Target Corporation: down 53%, is this dividend stock a buy?

Let's have a look at this interesting retailer – and use this opportunity to learn how to value retail chains.

The other day, I (Vincent) was driving around my neighborhood and noticed some construction work on the lot of an old supermarket that had recently closed down.

The signs that were posted on the exterior fences showed the easily recognizable red bullseye that most people associate with conveniency.

The sight of a new Target being built isn’t something that would usually catch your attention…

…except that this is the second Target within a mile and a half radius of the neighborhood.

I thought to myself, “Target must be doing really well”. Out of curiosity, I took out my phone to check what Target is trading at these days.

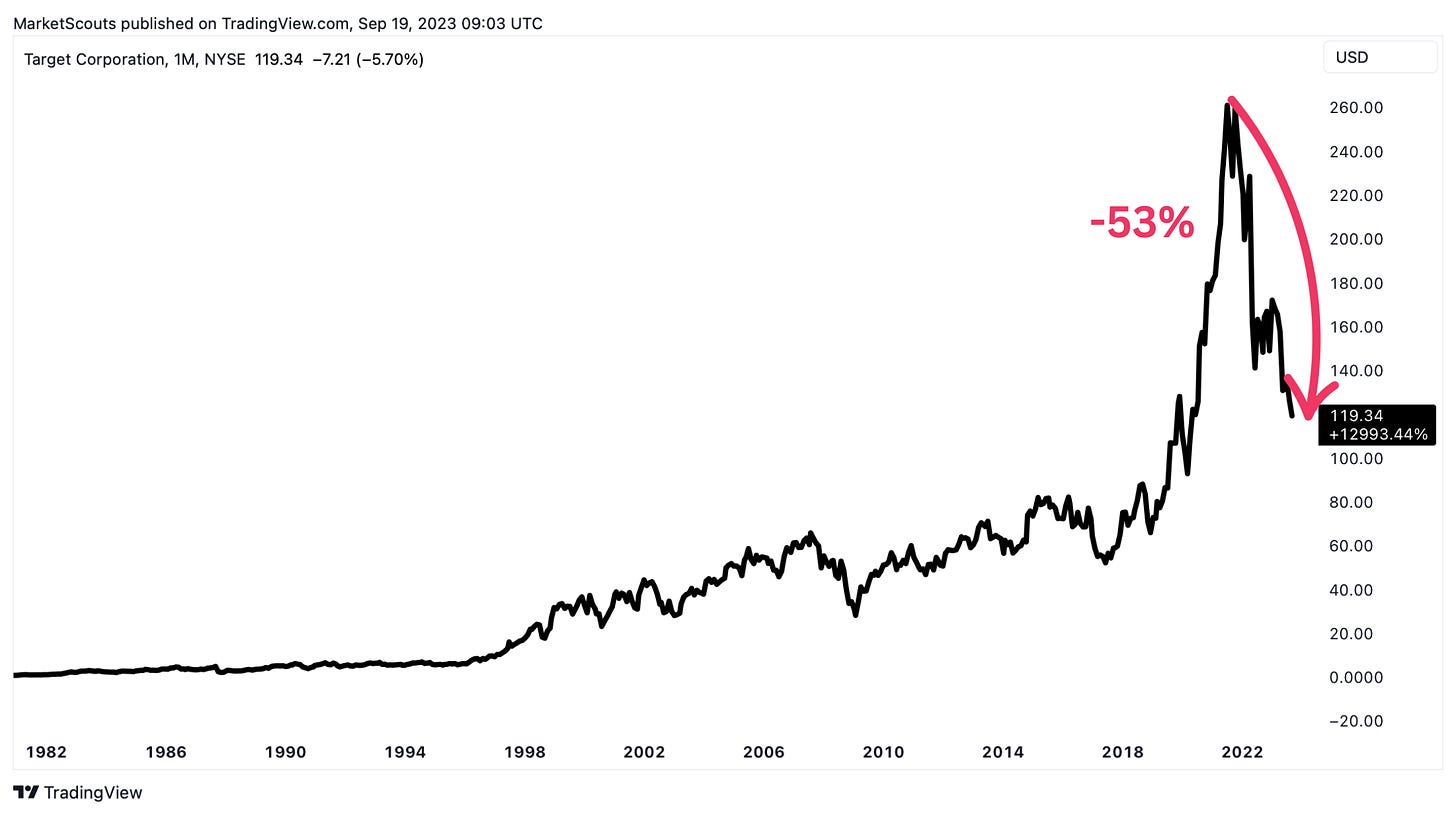

What I saw on my screen was that Target’s stock price was at a 3 year low, a 53% decline from its 2021 peak.

