The "Zyndemic": risk or opportunity?

Does Zyn's rise mean PMI is now a buy, or is this the next Juul?

We’ve all heard or seen the rise in the use of stimulants for work amongst the “corporate degens”.

From finance professionals in the ’90s taking coke bumps to stay sharp while analyzing spreadsheets all day, to the early 2020s, when the trend of using nootropics emerged among the health-conscious Silicon Valley crowd.

This group likes to engage in “biohacking” rituals. Biohackers are drawn to nootropics— substances that enhance mental stimulation and cognitive function. This perhaps explains why they're so popular among finance professionals.

But what is a nootropic?

Basically any substance that claims to improve cognitive performance can be classified as a nootropic – from exotics like ashwagandha to minerals like magnesium to everyday items like coffee or cigarettes.

However, consuming nicotine is now taboo– unless it’s for your brain health. A new “nicotine as a nootropic” trend has emerged in the market.

“Popping a Zyn” has become the latest ritual for many finance professionals. The pouches are placed between the gum and upper lip to allow nicotine absorption through the bloodstream, and provide the mental stimulation needed to power through 80-hour workweeks.

And it’s not just finance professionals. Everyone is now into Zyns.

What is Zyn?

If you’re not in the US, you might be confused by this trend.

Zyn is a nicotine pouch brand created by Swedish Match, which was acquired by Philip Morris in 2022. Known for its well-established Marlboro and Newport brands, PMI saw the acquisition of Swedish Match as a game-changer. This move allowed PMI to diversify its product portfolio beyond traditional cigarettes, a strategy that has been well-received by investors. The acquisition aligns with PMI's commitment to a "smoke-free future," positioning the company for potentially more substantial long-term growth.

From an investment standpoint, given Zyn’s current popularity, one might wonder what the future holds for a product subject to such stringent regulations. Will there be a shift in how we view nicotine, or will it continue to be strictly controlled?

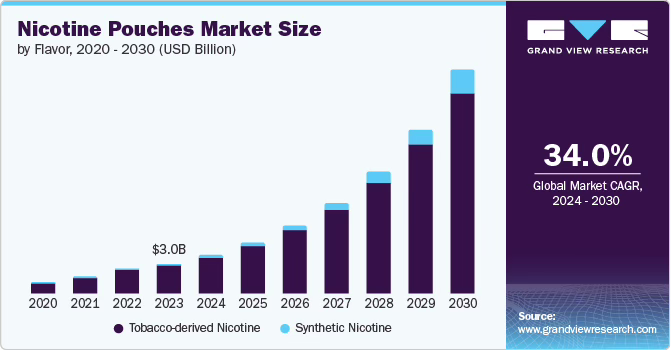

For now, though, nicotine pouches are fast gaining mainstream acceptance. Just look at this chart:

They have fewer regulatory hurdles than cigarettes and are perceived as less harmful since they’re not being burned.

However, like all nicotine products, Zyns are not immune to regulatory scrutiny and the potential long-term health risks associated with nicotine use.

To understand the impact of what could happen, let’s look at Juul. Now owned by Altria, it initially gained massive popularity– especially among kids. One interesting note here: Altria is a spun-off American counterpart of PMI. Altria bought Juul, now PMI bought Zyn.

After reports of severe health issues like "popcorn lung" from long-term vaping emerged, coupled with increasing hospitalizations, Congress responded by banning flavored pods. This of course was a bit hit to Juul– but while Juul's popularity has waned, the vaping market continues to thrive.

The same scenario could unfold for Zyns. The only question is: will face the same challenges or will PMI be able to carve out a more enduring market presence?

We’re actually starting to see the same pattern with Zyns– there are already growing concerns about kids using them.

While the company claims to age-gate its digital channels to 21+ and not use social media influencers in the US, unfortunately for PMI, Zyn pouches have gained immense popularity with teens. You can even find TikTok “zynfluencers”.

Plus, Zyns are much harder to police. They’re a very discreet way to consume nicotine: you just place them between your gum and upper lip. This makes them easy to conceal from their parents and high school teachers.

