Is India the most important stock market we're missing out on?

And, more importantly, is now a good time to buy?

Which country has the largest population in the world, contributes 3% to the world’s GDP and is on track to add one trillion dollars to its GDP every 18 months, making it the third largest economy by 2030?

You guessed it: India.

Yet despite all this growth, most investors are barely touching Indian companies: the Indian stock market takes up only 0.25% in so-called “All world” ETFs!

We don’t want to miss out, so let’s look at the reasons why you might want to make it a bigger part of our portfolio.

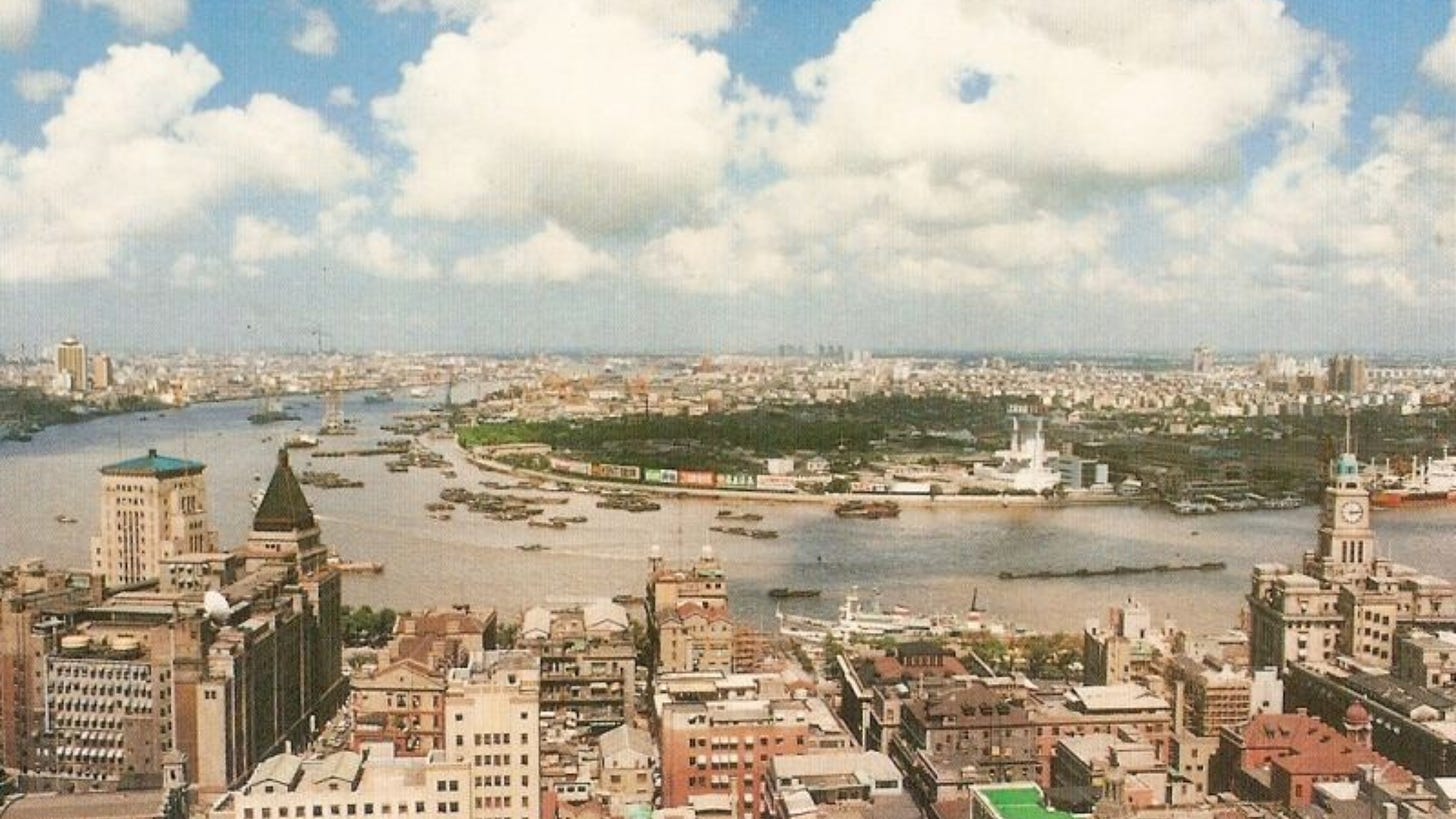

India in 2023 seems like China in 1993

This was Shanghai’s Pudong district in 1993:

And this is Pudong now:

Now many economists are forecasting a similar future for India. Some even a brighter one.