Why did Target’s stock drop by 53%?

After successfully navigating the pandemic, Target, one of America’s largest retailers, took an unexpected plunge.

Why?

5 minutes of googling showed us a “death by a thousand cuts”: supply chain issues, overestimated growth (and missed earnings targets), about half a billion in theft (!), and the growth of e-commerce.

Yet, when we stopped and looked at the fundamentals of the business, we saw there’s lots to be optimistic about.

And that’s before we even count the dividends and their constant growth.

So: could this drop in Target's stock price create a profitable window of opportunity?

We won’t try to predict the future here. Instead we’ll try to understand what really caused the drop in price, what it would take for it to get back up, the true value of Target’s share price – and generally see if things are as good as they seem on paper.

Let’s dig in.

Inventory issues

In the face of the lockdown and the massive and sudden shift towards online shopping, the retail chain remained steady by focusing on e-commerce and incorporating a convenient and safe pickup option for its customers – allowing them to get the products they needed without leaving their cars.

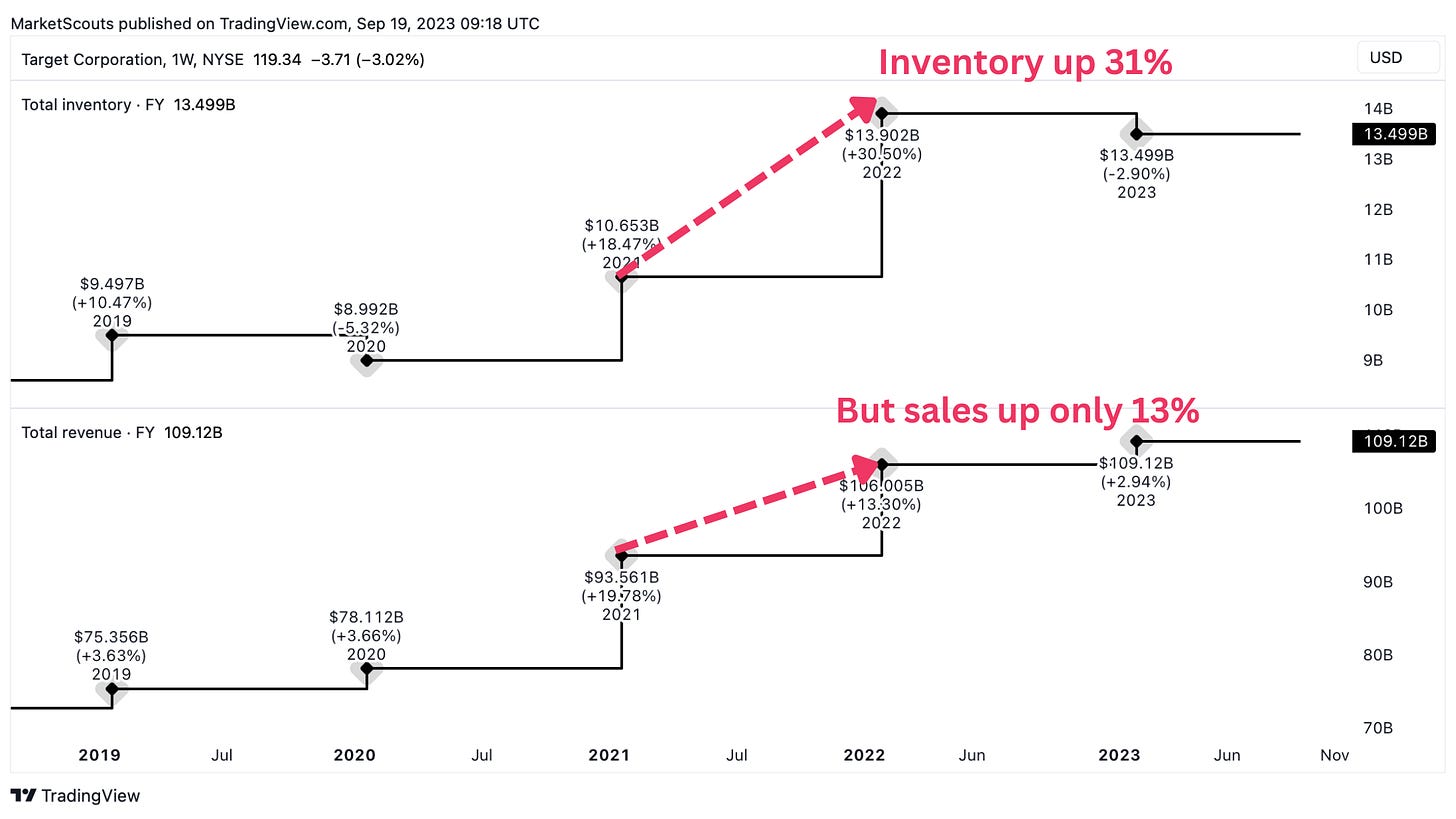

However, post-pandemic, Target failed to recognize the new change in behavior, and it mis-predicted consumer spending – ordering a ton of inventory in the process.

Add to this the new supply chain issues and all of a sudden Target had a new challenge: how to get rid of unsold inventory.

