MarketScouts: one year and two beaten benchmarks later.

Why the MarketScouts portfolio is higher than the most popular benchmarks (VT and SPY). How MarketScouts will be different after this five month break. What this means for us.

I can’t believe it’s already been a year since I published the first article on MarketScouts.

When I clicked that “Sign up” button on Substack, I had three goals in mind.

First, I wanted to become a better investor. Sure, I could just buy the index every month, but I wasn’t comfortable with simply buying a “black box” and expecting magical returns. I want to know what I own.

Second, I wanted to become a better “business person”. I’m a strong believer in the idea that learning to invest helps you learn how great companies are run.

Third, I love writing and I wanted to create something I was proud of.

In the six months that followed, I saw this newsletter grow exponentially, managed to bring onboard some amazing contributors and I even got recommended by some of the authors I used to read – 👋

.MarketScouts even got “cited” on Reddit (the most important award of all, of course).

Despite all this, I made a decision in late February to pause writing for MarketScouts.

On one hand, I had just started a new project and I just didn’t have the time to support my team of contributors as they deserved.

On the other, I realised that MarketScouts needed a clearer vision. Another investing newsletter in a sea of investing newsletters is not it. There are thousands of newsletters out there peddling investing ideas, charts, finance book reviews, you name it. Adding more noise to a field where a bit of quiet makes all the difference helps no one.

Basically, I didn’t want to become one of these guys:

But a lot has happened since February.

The companies and investment themes my contributors and I talked about here have outperformed the market – by quite a bit.

