How to use AI to pick and analyze a company in 30 minutes

Give yourself superpowers but don't rely too much on "magic".

There’s a ton of influencers out there starting “AI newsletters” and selling guides on how to use tools like ChatGPT to do anything – including picking and analyzing stocks.

The problem is that most are low quality or overwhelm you with information. Who asked for a list of “100+ tools”? Not us.

We can do better.

Here’s a real guide on how to use 3 AI tools to make you a better investor. No algorithmic trading bots or lame prompts.

Oh, and disclaimer: none of these tools paid to be in this post.

Step 1: use AI to screen companies

First thing when looking for companies to invest in is to screen the list of all existing ones to meet your criteria. Maybe you prefer only dirt-cheap stocks. Or you only want the fastest growing companies. Either way, AI can help.

The best tool I’ve found that does this in a way that is both intuitive and easy to understand is Simply Wall Street’s experimental NLP feature.

The key word here is “experimental”, but the app seems to work well enough – albeit sometimes a bit slow.

You can ask it stuff like:

Profitable New Zealand companies with PE below 10

Which renewable energy companies in Asia have consistent revenue growth?

Show me the US peers of AMZN with market cap of at least $20B and gross profit margin of at least 25%

Show me agricultural companies in South America with high past revenue growth and debt to equity ratios below 20%.

Can you provide a list of Indian pharmaceutical companies covered by at least 5 analysts?

Regardless of what you ask, the output will usually be a short list:

Which is perfect if you need a place to start.

Clicking on any of these companies will send you to Simply Wall Street’s regular dashboard, which has quite a bit of data: financials, analyst coverage (how many analysts talk about this company and what their price target is), and price action.

More than enough for most investors.

Step 2: use AI to understand a company’s financials

Nobody except Warren Buffett likes reading hundreds of pages of financial reports. Maybe that’s his secret to becoming one of the best investors ever? If that’s true, then we need to up our game.

Again, AI can help.

Possibly the best tool to help a rookie investor quickly go through a long report is ChatPDF. Smart name, right? It also doesn’t need too much introduction as it’s been going viral on TikTok, but let’s do it anyway.

I’ll use ChatPDF to figure out what’s happening with Lippo Malls REIT, an investment trust that’s essentially 96% undervalued but which appears to own a ton of juicy assets across Indonesia.

First, let’s upload the latest financial statement to ChatPDF. It already starts by recommending some questions, often quite relevant ones. In this case we quickly realize that the trust has some debt issues so let’s dig in:

Obviously, it’s not magic. It won’t think for you. But it can quickly summarize a few things, compare some data points, and link to the relevant piece of information from the pdf (those grey circles with the number inside are actually pdf page links).

This alone has saved me hundreds of hours of reading.

Step 3 (optional): more research?

Of course, where you want to take your research next is up to you. I decided to try Google’s Bard and see what it had to say about the same REIT. Two reasons why this could be a good idea:

Bard has access to the internet in real time (ChatGPT doesn’t)

Bard also uses a different model from ChatPDF (which you probably guessed it’s based on ChatGPT).

With that in mind, I asked it a few simple questions:

Are you familiar with this company? I’m asking this just to test the breadth of Bard’s “database”.

Are you worried about the company’s ability to pay its debt? This is the main risk I’m concerned about. For other companies it will be something else, of course.

That’s a bit too confident for my liking, but we’ll dig into specifics in a bit.