Basically, everything is growing in India (just like in 1990’s China):

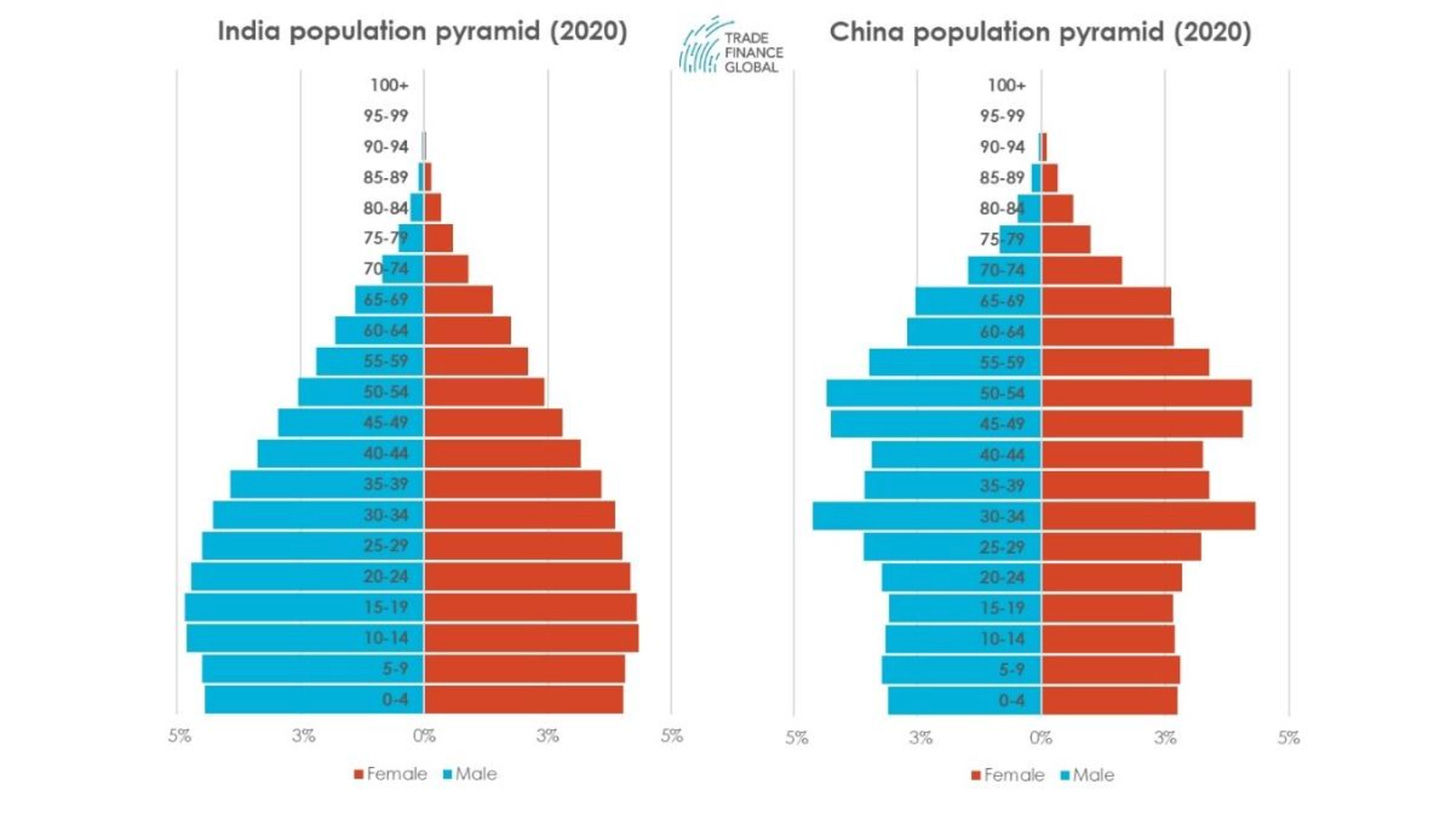

Young population: India has more than 50% of its population below the age of 25, with an average age of 29, compared to 37 for China. China gained from a similar young population boom in the 1980s and 1990s, but its “one child” policy essentially squeezed its later growth.

GDP: India is projected to be the third-biggest economy by 2030.