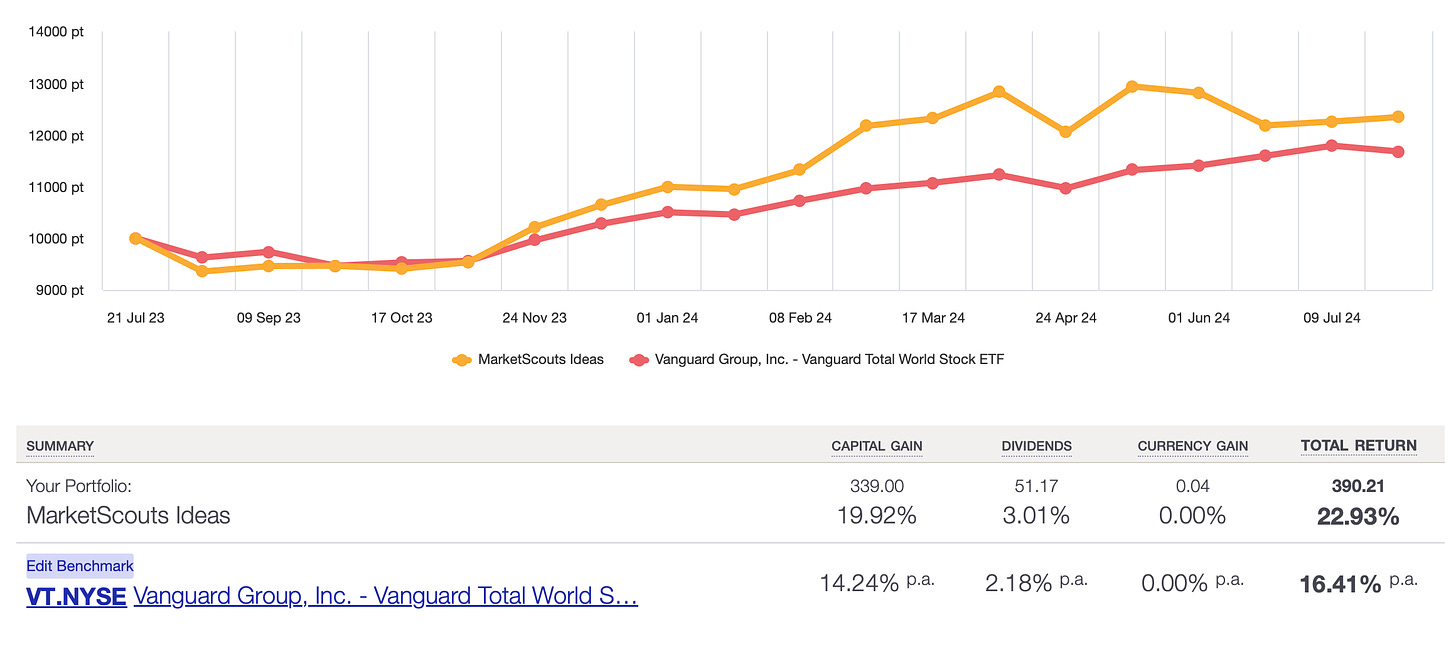

If one would have invested $100 in the companies and ETFs we mentioned here in a positive way (we also had some cautionary tales), compared to $100 in an ETF like VT, the total return would look something like this:

Now, of course there are a ton of caveats here: this portfolio has higher volatility, lower diversification, it’s not tax-efficient, and so on.

