Weight Watchers: can it pivot in the age of weight-loss drugs?

Or a case study in "what not to do when faced with technological disruption".

We’ve all witnessed the incredible rise of Ozempic, the new “miracle drug” for weight-loss. And one that actually works this time.

As the demand for weight-loss drugs like Ozempic surges, traditional weight management brands like WeightWatchers face a classic example of disruptive innovation. As a result, the stock trades at an all-time low.

The question is: can a company in this situation be a “value play” that can deliver returns through a turnaround process, or is it a “value trap” with no way of fighting the inevitable?

Why is Ozempic such a threat to WeightWatchers?

The "skinny" aesthetic of the 1990s is making a comeback. Just check the latest Victoria's Secret Fashion Show. This trend toward a slimmer physique has been driven in part by the rise of weight-loss drugs like Ozempic and Wegovy, initially intended for treating obesity and diabetes but now discreetly used by many celebrities.

These drugs have gained popularity as "miracle solutions" for those looking to lose weight without diet and exercise – a significant market.

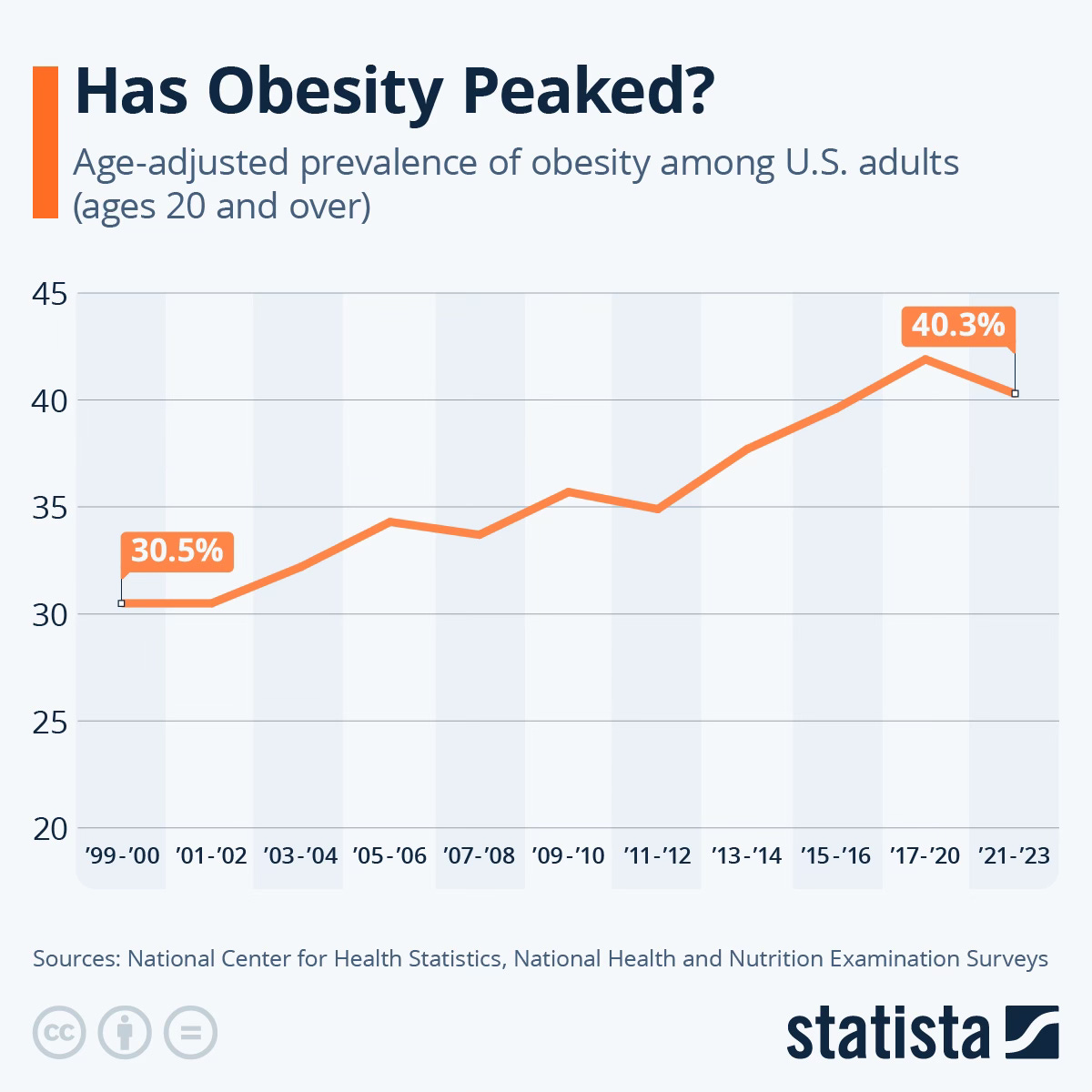

In the U.S., about 31.1% of people are overweight, and 42.5% of these are technically obese. On top of this, 80% to 90% of individuals with type 2 diabetes have excess weight, and obesity is also rising among those with type 1 diabetes, increasing sevenfold in the past 20 years.

