Is this Indonesian REIT a "Falling Knife" or "Hidden Gem"?

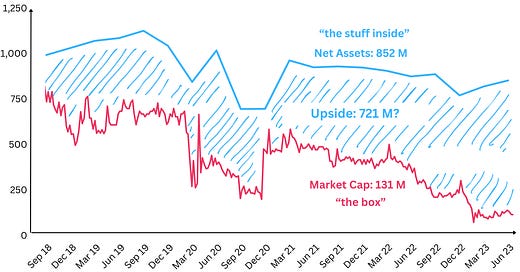

Lippo Malls REIT's share price has dropped by 93% over the past 5 years, and seems to be more than 80% undervalued. But is it "a buy"?

Let’s say someone asks you to put a price on a cardboard box filled with some valuables.

The price of the stuff inside might vary depending on which pawn shop you ask, but you pretty much have an idea of how much money you could get for it.

How much is the box worth?

This is the question we’re going to try to answer today.

Why is Lippo Malls interesting?

Lippo Malls – our box – has some debt. The debt is expensive, and coming due soon. Investors are scared.

But even if we look just at the value of what could be left over after the debt is paid (the stuff inside the box), there still seems to be a ton of value left.

And that value seems to be available for a ridiculously low price:

In our previous article we saw that choosing the most undervalued stocks, what investors call "deep trash", can actually be a way to find "multibaggers" (stocks that can grow many times in price).

Lippo Malls seems to fit the bill:

trades at an incredible 15% of book value (total assets minus debt)

zero analysts are covering it

investors are not touching it: the price has dropped 93% over the past 5 years

Looking at what assets the company has, the amount of revenue it generates, and how the market is pricing it, something just doesn't make sense.

Let’s dig in.

How did I come across Lippo Malls?

I lived in Bali for a few months in 2022 and 2023.

One day I finished some shopping in the nearby Lippo Mall, and as I was sipping my coffee in one of the many excellent coffeeshops around, I got curious to learn more about the Indonesian market.

For this, I used a basic stock screener to find companies with low P/E (price to earnings) and P/B (price to book) ratios. After all, buying stocks when they’re out of favor works better over the long term.

So you can imagine my curiosity when both my “buy low, sell high” screener and my “invest in what you know” filter pointed to the place I just came out of.

Lippo Malls.

A bit about Lippo Malls REIT

Lippo Malls is a large operator of malls and commercial spaces across Indonesia. Founded in 2007, it has since amassed 29 properties worth 1.75 billion SGD (that’s about 1.25 billion USD) in some of the most prime locations there:

Considering that foreign investors can’t easily buy Indonesian listed stocks, Lippo Malls, as a REIT (real estate investment trust) listed in Singapore, could be “a unique opportunity to participate in the bustling retail property sector in Southeast Asia’s largest economy”, as the company puts it.

So what’s going on with the price?