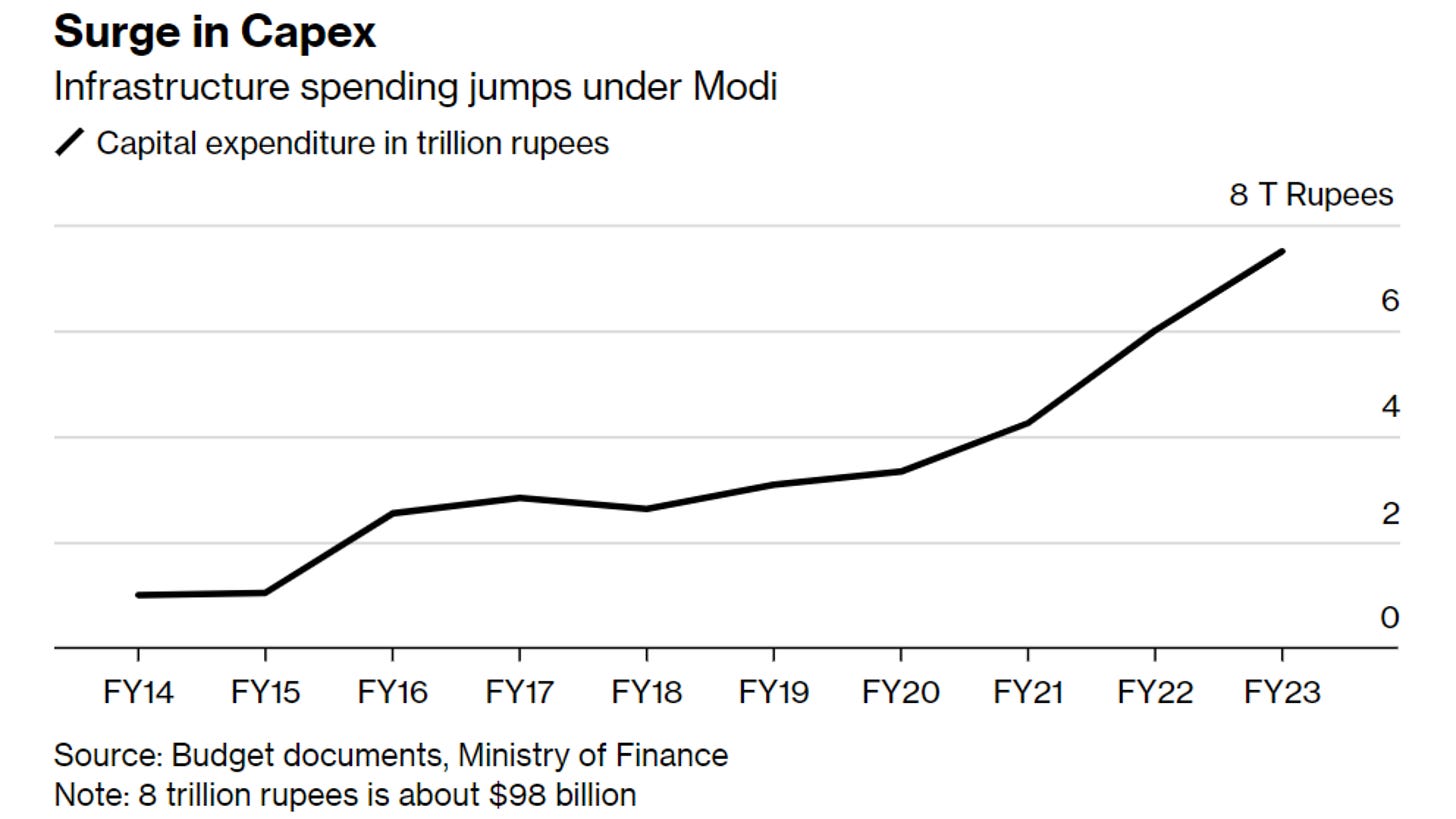

Infrastructure boom: India is still quite rural (67% of its population lives in villages), but its cities are growing fast and the government is investing heavily in infrastructure. The government of India is set to spend nearly 20% of its budget this year on capital investments (things like roads and railways).

