How to figure out what others are investing in #2: market sentiment tools

Last week we looked at some of the best tools for copying famous investors, corporate insiders, and politicians. Now let's see what everyone else is doing, too.

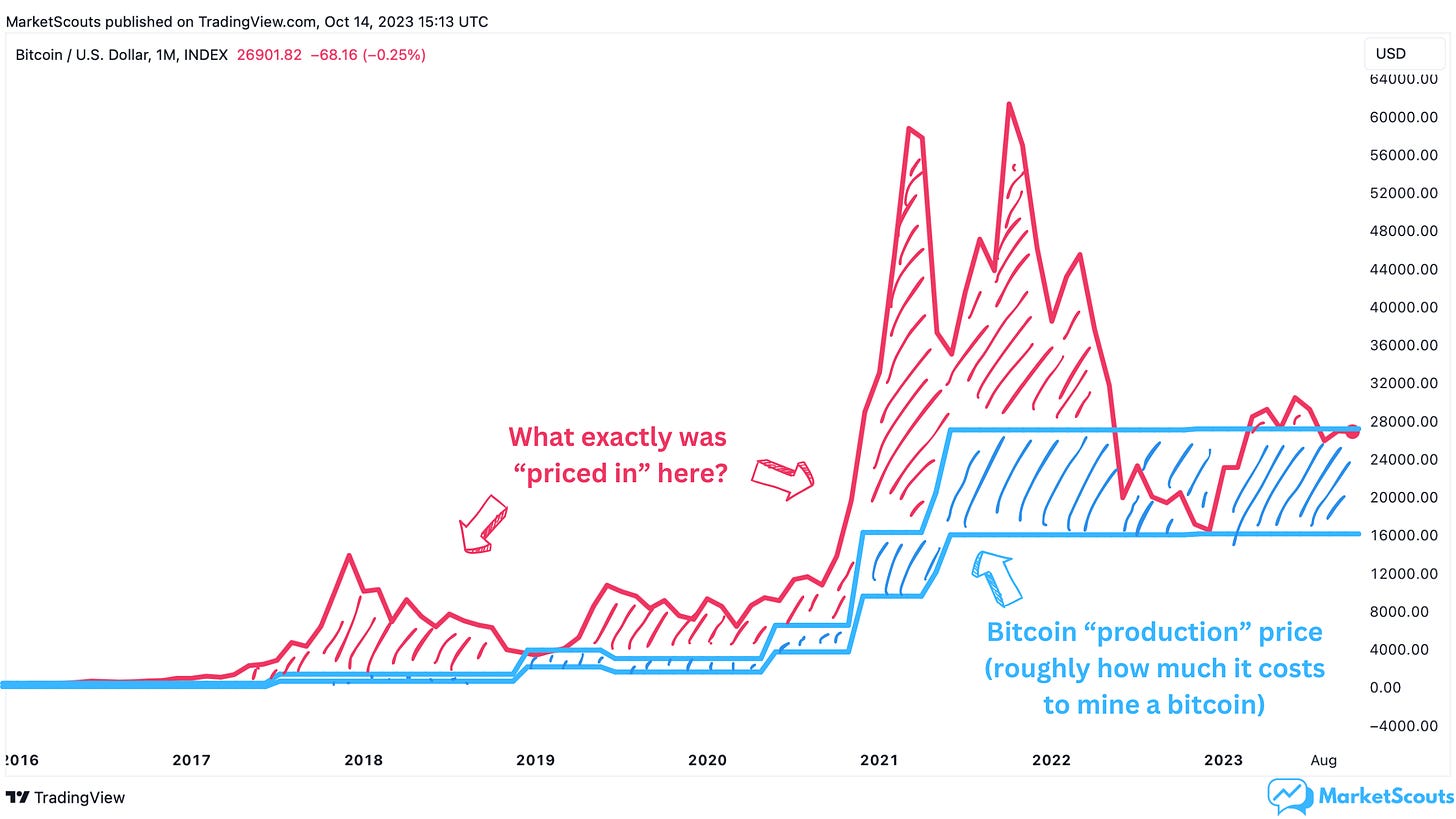

Did you know that there are people out there who believe that markets are 100% efficient? Who claim that everything that could be useful to an investor is already “priced in”?

That theory is called the Efficient Market Hypothesis (EMH), and it says that there’s no point trying to beat the market or time the market. You just don’t have enough “edge”.