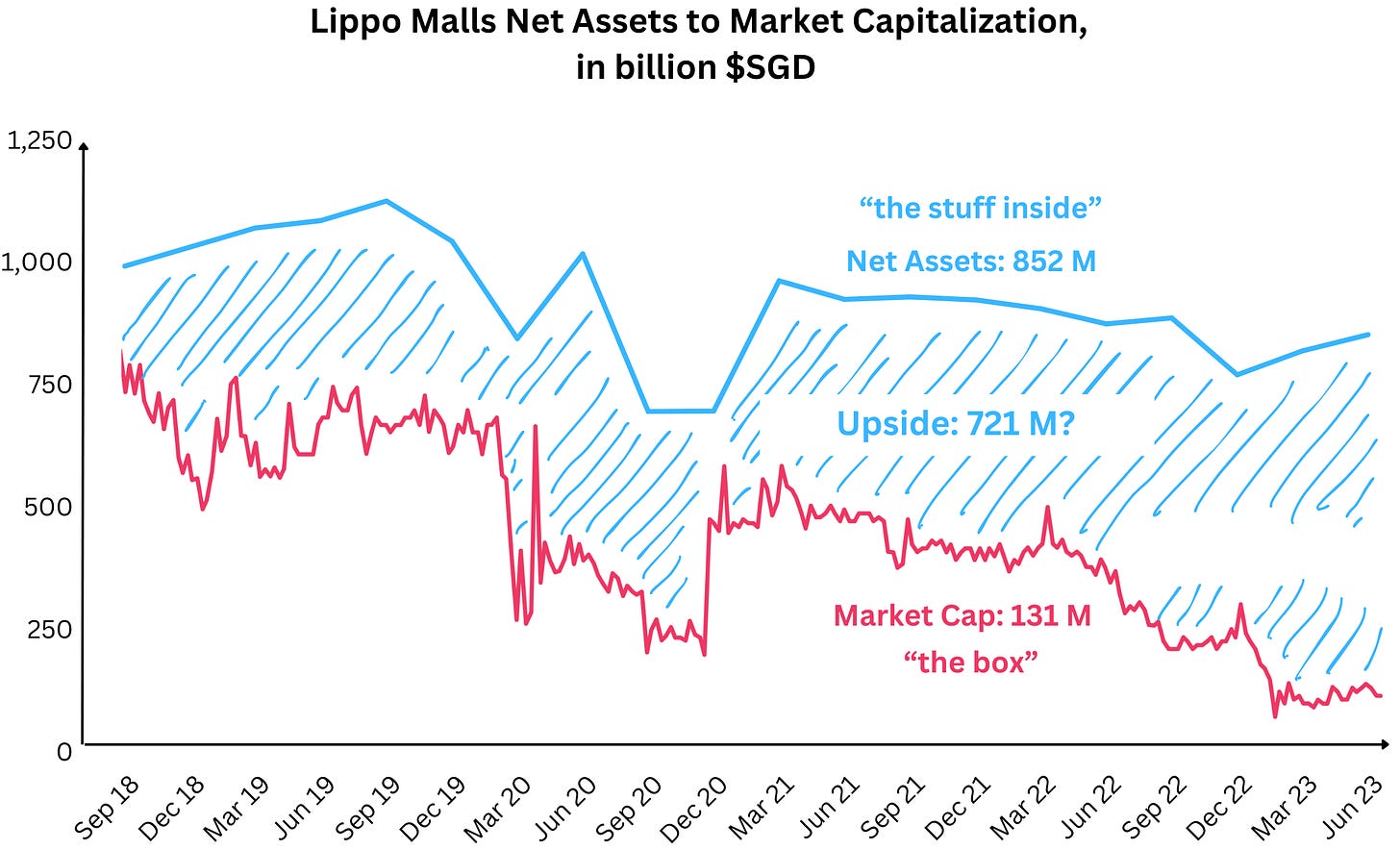

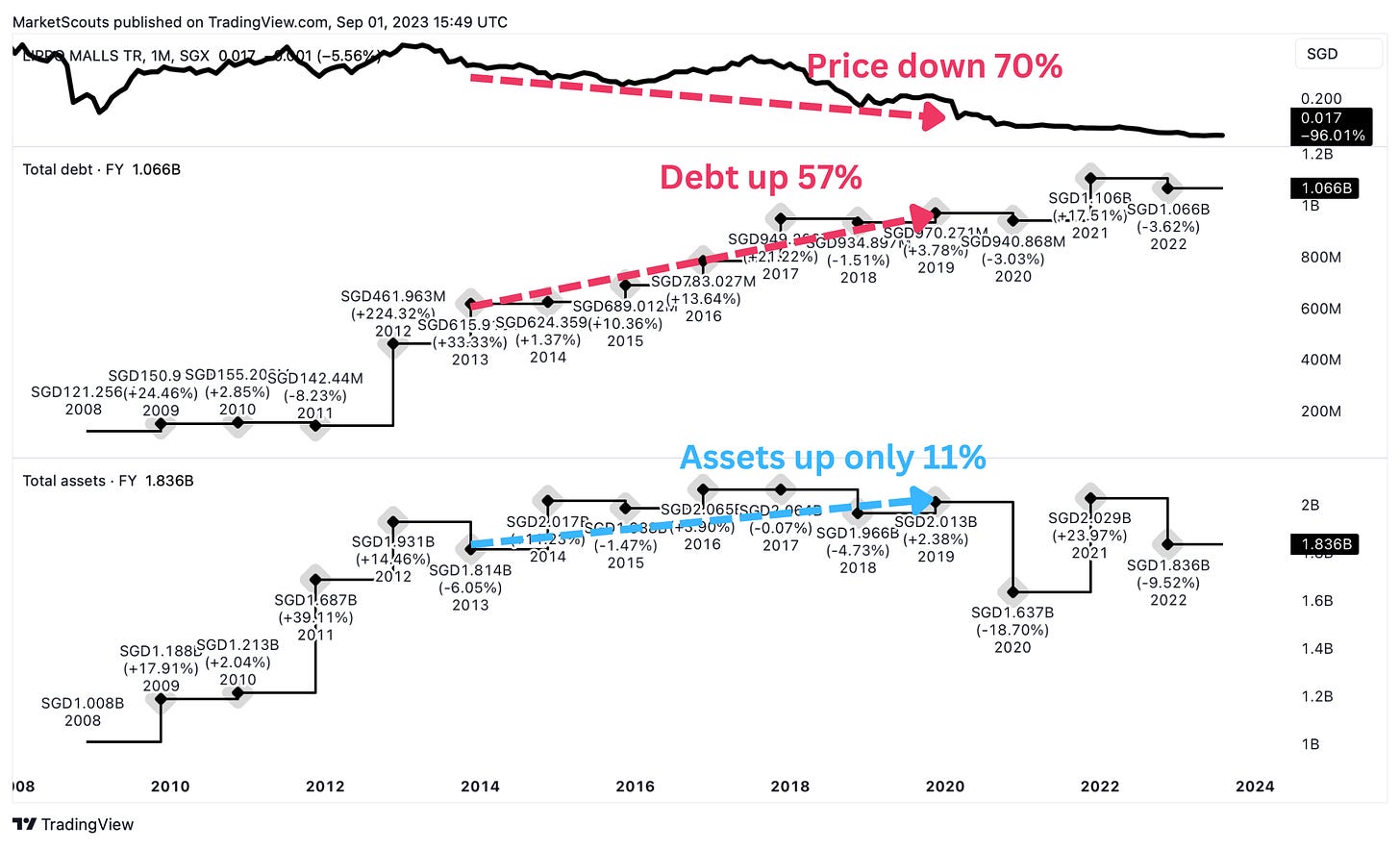

Lippo Mall went through one of the biggest stock drops I’ve seen: -97% down since IPO!

Now, you might be saying: well fine, at least it’s a REIT and it pays distributions – a piece of that juicy rental revenue. A REIT investor is basically a little landlord. Maybe that would make up for the loss in price?

You’d be wrong: an investor who bought then and held on to the stock would be looking at a loss of 0.012 SGD per share – even after taking into account all the distributions the trust has paid!

But why?

