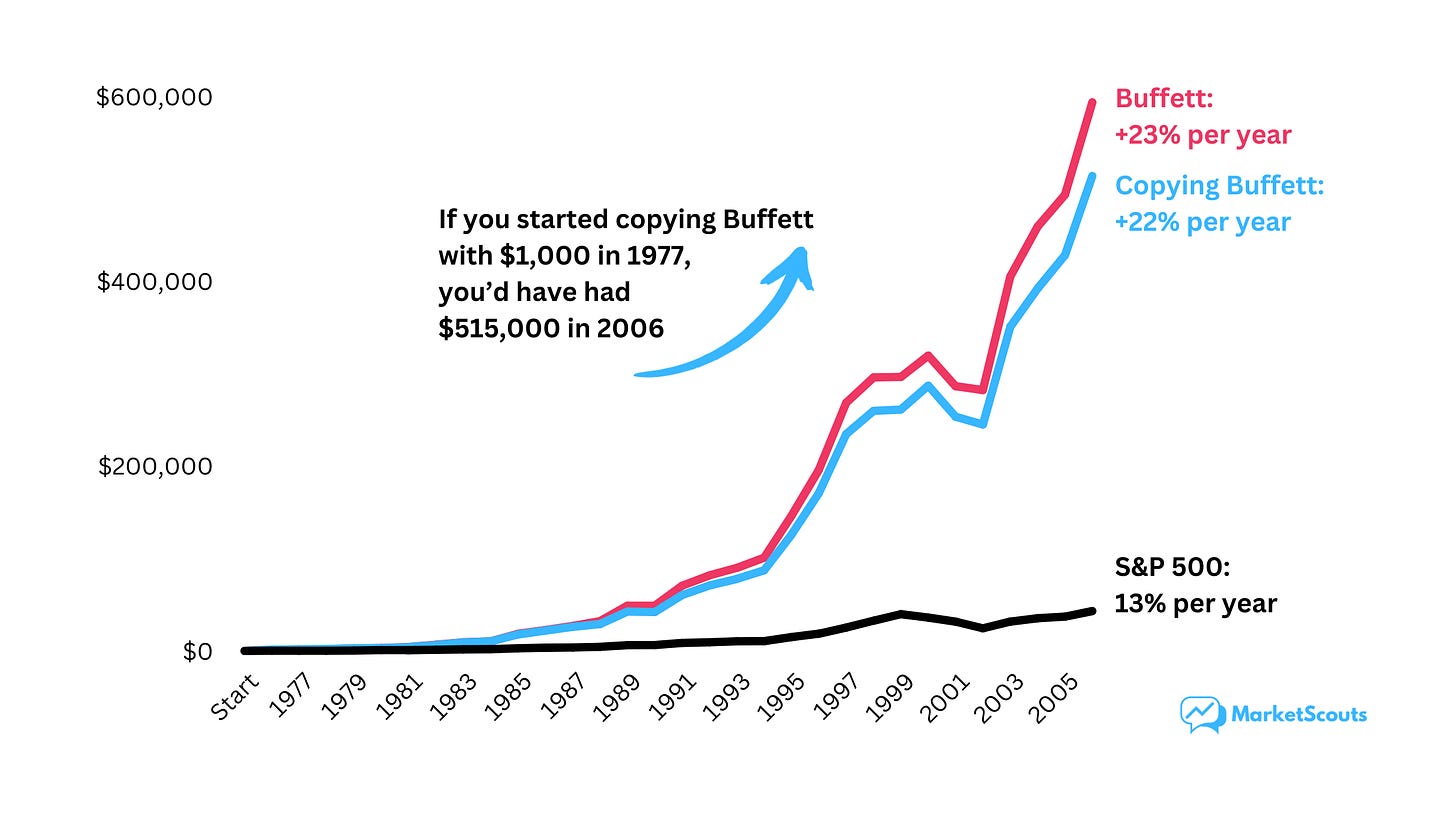

If you want to copy professional investors: Whalewisdom

In the US, any investor who manages more than $100 million must file something called a 13F filing with the SEC, and disclose what they bought or sold.