We’re not saying this theory is wrong, but it definitely isn’t right, either:

First, bubbles happen all the time: just look at the crypto craze in 2017 and 2021.

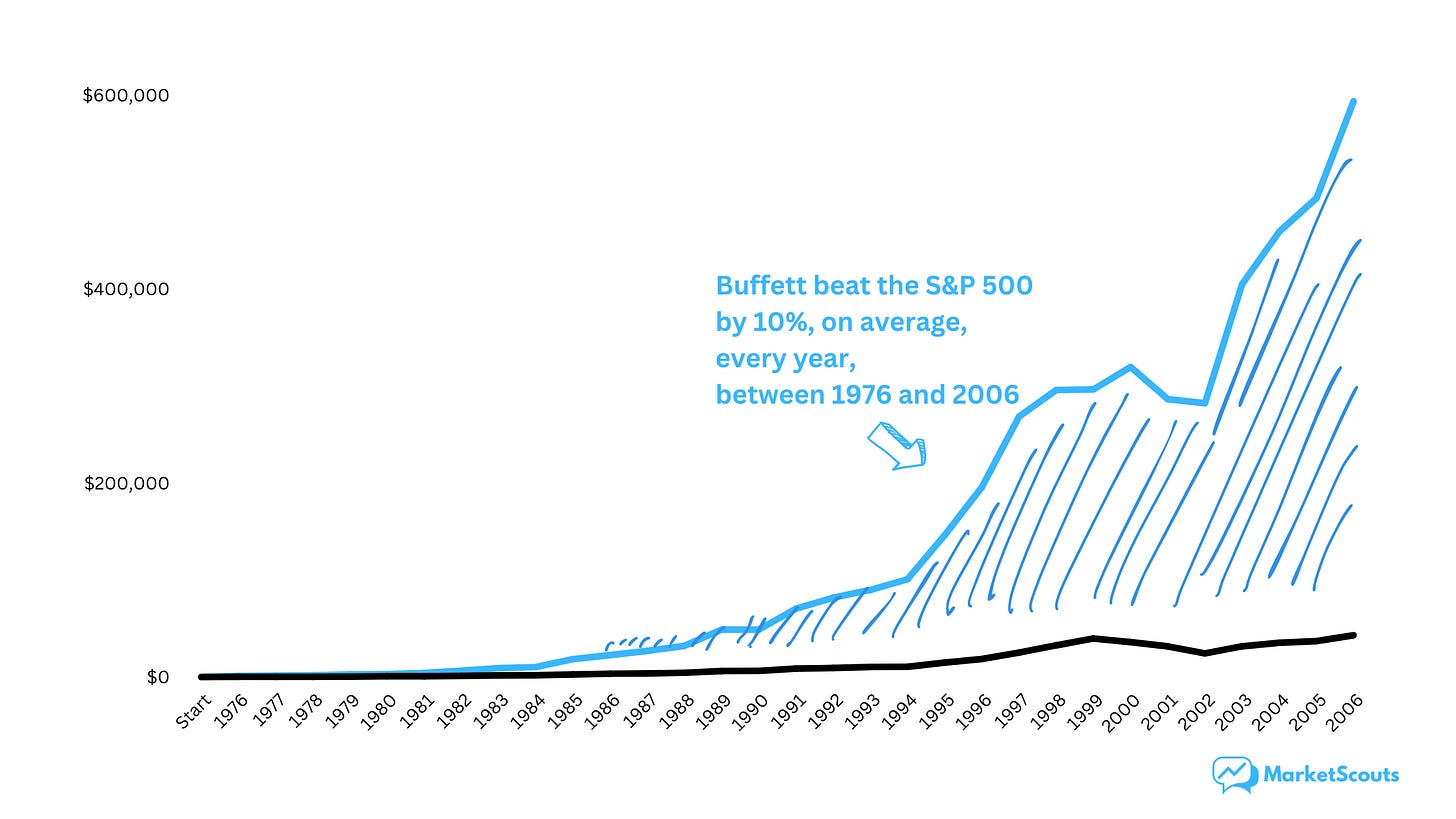

Second, some investors do beat the market consistently by picking stocks carefully.