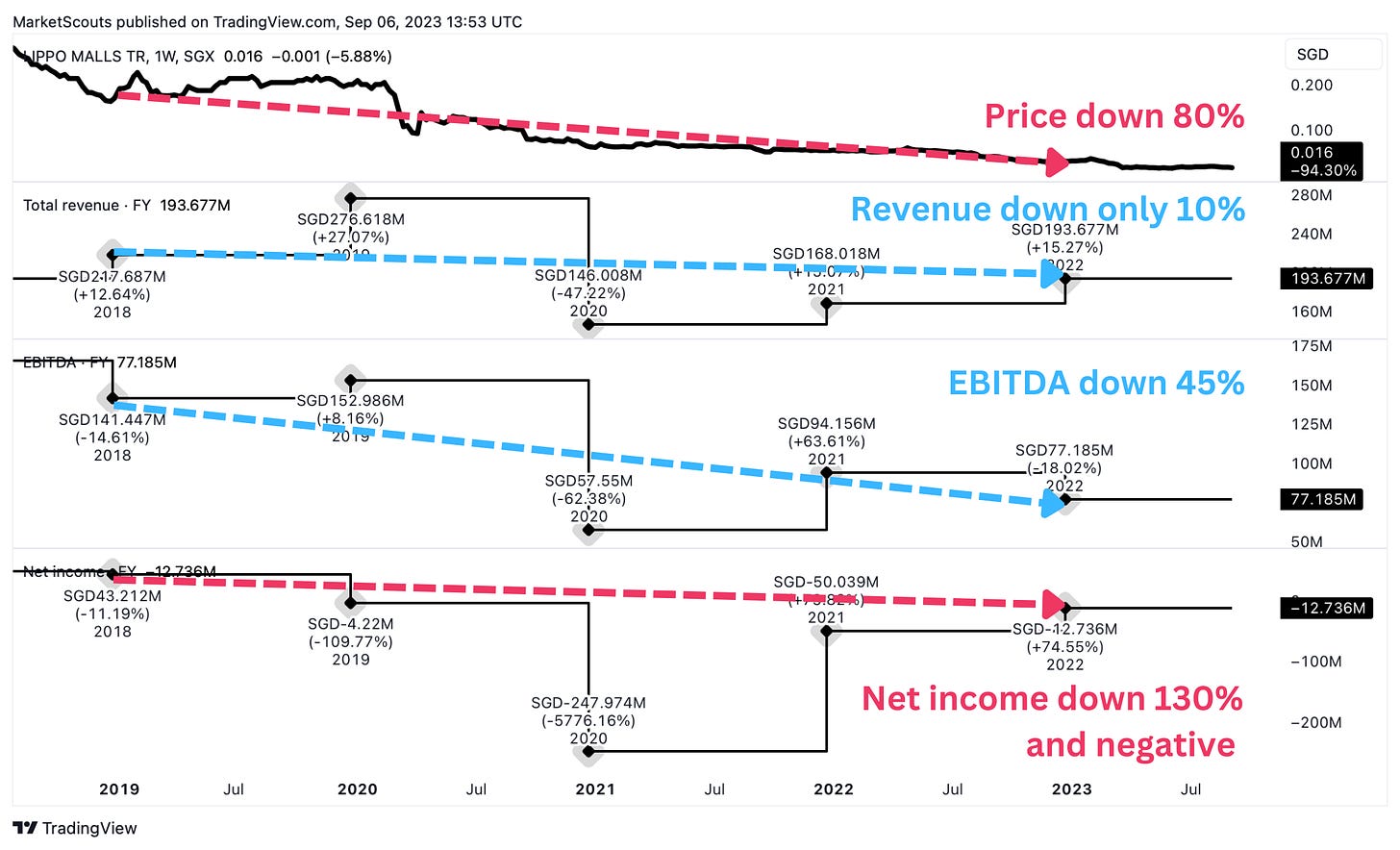

We’ve seen that the trust trades at a big discount to its assets – that’s how I found it in the first place. So the drop in market cap isn’t driven by a drop in asset value.

At this point our mission has two parts:

find out why the “discount” on Lippo Malls is so high: what are other investors scared of?

figure out if we want to take the risk.

Why is Lippo Malls on such a large discount?