Drugs like Ozempic and Wegovy offer a simple solution to this, which easily explains their popularity. Approximately 6% of U.S. adults—over 15 million people—are currently using a prescription for Ozempic, Wegovy, or similar drugs.

In fact, at some point, about 13% of U.S. adults have used a GLP-1 medication – prompting some researchers to think that perhaps obesity has peaked.

Their popularity is so high that we’ve also witnessed our first Ozempic shortage in early 2024, leaving those who genuinely need the medication unable to access it.

Buy the dip?

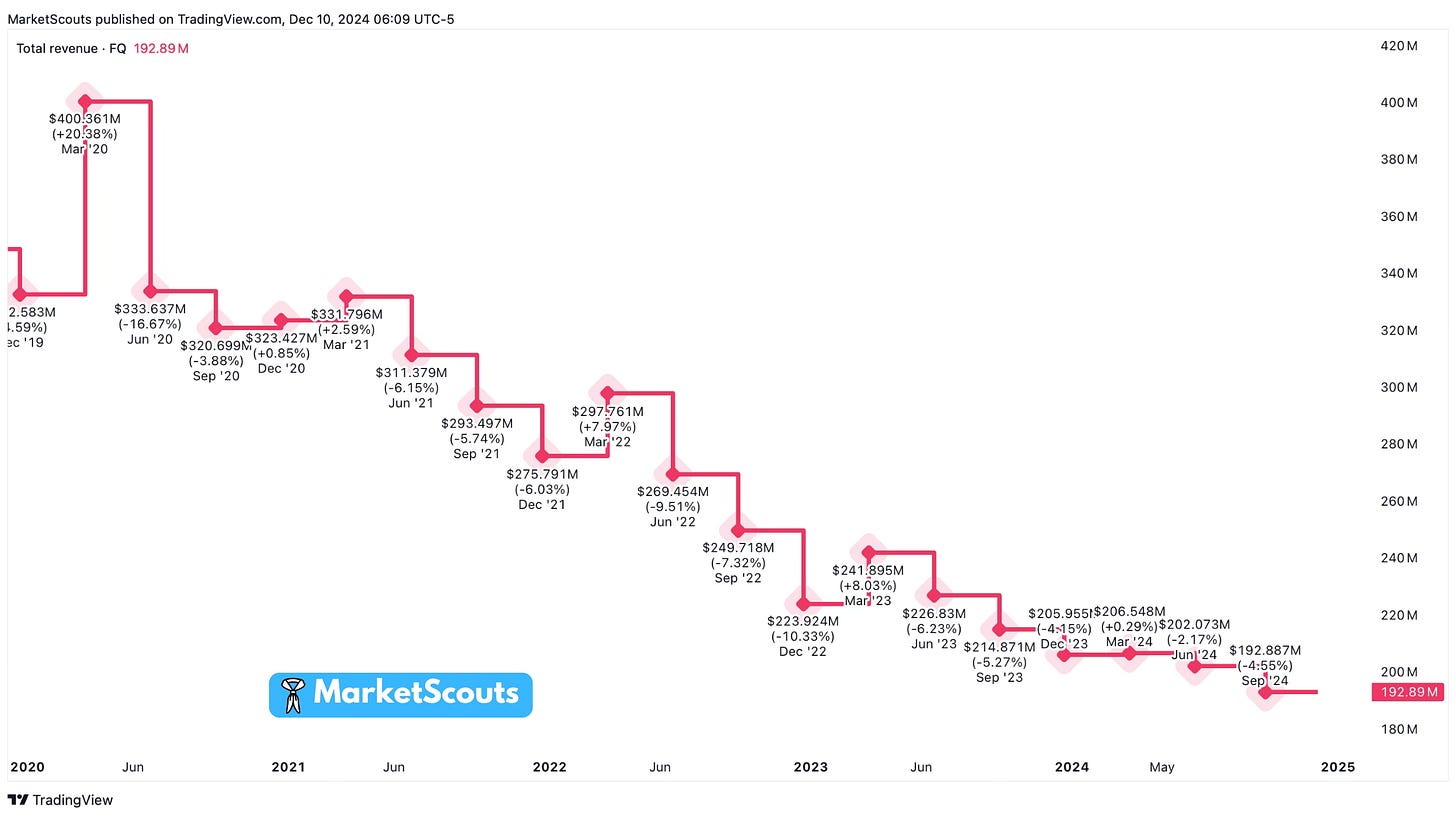

It should come as no surprise, then, that Weight Watchers (WW) has seen its stock price fall from above $100 in 2018 to below $1 by August 2024. In 2024 alone, it lost more than 85% of its value, and its market capitalization shrunk to just $62.58 million.

Despite what you may think by looking at its stock price, WeightWatchers hasn’t stood idly by.

In March 2023, WeightWatchers acquired Sequence, a telehealth company providing obesity drug prescriptions, and announced plans for a medication-based program. This means that Weight Watchers is now technically on the way of becoming a retailer for Ozempic, its own disruptor!