Whalewisdom lets you screen stocks based on this. Some of its best features are:

Whaleindex: creates a portfolio of commonly held stocks from the best funds

13F Stock Screener: helps narrow stock search based on fund holdings.

Consensus Picks: identifies popular stocks among investment funds.

However, their best feature by far might be their “13F Backtest” tool, where you can see how your personal pick of investors would have fared compared to the S&P 500:

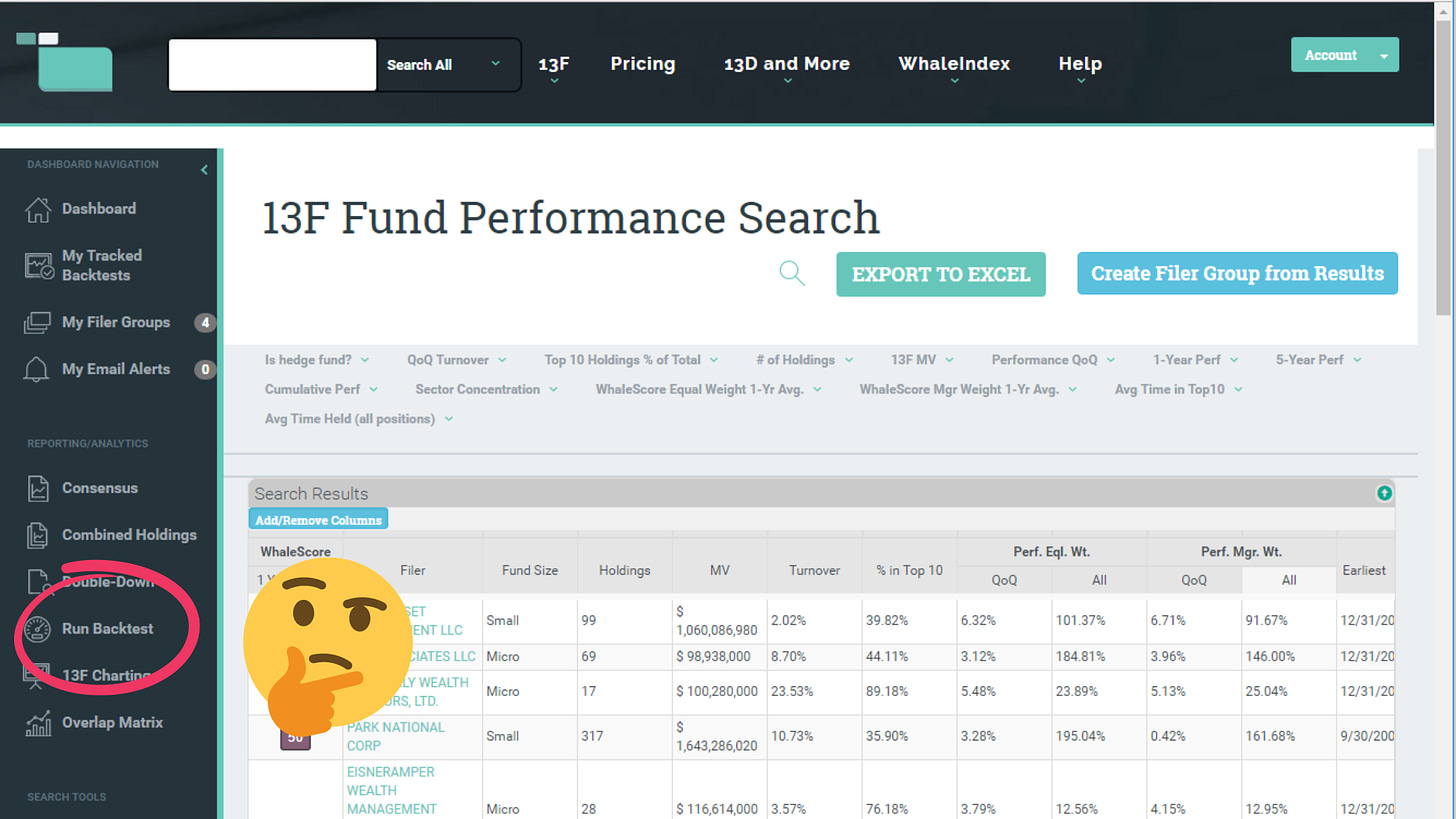

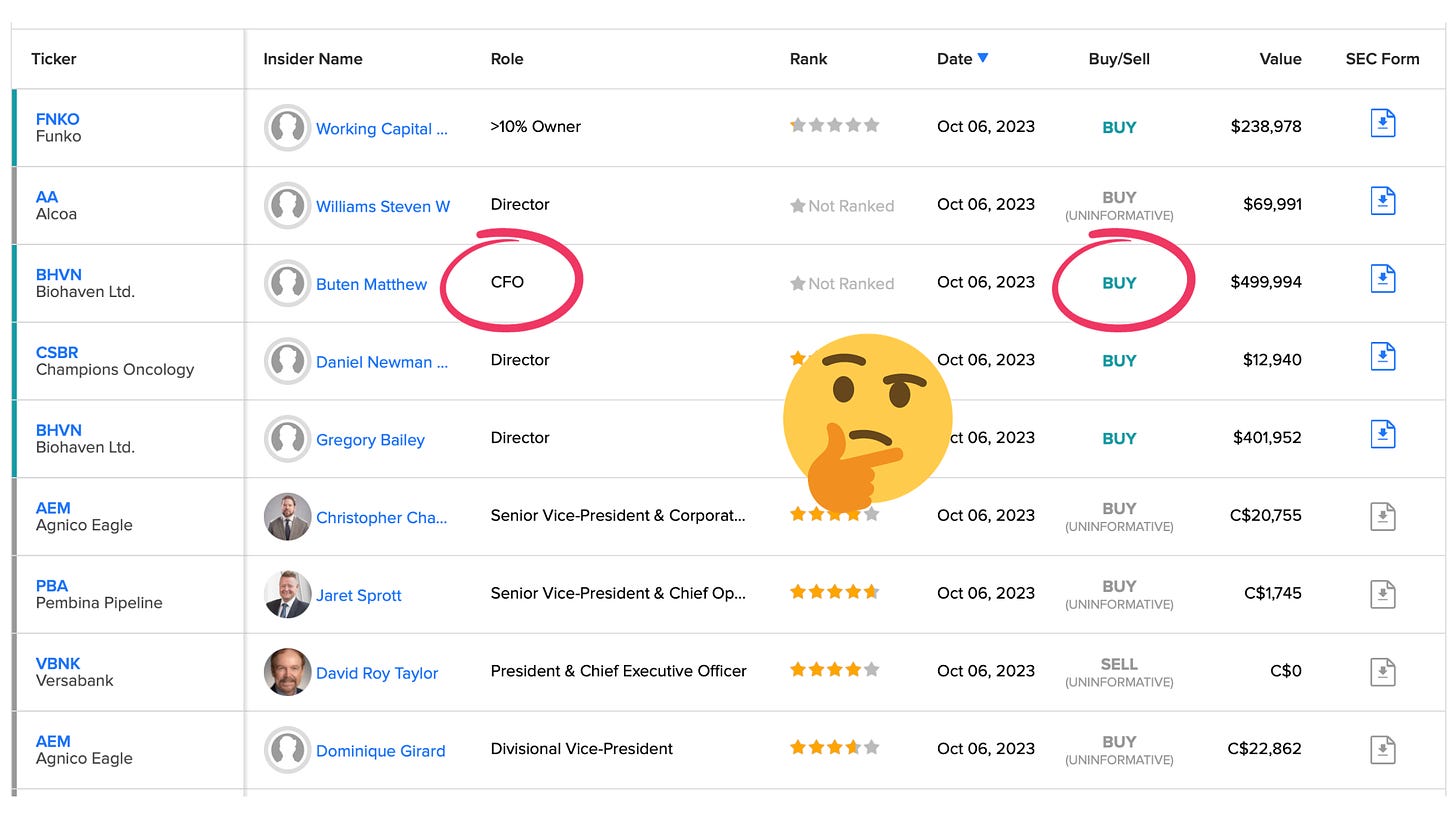

If you want to copy insiders: TipRanks

TipRanks is a platform packed with features, many not related at all to copying other investors. We’re not going to cover all of them.

For our goal today, it does have a screener called “Top Insider Stocks”.

It’s basically a filter that what insiders (CEOs, top management, and major investors) are doing. Adding more or dumping on the market?

