"Magic mushrooms" are now legal in California. Is this the next cannabis?

Cannabis stocks saw a 24x bull ride in 2018. Are psylocibin stocks ready to be next?

The past five years have been a period of non-stop bubbles in the stock market: Bitcoin, electric cars, SPACs, NFTs, meme stocks, etc. Some popped completely, others fizzled, and some popped then came roaring back up.

One of the most interesting ones was the boom in cannabis stocks – mainly because, unlike most other companies, the very legal status of the producers of cannabis was not always clear.

For example, some argued that if you bought an ETF that contained a cannabis stock, then you could be criminally prosecuted in your home jurisdiction if cannabis was illegal there.

That didn't stop investors from piling in in 2018, as the advantages of medical marijuana were touted as a real alternative to the worsening opioid crisis.

That was a short lived bull run, although a pretty incredible one: 24x (yes you read it correctly) followed by a 90% crash.

Another 3x ride up followed in 2020 and early 2021 (no doubt fueled by hopes of broader U.S. legalization after Democratic election wins). That ended similarly, with the largest 18 stocks now down an average of 82% since…

There were multiple reasons for this: inflation, the overall bear market, inflated expectations, increased competition, even cultivation costs (which can take anywhere between 21% to 47% of the cost per pound).

Still, despite the wild ride in stock prices, the global legal cannabis market is growing:

Across the United States: more than two-thirds of the US have now legalized cannabis, with the US cannabis market generating US$33 billion this year.

Europe: the majority of countries have legalized cannabis for medical use there already since 2017, and some (like Malta) even for recreational use – bringing another US$8.5 billion to the global cannabis industry this year.

But also in places that traditionally were extremely cannabis unfriendly, like South East Asia – with Thailand making it legal for medical use in 2018, then fully legal in 2022, and later with Thailand's health minister announcing that the government will distribute one million free cannabis plants to households across the country!

As the legalization movement grows, so does optimism about the cannabis stocks – especially as companies in the space "mature," enter untapped markets, diversify product lines, and acquire smaller ones to gain an advantage.

Which brings us to psilocybin stocks.

Is Psylocibin in 2023 like Cannabis in 2017?

For cannabis stocks, the past half-decade has seen first hype, then disappointment, and now guarded, fact-based optimism.

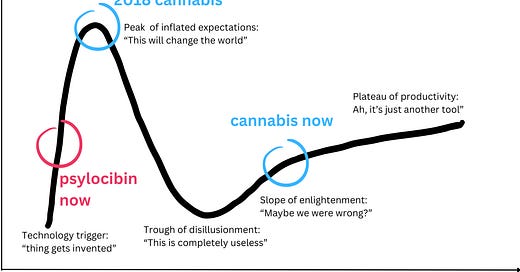

If we were to use the Gartner Hype Cycle (a framework used to figure out where technologies are in terms of “hype”) to look at how investors' feelings about cannabis have changed, it would probably look something like this:

Like cannabis, psilocybin (the name of the psychedelic found in “magic mushrooms”) is going through a shift in perception as major pharma companies recognize its potential for treating quite a few mental health conditions – especially for treatment-resistant depression.

Like cannabis, there’s already a market for recreational use, too – for example “micro-dosing”, popular in Silicon Valley for increasing productivity.

Like cannabis, magic mushrooms are also becoming less taboo in popular culture. The best evidence? In the late 2000s, cannabis use became a popular plot tool or pastime in TV shows. In 2020, documentaries about psychedelics started becoming a hit on Netflix.

And just like cannabis a decade ago, psylocibin is at the beginning of a process of broadening legalization.

This week psylocibin became legal for recreational use in California – now what?

This Thursday, California's assembly passed a bill that would make it the third state to decriminalize psychedelic drugs for personal use.