Partially this makes sense. For many, accessing Ozempic through Weight Watchers is more straightforward than going to a general doctor. Their doctors specialize in obesity medicine, offering a smoother, more comfortable experience and expertise in weight-loss medications. It also combines medication with dietary and lifestyle support. Having it all in one place (prescriptions, daily nutrition plans, insurance, doctor advice, and so on) does make combining WeightWatchers with Ozempic appealing. And many users do report success with this approach.

But is buying Weight Watchers a good investment opportunity now that they’ve taken this path? Let’s look at both sides of the argument.

Arguments against investing in WWI

In theory, shifting towards prescription-based weight loss seems like a promising opportunity for Weight Watchers. I even considered investing in their stock, expecting these new programs to boost revenue and stock price. However, despite this strategic decision, WeightWatchers has recently done quite poorly in the market.

Here are some of the main reasons why.

First, worsening balance sheet and financials. Last year, WW reported an annual loss of $112.26 million. The $106 million acquisition of Sequence in early 2023 didn’t help, and integrating new digital platforms and clinical services has added operational costs. This also means more debt in the short run, to fund this new investment.

Second, WW has had very poor brand management. Even before Ozempic came on stage, the focus in the industry shifted from weight loss to overall health and wellness. Jumping on this trend, WW rebranded itself as "WW" in 2018, with the slogan "Wellness That Works".

Its loyal customers didn’t like this and WW lost some appeal among those seeking dedicated weight-loss solutions. And while (to its credit) Weight Watchers recognized this mistake, its recent efforts to reposition the brand as a GLP-1 drug retailer has also been met with mixed responses, further eroding brand value.

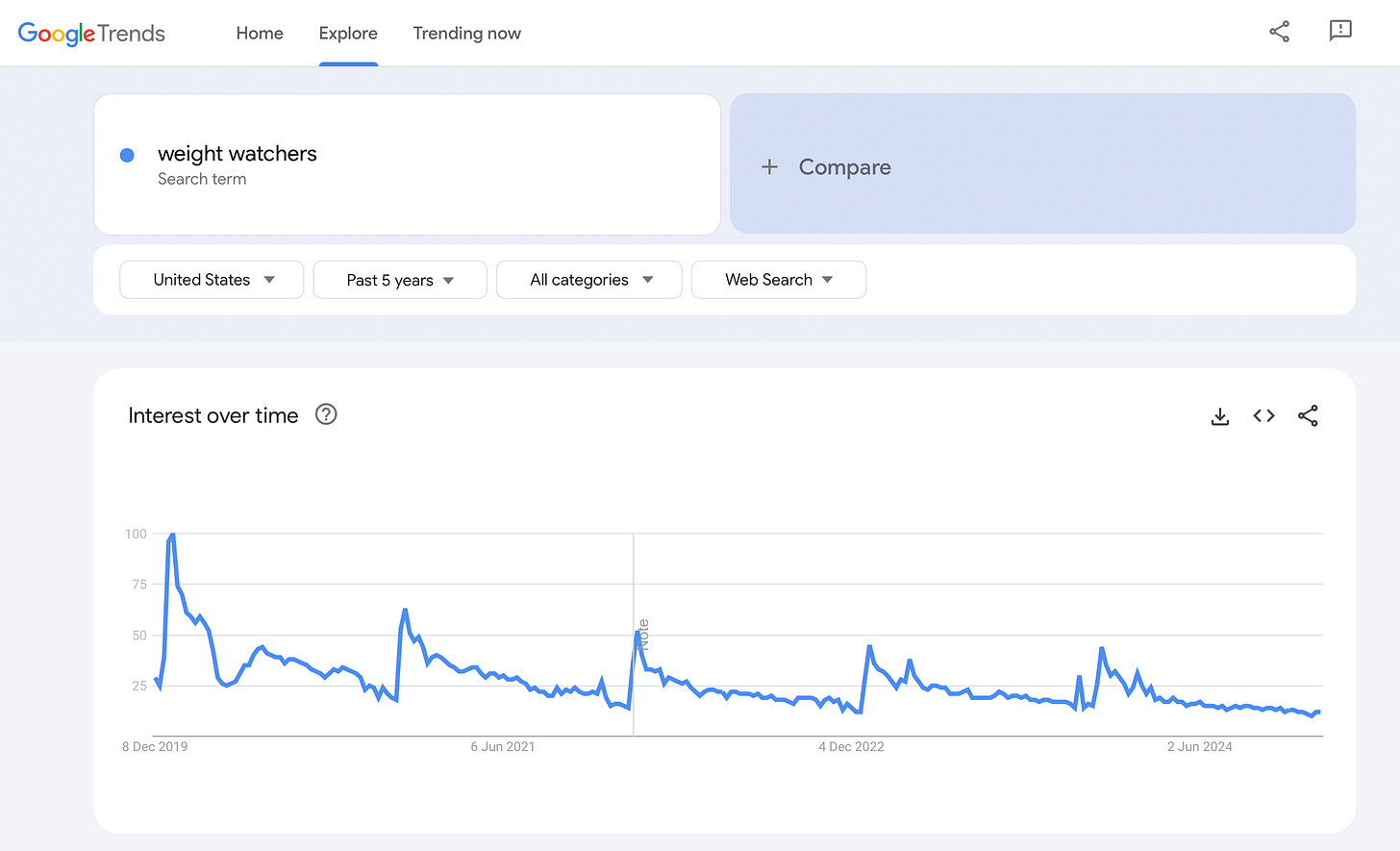

Fewer and fewer people are searching for Weight Watchers on Google, too:

Third, technical challenges. WW is not a tech company. Despite trying to become “digital first”, WW has had serious challenges in its digital transformation. The initial rollout of its new program app faced issues, with users reporting problems like the app not opening or syncing with Apple Health or other apps. I’ve seen plenty of troubleshooting guides and community discussions about technical issues with WW's apps.