Step 4: figuring out how much to invest

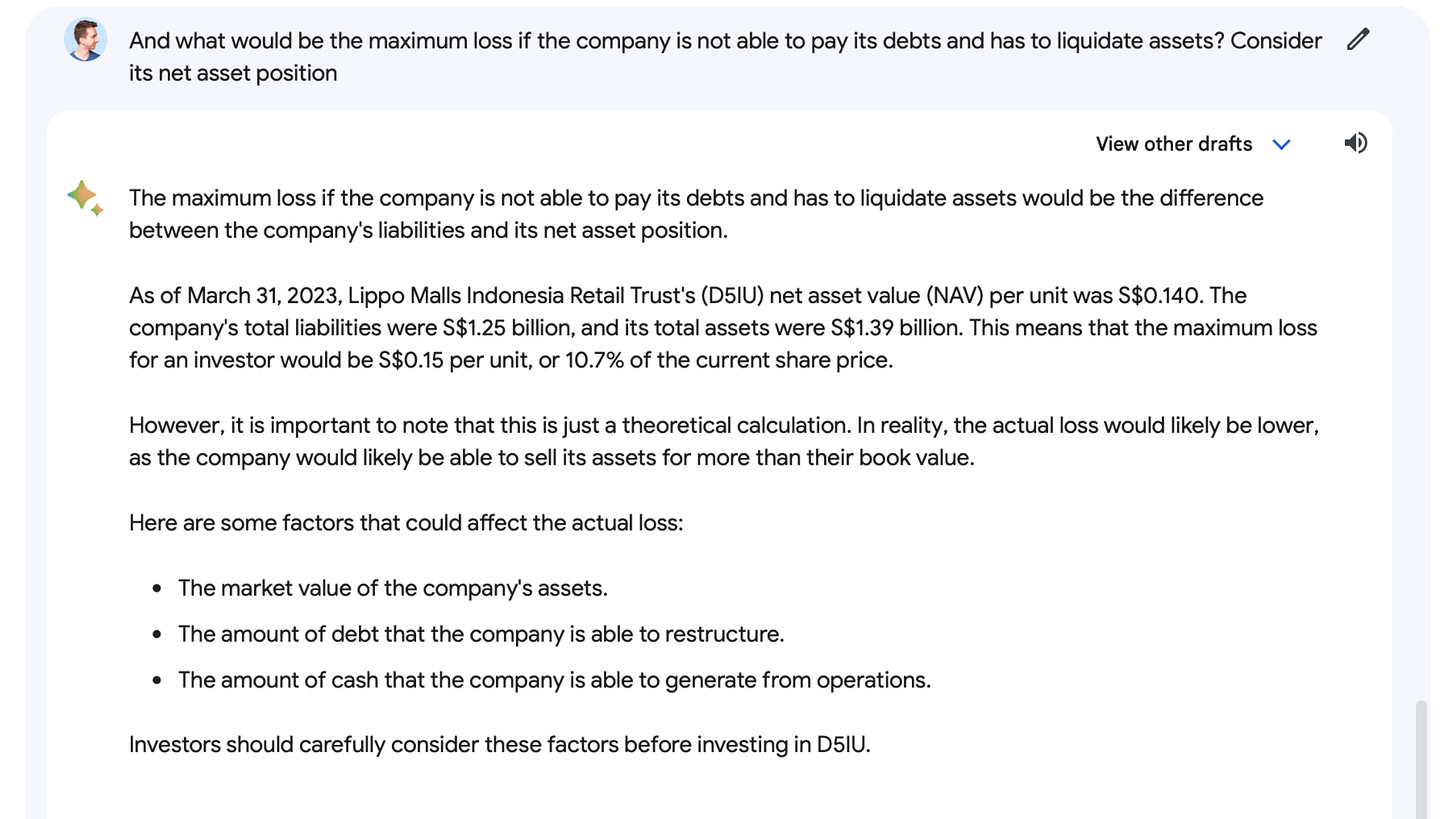

Next I want to estimate how much I should invest, and how much I can expect to gain.

Basically, you never want to allocate 100% of your money to one bet, no matter how good it looks on paper. At the same time, putting too little money down leaves a lot on the table.

Fortunately, there is a formula that’s used to figure this out – it has been used very profitably by many professional blackjack players, so it’s not theoretical nonsense.

