Are you team Sam Bankman-Fried or Nassim Taleb?

SBF and NNT are both similar and polar opposites when it comes to investing. Let's see what one's failure and the other's success can teach us.

If you’ve spent even an hour of your time following crypto over the past two years, you definitely came across one acronym:

SBF.

If you didn’t, then a) wow, lucky, and b) here’s what you need to know about SBF.

It stands for Sam Bankman-Fried, a crypto “wunderkind” who ran one of the most successful crypto exchanges, FTX. He also ran one the most successful hedge fund and venture capital firms in crypto, Alameda Research.

Successful, of course, until it came crashing down with a $8 billion hole in its balance sheet. The US government accuses him of fraud, while his defense claims he’s just bad with numbers (…as a former physics major at MIT).

Anyway, if you want to dive into that whole saga there are two pretty good books on it (Going Infinite by Michael Lewis and the much better Number Go Up by Zeke Faux), plus a documentary that Bloomberg released two days ago. You can watch it for free on YouTube.

Here’s the trailer (keep the title in mind):

What is SBF’s investing philosophy?

SBF was a vocal member of the “effective altruist” (EA) movement. Effective altruists basically argue that you should optimize your career in such a way as to save as many lives as possible.

There are a few paths an effective altruist can choose, and the one SBF chose was that of “money maker”: make as much money as possible via a high-paying career, and then donate it to charity.

And here is the relevant bit for us: SBF prioritized his actions by their “expected value” (EV).