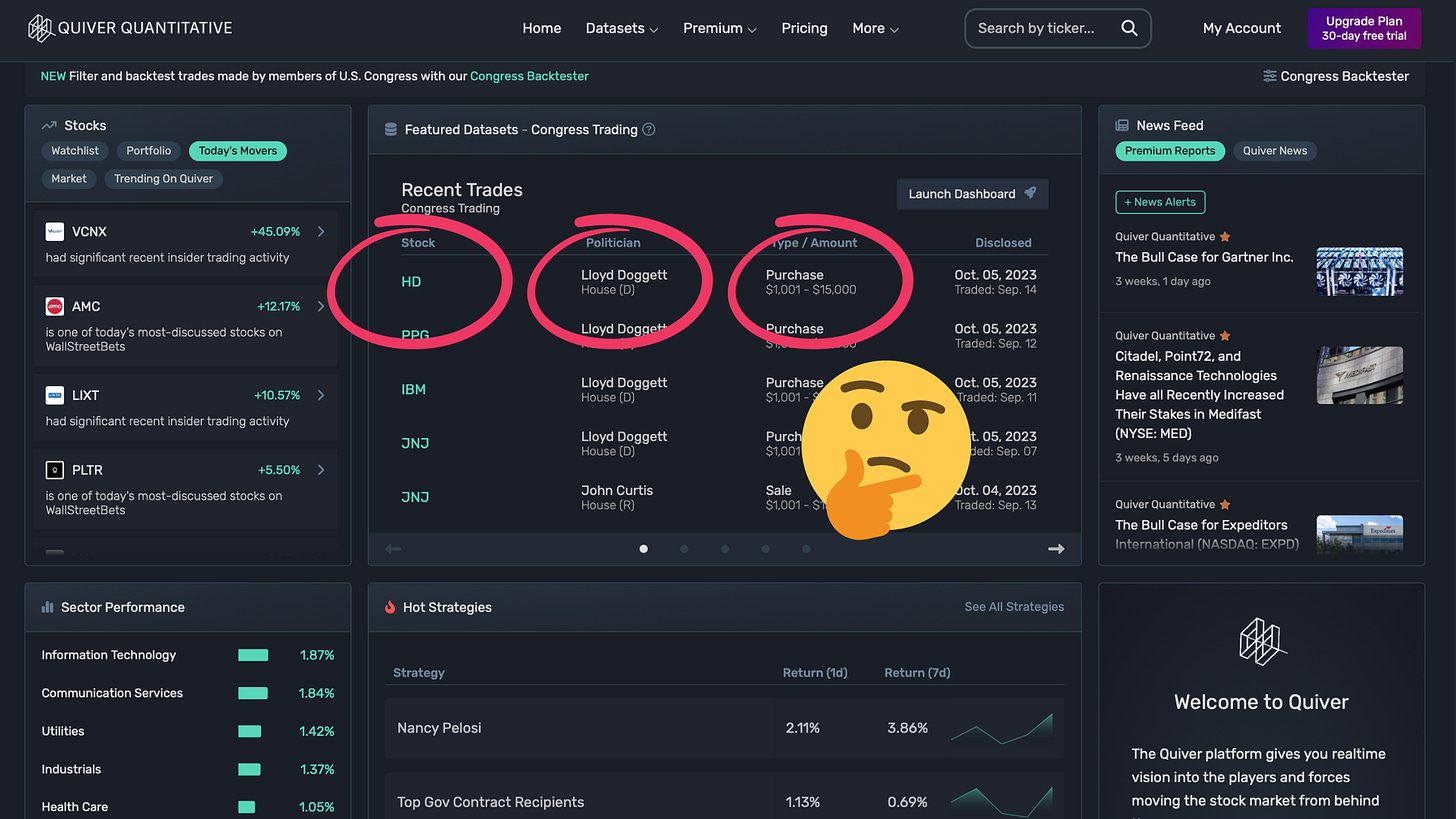

If you want to copy politicians: QuiverQuant

You might have heard the news that some politicians made quite a bit of money during the pandemic – by selling before everyone else and then buying shares in companies related to remote work.

To be fair, some studies have found that, even with this insider information, the average politician still doesn’t beat the S&P 500.

But some do.

QuiverQuant lets you see what politicians invested in, so you can figure out which ones do beat the market – and copy their trades, of course.

It even lets you backtest strategies based on specific US Congress members:

If you’re lazy: eToro

What if you don’t want to do too much work?