The cons don’t stop here, though.

For starters, the price for GLP-1 drugs like Ozempic depends on individual insurance. There isn’t any competitive edge for WW as a retailer. In fact, there is plenty of competition from other GLP-1 retailers.

Reviews are also not great. As of November 20, 2024, WeightWatchers has a 2.1 out of 5-star rating on Trustpilot, based on approximately 1,200 reviews. Common complaints include trouble canceling subscriptions, getting refunds, and overall unhappiness with recent program changes.

Staying on the topic of brand, there haven’t been any significant memes or viral content associated with WW lately. Influencers just don’t care—or are not being incentivised to talk about it. WW’s marketing team seems all over the place.

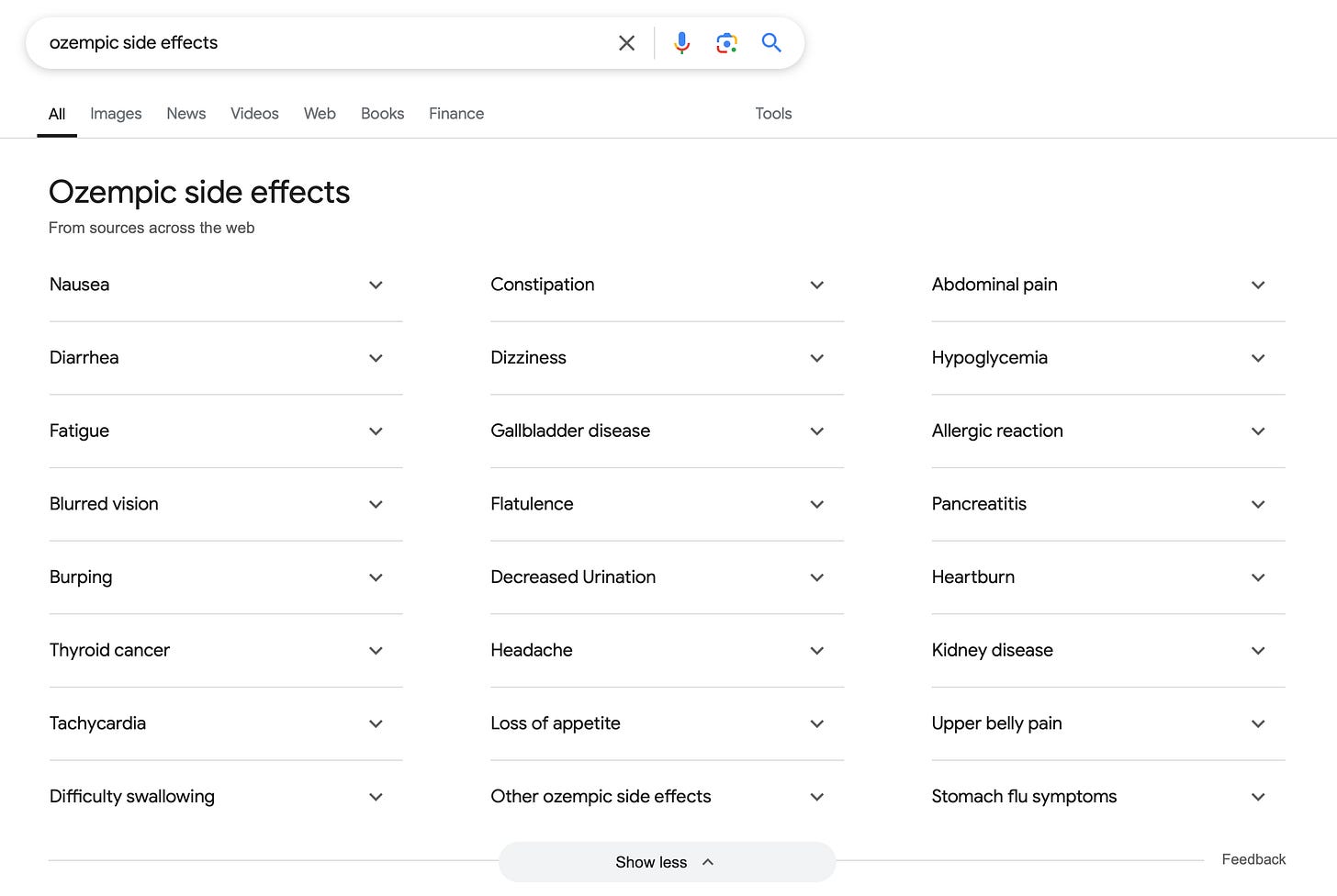

Finally, no drug is free of side effects – as many Ozempic users are now starting to realize. Concerns about the long-term safety of medications like Ozempic could also harm WW's reputation, potentially discouraging members from using its weight-loss plans.