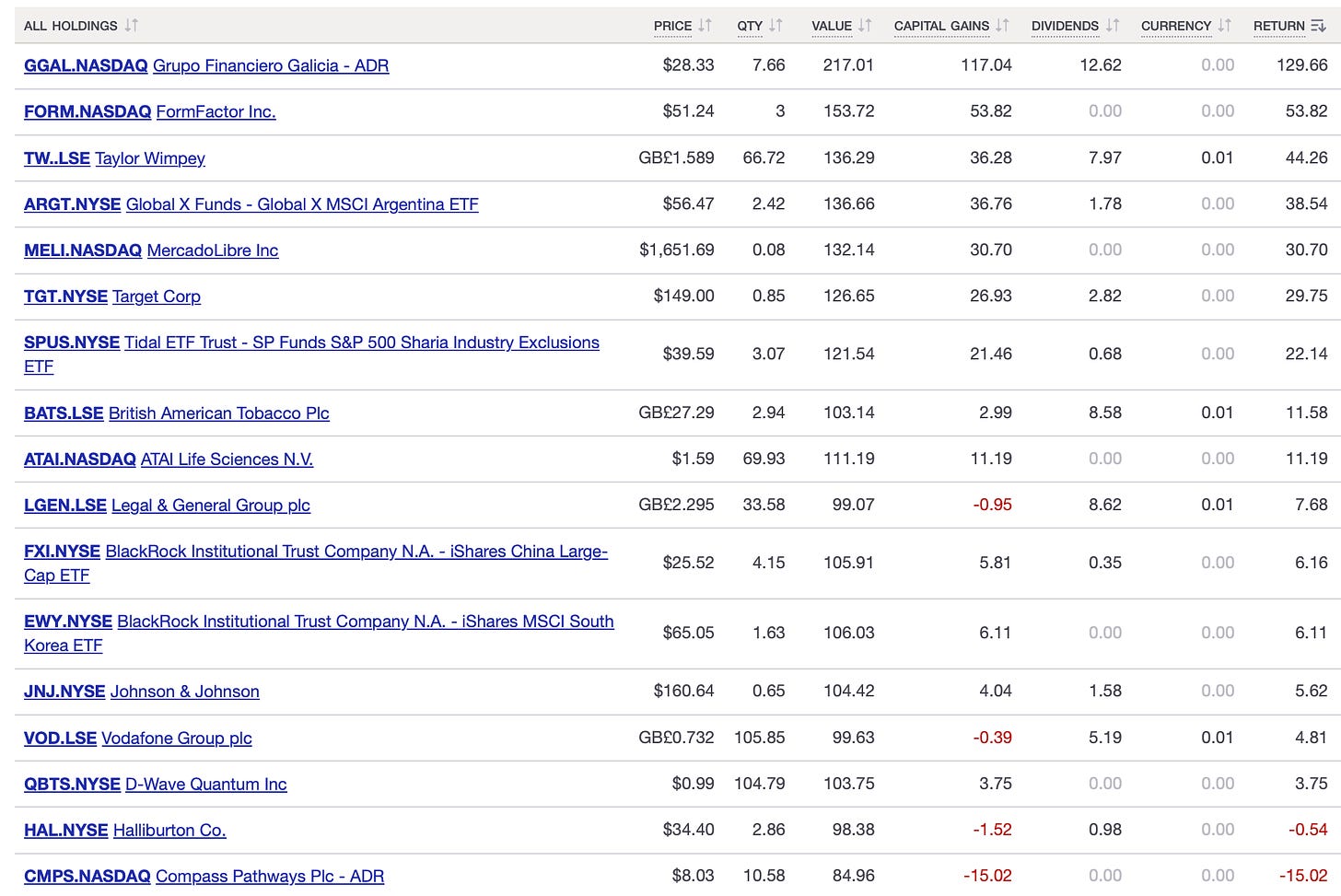

But it’s still fairly diversified: our ideas ranged from Argentinian banks to quantum computing companies to whole-country ETFs:

And, most importantly, the MarketScouts "virtual” portfolio outperformed VT by 6.52%. It even outperformed the S&P500 over the same period.

The reason, I believe, comes down to one thing.

The team.

Most of these ideas have been researched by a talented group of young students who believed in what I wanted to build at MarketScouts and who wanted to leverage this newsletter as a platform for their investing careers.

This means that they have a few advantages over both experienced professionals and TikTok influencers:

They research from first principles, but still have the theory fresh in mind.

They’re humble, eager to learn, and are receptive to feedback – crave it, actually.

And don’t have “style drift” yet.

This last one trips many people, and especially experienced investors. Any investor you know and follow will eventually experience it. Even Warren Buffett.

Style drift basically means that the world changes but your investing style – your picking criteria, the ratios you look at, the entry and exit levels, even the kind of assets you invest in – will be left behind.

When the famous “Intelligent investor” was published, it revolutionised the field and formalised a new style of investing: “net net investing”.

This meant looking for companies where the value of their most liquid assets (cash, cash equivalents, and inventory) minus their total debt was still higher than the market cap of that company. You were basically buying cash at a discount.

Today, the book is still important, and you should still probably read it. But don’t expect to apply its lessons literally. The world has changed. You can’t find those opportunities anymore.

Which brings me to the new MarketScouts – MarketsScouts 2.0, if you will.

How will MarketScouts be different from now on?

Some things will stay the same. The charts will still be fun to look at and easy to understand. The language will remain friendly and without too much jargon. You won’t need an accounting degree to follow along.

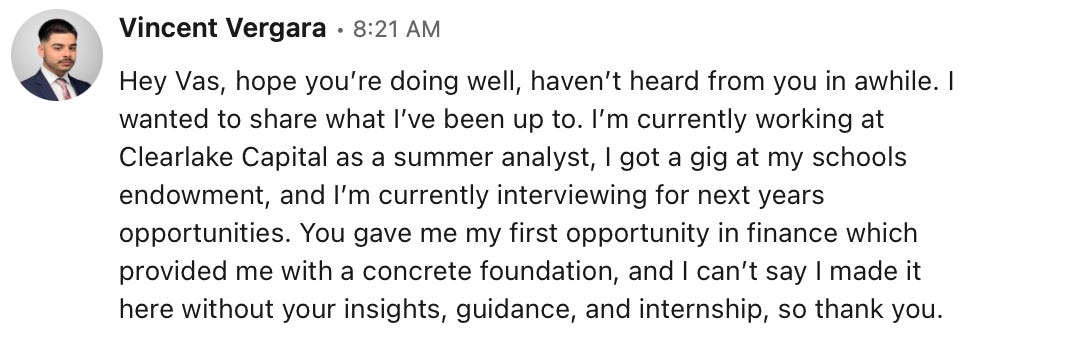

But from now on, MarketScouts will officially become a platform for young people to put the theory into practice, refine their investment approach, and built a public portfolio which will help them enter a hyper-competitive field.

A platform for more bright students like

:Welcome to MarketScouts 2.0, the investing newsletter written by tomorrow’s top investors.

Next week:

will take a look at whether investing in an IPO of a PE-backed company is a good idea. No spoilers, but it’s really interesting.See you next week!

P.S. If you work in asset management or related fields and are interested in becoming a mentor, do reach out.

So excited!

Excited to see what more is to come!