"Price of Time" book summary part 3: lessons for investors.

Interest rates influence all asset prices, from stocks to property to crypto, more than you think. This post continues our summary of “The Price of Time” by Edward Chancellor.

This post continues our review and summary of “The Price of Time” by Edward Chancellor.

Its main premise is simple: we’re in a decades-long experiment to push interest rates as low as possible. It also has a few scary conclusions regarding rising inequality, authoritarianism, and how this all might end.

But let’s not focus on that.

Let’s talk about what we, investors, can take from it.

For starters, the book has a ton of examples of what happens to markets when interest rates go too low (for a reminder of what “too low” means, please check part 2 of the review).

Lessons from the past

1700s France

This is a situation eerily similar to the one US has been in after 2008.

In France, after King Louis XIV died, the country was facing mountains of debts.

Enter John Law – an outlaw in England that managed to escape to France and climb his way up to become a finance minister and tycoon. His biography sounds like the next book on the list, to be honest.

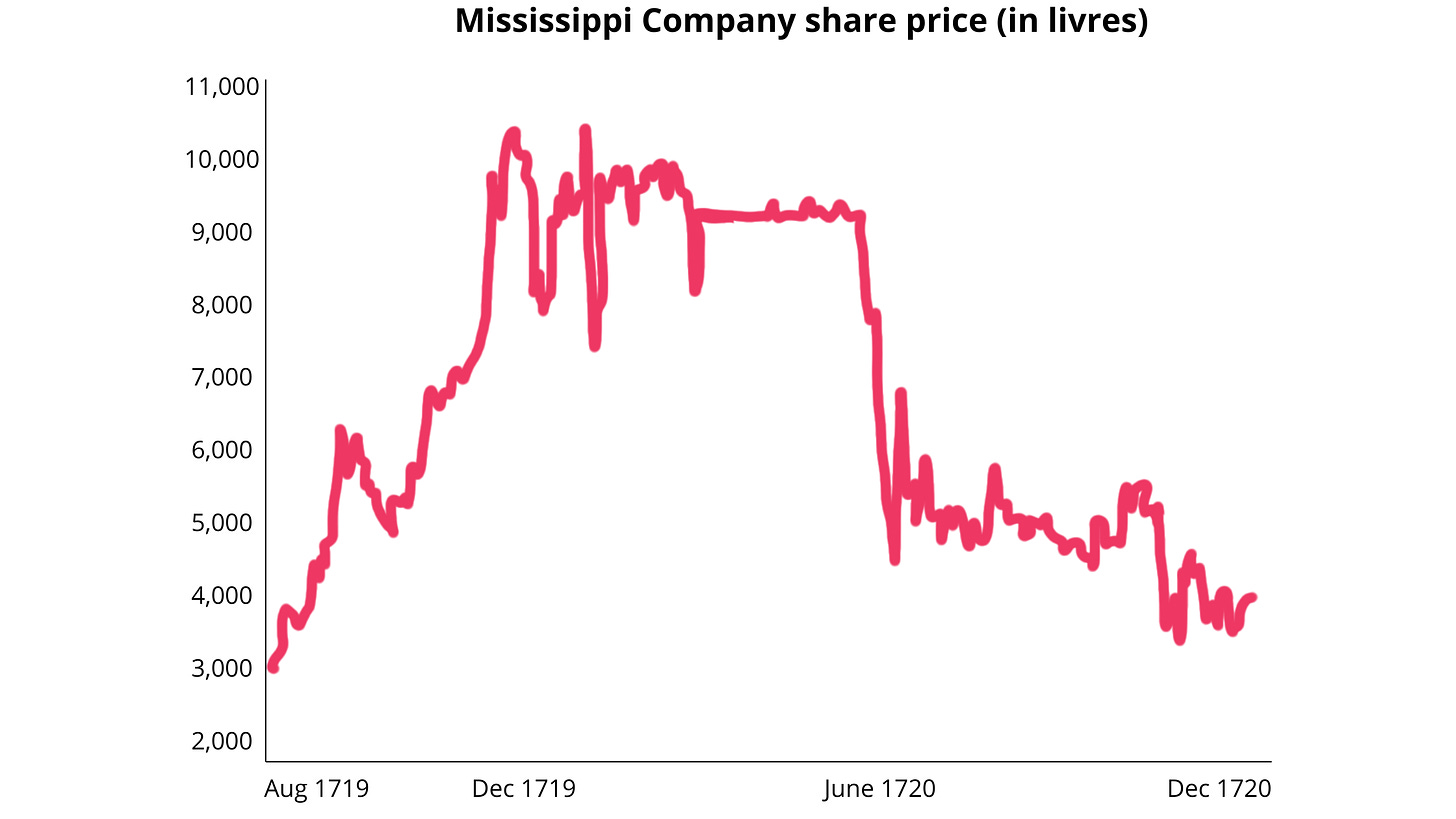

After rising to the top, he essentially created France’s first central bank and also the Mississippi Company – one of the earliest conglomerates. At this point, France started pushing down interest rates, around 2% – the danger zone. It also started printing money by buying government debts and Mississippi Company shares, which were interchangeable with government debt.

Long story short, it triggered a massive inflation (23%), created a huge bubble in the Mississippi Company share price – which then crashed by 90% in 1720.