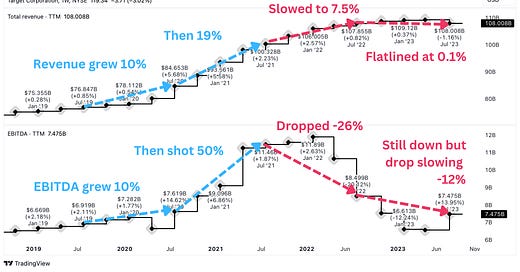

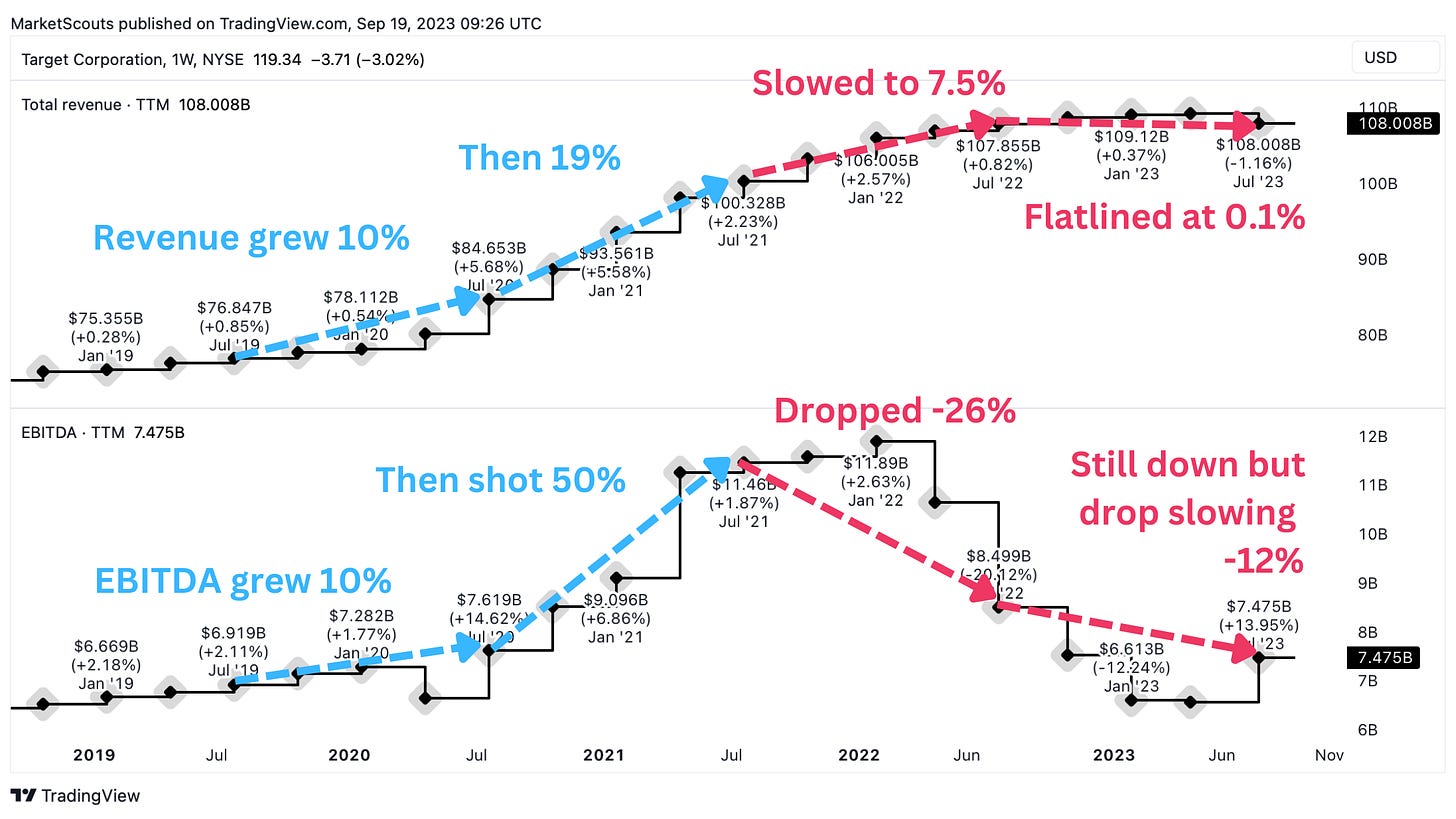

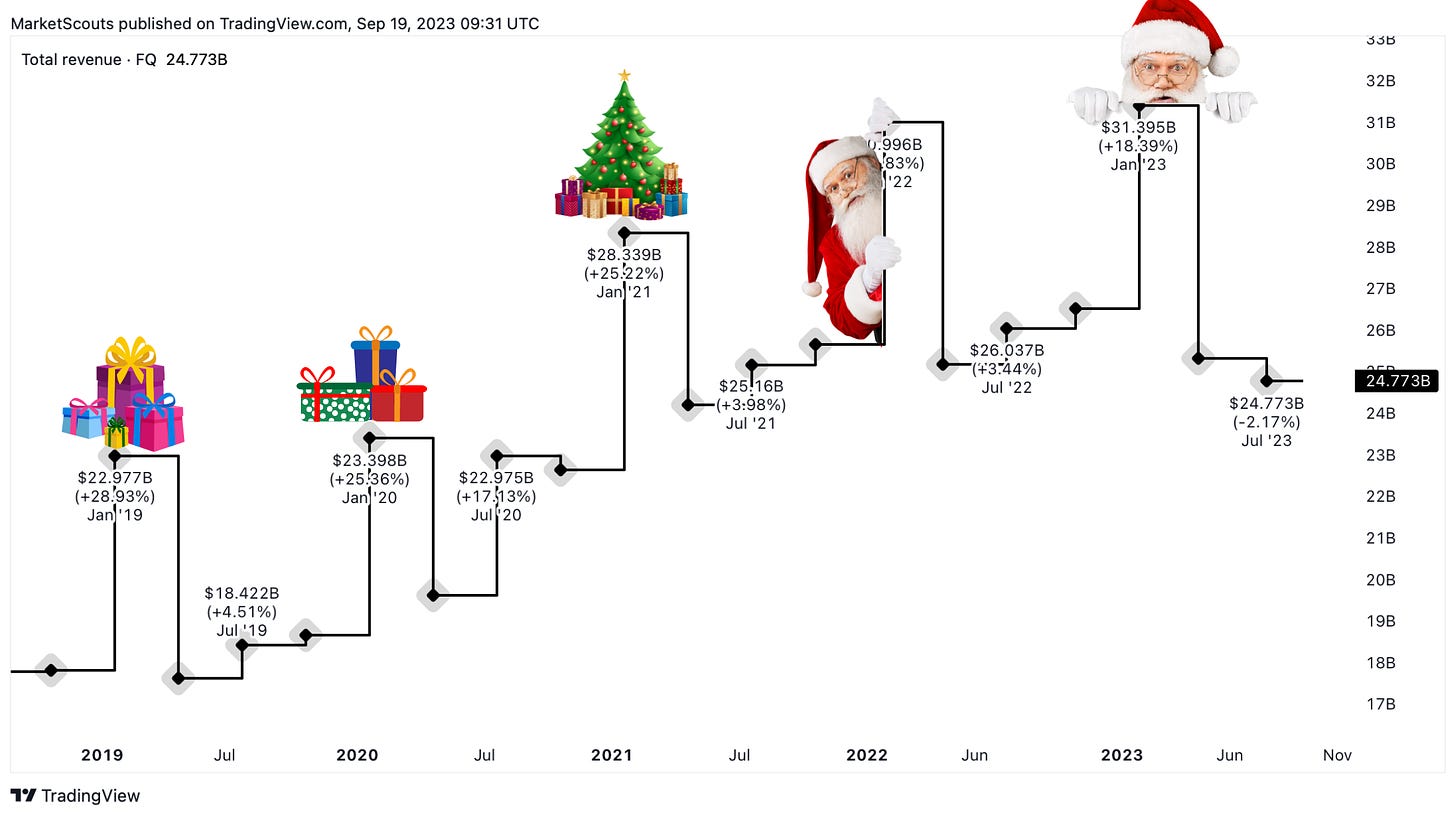

The solution was simple but painful: mass discounts – explaining the slowdown in revenue and profits (although profits seem to have started to picked up again recently):

As cash and net income dropped, investor confidence decreased – and its stock fell with it.