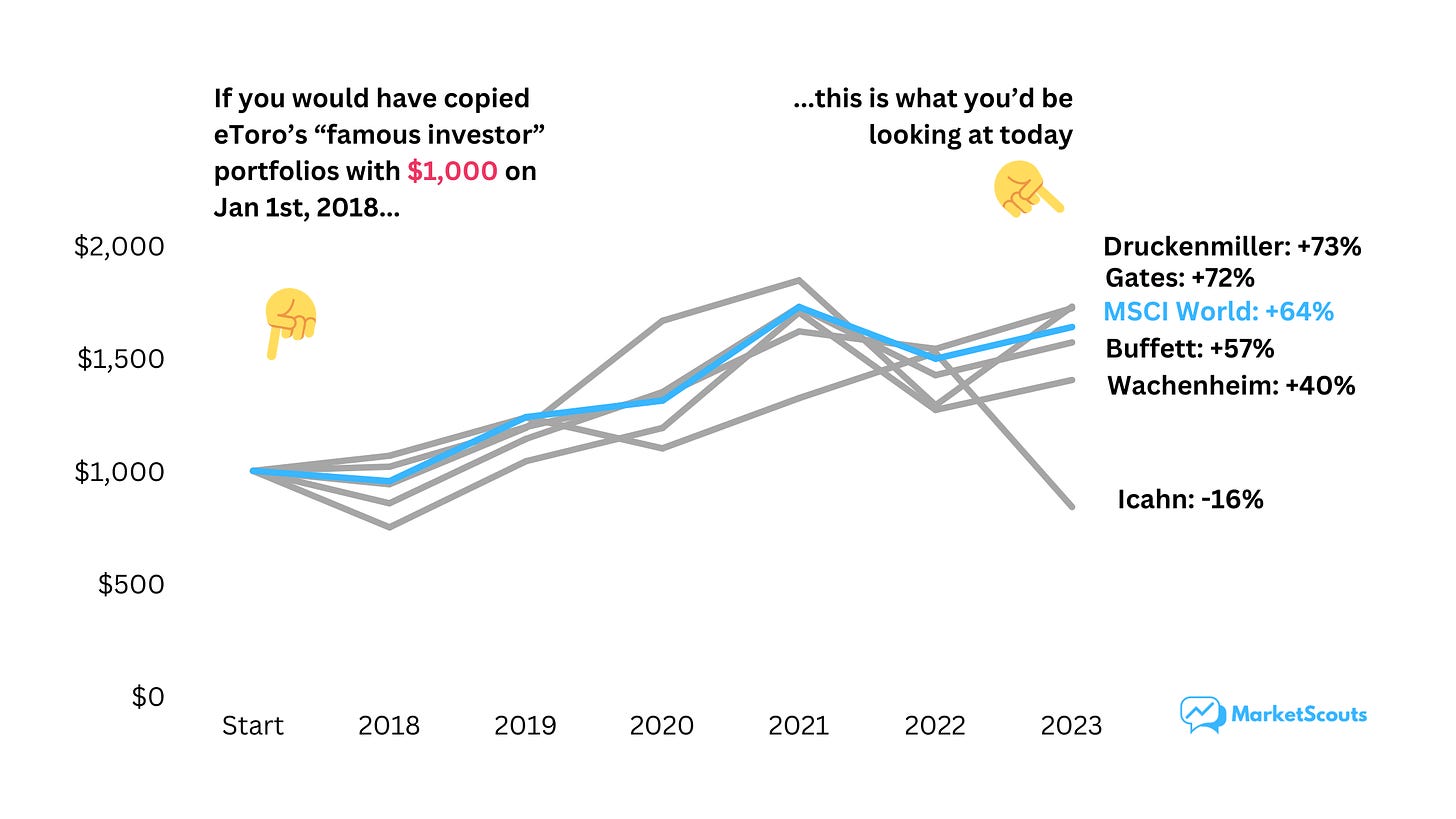

In that case, eToro lets you automatically copy other traders using special “copy portfolios” that track famous investors.

You can copy a fairly small list:

Stanley Druckenmiller, hedge fund manager and owner of Duquesne Capital, which between 1981 and 2000 made about 30% a year without any money-losing year.

Edgar Wachenheim, chairman at Greenhaven Associates and the author of a few famous investing books.

The Bill and Melinda Gates Foundation: you can track the trades the endowment makes in an effort to grow its capital for charitable causes.

Berkshire Hathaway, Warren Buffet's holding company.

or Carl Icahn, one of the first activist shareholders, and owner of a fund which has made 31% per year since 1968.

Also, eToro is technically a trading app, so you can also use it to track other investors like you… although we wouldn’t recommend that.

At least based on our own experience 😬

Should you even copy other investors, though?

Before you rush off to copy Buffett or Druckenmiller or who knows who else, you might want to think a little bit about the pros and cons:

pro: sure, it’s easy to find ideas that someone else already did the research on

pro: many of these ideas might be better than yours

con: you have no idea why they’re buying or selling

con: the data that these tools use (mostly 13F filings) can be 45 days late. You might be too late to the party

and the biggest con of all: mixed performance. Very often a long streak of wins ends with a massive bust.

For a quick example, let’s actually look at how the eToro Copy Portfolios have done:

Looks like simply buying something like iShares Core MSCI World UCITS ETF USD (Acc) would have been a better deal for most people?

This is an ETF which tracks the MSCI World index (basically 1,500+ companies), reinvests dividends automatically, only charges 0.20% per year, and seems to have lower volatility than most of these eToro portfolios.

We talked about this before: lower risk doesn’t always mean lower returns. Or not much lower, in any case.

And considering that you literally have no idea why Buffett or Druckenmiller bought or sold something, maybe think twice before clicking “copy”.