This immediately opens up a few opportunities for companies in the space.

local mental health market: 5.2 million Californian adults have experienced at least one major depressive episode.

local recreational drugs market: California is estimated to bring in US$ 5.9 billion in legal recreational and medical marijuana sales this year. Presumably some of them would be eager to try something new?

tourism: Amsterdam and Prague have become popular European destinations for travelers seeking drug-related experiences. California could see something similar from “psilocybin tourists”, potentially boosting both the psilocybin market and overall tourism in the region. To give you an idea, Amsterdam attracts around 4.5 million foreign tourists each year, with approximately a quarter of them visiting “coffee shops” (not the same as coffeeshops) – where cannabis is available for personal use.

further pressure on regulators in other states to legalize it: “where California leads, other follow” – as it’s been the case, culturally, for a while, anyway. This is already happening: resistance from regulators has gradually waned over recent years. Plus, the FDA's current guidance supports the development of psychedelic drug treatments.

finally, increased investor appetite. So far, most of the funding has come from venture capital investors and public investors comfortable with high levels of risk. This industry has garnered a reputation as an exceptional outlier where conventional funding obstacles do not hold. Psychedelic companies went IPO before putting any products on the market and getting revenue. We can even think of them as “publicly traded start-ups”. That’s not necessarily a good thing – with extra uncertainty about raising capital, plus the risk of being delisted.

If we put all of these pieces together, I believe that on the Gartner Hype Cycle, psilocybin stocks might be a few years away from "the big hype boom":

Considering that the global market for these substances is projected to grow at a healthy 13% from 2022 to 2029, reaching a value of US$ 6.5 billion by 2029, perhaps it's time to see how we could invest in it.

How can we invest in psilocybin companies?

Usually, when it comes to new technologies, everyday investors are left out – most companies are private. Luckily, a few publicly traded companies are already working on psilocybin treatments.

Let's have a quick look at them:

Atai Life Sciences (ATAI):

ATAI is the leader when it comes to using psychedelics for mental health treatments – especially anxiety, PTSD, and eating disorders.

They’re targeting a big market: in 2021, a survey found that 29.5 million individuals (11% of the entire US) experienced AUD, and 61% of the 21 million adults who experience at least one major depressive episode per year sought treatment. Psychedelic compounds like psilocybin has been shown to be particularly effective in treating these conditions.

ATAI is making great progress: their primary drug candidate, ATAI-101, is in Phase 2 trials targeting major depressive disorder (MDD) and alcohol use disorder (AUD). They’ve also opened a research center in Switzerland and established an accelerated Phase 3 program for MDD.

However, it’s also had some setbacks earlier this year: two months after their ketamine-like drug failed a phase 2 trial in depression, ATAI laid off 30% of staff as it allocated resources to pushing candidates through mid-stage trials.

Interestingly enough, it has significant stakes in two competitors: Compass Pathways, and GH Research.

Compass Pathways (CMPS):

Compass specializes in synthetic psilocybin therapy for treatment-resistant depression, anorexia nervosa, and PTSD treatment.

This is a fast growing market: inpatient visits for eating disorders increased by 107.4% between 2018 and mid-2022. Visits linked to anorexia nervosa saw a striking 129.26% increase. About 6% of the U.S. population is projected to experience PTSD at some point, and around 50% of those affected by PTSD actively seek treatment.

Clinical trial outcomes for their leading drug candidate, COMP360, are favorable. A clinical study showed over 50% of depression patients exhibited significant remission signs within 18 months of Compass' treatment. If late-stage trials continue successfully, psilocybin-assisted therapy could gain regulatory approval by early 2027. It also submitted a New Drug Application (NDA) to the FDA, with a decision expected in 2023.

CMPS is named the first-ever “psychedelic unicorn”, with a valuation of over $1 billion – pumping up ATAI’s own valuation in the process.

GH Research (GHRS):

GHRS has a unique position in depression treatment using exclusive 5-MeO-DMT therapies, also known as GH001.

Preclinical data for GH001, published in Nature Medicine on December 6, 2022, show potential efficacy for treatment-resistant depression (TRD).

GHRS is dedicated to advancing depression treatments with substantial financial support for faster progress.

GHRS is another company where ATAI holds a stake.

MindMed

MindMed focuses on depression, anxiety, and addiction.

Experienced a significant milestone recently: the FDA granted clearance for a new drug application for MM-120, a specialized LSD variant for generalized anxiety disorder. Phase 2 trials for this drug are underway, with the initial results expected by late this year.