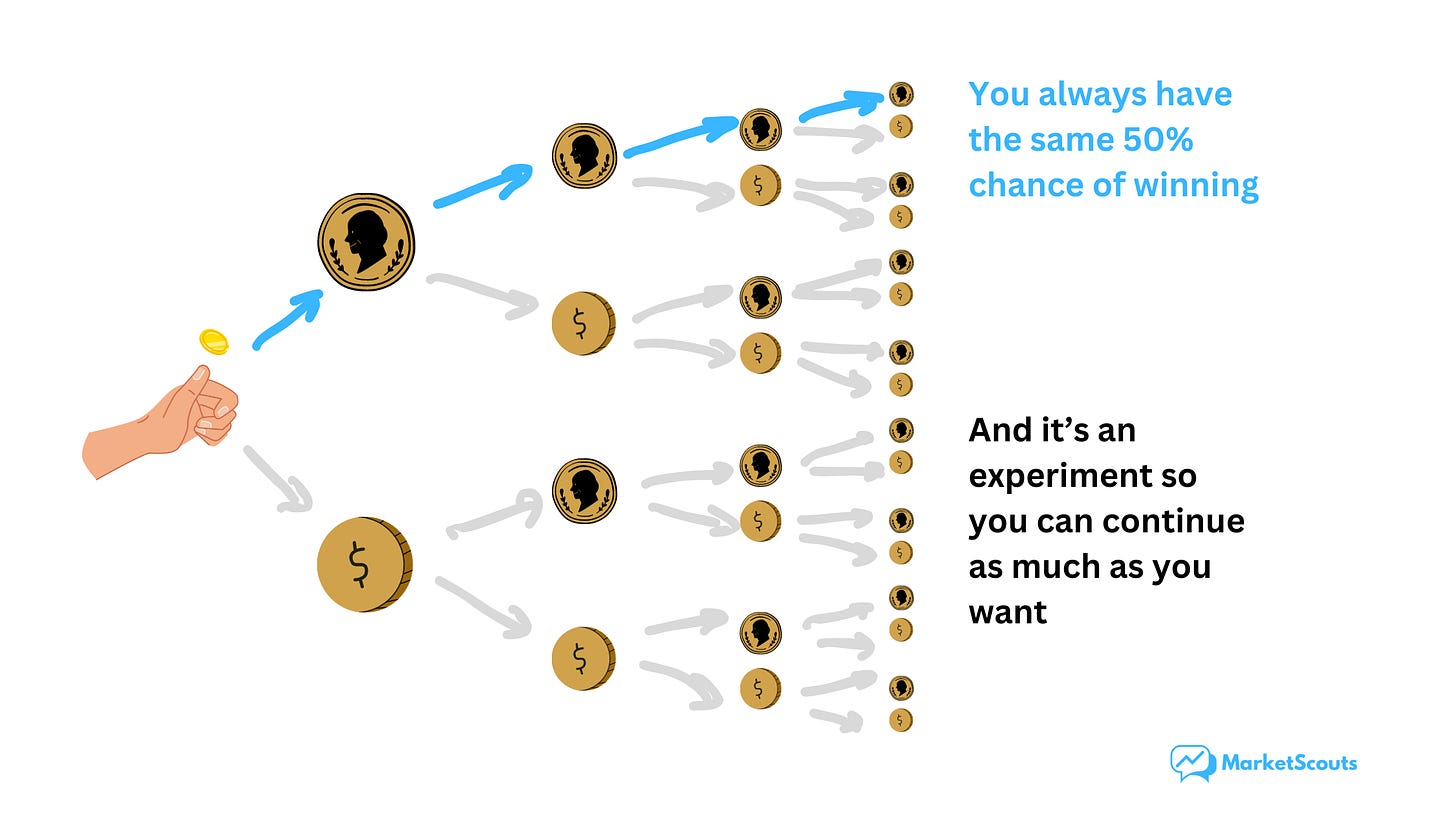

Think of it this way: you and your friend decide to toss a coin. You have a 50% (one out of two, or 0.5) chance of winning. You both put down $100, winner takes all – you can make either $100 profit or lose $100.

The expected value is going to be:

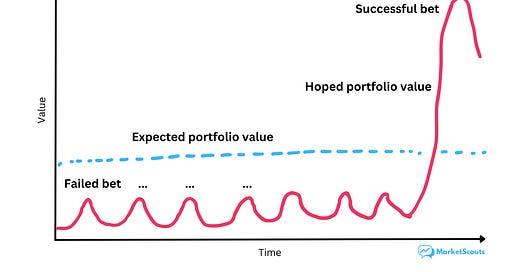

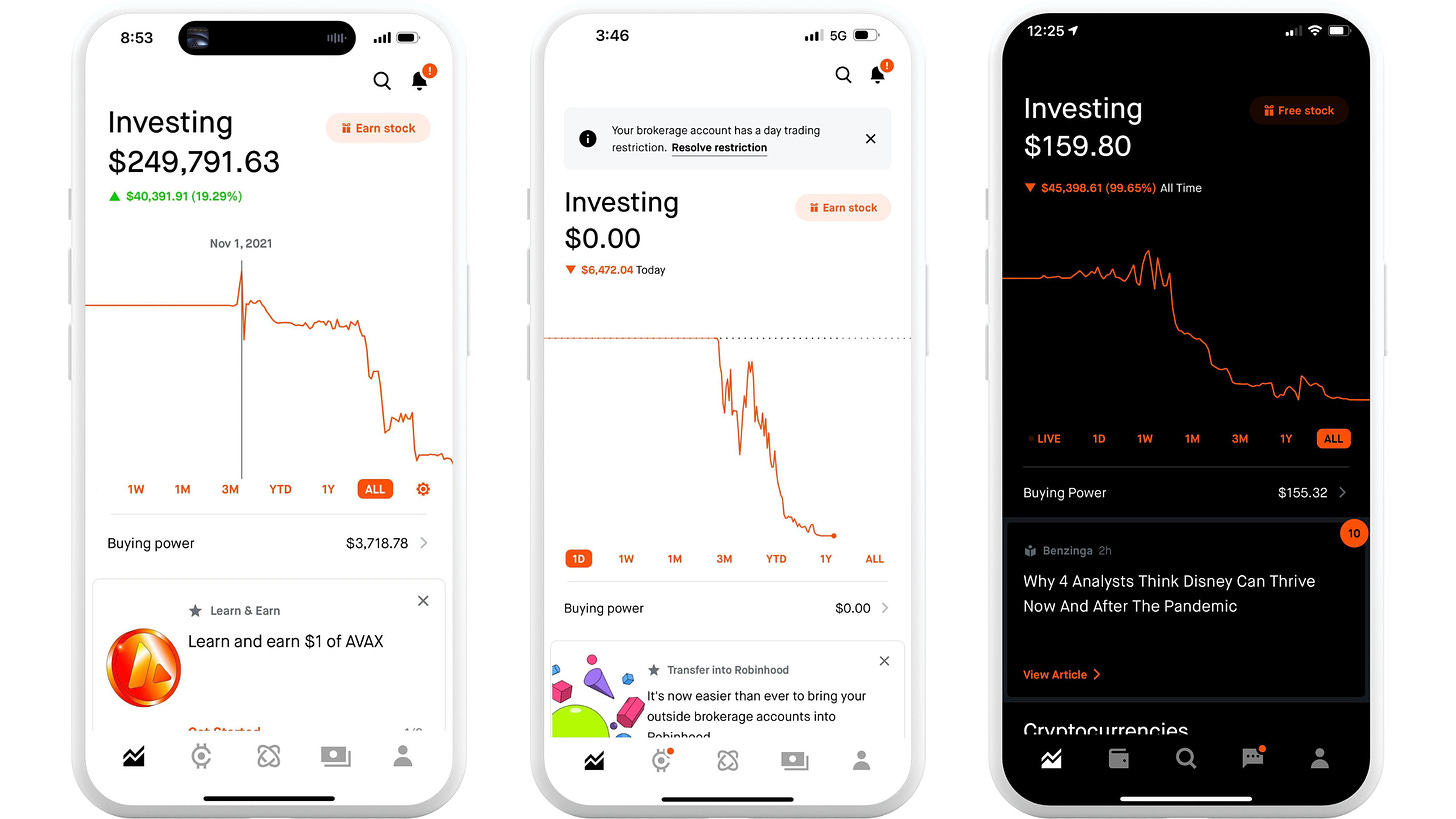

The way SBF’s hedge fund, Alameda, used this formula was by saying: hey, let’s place these crazy bets, we only need a few to succeed to make it BIG.

This is a version of the so-called “Power Law” investing strategy, which venture capitalists (VC) use all the time.