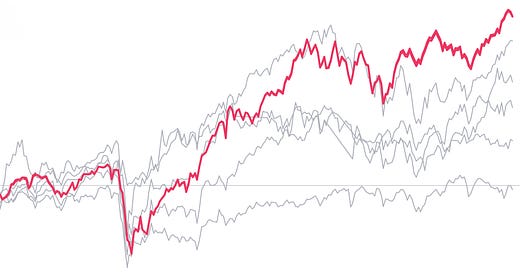

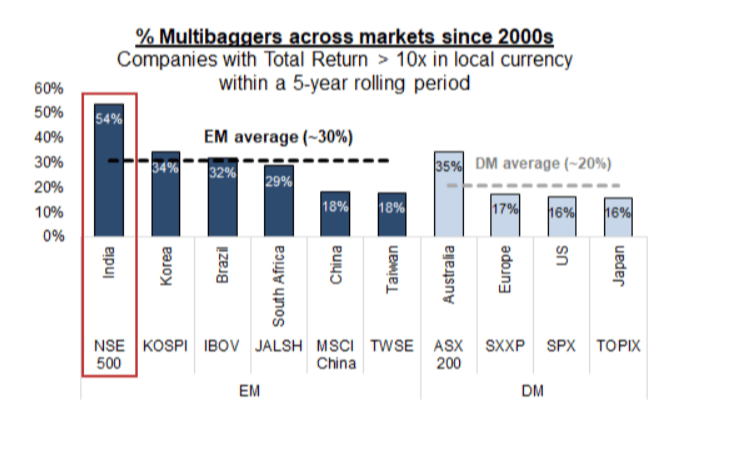

Unlike China, the Indian stock market has been one of the best in the world for 10x-ing your money

All this growth has been great for stocks. According to a Goldman Sachs study, if we look at any five-year rolling period since 2000, more than half of the stocks trading on the Nifty 500 Indian index increased in value more than 10x – more than in any other market.

Are Indian stocks too expensive now?

After hearing all of this, investing in India might sound like a great idea.

But.