In fact, the overwhelming demand for Zyn has led to a so-called “Zynpocalypse” – a shortage of Zyns. PMI's existing factory in Kentucky simply cannot keep pace. To meet the surging demand, PMI is investing $600 million in a new manufacturing facility in Aurora, Colorado, slated to begin operations by late 2025 and reach total production capacity by 2026.

The shortage is expected to persist until the end of this year.

Now, the surge in Zyn's popularity has had negative consequences and caught the attention of regulators.

On April 4, 2024, the FDA issued 119 warning letters and filed 41 civil money penalty complaints against retailers for selling Zyn nicotine pouches to underage buyers. On top of this, three online retailers were warned for selling unauthorized flavored Zyn products. The FDA has emphasized the illegality of selling tobacco products to anyone under 21 and warned of stricter enforcement if violations continue.

And the noose is tightening: Senate Majority Leader Chuck Schumer has called on the Federal Trade Commission and FDA to investigate Zyn's marketing practices, particularly its potential targeting of young people. Plus, the FDA and health experts are already concerned about the lack of long-term studies on the health effects of nicotine pouches like Zyn, especially given their addiction potential for younger users with developing brains.

In short, although Zyn hasn't yet faced the same scrutiny as vapes or electronic cigarettes, this is changing as Zyn's popularity has increased.

Again, we’ve seen this story play out before, with Altria and Juul.

Juul was under scrutiny too. What happened then?

After the Juul scandal… nothing much happened. Altria had barely taken a financial hit– despite all the regulatory scrutiny, lawsuits, and litigation charges.

This came down to two factors.

First, Juul's impact on Altria's stock was never expected to be significant. The upside was never priced in.

After Altria's $12.8 billion purchase of a Juul stake in December 2018, its stock dropped sharply. By July 2022, Altria had written down the value of its stake to $450 million, less than 5% of the original investment. This contributed to a nearly 60% drop in Altria's quarterly earnings that year, exacerbated by the FDA's 2022 ban on Juul products.

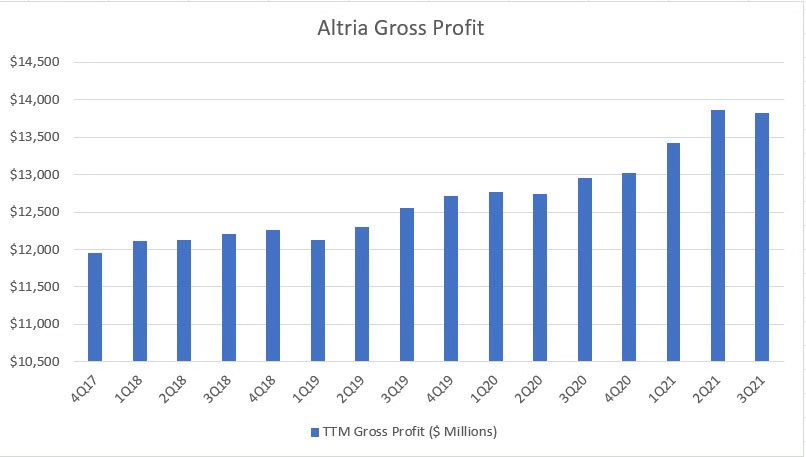

Second, analysts believed that the durable cash flow from Altria’s cigarette business was more valuable than Juul's growth potential. The company generates substantial cash flows from its core cigarette business– which has high margins and a very loyal customer base. Even as regulatory pressures mounted on vaping products, the demand for traditional tobacco products remained stable.

Also, Altria's strong pricing power has allowed it to raise cigarette prices without reducing demand, offsetting litigation and regulatory costs. Despite long-term decline, its tobacco business remains a near- to medium-term cash cow.

This means that while Altria's investment in Juul has not generated the anticipated cash flows due to regulatory challenges and declining sales, they’re still doing ok.

Is Zyn priced in?

As of now, we don’t know. But here are a few indicators that Zyn’s impact on PMI’s stock aren't really priced in either- but with much more upside potential than what happened with Altria.