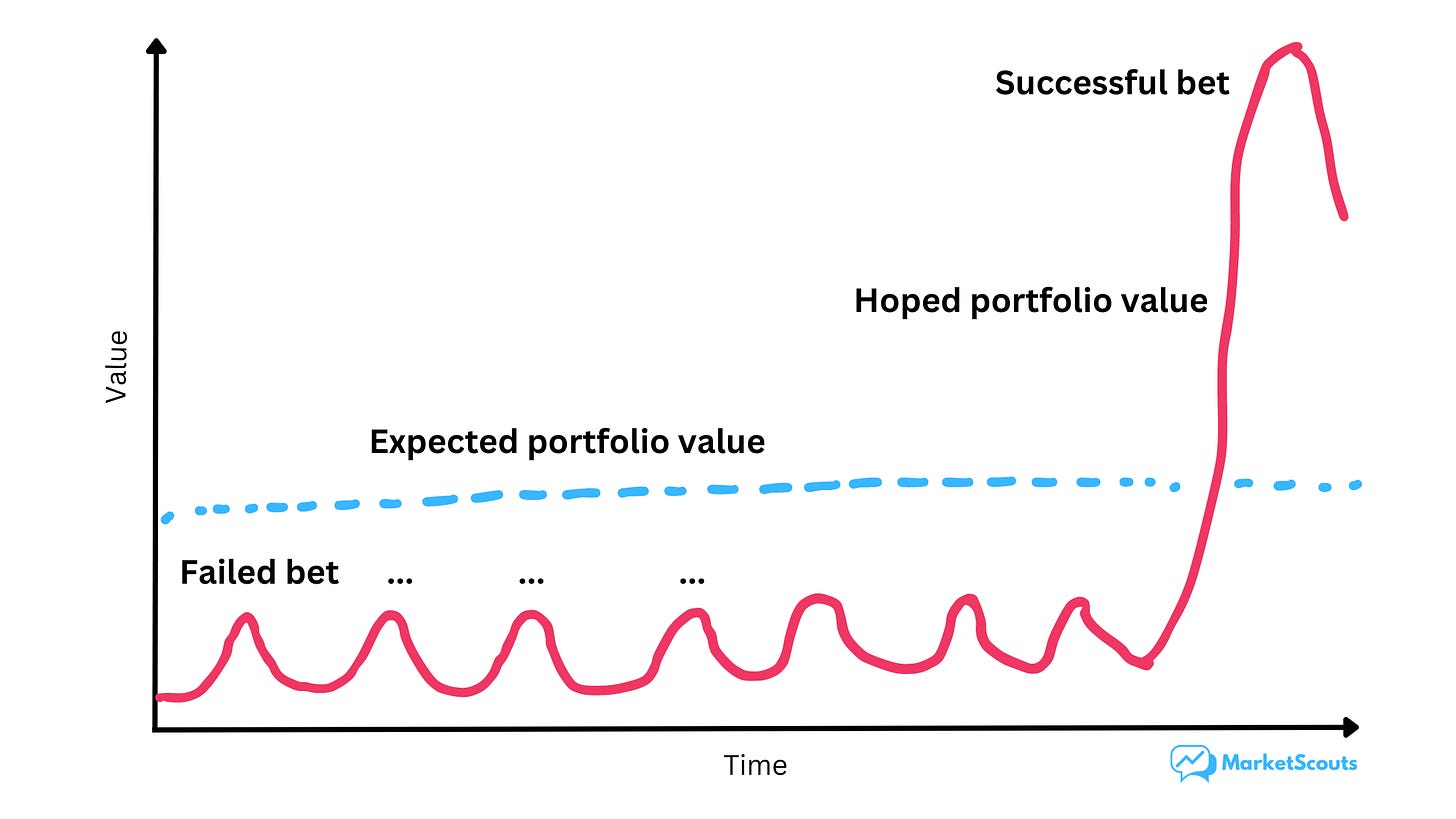

For most VC firms, backing 100 startups and seeing 99 of them fail is fine – the one that succeeds will more than pay for the rest.

There are two big problems with this approach:

First, if you make many small bets to spread your risk, your returns will be mediocre at best.

The average VC fund return has actually been 12.25% per year since 2002, only slightly better than the S&P 500’s 9.9%. But if we exclude the best 25% of VC funds, the returns are much worse. In fact, a small number of VC funds make a ton of money, while most of them lose money. And, of course, all charge ridiculously high fees for the privilege.