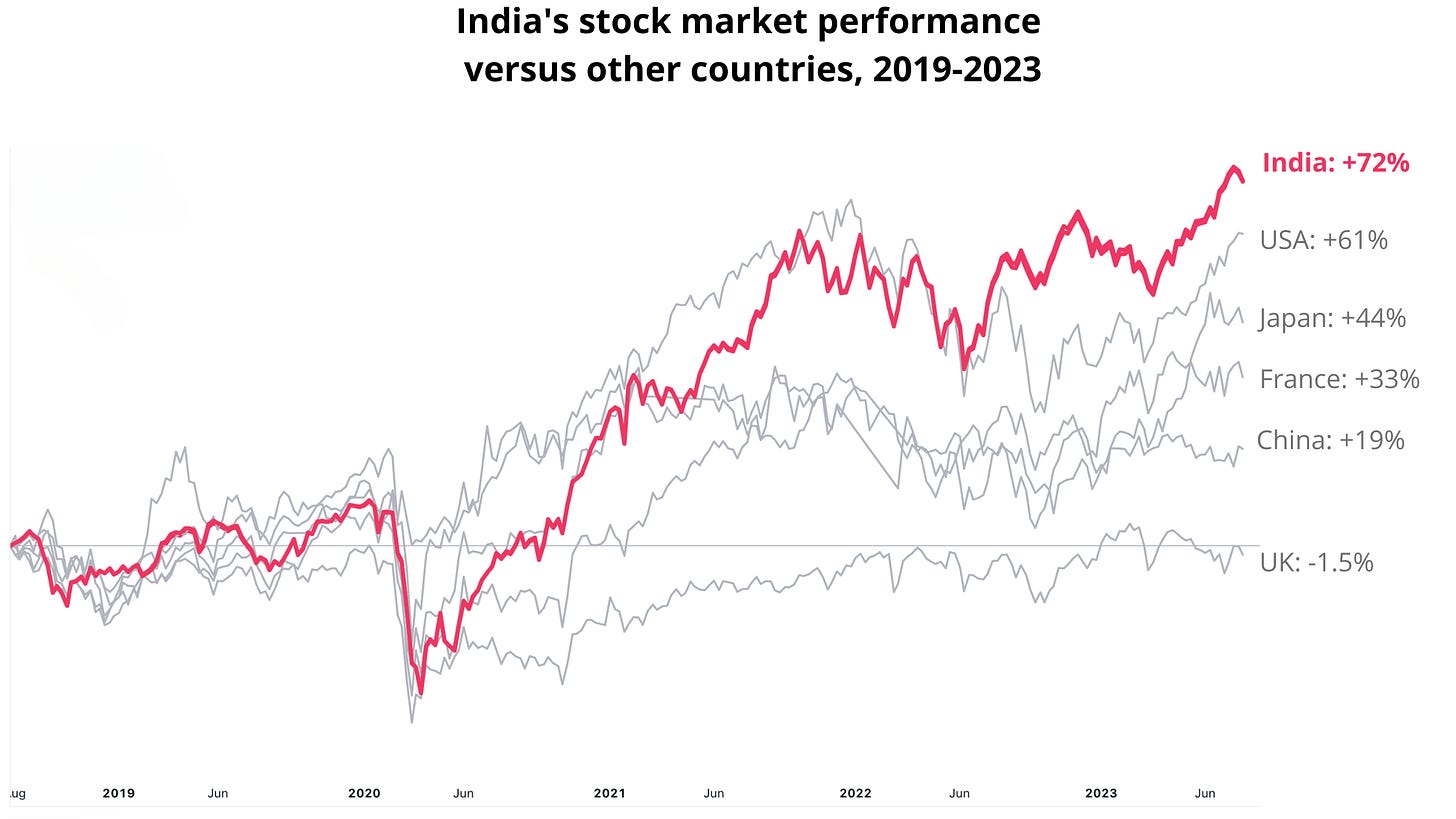

Lots of other investors have already thought so too, and jumped in. The country’s stocks are so hot that the Indian stock market is the 4th largest in the world – larger than any European market and only smaller than the US, China, and Japan.

It has also done much better for the past 5 years than most other markets.

But does that mean that Indian stocks are truly expensive?

Well, let’s look at a few indicators.

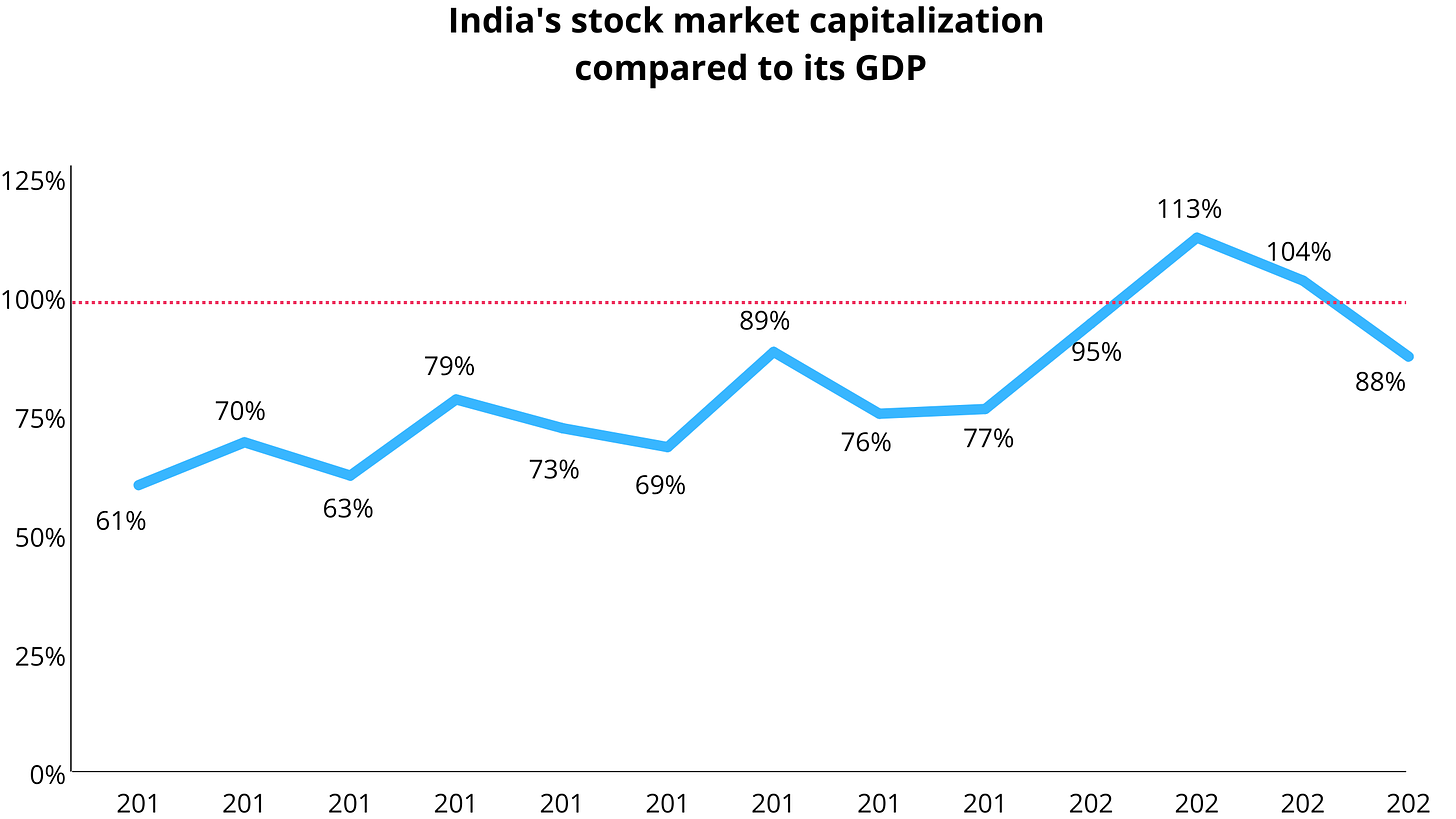

First one is market capitalization to GDP.