Arguments for investing in WW

The cons we looked at just now are pretty serious. But that’s the beauty of investing: risks can often be overly priced in. Studies actually show that most investors in fact stay away from some of the best deals in the market.

Here are some good reasons why WW could turn out to be a good investment.

First, the new turnaround seems to have some legs. Previous CEO Sima Sistani has been open about the company’s past mistakes and took steps to fix things. Now we’re seeing progress, slowly but surely. The company returned to year-end subscriber growth in 2023, up 7% year-over-year, and WW is projecting subscriber growth for 2024, expecting to end the year with 3.8 to 4.0 million subscribers.

Second, there is plenty of international opportunity. Obesity isn’t just a US issue. WW has the potential to expand internationally, especially in markets where medications like Ozempic are not yet prevalent or regulated. One such market could be in the Oceania or the Carribean, where many areas have over or close to 50% obesity rate.

Third, WW still has decent brand value. Despite all the missteps, WW’s established brand and customer base still offer some credibility in a new market. WW is positioning itself as a comprehensive weight management solution, integrating traditional programs with access to weight-loss medications. This strategy can potentially enable WW to compete in a rapidly evolving market where drugs like Ozempic are gaining popularity.

Finally, the miracle obesity cure hype might be overblown. The Ozempic trend has led to a resurgence of the "skinny aesthetic," prompting concerns about societal pressures to achieve extreme thinness and the potential health risks associated with such practices. More importantly, there are real health risks linked to the misuse of Ozempic, including side effects like nausea, vomiting, and more severe complications when used without proper medical supervision – and these risks are just now starting to be seen.

In fact, a nurse in the UK actually passed away very recently as a result of using a weigh-loss drug:

This won’t be the first time when a “miracle drug” comes with serious side effects. Just look at finasteride. Finasteride is prescribed for hair loss, but has recently been linked to severe health issues. This so-called Post-Finasteride Syndrome (PFS) includes symptoms like genital shrinkage (yikes!), numbness, severe fatigue, joint and muscle pain, panic attacks, cognitive impairment, and depression. Some people have even taken their own life as a result of using finasteride.

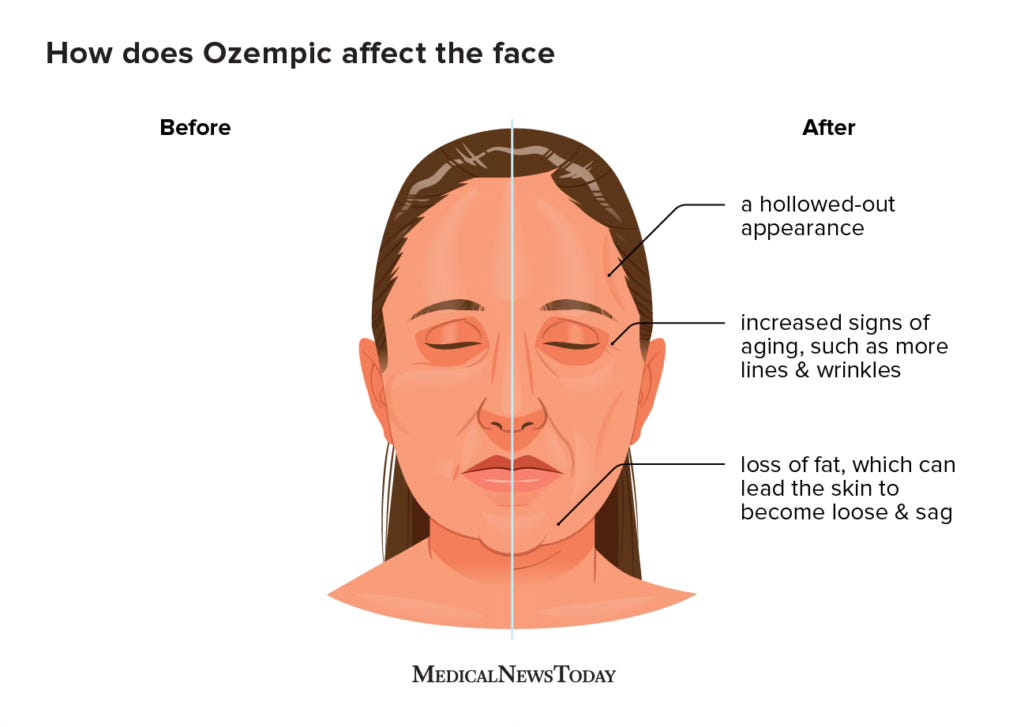

This is a real opportunity for Weight Watcher to position themselves as the “natural” weight-loss alternative. Unfortunately, their latest annual report talks positively about GLP-1 and nothing about health risks or side effects. But the opportunity is there. Just look up “Ozempic face”:

What’s the conclusion?