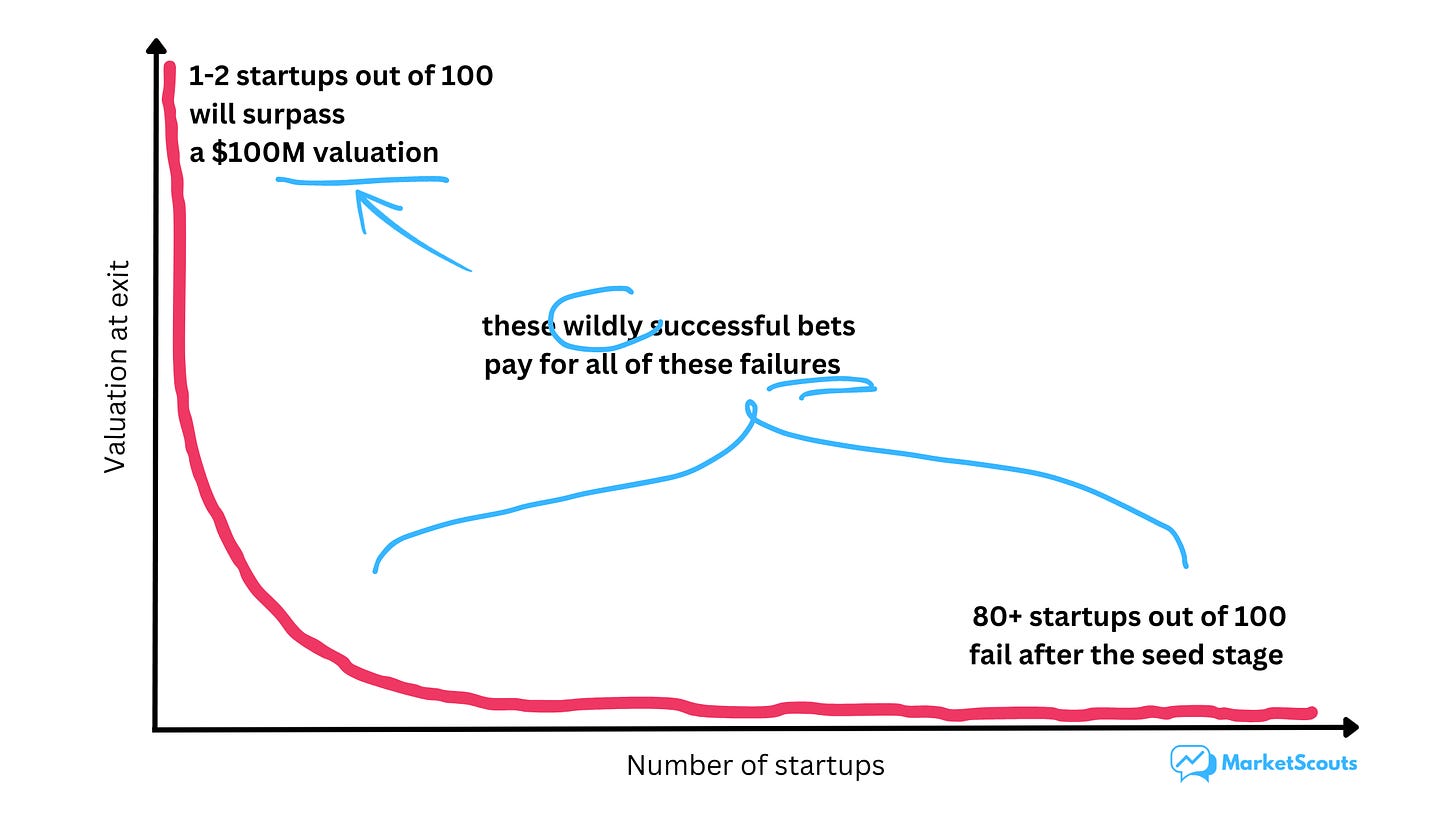

Second, if you take fewer, bigger bets, you’re facing a real risk of ruin.

Yes, you can make 1,000% in a day or whatever – but if you lose, you don’t get to play again. Like these examples of Redditors sharing their losses from trading options:

And in fact, this is actually a big reason why SBF is now in jail and not a billionaire in the Bahamas anymore: his hedge fund, Alameda, dipped into FTX customer funds to gamble on a series of high-risk tokens, startups, and strategies.

The thinking was that each of these investments has a small probability to make it big, and there's only a small probability that lots of FTX customers will ask for their money at once. Overall, the risk seemed to be worth it – in theory.

Which brings us to Nassim Taleb.

Nassim Taleb’s investing approach

Nassim Nicholas Taleb (NNT) became famous for his “Black Swan” book – which now gets quoted every time there’s a market crash – and also for making some pretty big profits during the 2008 crisis.

He also explains in “Fooled By Randomness” why people don’t get probability and risk: we see a small percentage of something bad happening and say “hey, that’s worth it”.

But that's not how it works in real life. Concepts like “expected value” only work in casinos and in class. There, you can flip a coin as much as you want:

Basically, in theory, probability is like measuring what happens across all “timelines”.