As an aside, “TTM” in the chart above means “trailing twelve months” and it makes the chart clearer to look at than on a quarterly basis – since retailers like Target have to deal with a ton of seasonality. And seasonality would make the chart really hard to understand.

See what happens every January – when sales from the holiday season are “counted”?

Theft

Plenty of retailers see theft in their stores. But at Target, the scale was much higher – the company lost $500 million in 2023 due to crime.

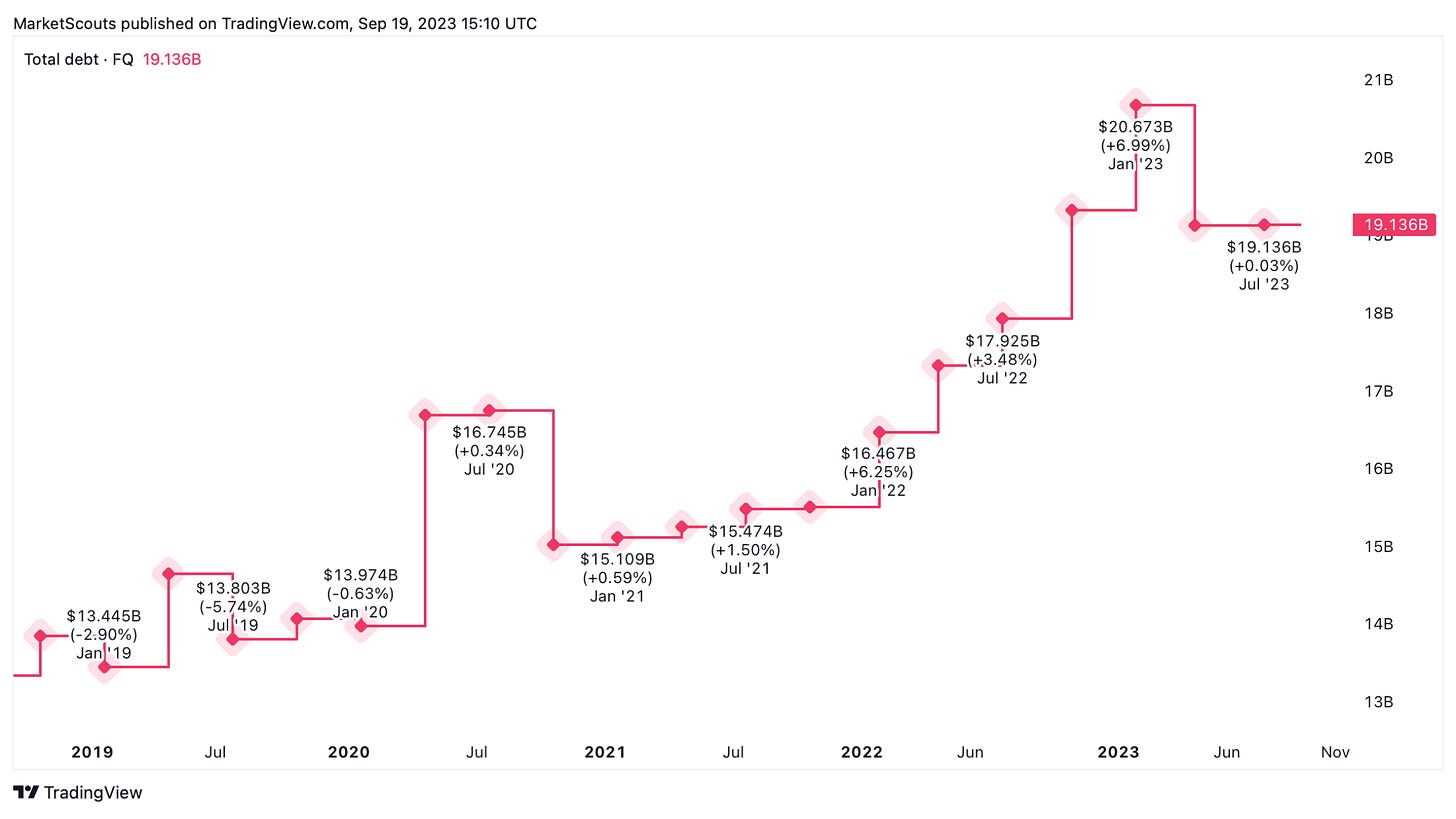