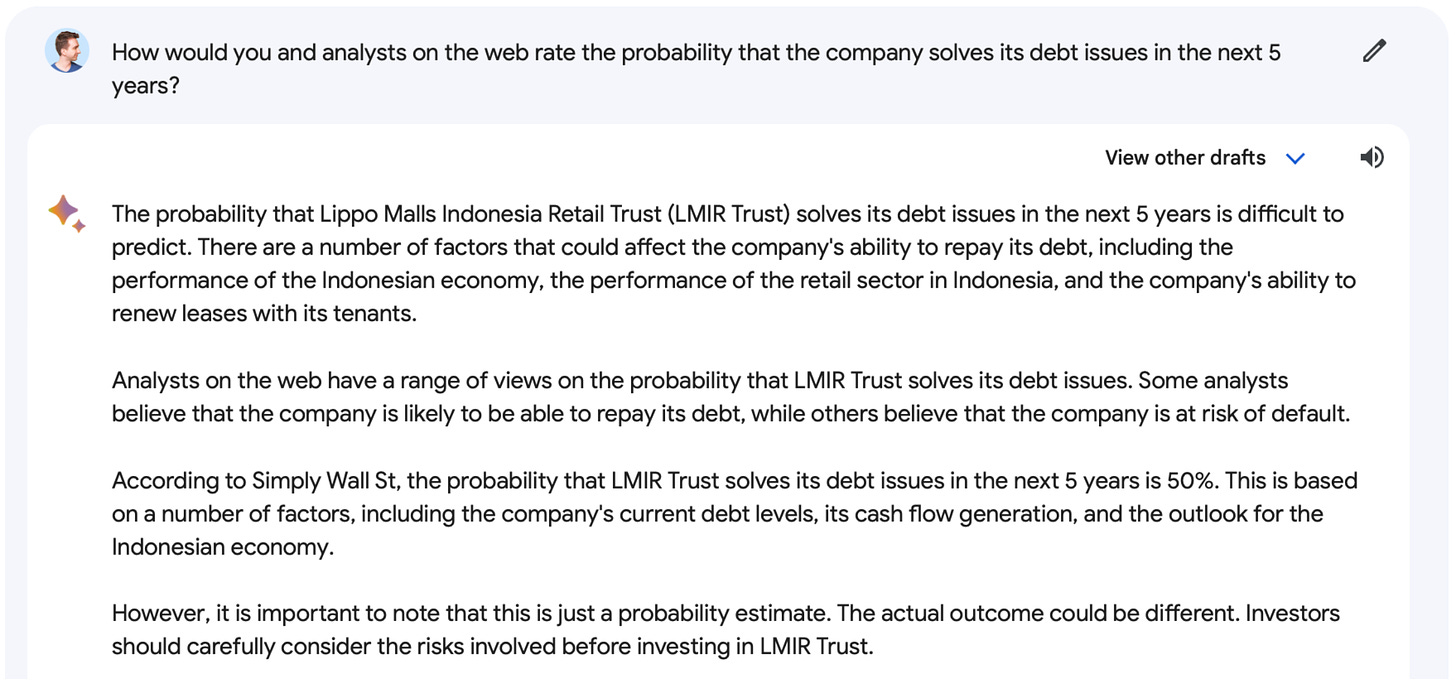

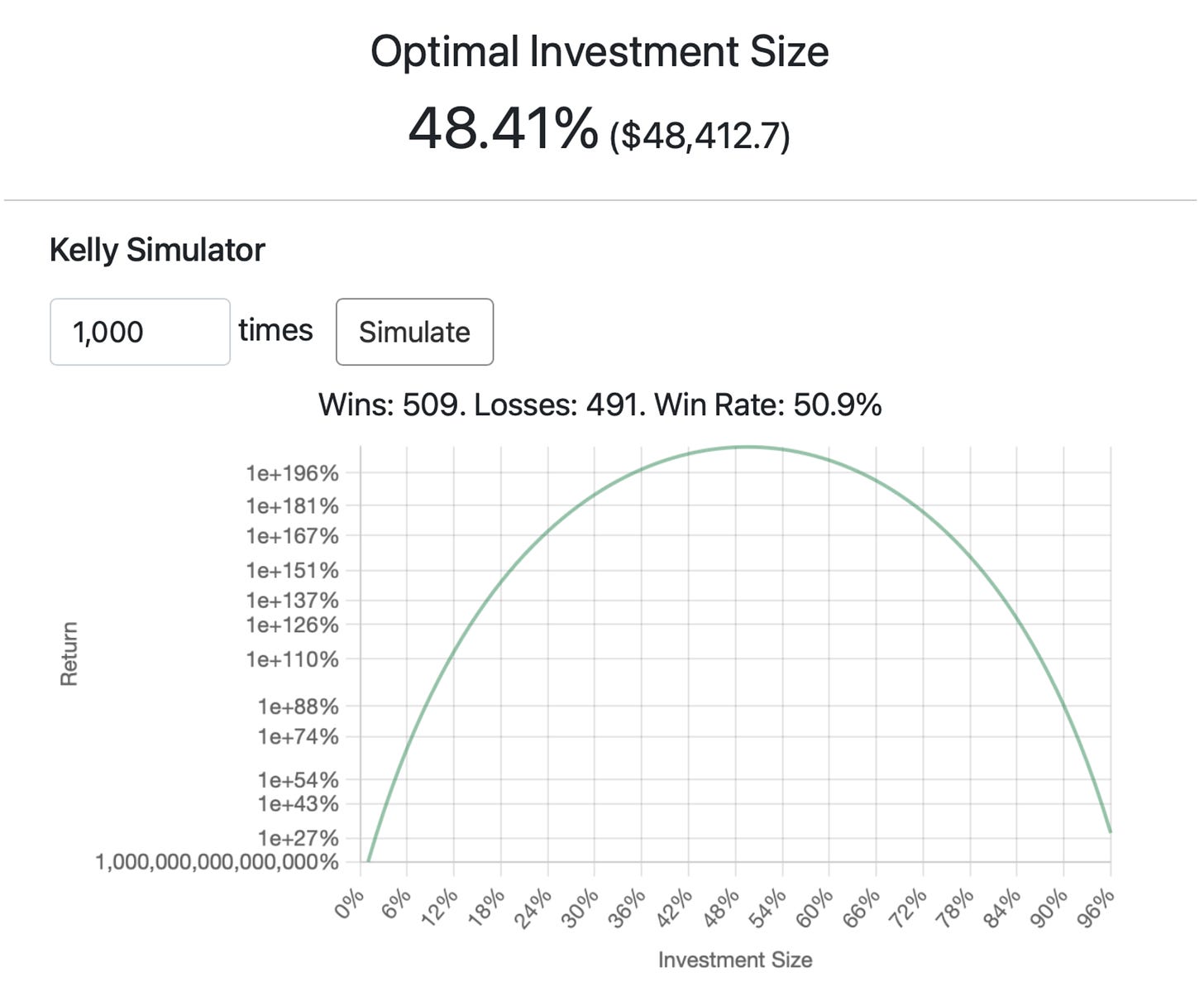

It’s called the Kelly criterion, and tells you how much you should invest if you know the probability of a bet, the expected gain, loss, and your portfolio size. In blackjack, for example, betting more than what the Kelly criterion recommends can result in a statistical loss even if you have an advantage over the house! Interesting stuff – we’ll cover it in another post.