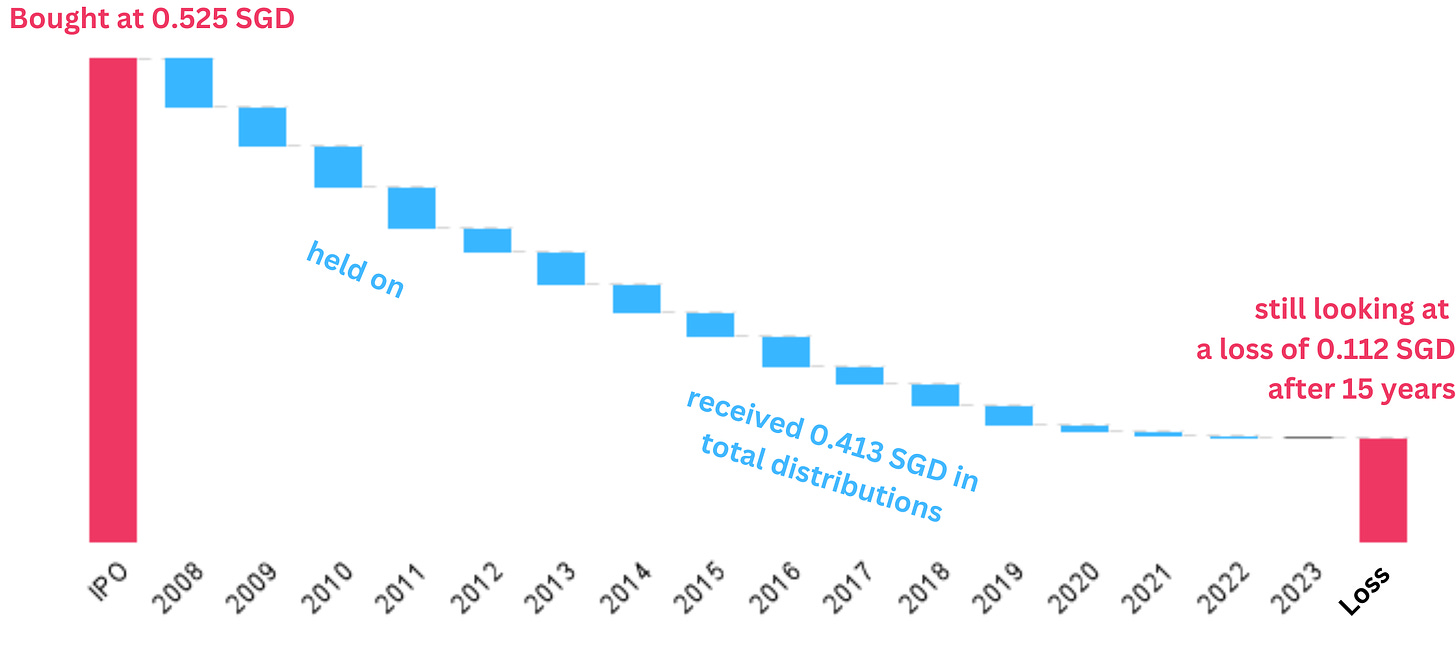

Let’s look at the trust’s revenue and profit, and see if something stands out: use the 80/20 rule!

So: despite surviving the pandemic with its revenue in decent shape, Lippo Mall Trust’s net income is down as a rock and showing a loss.

So let’s unpack how “EBITDA” (profit before interest, taxes, and depreciation) becomes “net income”. We’ll skip T (taxes) because a positive percentage (tax rate) times a positive number (profit) won’t turn it negative.

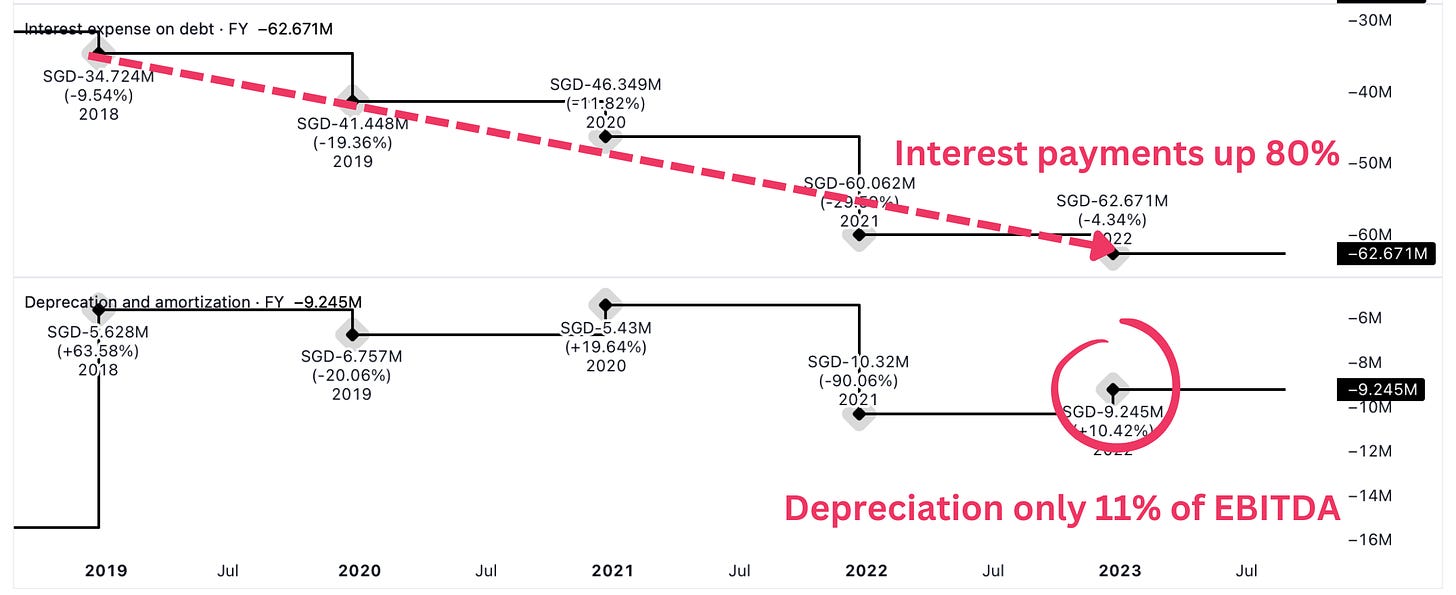

Two things are interesting here:

interest payments are going up (costs are labeled are negative in TradingView, so down is up); they’re also mirroring the drop in stock price.

depreciation and amortization have also gone up but are quite small – perhaps the debt was not used to acquire new assets?