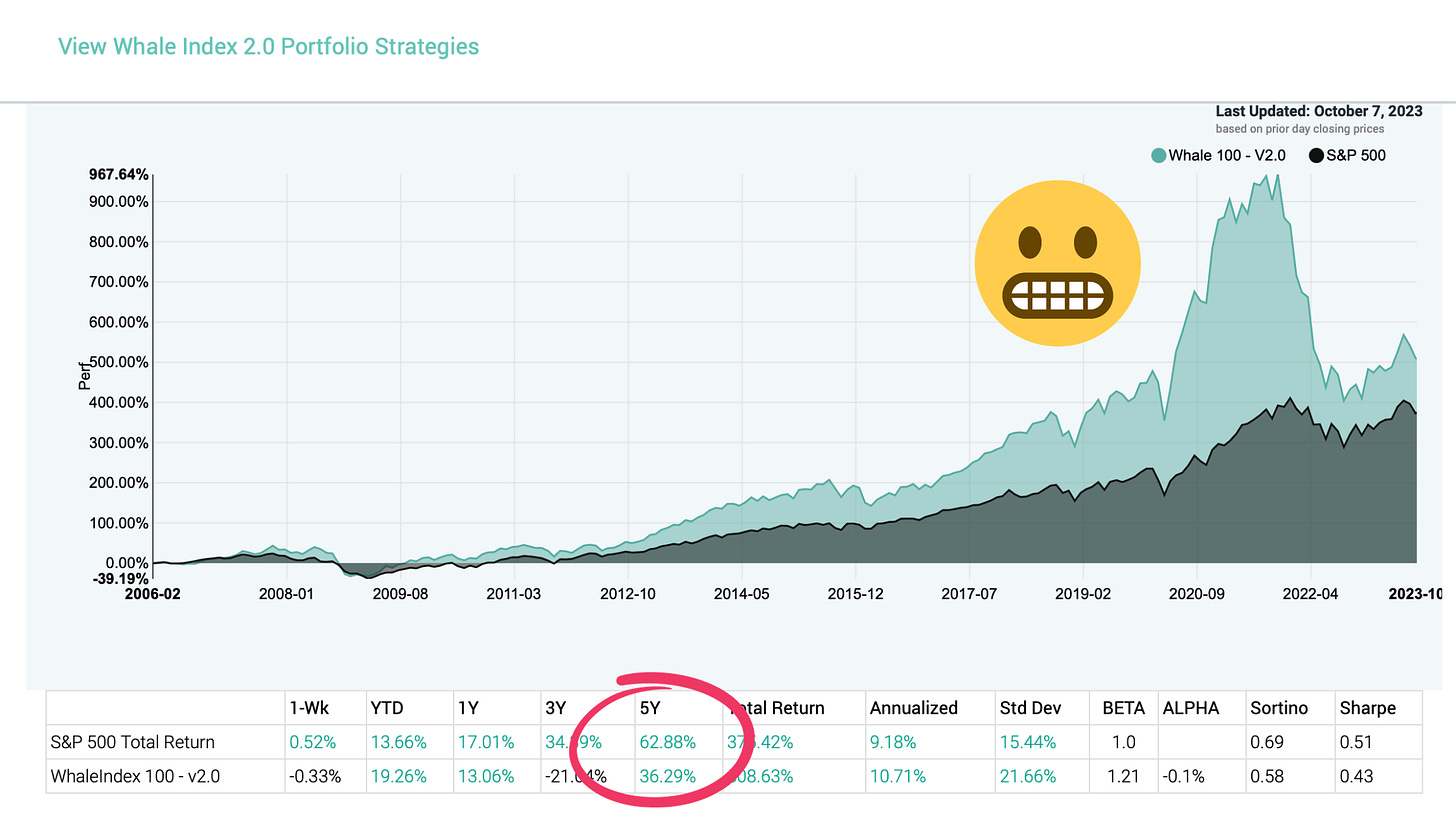

Another example: WhaleWisdom’s own Whale Index versus the S&P 500.

It did a bit better than the S&P 500 since 2006, sure, but at what cost? And not to mention that over the past 5 years… it only achieved half the performance!

Is that worth paying $360-600 per year, which is how much a WhaleWisdom subscription costs?

Not if you simply copy it.

So go out there and use these tools as a starting point – they really are useful. Find interesting ideas and do more research. Or invest and have fun telling your friends how you’re “co-investing” with Warren Buffett. But don’t just trust the data on these tools blindly.

“Immature poets imitate; mature poets steal” – T.S. Eliott.

I do seek opportunites just not this way. I'm not too much of a fan of these insider buying / copy services since they're dumping huge amounts of cash into short-term opportunities most of the time.

Most of the long-term investors will just tell you what they're bought into anyway.