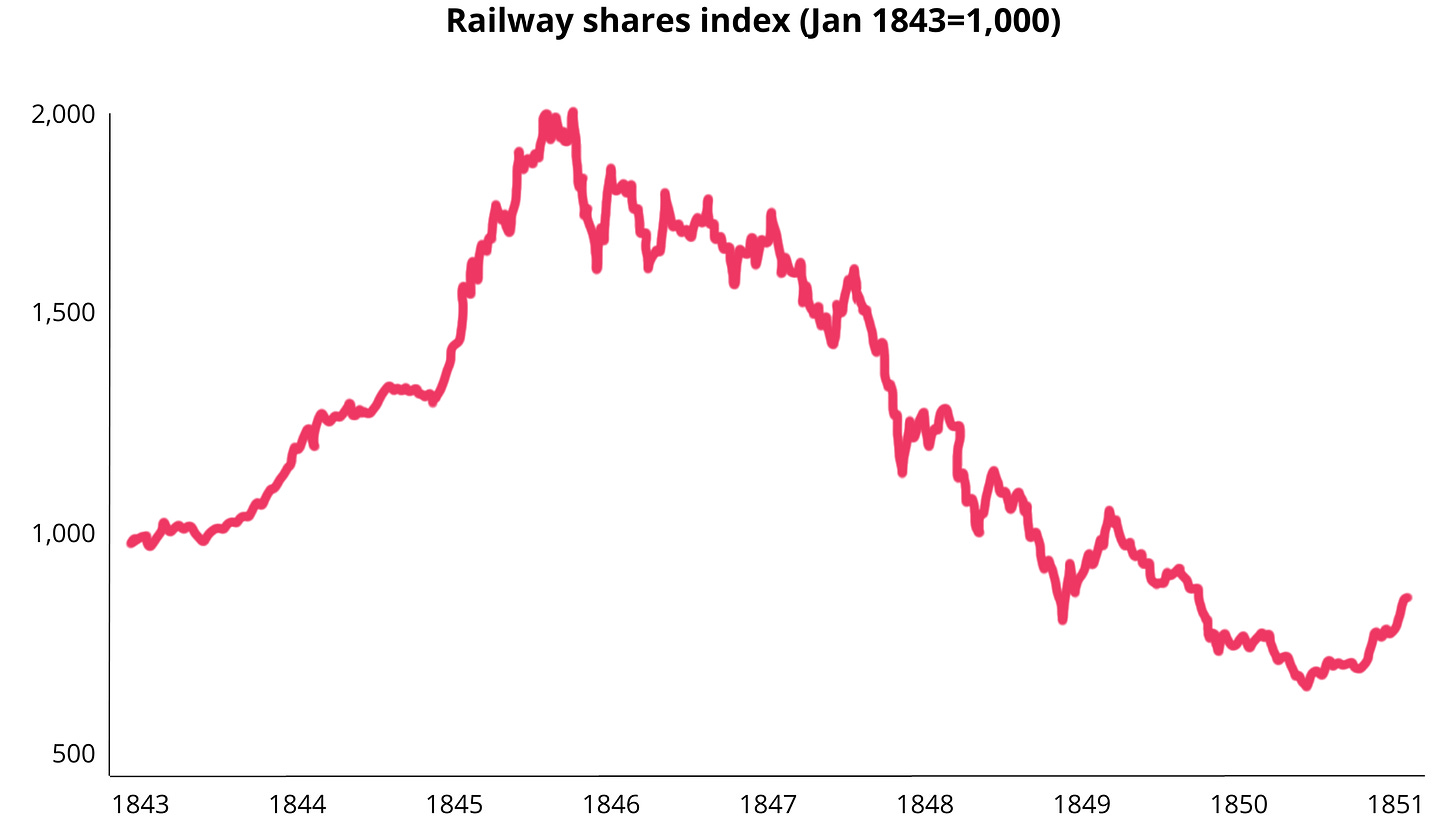

Railway Mania 1840s

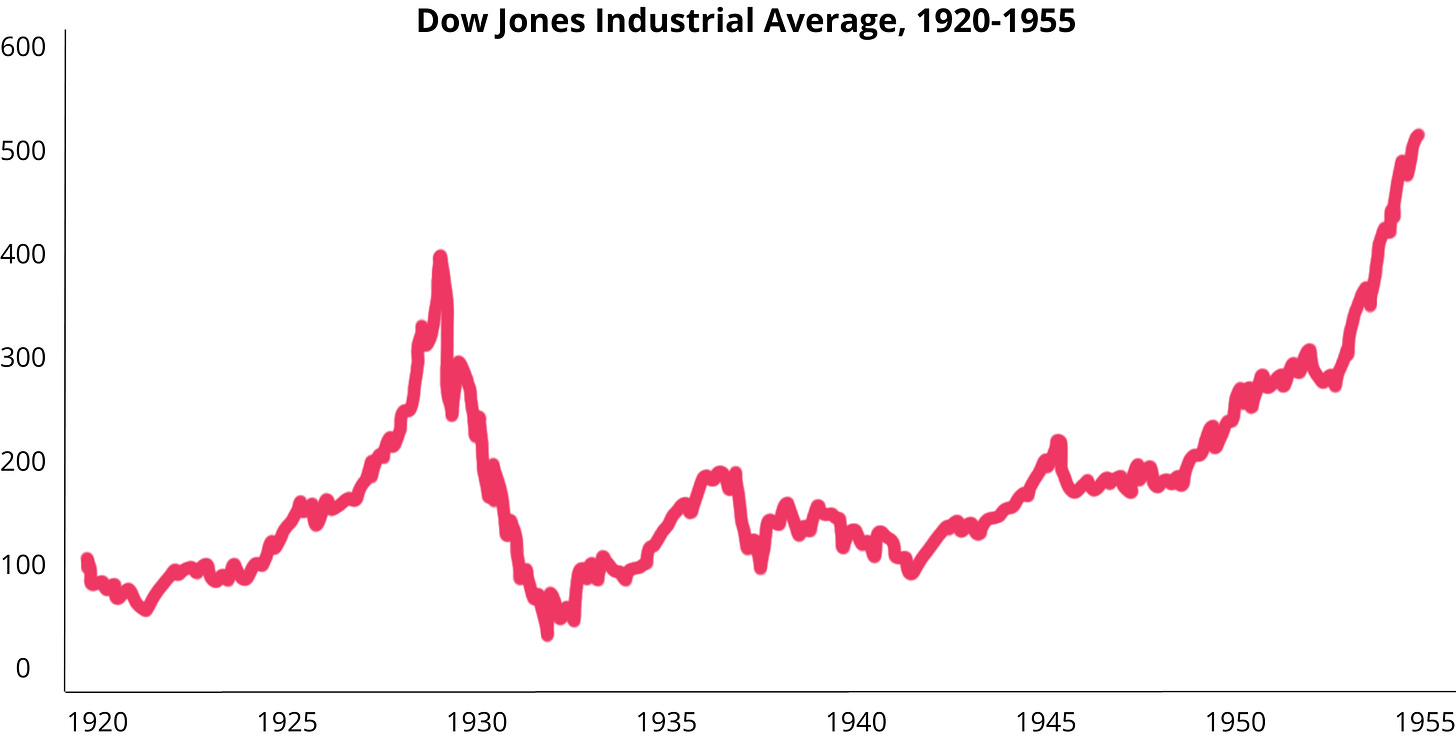

Roaring 1920s

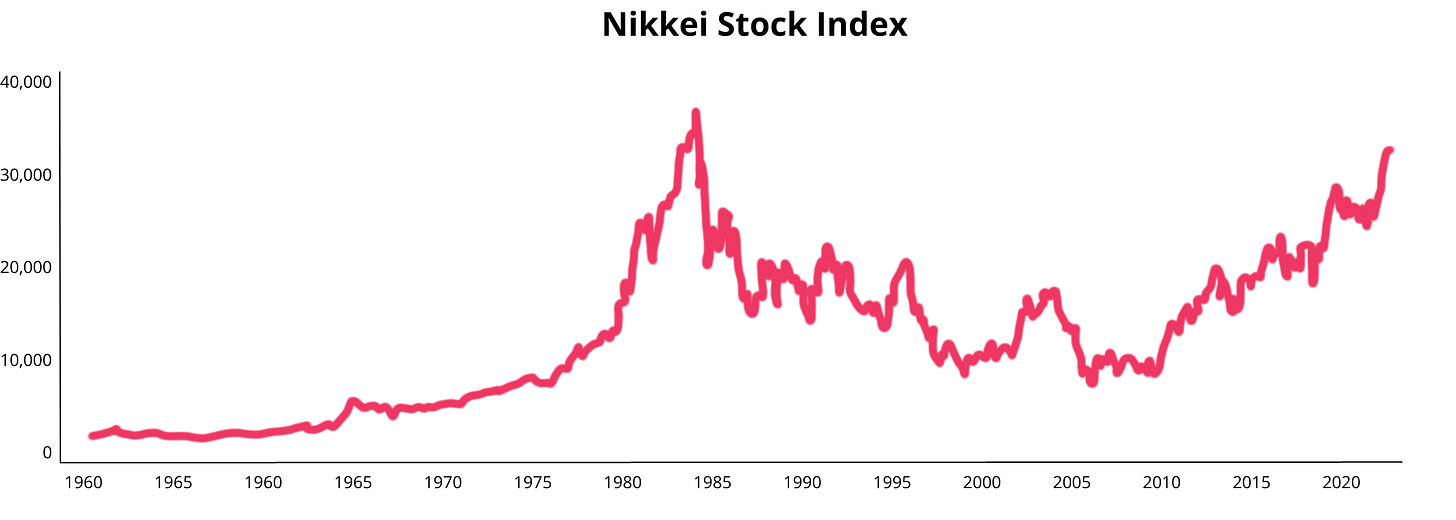

Japan in the 1980s

What all these examples have in common is that when interest rates get too low investors pretty much “lose their mind”, looking for any investment that can get them a decent return, regardless of risk or viability.

And that risk-on attitude seems like a good choice, for a while.

But that bull run always concludes in a painful correction.

A crash.