In fact, there’s a clear disconnect between Zyn’s success and PMI’s valuation. Despite Zyn's impressive growth, particularly with an 80% surge in US volumes in Q1 2024, PMI's stock has underperformed the market.

But the upside potential is significant.

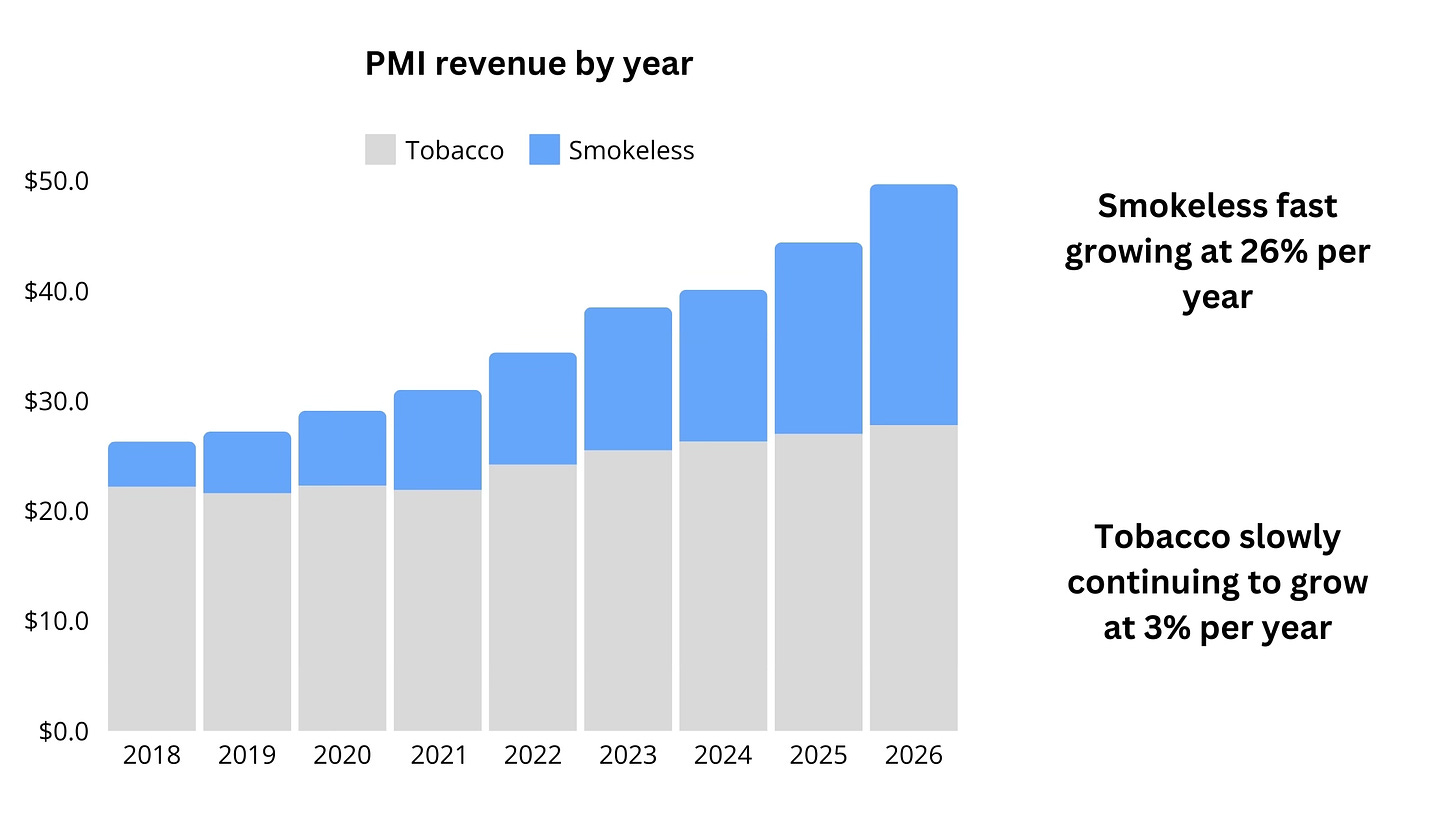

Zyn has been a key driver of PMI's growth, with smoke-free products like Zyn contributing to double-digit increases in net revenue and operating income. Smoke-free net revenues grew by 25%, and gross profit from these products rose by 38%. Analysts expect Zyn sales to accelerate under PMI, supported by improved distribution, marketing, and potential gains in shelf space.