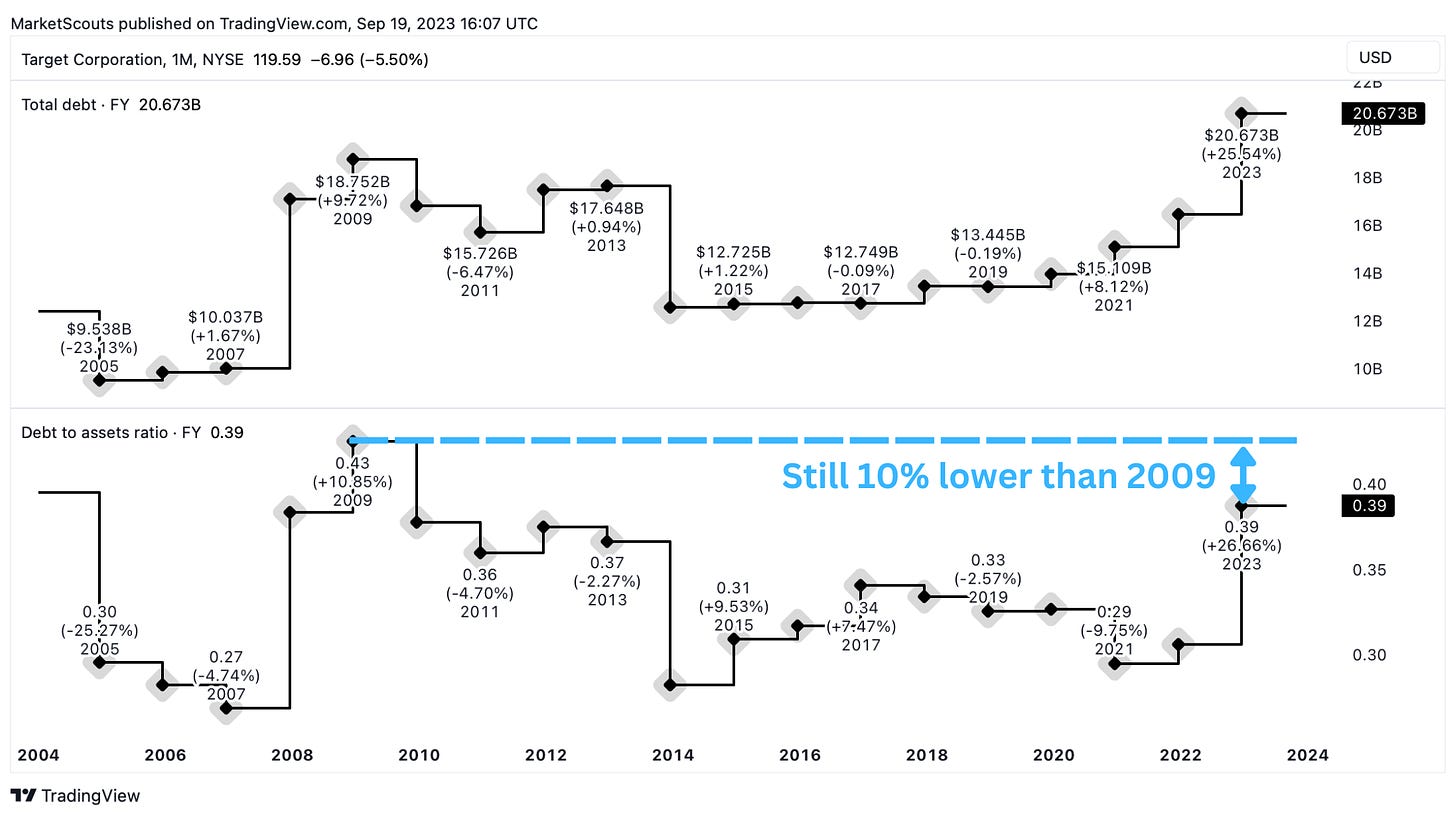

Debt

Target amassed a pretty big chunk of debt: US$16.1 billion:

While it might have scared investors, there are quite a few good things about this debt:

First, it seems to have been taken for “productive” purposes and less for financial engineering: Target used debt to weather the pandemic and invest in e-commerce.

Second, the debt is not an existential issue: a debt to assets ratio of 0.43 means that debt is 43% of its assets (existential would be close or over 100%).