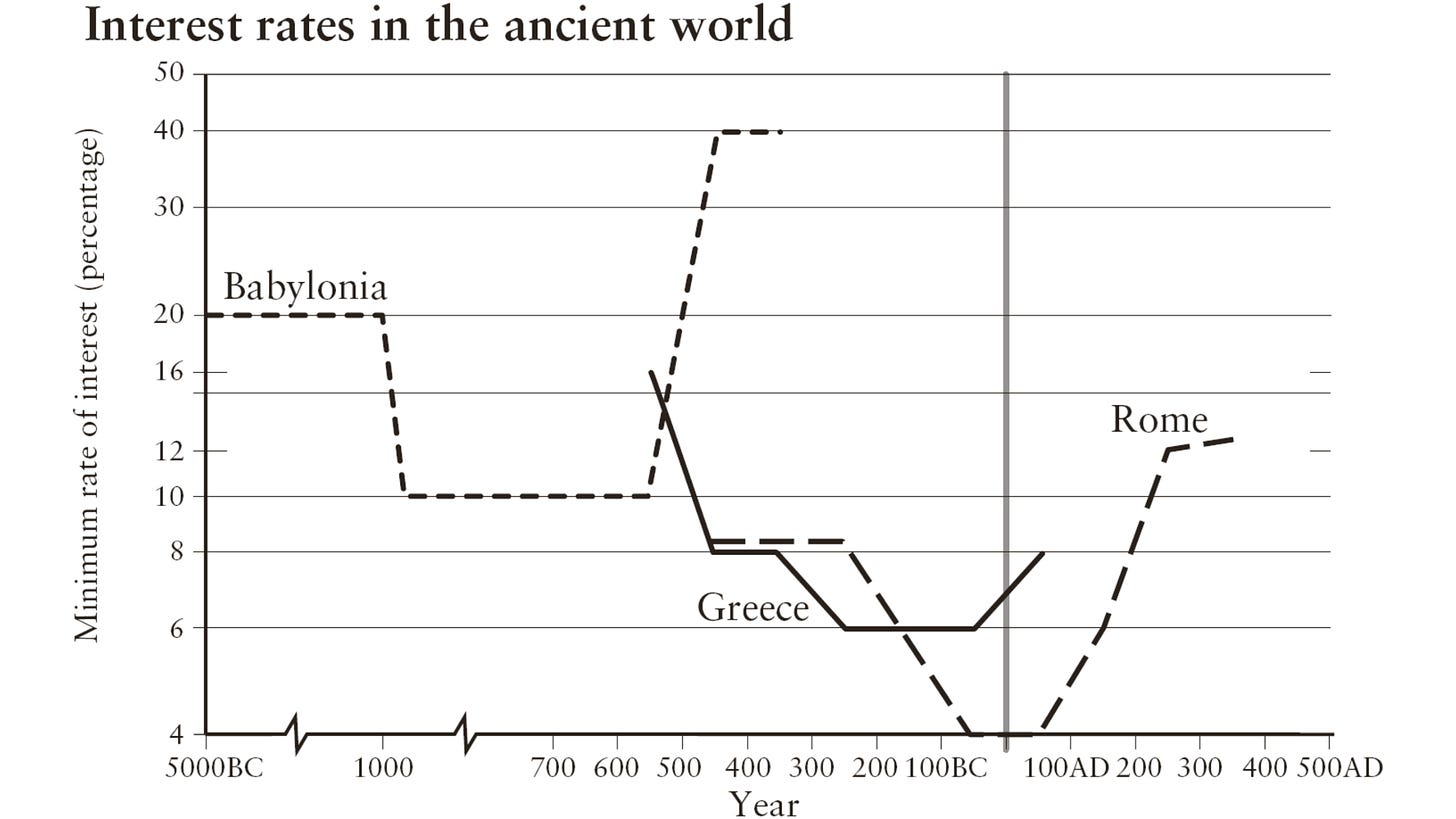

Or maybe even more than a crash – the book points out that each civilization tends to have interest rates that behave in sync with its “lifetime”: rates get lower as the civilization becomes more modern and powerful, then snap back up as it enters decline.

But we’ll leave this sort of macro speculating to others.

Let’s focus on our investments.

Strategies for investors

Be skeptical

First, the book is a great reminder to not always trust what famous economists and bankers say.

Many will tell you “this time is different” and “stocks only go up” right before being wiped out themselves.

Some great examples:

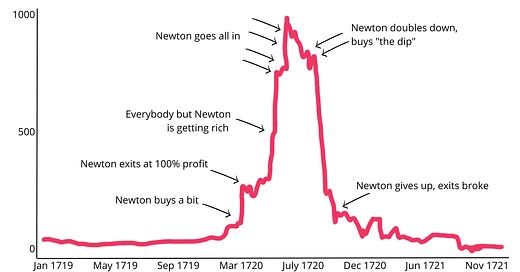

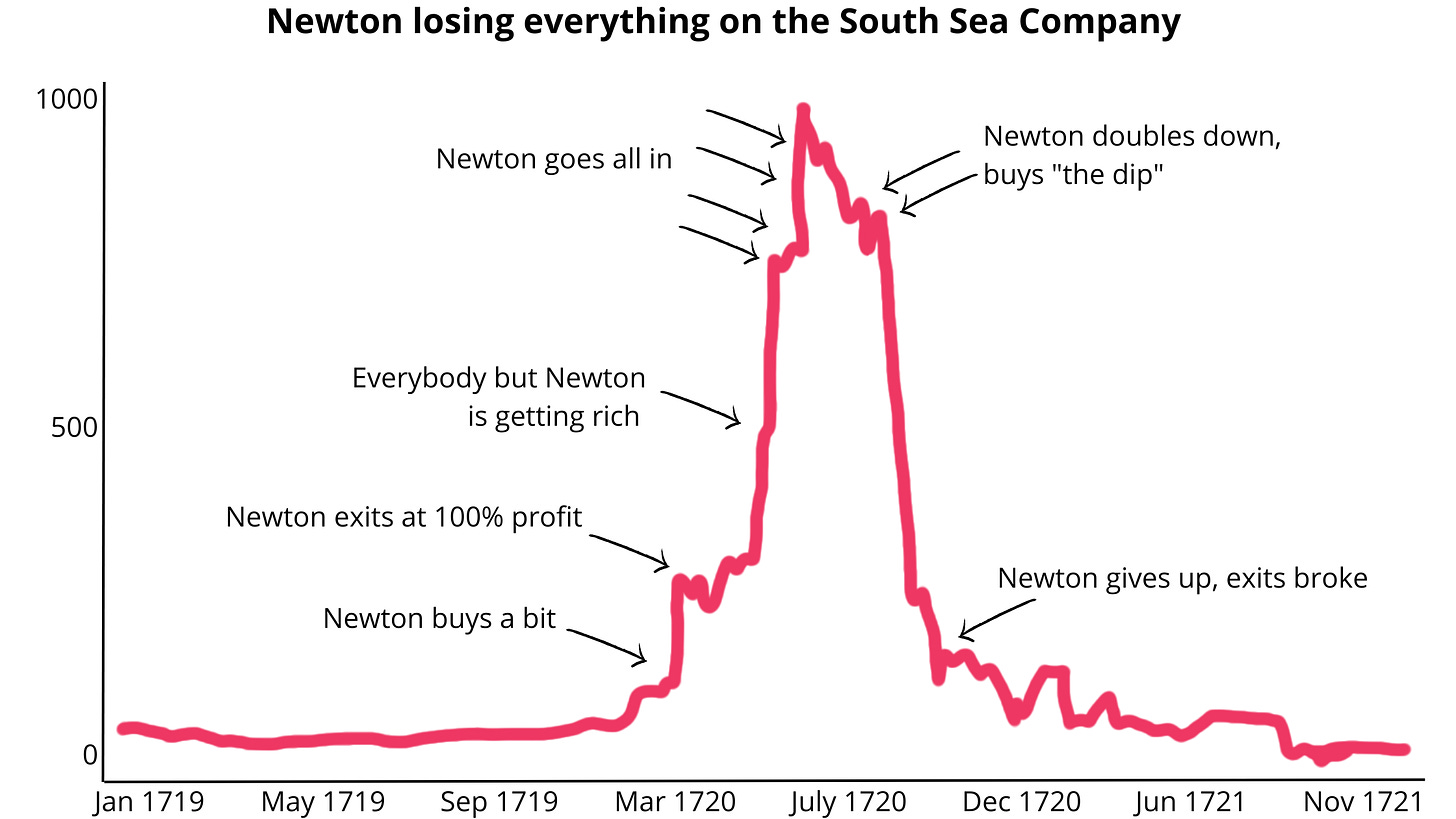

Isaac Newton

You know, the guy who invented calculus, the kind of math we use to send rockets to space?

He lost £20,000 (or more than $5 million in 2023 money) by FOMO buying shares in the South Sea Company… at the very top.

John Maynard Keynes

He’s the guy who basically created modern economic theory – and whose ideas on business cycles and using government spending to bounce back from recessions influenced most economists and central bankers.

That did not help him in the stock market.

Here’s a quote from “The Price of Time” again, showing a conversation between Keynes and a Swiss banker friend… in 1928:

Keynes: “I think the market is very appealing, and prices are low,’ said Keynes. ‘And where is the crash coming from in any case?’

Banker friend: “The crash will come from the gap between appearances and reality.”

Chancellor does not pull punches next:

“If Keynes failed to heed this warning it was because he’d enjoyed no previous success in applying interest rates and other macroeconomic inputs to his own investment process and had given up on what he called ‘credit cycle investment’.