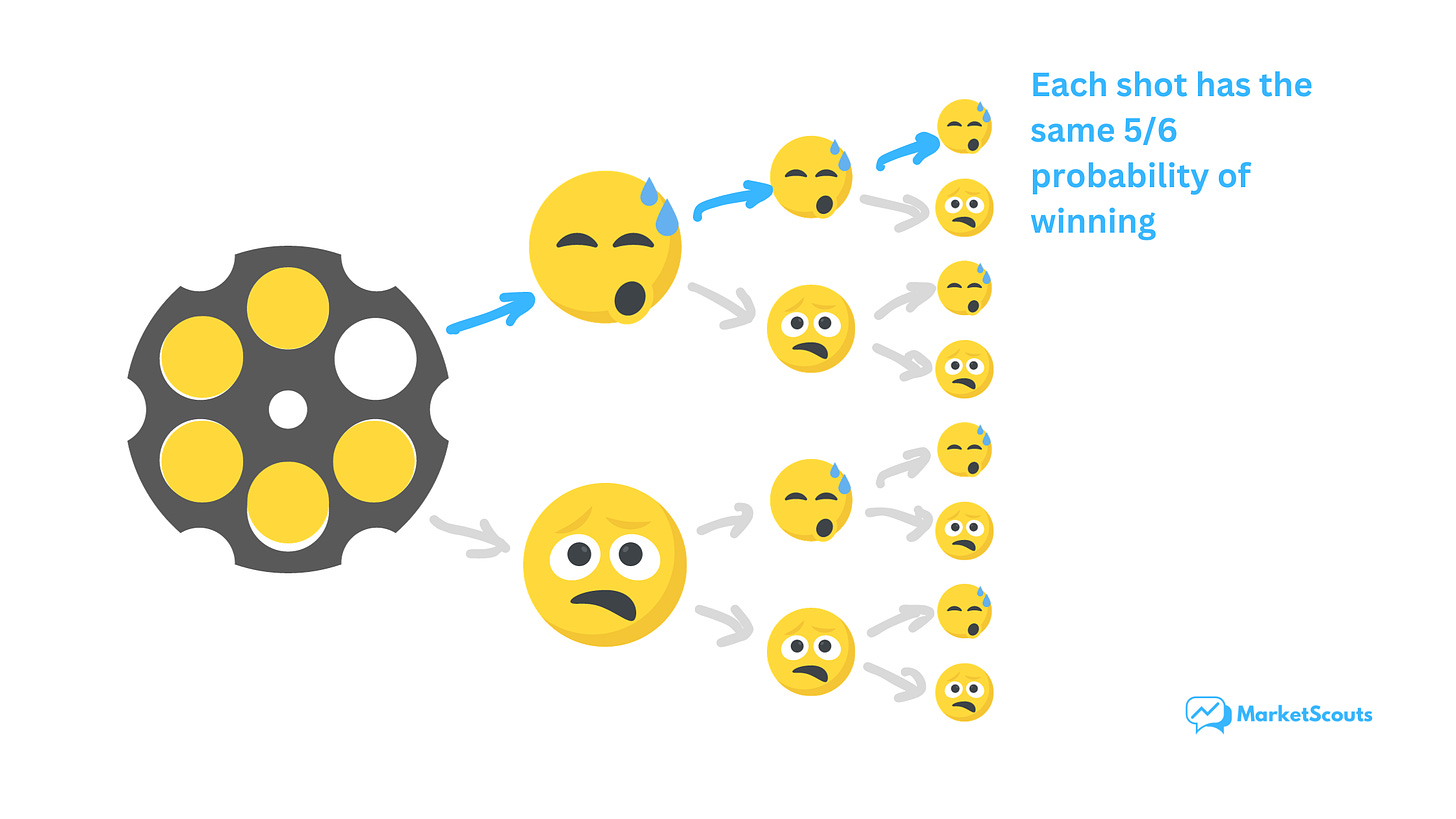

But let’s take another example: Russian roulette.

In theory, you have only 1/6 chances of losing – and a 5/6, or 83% chance of winning. That’s pretty good, in theory.

In theory, you should take each shot.

The problem is that in real life, you only exist in one timeline.

If you take the wrong shot, you’re done. There won’t be another “coin toss” for you. If you fail catastrophically, that’s it. The story is over. Probability won’t matter anymore.

Investing is much more similar to this.

This brings us to how Nassim Taleb actually made money: not by taking risks, but by insuring against them.

For example, his fund would pay premiums for options that paid big in case there was a market crash. That meant that, until that “unlikely event” happened, his fund would slowly bleed a little bit of money every month.

So, team SBF or team NNT?

To be fair, both are pretty bad teams for an everyday investor.

Join Team SBF and you’re in serious danger.

Any portfolio where there is a risk of total ruin should not be an option for you. The math might make sense, on paper, but if you ignore how things work in reality, you’re just an IYI, or “intellectual yet idiot” (Taleb’s words).

Thinking you’re smarter than the market only makes it worse. Here’s Alameda’s CEO, Caroline Ellison, talking about how they didn’t even use stop losses:

On the other hand, you can’t really join Team NNT unless you have some serious capital to cushion you until the insured risk pays off. Not to mention the professional trading skills, environment, and tools.