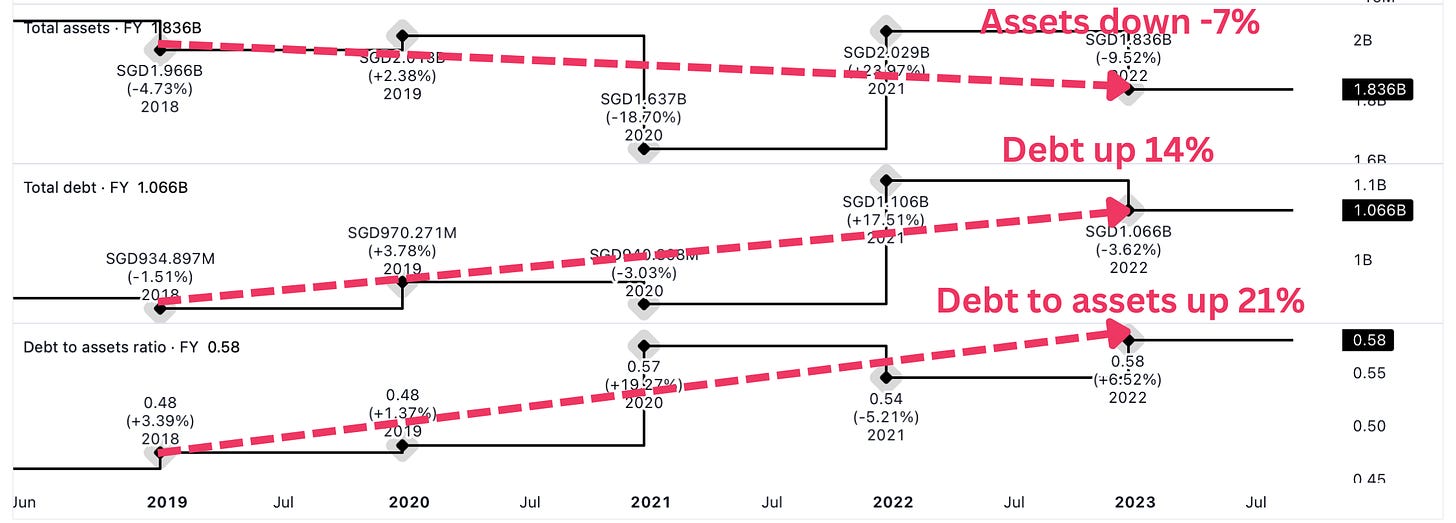

Let’s verify this by looking at the debt, and debt to assets:

Hard to imagine the debt was used to buy new mall leases – as the value of the assets has actually gone down.

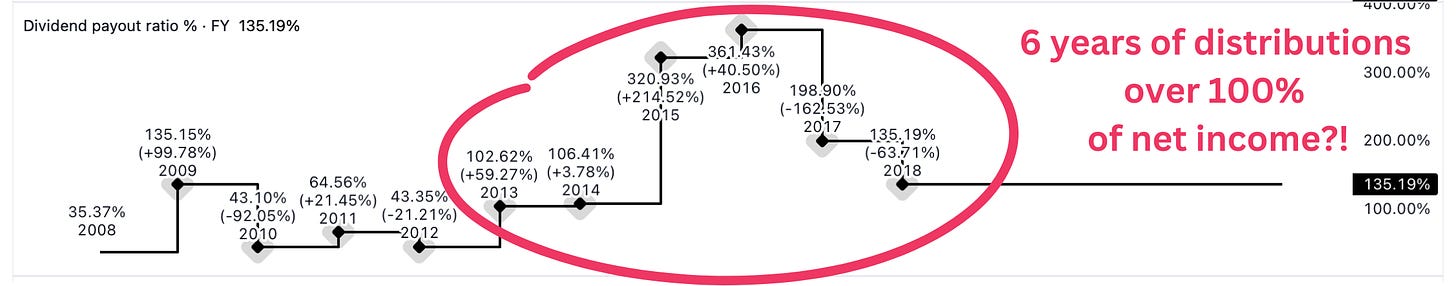

I’m starting to suspect debt was taken in order to pay distributions. Let’s compare the distributions to what the trust earned, since it started:

Two things seem to confirm my theory here:

First: distributions are consistently over 100% between 2013 and 2019. Distributions or dividends over 100% should always make you cautious: it means that the company is dipping into its cash reserves (or maybe even taking on debt) to pay investors. It rarely ends well: GE did something similar by borrowing at low rates to buy back shares, and later lost over 90% of its market cap.