And this doesn’t even account for the international expansion potential.

What does the opportunity look like?

While we can’t predict the future, we can think of what the best and worst case scenarios for PMI could look like.

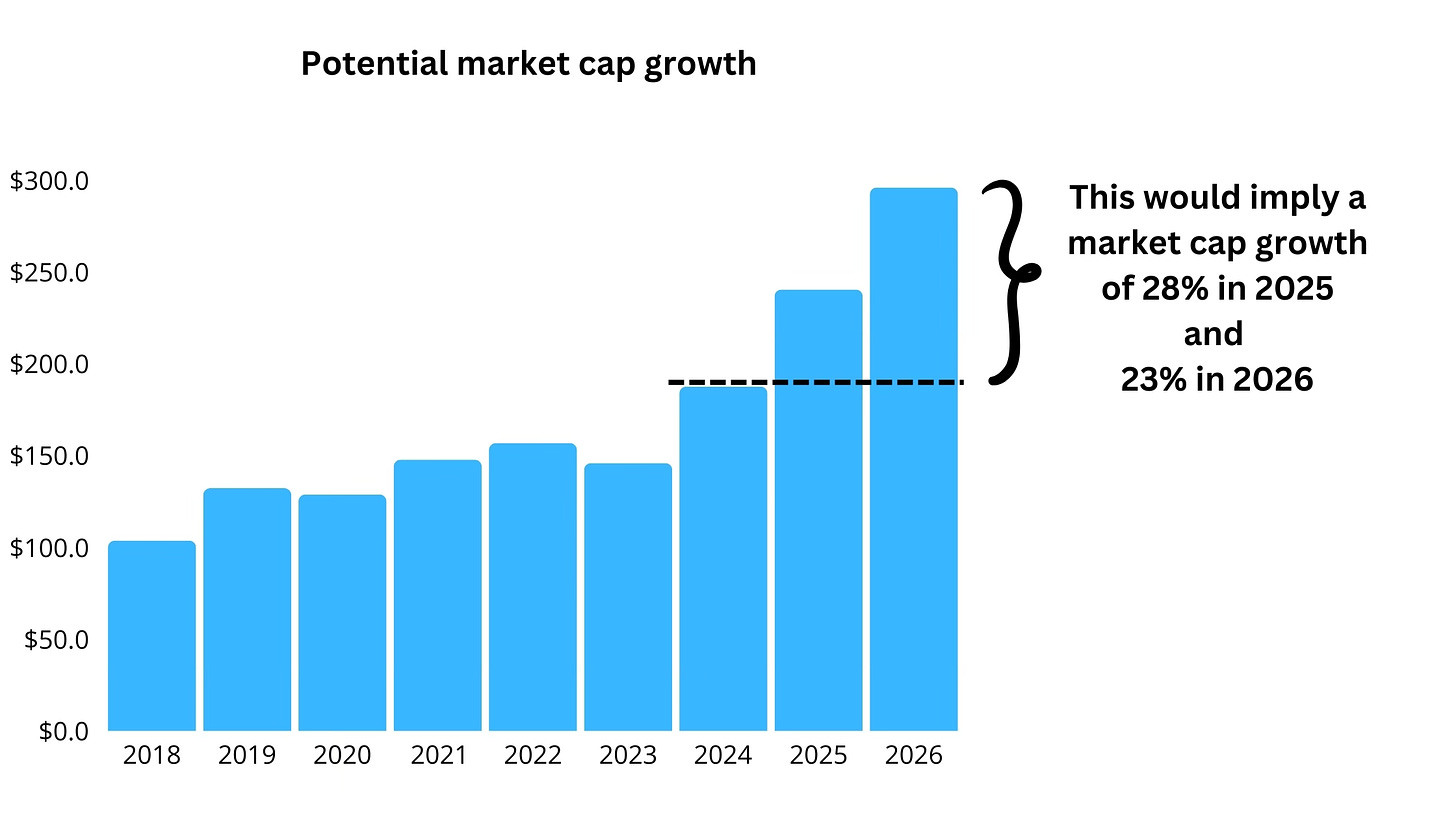

Best case scenario for investors: PMI fully integrates Swedish Match, inventory for Zyns will be stablized, and Zyns go global. None of this is truly priced in now, either.