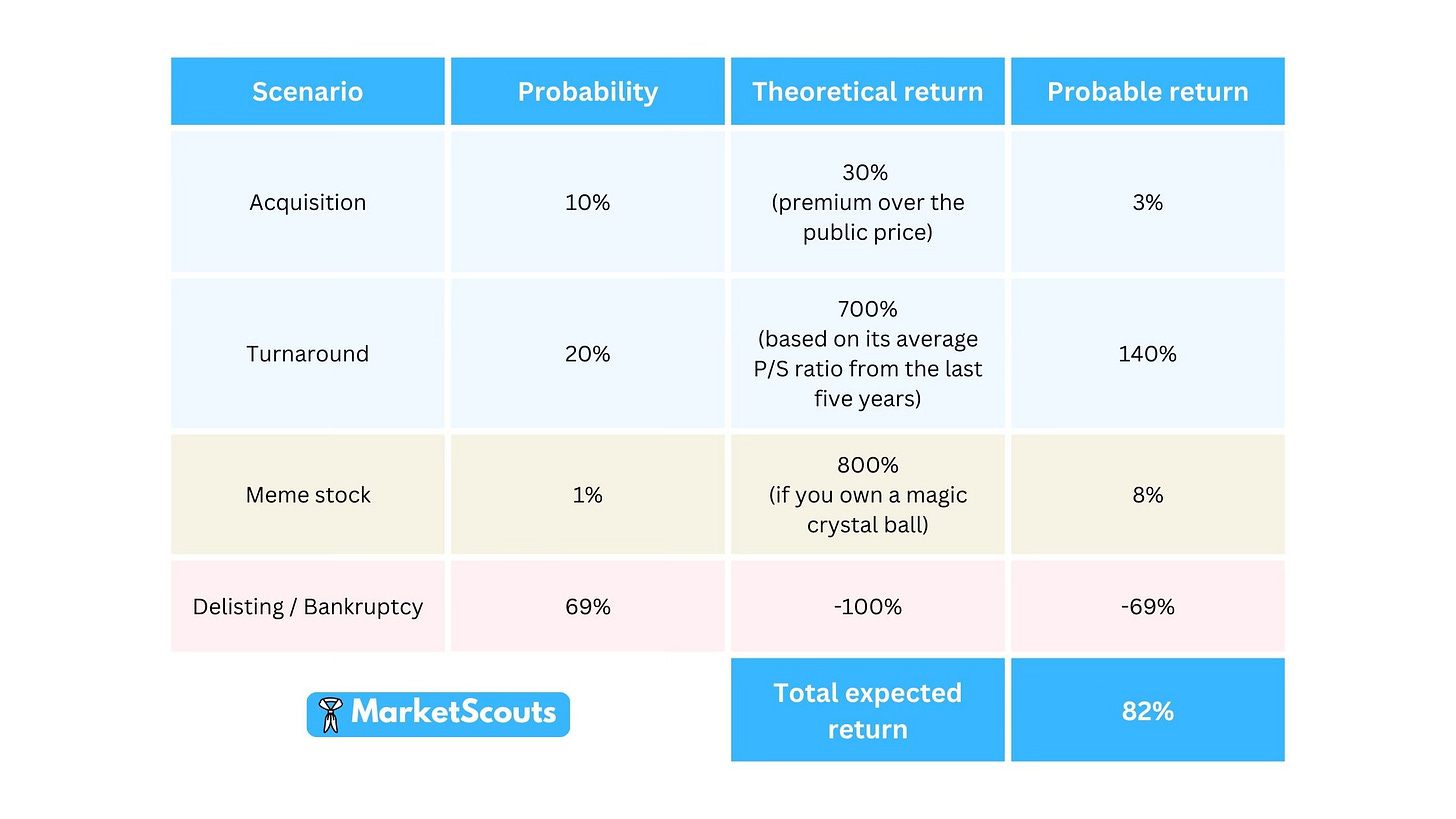

This is a high-risk, potentially high-reward situation. There is no crystal ball here. However, we can figure out what can happen and the probability for each scenario.

Scenario 1. M&A (Novo Nordisk buys WW): 10% chance

Take Rolex and Watches of Switzerland as an example. Speculation suggests Rolex may acquire Watches of Switzerland due to their quasi-exclusive deal with Rolex. Similarly, if WeightWatchers becomes a primary Ozempic distributor, it could follow a comparable path. In that case, one might wonder if Novo Nordisk could consider acquiring WeightWatchers or if private equity firms might show interest. However, WeightWatchers’ substantial debt load likely deters such buyout scenarios; acquisition prospects would likely be higher without this financial burden.

Scenario 2. Turnaround: 20% chance

Instead of waiting for an acquisition, WeightWatchers is restructuring itself through cost-cutting initiatives and leadership changes. The company has announced layoffs and plans to cut costs by $100 million annually. Analysts anticipate annual earnings growth of 112.4%, indicating that these restructuring efforts could boost profitability, even in a challenging revenue environment.