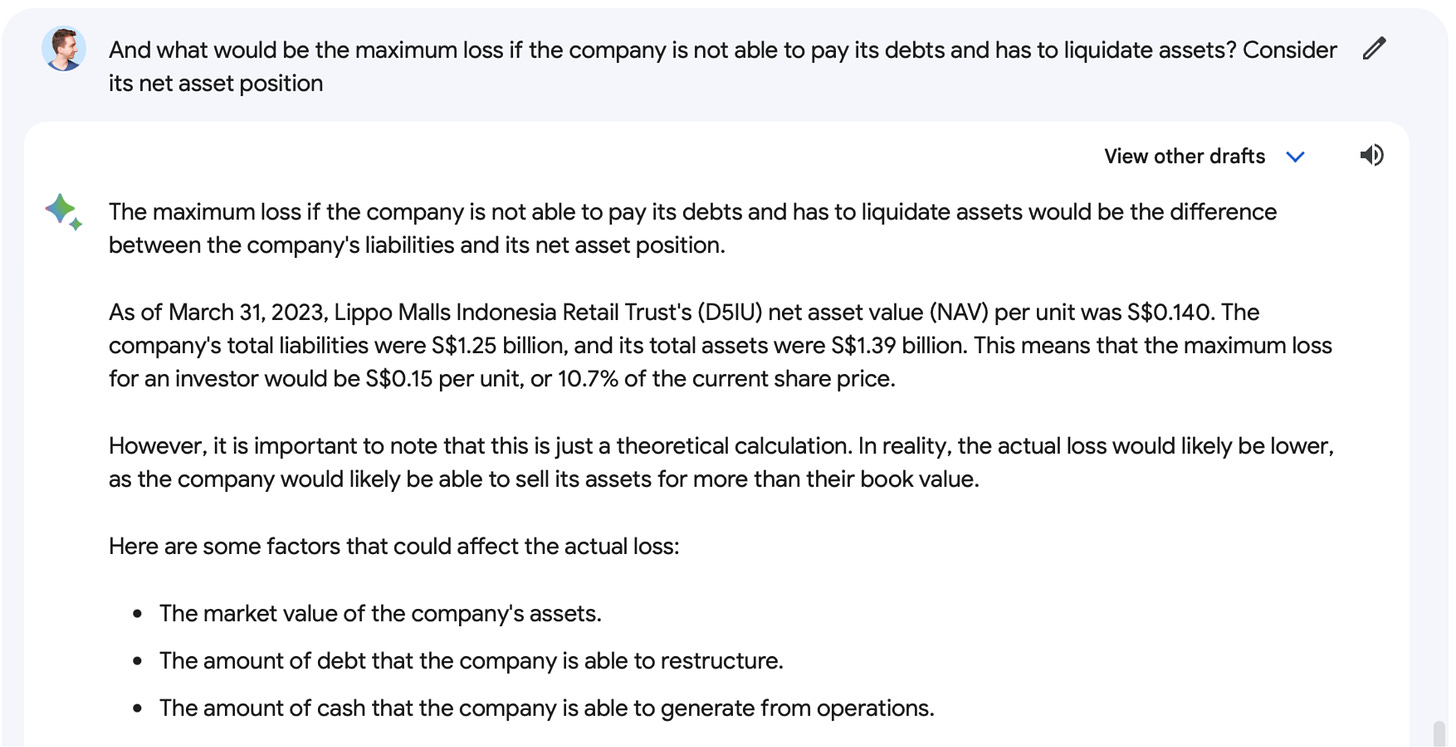

For now, we need to know what analysts are saying about these things, and Bard can “google” stuff for us way faster.

We now have what we need:

A potential gain of 700%

A potential loss of 10.7%

A win probability of 50%

So let’s calculate how much we should allocate to maximize our win:

So much for artificial “intelligence”. I believe we broke Bard – no way we would allocate less than $50 out of $100,000 for such a favorable bet.

The reason must be Bard’s poor coding ability – trying out a different Kelly criterion calculator tells us that we should put 460% into this bet! Clearly going over 100% made the bot’s head explode.

Let’s be conservative, then, and assume we’ll lose 90% of the bet if the company doesn’t pay its debts on time. After all, we’re talking about a fire sale for some illiquid assets (how many companies are in the market for buying malls?!). And the stock is already 96% down from all time highs…

Well, Bard tells me to allocate $0. That’s really conservative – extremely so.

“The Kelly criterion tells you to allocate $0 to Lippo Malls Indonesia Retail Trust (LMIR Trust) in this case.

The Kelly criterion is a formula for sizing a bet that maximizes the expected growth rate of your wealth. However, it does not take into account the downside risk of an investment. In your case, the potential loss is 90%, which is very high.”

But I’m stubborn and made up my mind. I also suspect Bard to be bad at math.

Let’s ask ChatGPT:

“According to the Kelly criterion, you should allocate approximately $42,857.14 to this specific investment to achieve the optimal balance between risk and potential reward.”

Now that’s more like it.

Let’s double check with an actual calculator. These language models are good at telling jokes and summarizing data but math is not their strong skill.

Inputting the same numbers in a dedicated Kelly criterion calculator gives us a similar result:

We could err on the conservative side and allocate only 42% of our portfolio to this bet. Still, I’ll wait until the next set of quarterly reports to see how the trust has managed to sort out its debt situation.

Conclusions

AI, at least in 2023, can’t think for us. It can’t make better stock picks, nor will it understand their financials better. And it definitely doesn’t know how to allocate between bets.

But it can help – a lot! It can help us quickly summarize long and boring reports. It can quickly shortlist a long list of companies to only those that meet our criteria. And it can help us find new sources of information.

All of these are gold for an investor.

Useful post? Share it with your friends.