It basically shows how big is the value of the entire stock market compared to the country’s output of goods and services. On the chart below, the red line can be interpreted as “overpriced”.

We can see that despite a strong stock market rally this year (the stock market reached $3.3 trillion in June 2023), the economy is growing even faster (GDP estimated this year at $3.75 trillion), making the stock market capitalization to GDP ratio actually fall under 100%.

Based on this indicator alone, we could say that the stock market is fairly or even slightly under-valued (“cheap”), especially considering that markets like US or Japan have long crossed 100%.

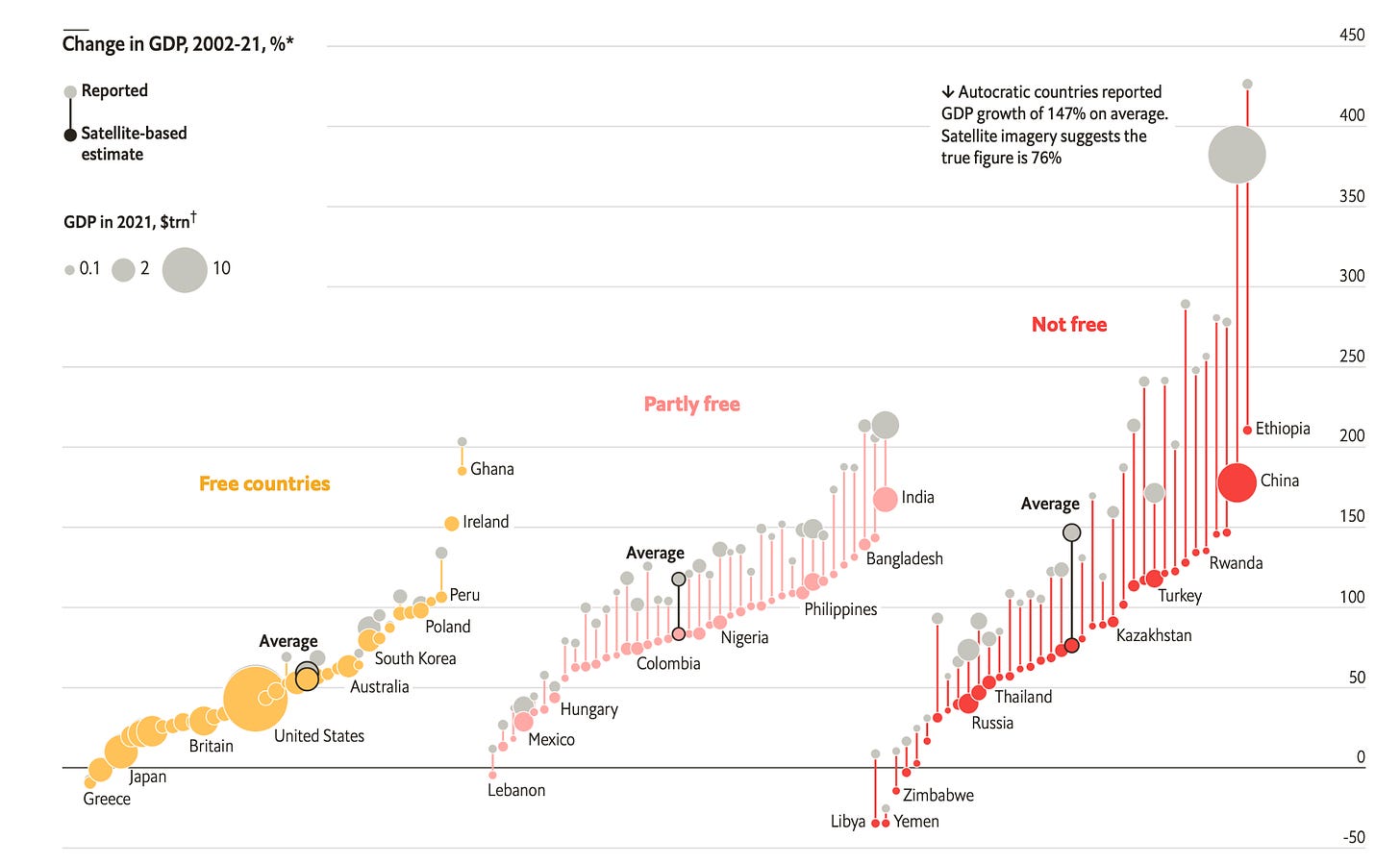

However, while the stock market is a number we can “see”, the GDP figures are much more easily fudged.