There is an obvious sign that this is the path the company wants to take: a new CEO. WeightWatchers appointed Tara Comonte as interim CEO, effective September 27, 2024. Comonte, known for her strategic marketing expertise, has previously held CEO roles at TMRW Life Sciences, president and CFO at Shake Shack, and executive roles at Getty Images. It’s clear that WeightWatchers isn’t giving up; it’s betting on a strategic transformation to turn things around.

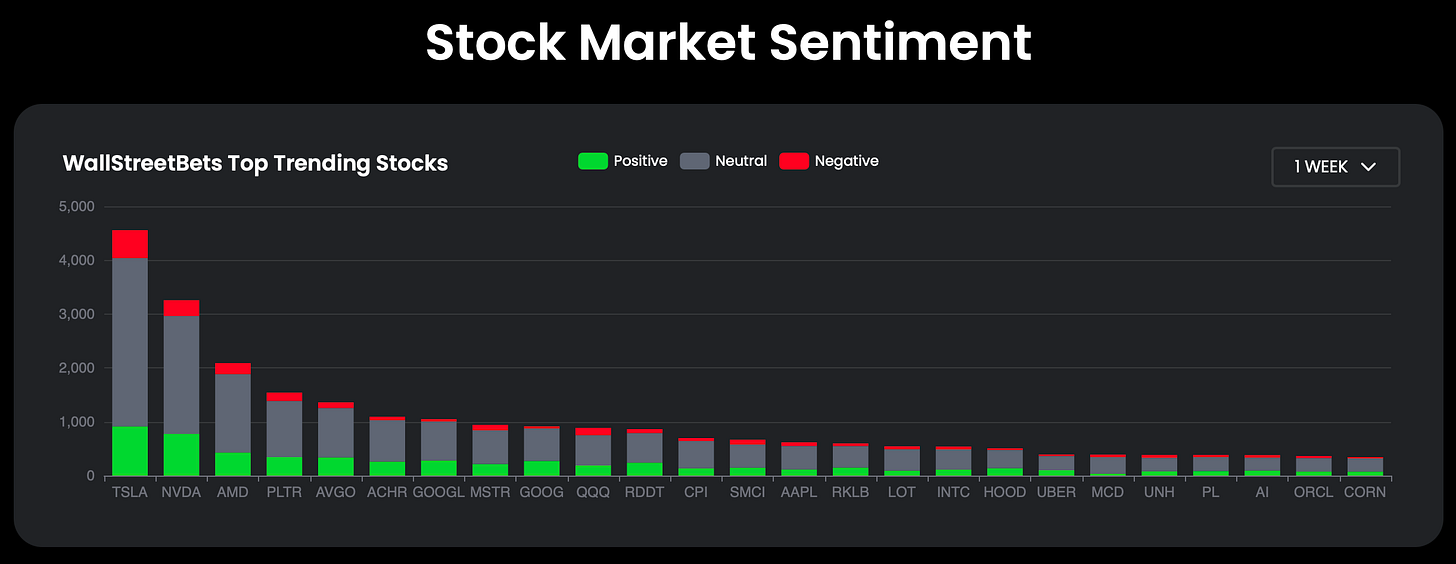

Scenario 3. Meme stock: 1% chance

As with any company in a tight spot these days, the potential of becoming a meme stock and seeing the share price climb purely as a “degenerate bet” is there. However, there's no direct indication of WW being targeted as a meme stock. WallStreetBets and the rest of Reddit is quiet.

You can easily check this using a tool like Swaggystocks. As you can see, WW is not a topic of interest for the “ape army” yet.

Also, even if WWI does become a meme stock, expect a ton of volatility. You’ll need to time your buying and selling ideally to make even a tiny profit.

For an example, look at Hertz. In 2020, Hertz's stock surged 800% after filing for bankruptcy due to memes circulating on Reddit about the stock, peaking at $5.53 before collapsing. Despite Hertz’s efforts to capitalize on the frenzy, the stock became worthless for many retail investors by early 2021.

Scenario 4. Delisting or bankruptcy: 69%

Unfortunately for WeightWatchers, the risk of delisting from the market currently appears higher than that of a buyout and a turnaround. The company’s stock has plummeted by over 88% since the start of 2023, and its heavy debt burden has raised alarm among investors and analysts. On March 11, 2024, S&P downgraded WW’s debt rating from B- to CCC+ with a negative outlook. Things are not looking good.

Drawing the line

All these scenarios point in very different directions. What’s the expected medium-term return, then?

A simple framework would be simply list out these scenarios with their probability, multiply that by the potential return, and get the total “expected return” – the sum of all the bets.

82%. Not bad, but not great either, considering the over 50% risk that the investment goes to $0 or close to it. This is not a bet that we could easily recommend.

WeightWatchers is at a critical juncture. Its pivot towards integrating Ozempic into its offerings is a necessary response to a shifting market, but it faces significant challenges, from regulatory hurdles to a potentially alienated customer base. For investors, the decision hinges on whether they believe WW can successfully navigate this transition and adapt to the growing demand for pharmaceutical weight loss solutions while retaining its core brand identity. Given the stakes, those with a high-risk tolerance may see an opportunity, but more conservative investors might want to wait for clearer signs of long-term success.