Second: between 2013 and 2019, even as Lippo Malls’ assets grew by 11% and profits by 26%, its total debt ballooned by… 57%.

Now the picture’s a bit clearer: the trust is bleeding out cash, with interest eating up more than 80% of EBITDA, and for debt that seems meant for “financial engineering” rather than productive purposes.

Will they be able to pay off this debt?

There are five things we need to look at.

One: are the profits sufficient to pay interest?

For now yes, but barely. The trust spent 80% of its EBITDA on interest last year. 2023 was a bit better: only 55% so far, as profit increased.

Two: how much higher can interest get?

The trust earns revenue in Indonesian rupiah (IDR) but has to pay interest mostly in Singapore dollar (SGD). So far in 2023 this led to an additional foreign exchange loss of 3.4M.

Not the worst news, though: this is less than the first half of 2022, which saw a bigger loss of 19M. The IDR has started to recover some losses against the SGD. And the piece of the debt that’s in USD has mostly been swapped to SGD too.

Also, about 61% of the interest on this debt is variable, usually a risk factor. However, as Singapore’s economy is slowing down, the central bank has already halted their interest rate increases – more good news for Lippo Malls.

Three: are the assets enough to cover debts, in case the company has to sell off some of them in order to meet liabilities?

Obviously, yes in theory – we saw the price to book ratio.

That might be too optimistic. But even if we assume a “fire sale”, where everything is sold at a massive 30% discount, we’re still talking about 281M left over.

Plus, the entire debt is on an unsecured basis – which means that creditors can’t easily “collect”. This could, in theory, give Lippo Malls some advantage in renegotiating or refinancing its debt.

Four: is the company willing to do the hard things?

Already is. It changed management and shuffled part of its board of directors. And it also cancelled distributions for its “perpetual securities”, technically a form of default – and a deeply unpopular move with investors and rating agencies.

In the short term, it was a painful but needed move to conserve cash: “based on the Group’s cash flow forecast for the next 12 months, the Manager believes the Group will be able to pay its debts as when they fall due”.

In the medium term, this definitely hurt the renegotiation process: “ongoing negotiations with existing bank lenders remain challenging due to current financial market conditions and the downgrading of the Trust’s credit ratings in 4Q 2022”.