Between 1927 and the end of 1929, Keynes’s personal fortune declined by more than three-quarters, from £44,000 to £7,815”

Remember, this was not just any economist, but one of the top economists ever.

Irving Fisher

The grandfather of modern monetary theory, and one of the most important economists of the 20th century, just like Keynes.

Just like Keynes, he saw nothing wrong with bubbling stock prices. This is him, in the summer of 1929 (literally right before the crash):

“Stocks have reached what looks like a permanently high plateau.”

And just like Keynes, he…

“lost a fortune in the ensuing market rout and had to be bailed out by Yale.

Should investors be banned from reading economics books?

The 2008 Global Financial Crisis is not over

Second, the book argues quite successfully that the crisis from 2008 is far from over – only delayed and prolonged.

Basically, many of the issues and crises since 2008, like:

the “zombification” of corporations

lower productivity

the everything bubble

the Arab Spring in 2011

the collapse of Brazil in 2013

Greece in 2015

the crash of the Turkish Lira

the crash of the Argentinian Peso

the chaos in Italy

the boom and bust in China

and even the global inflation since 2022

...are all the result of the persistent low interest rate policy adopted by central banks.

The future, at least according to the book’s logic?

A colossal meltdown.

Stocks are more influenced by central bankers than investors like to admit

Third, the book forces us to acknowledge that interest rates do impact valuations and stock prices quite a bit – so a strategy of “buy stocks when interest rates are going down and take profit when they’re going up” is pretty much implied.

With that being said, the conclusion of the book does suggest some strategies for us investors.

When interest rates are going down:

Load up on assets with earnings “far into the future”, like tech stocks, as well as property (REITs), and even cryptos. Be aggressive. Chancellor says it clearly:

“It is no coincidence that the greatest fortunes have been gained during periods of abnormally low interest rates.”

Carefully invest in companies from countries with high debt: servicing it usually needs more debt to pay back existing interest, and low interest rates beget low interest rates.

Invest in “inequality play” like luxury goods manufacturers (LVMH?)

Invest in housing REITs – low interest rates create bloated asset prices, especially in housing.

As the 99% have to take on more work to make ends meet, consider investing in companies that service the self-employed (H&R block?). Chancellor observes that

“an increasing number of Americans were forced to work beyond the traditional retirement age. For younger workers, the dream of enjoying a comfortable old age would remain a dream — another illusion of wealth. Pensioners faced the prospect of their nest eggs running out.”

Careful with banks: according to “The Price of Time”, they basically have no business model in an age of low interest rates, which is why so many of them go into subprime lending and investment banking.

Also consider the risk of pension system failure, as well as the increasing future obligations of companies with large pension liabilities. Chancellor quotes Michael Burry (you might have met him in “The Big Short”):

“The zero interest-rate policy broke the social contract for generations of hardworking Americans who saved for retirement, only to find their savings are not nearly enough.”

On the same note – why not invest in gambling companies? There’s nothing that says high risk like a “put it all on red”.

But throughout all, keep some cash ready to scoop up opportunities. According to “The Price of Time”, in a world of persistent low rates, the risk of collapse is always there:

When interest rates are going up:

Load up on defensive stocks and high quality, cash rich, high margin businesses instead.

As mentioned above, it would be nice to have cash available to scoop up opportunities that will become undervalued as other investors panic sell.

Keep away from private equity firms and companies with large debts if interest rates rise.

Look into Sharia-friendly ETFs or dig into their composition and pick your winners). Sharia Finance (or Islamic Finance) only allows for companies with no debt or which make no revenues from interest to be included in a fund. Not a bad choice when interest rates are going up.

Lastly, consider which companies benefit from a potential “reversal of globalization”. Defense companies and “national heroes” could make the cut.

Again, these themes and ideas are entirely based on the book.

We can’t stress this enough: this review really isn’t financial advice. The whole point is to make you look at interest and the relationship between interest and stock prices from a new perspective.

We hope you enjoyed this review and summary of “The Price of Time” by Edward Chancellor. The investment ideas here are just thought starters – we’ll review them in a post soon, and share some more specific ideas in detail.