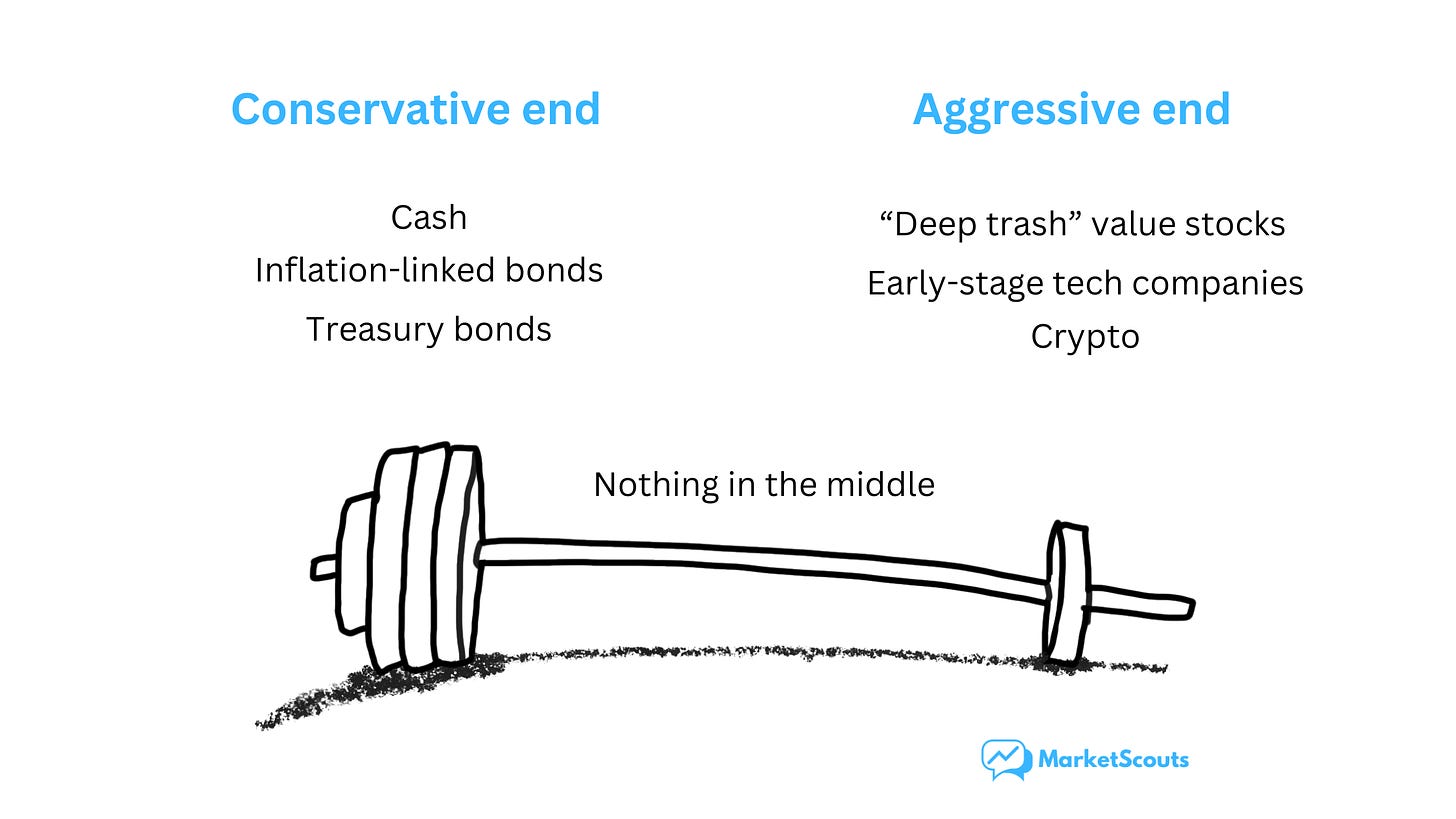

So maybe a mix of both is best: take a handful of wild risks with a part of your portfolio, and make sure you’re protected with the other.

In fact, that’s actually what Nassim Taleb recommends, and he calls it “the barbell investing strategy”: be super conservative with the amount that you can’t stomach losing, take wild risks with the other part of your portfolio, and leave nothing in the middle.

Great post, I'm leaning towards Nassim Taleb for sure!