Here is how it could look.

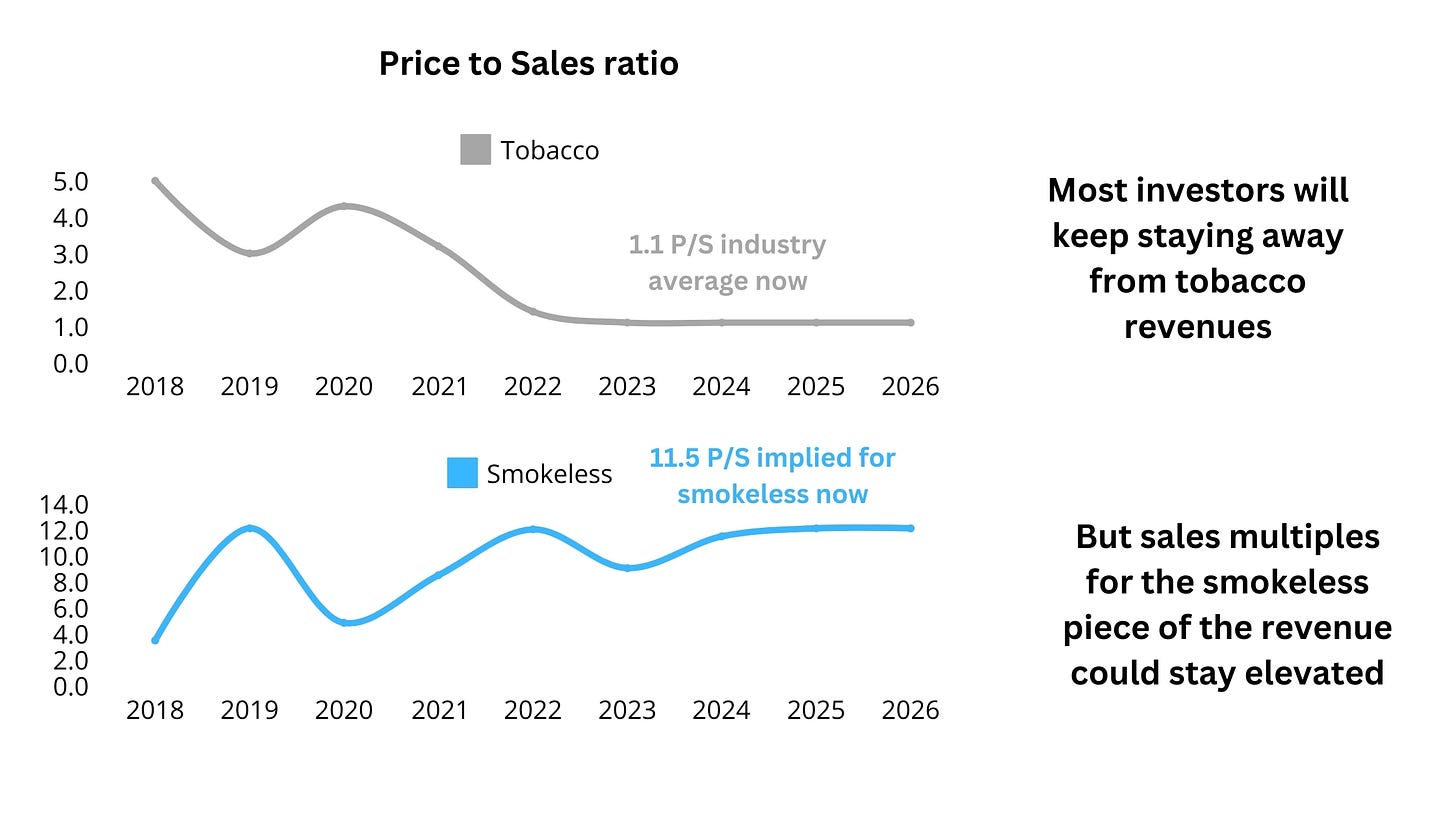

First, let’s try to figure out what price the market is putting on Zyns. An easy way to do this is by comparing PMI’s valuation multiples (say, its price to sales ratio) with that of its industry. Any premium should really come from Zyns– its hot new revenue stream.