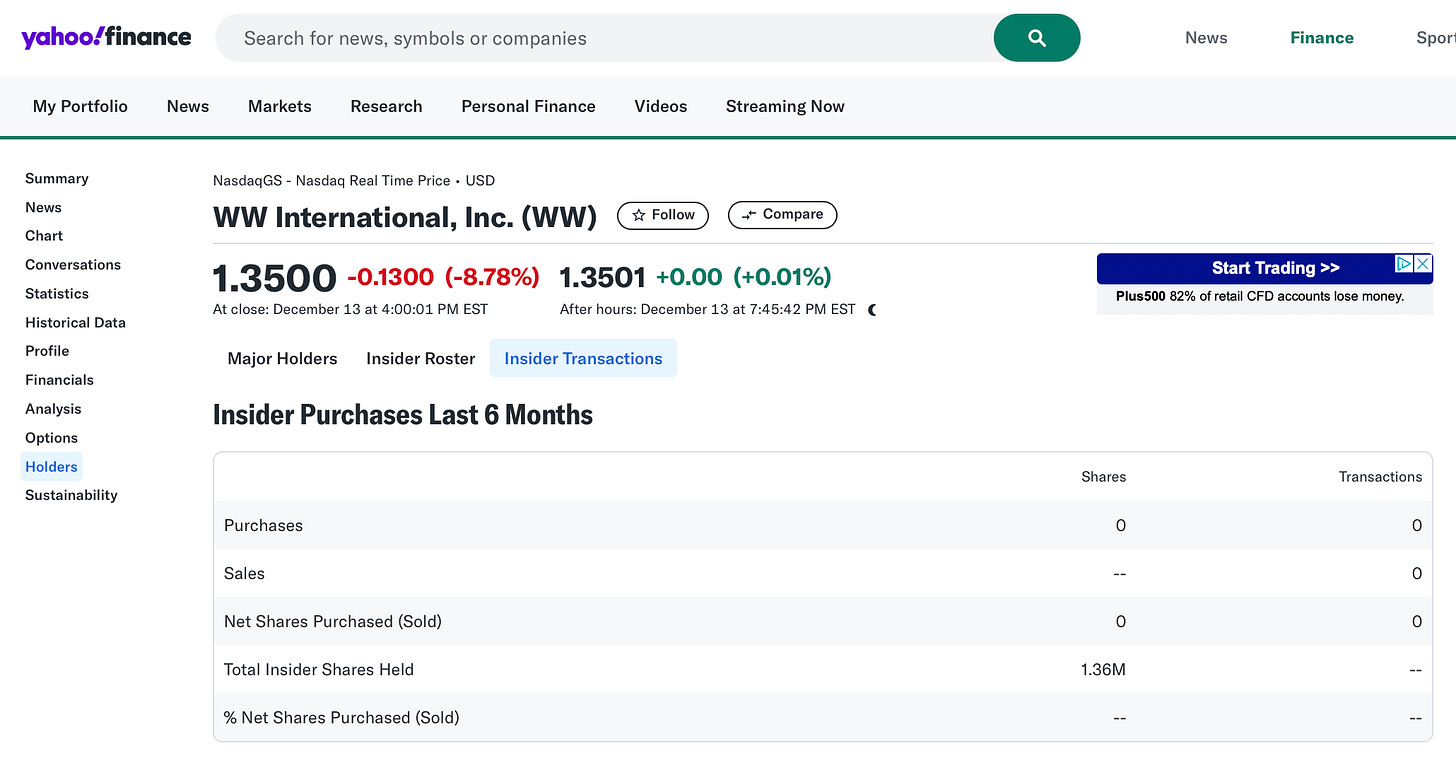

What do insiders seem to believe?

Over the past 24 months, insiders have purchased shares worth little over half a million dollars. However, there has also been notable insider selling. Over the past two years, insiders have sold shares worth more than 100 million dollars.

Normally, this would of course be a huge red flag. However, over the past six months there have been no new reported insider selling or buying. Either they are as undecided as we are or there is reason to hope.

What’s the lesson here?

Weight Watchers seems to be a classic example of how technological disruption can completely catch a “traditional” incumbent off guard. As AI accelerates and brings innovation in many fields, we’re bound to see many more companies in this situation.

It might seems like the answer is a foregone conclusion, that the incumbent falls while the disruptor wins. But this is not entirely true. The incumbent has still a few cards up its sleeve, from a trusted brand to the risks posed by the new technology.

Ultimately, though, what really makes a different is leadership. At Weight Watchers we don’t see the decisive leadership needed to pull off a real turnaround.

Other soon-to-be incumbents should take note.

Before buying the dip on WW, please bear this in mind: we talk about various stocks, funds, and securities because they’re interesting or can be used to teach a lesson about investing. None of the posts we publish are intended to be taken as individual investment advice or a recommendation to buy or sell any specific stock or other security. We can’t even guarantee that our information sources are 100% accurate. The only purpose of these posts is to teach you how to do research and figure this stuff out for yourself.

Have you seen other companies in this situation? Are they doing any better?