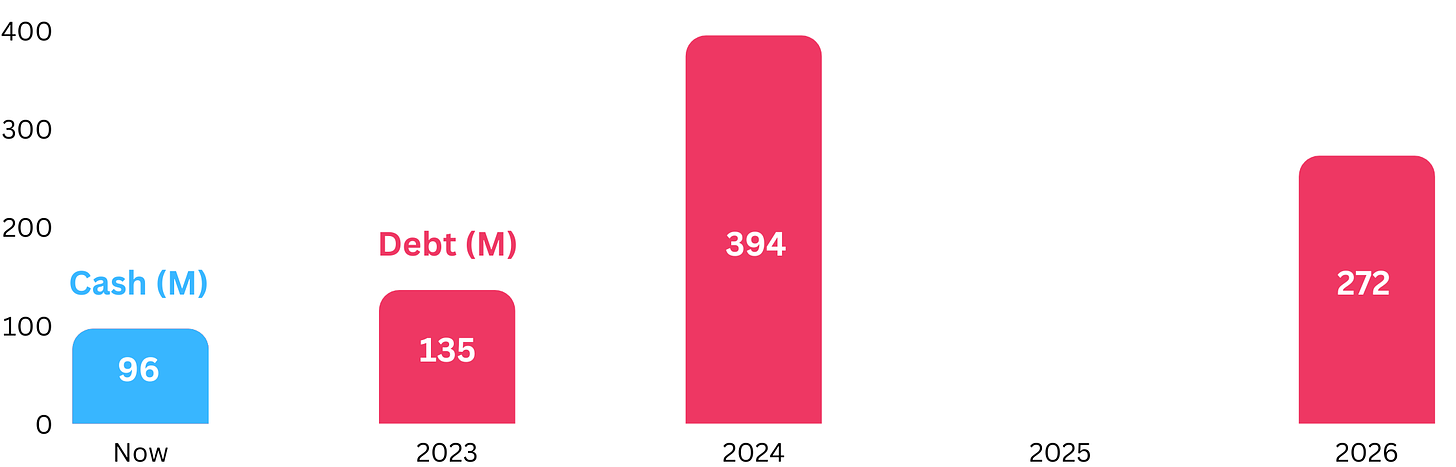

The biggest challenge here is time, though: the entire debt is due in February 2026, with the biggest chunk in June 2024:

Five: is the business healthy?

First off, while the pandemic has dealt a serious blow to retail REITs like Lippo Malls, it’s been able to navigate it better than other mall operators by offering discounts to tenants. As things return to normal the profitability should increase.

It seems to be on track: shopper traffic to their malls has bounced back to almost 70% of the pre-covid level, and continuing to recover. Some malls are actually seeing more shoppers than before.

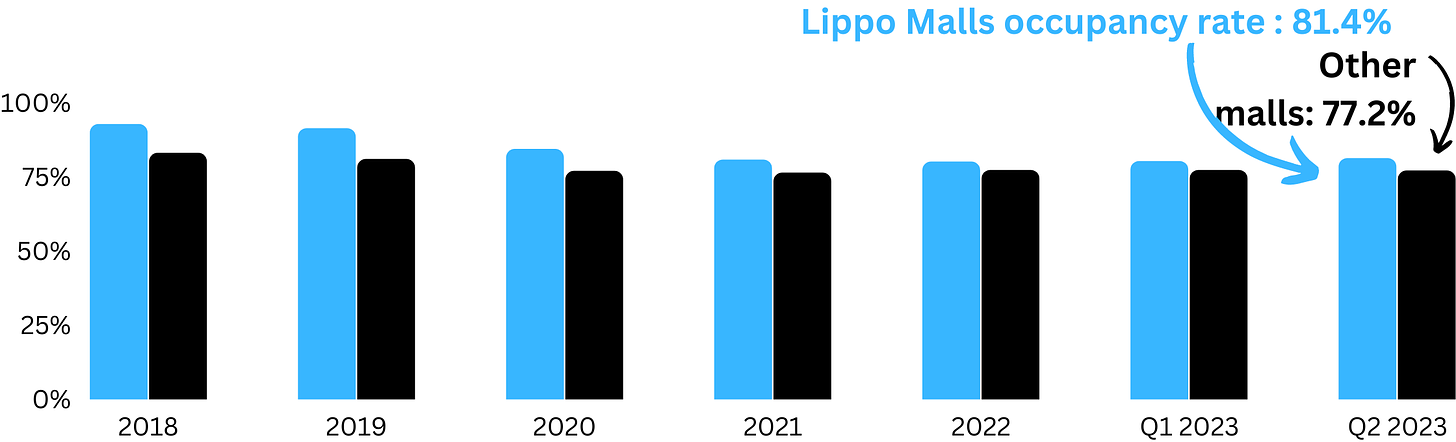

Second, its malls are in great locations, and its occupancy has consistently been higher than industry average:

Falling knife or hidden gem?

A question that’s really hard to answer.

I believe Lippo Malls is a classic example of a company with a real, solid business that’s been deeply and massively 💥ed by financial engineering.

Lots of things can happen: it can enter bankruptcy proceedings, maybe even go through that “fire sale” I talked about; it could even get delisted; or it can keep improving its profitability, renegotiate its debt, and become fairly valued (a 700% upside?) after a long period of pain.

Most of these situations look ugly. But that’s the point – most investors miss out on truly undervalued stocks because they look “like trash”.

For me, following Lippo Malls has been an exercise in learning about what I am or am not willing to stomach – even if the math, on paper, looks decent.

Oh, and please keep in mind our disclaimer: we talk about various stocks, funds, and securities because they’re interesting or can be used to teach a lesson about investing. None of the posts we publish are intended to be taken as individual investment advice or a recommendation to buy or sell any specific stock or other security. We can’t even guarantee that our information sources are 100% accurate. The only purpose of these posts is to teach you how to do research and figure this stuff out for yourself.

Share with a contrarian friend?