A study comparing “real” economic activity using the satellite images of lights at night suggests different countries over-report GDP figures. India for example, is estimated to over-report by about 33%.

We’re not accusing the Indian government of anything, but if this is true, the stock market would now seem a bit more overvalued, with a market cap to GDP ratio of 131% this year instead of 88%.

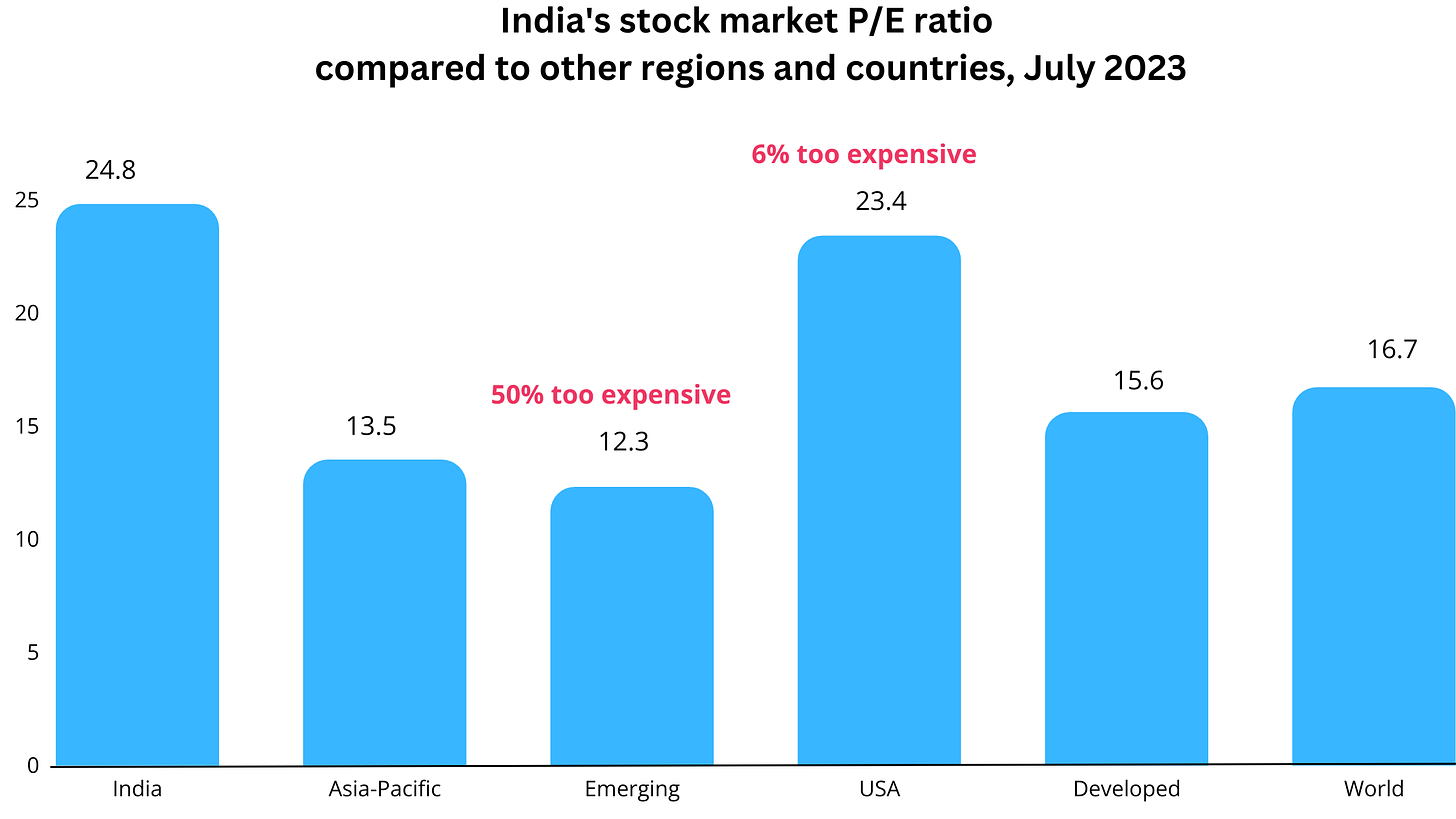

Second is Price to Earnings (P/E).