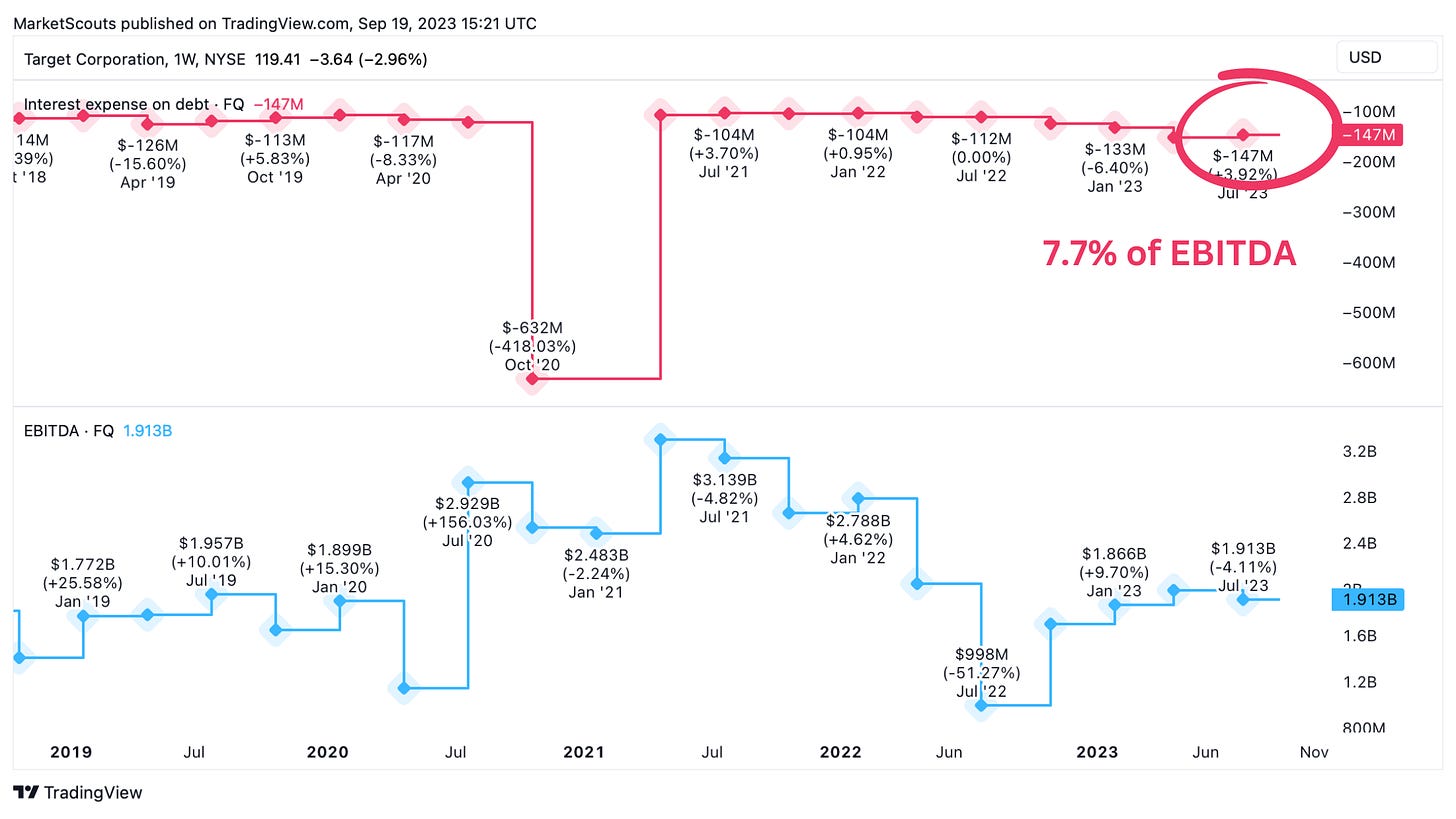

Third, the interest can be easily “serviced” – meaning Target can afford to pay it off.

Last quarter’s EBITDA (profit before interest, taxes, and depreciation) was US$ 1.91 billion. That was more than enough to pay interest worth US$ 147 million – or 7.7% of net profit.

Target’s managed well a higher level of debt before: in 2009, Target's debt-to-assets ratio was 0.43, compared to this year's 0.39.

Back then, they used the debt to finance projects that yielded future growth and higher cash flow. They opened up new stores and closed down poorly performing ones, increased their online presence, sold bad assets, and maintained their dividends to attract investors.