Then, let’s presume FDA doesn’t crack down too much on Zyns, and the party continues. We can get these numbers straight from PMI’s annual reports.

But how much is this worth?

Well, if we work backwards from the actual market cap, it’s a simple formula: the “extra” market cap beyond what’s implied by multiplying tobacco revenues with the industry tobacco average P/S ratio should come from smokeless.

This could translate to a potential return of 58% over the next two years. And this is before even considering PMI’s dividend yield of almost 4.5%.

Worst case scenario: FDA regulates, class-action lawsuits drag down earnings, and Zyn inventory mismatch create chaos. But at least tobacco revenues keep PMI stable. This is pretty much what the market seems to price in right now.

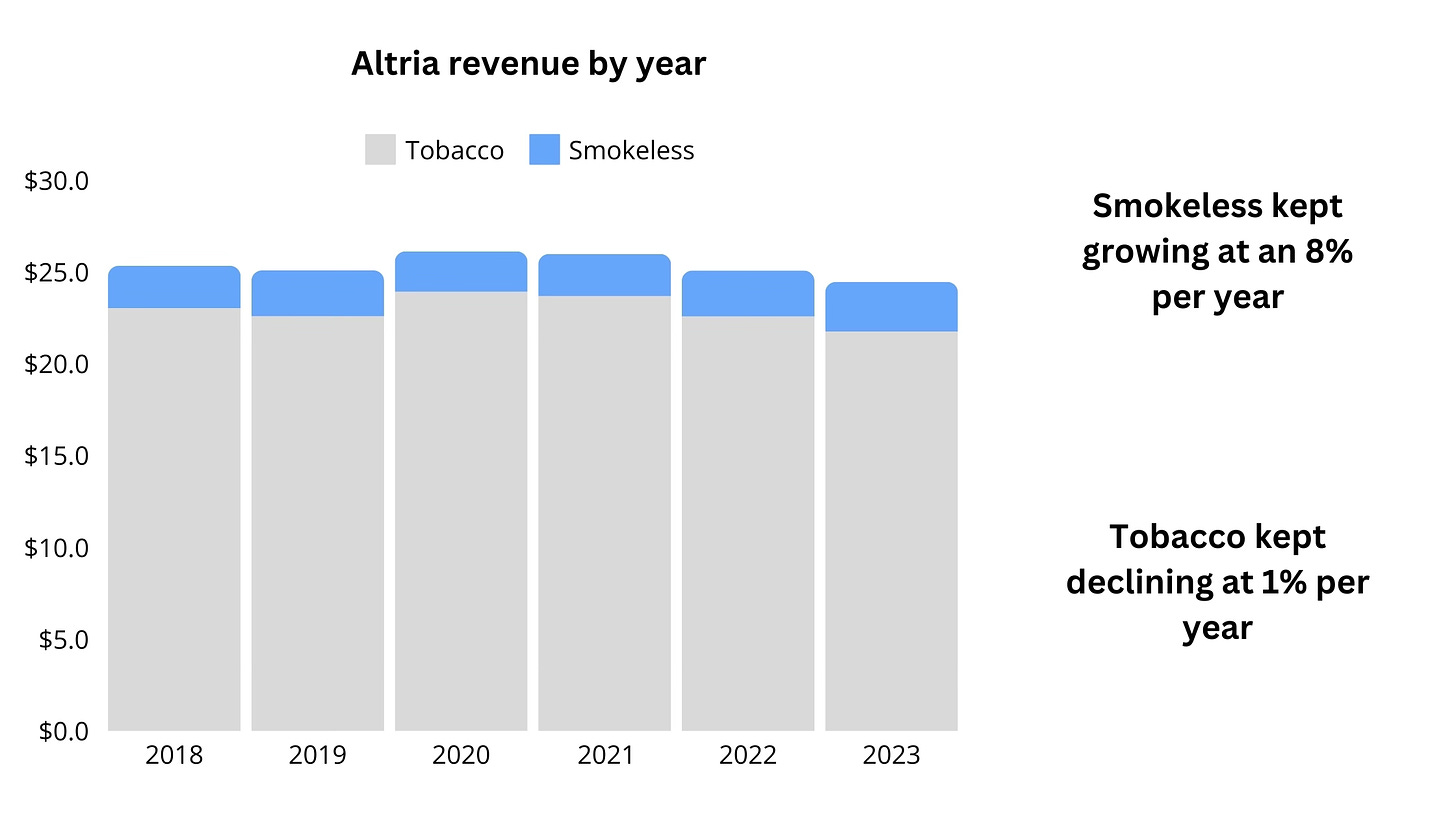

The easiest way to figure out how this scenario would look like is to use the Altria analogy again.

Despite all the regulatory action, the rise in competition, and the decline in demand for Juuls, Altria’s smokeless revenue didn’t crater. In fact, it was its tobacco revenue that kept declining– something that shouldn’t affect PMI as much, since they sell tobacco outside the US.

So for a worst-case scenario for PMI, let’s assume that the market gets scared by potential FDA rulings (P/S of, say, 7 next year for the smokeless piece) and also that revenue growth stalls at a 8%, similar to what Altria saw.