MindMed has access to advanced research and development facilities, having closed partnerships with the University of California, San Francisco, and the University of British Columbia.

Seelos Therapeutics (SEEL):

SEEL focuses on Central Nervous System (CNS) disorders and rare medical conditions.

SLS-002, its leading drug candidate, is an intranasal racemic ketamine designed for acute suicidal ideation and behavior (ASIB). Initial results will be available in the third quarter of this year.

They also plan to present a study on Alzheimer's disease at the Society for Neuroscience in November this year.

Are psilocybin stocks a good investment?

Obviously both the FDA's approval for psychedelic drug development, and the California legalization are big steps forward for the industry.

At the same time, the market for these drugs is significant, with potentially millions of customers who right now lack an effective treatment for their disorders.

However, does this mean that this is an opportunity for us investors?

Depends.

There are a few challenges in the space, but if we take a step back from regulation and focus on the companies themselves, we notice that they’re mostly pre-revenue. Even if they’re publicly traded companies, we should still consider them startups.

Since they’re still “in startup mode”, traditional valuation methods don’t really apply.

We need to think like a VC (venture capital) investor.

What are some basic VC investing principles?

“Power law”: most of the returns will come from a small number of winners.

“Spray and pray”: related to the power law, basically you need to recognize that it’s incredibly difficult to predict “the next Google” – and taking a small stake in multiple companies is probably a better idea.

“Get in early”: you need to identify trends before they’re mainstream. This is where frameworks like the Gartner Hype Cycle are useful.

“Back the fastest movers”: startups should race, not walk. For a VC, rate of growth is most important. Since our psylocibin companies are not yet making revenue, the next best metric is how fast they’re racing to research.

“Due Diligence matters:” an investor in startups needs to focus more on the risks in a startup rather than their product or growth. Things like team, regulatory blocks, and runway (how long until they run out of cash) can easily break what could have been a great early-stage company.

This is we should compare them and see:

which ones race faster (mostly in terms of research & development)

which ones have a longer “runway” (a term venture capital investors use to express how long a startup has until it runs out of cash)

Speed

Most of the companies here behave as research labs, and a big chunk of their operating expenses are dedicated to research and development.

If we compare their R&D costs to their other costs, Seelos and GH Research seem to be “racing” the fastest. But in terms of brute spending on R&D, Compass and ATAI are certainly bringing more firepower:

Runway

For a startup, runway is life.

This is especially important for a “publicly traded startup” like these companies are. In the usual (private, that is) startup, you can always find a VC investor to raise a new round – if the numbers look good and you have great sales skills, of course. But once you’re public, things are not as easy – and your metrics there in public, for everyone to see.

So how long until these companies start feeling the pinch?

Seelos, ATAI, and Compass seem to be well capitalized, with sufficient runway to last them until they can launch a product – at which point they can either issue more stock, take on debt, or maybe even earn revenue.

To sum it up, ATAI and Compass (in this order) seem to be the most obvious bets. Seelos is certainly punching above its weight in terms of research speed and runway, but it is a bit of a wild card. MindMed and GH Research seem a bit doubtful – and perhaps soon facing an existential risk…

Whatever the future holds for these specific companies is hard to say – but for the industry as a whole, there is a decent chance that psilocybin will follow the trajectory of cannabis:

Or not.

Regardless, investing in listed early-stage, pre-revenue companies should be a risk category all of its own. The fact that these companies are active in an area still subject to evolving regulations and uncertain outcomes should make you especially wary.

And even if you catch the next boom early, timing it and making sure to take profit before the bubble pops, or staying invested and waiting for long-term returns while the stock goes up and down violently might not be as easy as it sounds...

But of course you can also think of this as “investing for a greater good”: considering the many downsides associated with traditional mental health treatments, we should be at least a little excited to see less risky and addictive alternatives being produced.

In any case, please bear in mind this disclaimer: we talk about various stocks, funds, and securities because they’re interesting or can be used to teach a lesson about investing. None of the posts we publish are intended to be taken as individual investment advice or a recommendation to buy or sell any specific stock or other security. We can’t even guarantee that our information sources are 100% accurate. The only purpose of these posts is to teach you how to do research and figure this stuff out for yourself.