Coincidently enough (not?), Target is using a similar tactic today to turn its debt into higher revenue. In February, Target announced plans to reduce its debt by $10 billion by 2025.

Is Target fairly valued or not?

So far we’re looking at a stock that:

was growing slowly before the pandemic

saw a mini-boom during covid

then was brought back to roughly where it was before, on the back of disappointing revenue and increasing debt.

But is that where it should be?

There are a few indicators we can look at to see if Target is “undervalued” or not.

Price to Earnings

Target's Price-to-earnings ratio, also called the P/E ratio, is 16.8.

A better way of understanding P/E would be to think of it as the number of years it would take to make back your initial investment from the company’s profits alone (presumably you want to be a Target shareholder forever).

Based on P/E ratio, Target seems to be quite undervalued:

the industry average is 19.1 (13% higher)

if we look only at its competitors, Target has the lowest P/E ratio, with Walmart at 31, Dollar Tree at 21.4, and CVS at 28.6.

Price to Sales

Profitability might go up and down but the best way to compare retail chains is to look at how much volume they’re actually selling.

The Price to Sales ratio, which is a company's stock price divided by the company's revenue per share, helps us do that: a lower ratio suggests that investors are paying less for each dollar of a company's sales, making it potentially undervalued.

Target's P/S ratio, 0.52, is less than Macy's (1.02, or 49% higher), Walmart's (1.02), Costco's (1.47), Amazon's (3.69), and Best Buy's (1.24).

In other words, Target is generating more sales per share price than the rest of its competitors.

What would it take for Target to recover?

As we have seen, multiple indicators show that Target is currently undervalued at its current price.

Its P/E ratio compared to its competitors tells us that its stock is trading at a low valuation compared to its earnings. Its P/S ratio tells us Target generates more sales per share than its competitors.

Of course, because of this, many analysts believe that Target is an undervalued stock. Depending on what formula they use, the “undervaluation” can be anywhere from 13-55%.

However, being undervalued doesn't necessarily mean that a company will reach its "fair value" or even come close to the number the analysts have come up with.

These are theoretical numbers built on the expectations that a company will improve and that investors will be enticed by this.

So is Target doing anything to improve both results and perception?

First, Target's biggest enemy has been its inventory issues, which were largely responsible for an $800 million loss in 2022.

As of today, Target is now focused on a lean inventory model. This will allow them to avoid using markdowns to sell what they currently have; fewer discounts will also mean more profit.

Second, Target is expanding its online presence with its relatively new rewards program, Target Circle, already with over 100 million members.

A study conducted by RetailMeNot found that Target Circle members spend an average of $1,200 more per year compared to non-member Target customers.

This program is similar to that of Starbucks, which launched its rewards program in 2019. After the launch, Starbucks saw an immediate 7% increase in sales that year and the rewards program is now responsible for 40% of Starbucks' overall sales.

Could we see similar results for Target?

Third, Target is also cracking down on theft, like using RFID tags which beep when items are taken out of store. They also plan to work closely with law enforcement by sharing data from its surveillance systems.

Of course, it’s too early to tell if this will work, but at the very least they should show investors that Target is serious about preventing theft.

Finally, Target also is using some of its profits to boost investor confidence:

it is buying back shares: 2.32% this year (although fewer than last year)

offers a stable dividend growing at an average of 9% per year

and increased their payout ratio to 69% this year, compared to last year’s 24% – meaning they used more of their earnings to fund the dividends.

Will all of these work?

Will Target’s stock raise to its “fair value”?

Perhaps.

Financial metrics such as the P/E ratio, P/S ratio, and increasing profits certainly suggest that Target's current stock price may understate Target's true value.

On top of this, Target has a history of stable and increasing dividend payments, and a track record of paying off debt while using it for growth opportunities.

At the end of the day, it seems that Target is financially healthy and fully capable of turning around, as it has done before.

However, for Target to reach its "true value," as some analysts may put it, significant changes must be made to allow its cash flow to improve while restoring the trust and high expectations of the investors.

Target has already started to do some of these, and who knows? It might all work out. Or it might still say behind its competitors.

In any case, this is not a recommendation to buy Target, so bear in mind this disclaimer: we talk about various stocks, funds, and securities because they’re interesting or can be used to teach a lesson about investing. None of the posts we publish are intended to be taken as individual investment advice or a recommendation to buy or sell any specific stock or other security. We can’t even guarantee that our information sources are 100% accurate. The only purpose of these posts is to teach you how to do research and figure this stuff out for yourself.