Price to Earnings, or P/E, compares the prices of stocks to how much those companies earn per share. The idea is basically: “in how many years would an investor recoup their money from profits alone?”

The chart below shows that India’s P/E is much higher compared to other markets, even developed ones.

If India were to be valued similarly to these other markets, the P/E ratio would have to fall (“contract” as analysts say) by anywhere between 6 to 50%.

This would happen either by prices staying flat while earnings jumped significantly or (more likely) the prices would have to fall by the 6-50% amount and “normalize”.

With that being said, India has always been “more expensive” than most other markets, so this could continue for a long while if the fundamentals keep growing.

The third indicator of “too much excitement” in the markets? Lots of IPOs!

When markets get frothy and stocks get expensive, it’s usually a great time for companies to sell their shares to the public – and a pretty bad time for individual investors to buy. While buying shares at IPO sometimes can work wonders (Apple, anyone?), most stocks tend to lose value following the IPO, something we should look at in a future post.

Back to India: a report by consultancy firm Ernst and Young shows that there have been 80 IPOs in India in the first 6 months of 2023, already more than the entire 2022 (60 IPOs)!

The country has also topped the global IPO rankings, with 13% of IPOs in the first half of 2023 compared to 11% in 2022 and 6% in 2021.

Is this bad? Good? Too early to say. But what we can say is that this Indian IPO wave is a clear show of accelerating investor excitement.

What could keep the party going?

So based on all 3 main indicators of frothiness, India seems too expensive. But that doesn’t mean a crash is around the corner. The party could keep going for a long time.

In fact, some analysts think that the E (earnings) part of the P/E ratio is due for a big rebound, as earnings have been weighted down by multiple one-off events in the past few years. For example: a demonetization program in 2016, the collapse of a large non-bank financial company in 2018, and the recent Adani scandal led to quite a bit of risk aversion for investors.

Expensive or not, India is growing fast, and there are more factors driving growth. One is digitalization, with India’s population going from 20 to 60% smartphone ownership in just 5 years.

The other is housing, with the housing affordability ratio at its lowest in 14 years. Since homes have never been so accessible, a boom in the real estate sector can spill over throughout the entire economy.

In other words, the Indian stock market could be the classic example of “expensive for a reason” – and it could stay that way a long time.

Then again, prices can’t float too far from reality for too long either. The P/E ratio will normalize at some point: either P falls (sorry if you invested), or E grows even faster.

How can foreigners invest in India?

Thinking about taking your shot at Indian stocks?

Sadly, you can’t just pick and choose whichever companies you like. Foreign individual investors can’t buy Indian stocks directly, but you can do it in other ways.

One way is through Indian companies that are also listed abroad, using things like American depositary receipts (ADRs) and global depositary receipts (GDRs).

You can find the complete list of Indian ADRs here and the complete list of Indian GDRs here.

The other way is by investing in exchange-traded funds (ETFs) and exchange-traded notes (ETNs) that track the Indian stock indexes.

Some popular ETFs that track the India stock indexes are:

iShares MSCI India UCITS ETF (ticker: NDIA; expense ratio: 0.65%), which tracks more than 100 small and mid-cap stocks.

Xtrackers Nifty 50 Swap UCITS ETF (XNIF; 0.85%), which tracks the country’s 50 largest stocks.

Just as an FYI, India has two main stock markets, the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE), each with its own index (Sensex for BSE and Nifty for NSE). You don’t really need to worry about this, though, as most large companies are listed on both and the indexes closely track each other. It’s even hard to see them apart on a chart.

If you want to invest in specific sectors, then look at:

Columbia India Consumer ETF (INCO; 0.75%)

VanEck Digital India ETF (DGIN; 0.71%)

VanEck India Growth Leaders ETF (GLIN; 0.77%)

There are of course many others, and many more coming as the Indian stock market matures.

Regardless of how we’ll choose to invest, or even if we choose to do it now at all, India is simply becoming too important to ignore.

Tread carefully, though: China was once the golden boy too, and boy has its stock market disappointed.

Maybe just add to watchlist for now?

Useful article? Then go ahead and share it with your friends. We’re at the very beginning so every share counts.