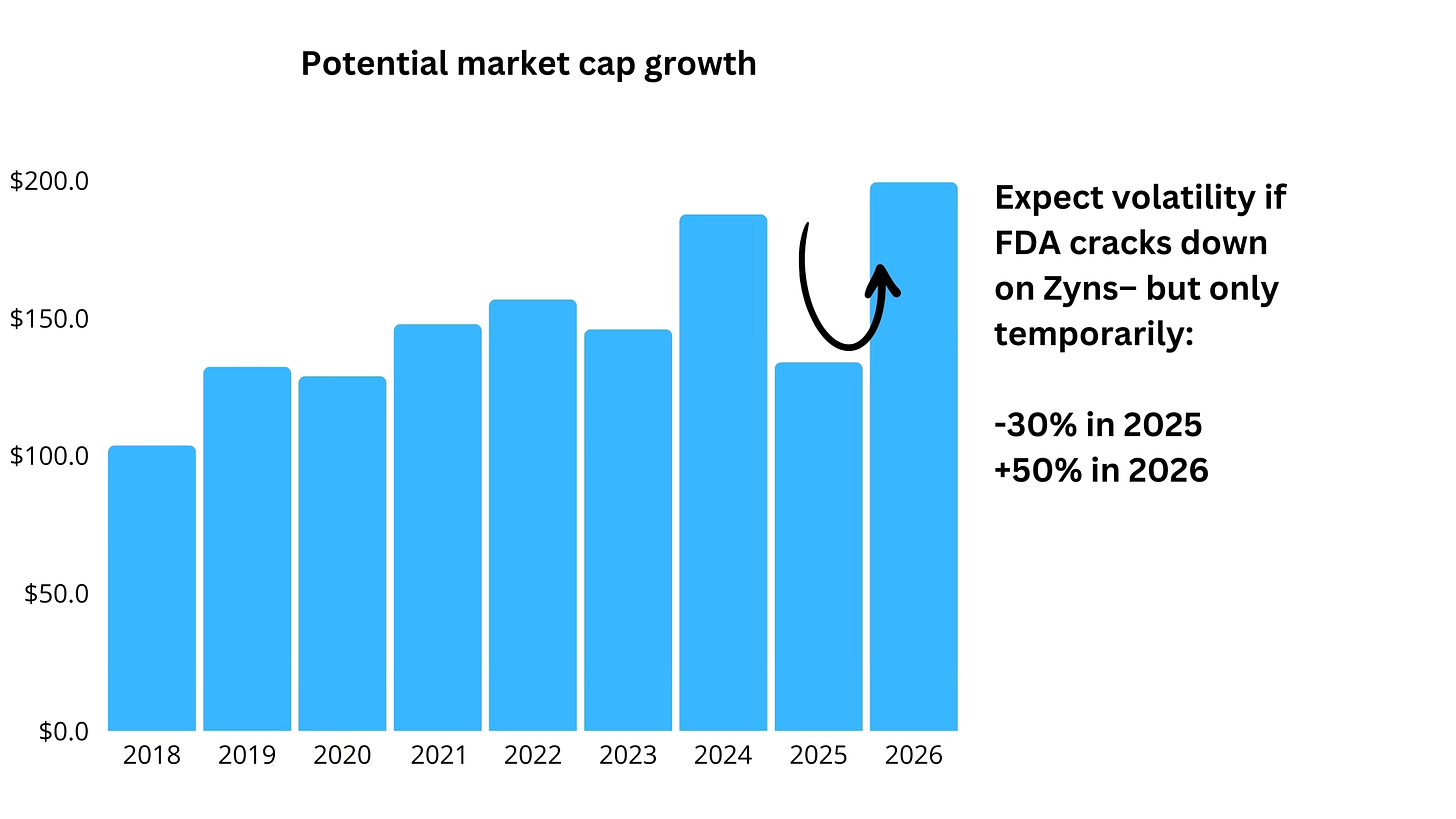

But this isn’t where the story would end.

Zyns are at the beginning of the journey– and let’s not forget, PMI has a massive international distribution network for its tobacco business. It’s only a matter of time until the leverage that for Zyns. Expecting investors to acknowledge this, even if international revenue growth takes time, is pretty reasonable.

Here is what this scenario would look like:

My bet?

Zyn’s potential downfall will not have that much effect on PMI’s stock– the worst being a financial slap on the wrist. Here are a few reasons why:

Zyns are proven to be less harmful than Juuls. There have not yet been any long-term studies on the adverse effects of Zyns (disregarding the addictive element of nicotine), including any dental harm to gums caused by placing the pouch in one spot over a long time.

Zyns aren’t truly priced into PMI’s stock. Given the current economic/political climate, my gut feeling is that investors simply choose to ignore the value of investing in nicotine.

Also, PMI is now focused on expanding in North America before ever expanding to other countries. Zyns still has a long road to travel before it develops its presence and fixes its inventory– but there is no reason why PMI will stop to the US.

As for whether this is an ethical investment, probably not– but I’m not here to judge. But if investing in tobacco companies isn’t your thing, don’t worry– there are other options.

The “ethical” way to invest in Zyns?

Unknown to the finance crowd hooked on Zyn, regular use of these pouches in the same spot apparently may lead to severe gum and bone loss.

If Zyns go truly global, can only mean one thing– higher demand for dental treatments. The use of Zyn can cause localized gum recession, leading to more patients requiring procedures like gum grafts. Additionally, young users may face long-term oral health problems, such as sensitivity and pain, resulting in more frequent dental visits in the future. As awareness of these risks grows, preventive dental care could see a rise.

However, this is not really an investment thesis. The long-term oral health effects of nicotine pouches like Zyn remain unclear and need further research.

I’ll admit, buying stocks to profit from negative outcomes isn't exactly ethical, and I don't believe there's a strong direct link to Zyn consumption. Still, I do see a growing trend of people getting veneers, so maybe this is just another catalyst to the shares of dental industry companies. We’ll check these out in the next article.

Also, please bear this in mind: we talk about various stocks, funds, and securities because they’re interesting or can be used to teach a lesson about investing. None of the posts we publish are intended to be taken as individual investment advice or a recommendation to buy or sell any specific stock or other security. We can’t even guarantee that our information sources are 100% accurate. The only purpose of these posts is to teach you how to do research and figure this stuff out for yourself.

Have you tried Zyns? Would you buy a tobacco stock to benefit from their rise? We would love to hear what you think!