Warren Buffett is the most obvious example:

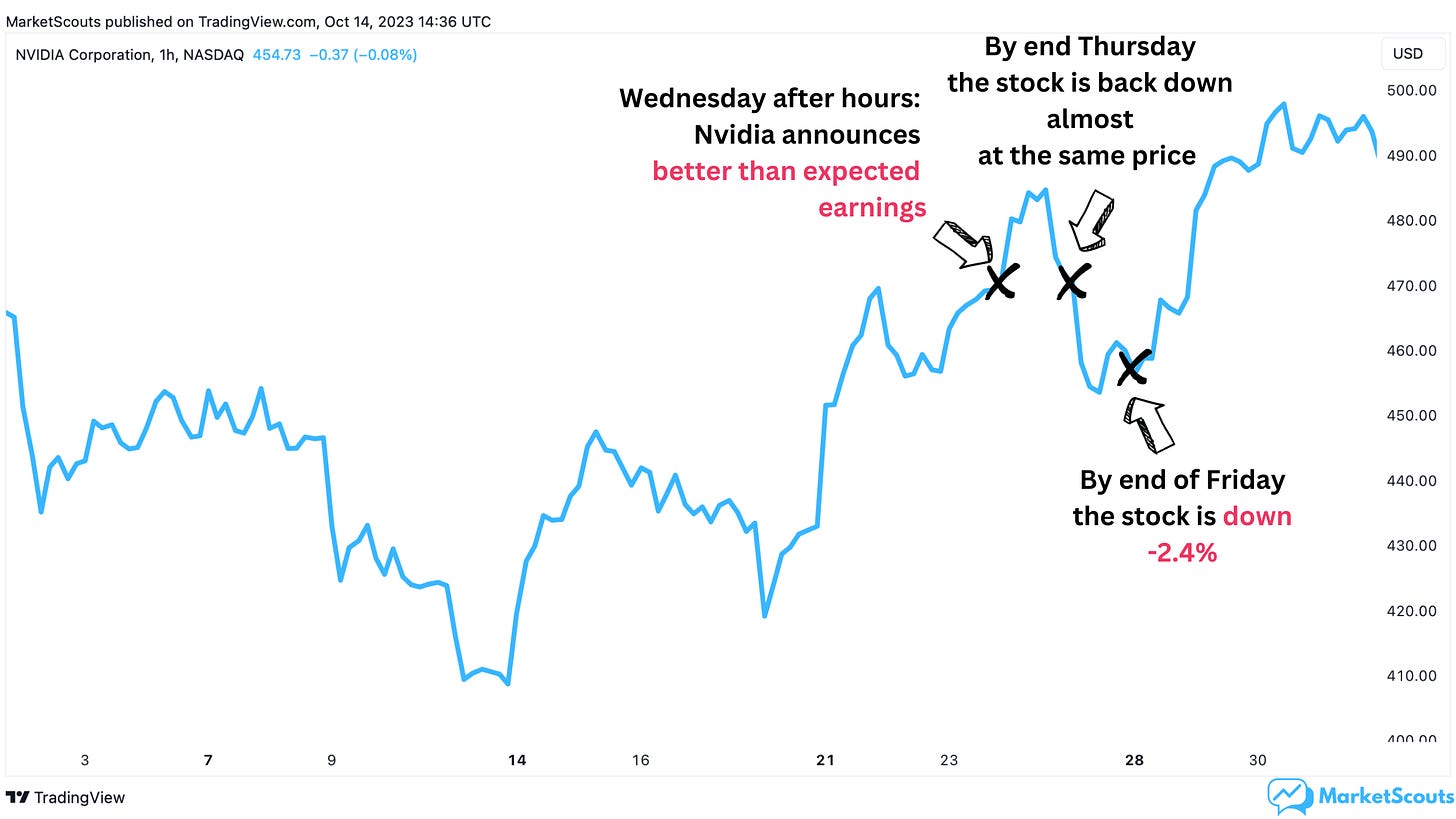

Third, sometimes the actual opposite of EMH is true. The best example are the “buy the rumor, sell the news” situations.

Take Nvidia in August this year. Everyone was getting excited for Nvidia to show strong earnings because of the AI hype. Nvidia not only did, but also beat estimates by about 25%!

The stock gained 10% on Wednesday after hours (when results were announced), then lost it on Thursday, and lost another 2.4% on Friday.

So obviously there’s more to the market than just the cold hard numbers.

Last weekend we looked at some tools to help you copy famous investors, corporate insiders, and politicians – people who know things you don’t.

Today let’s go a step further, and see which tools we can use to figure out what the market “feels” about specific investments.

If you want to see what people search for

What if you could know what's on everyone's mind?

Google Trends wants to be that crystal ball.

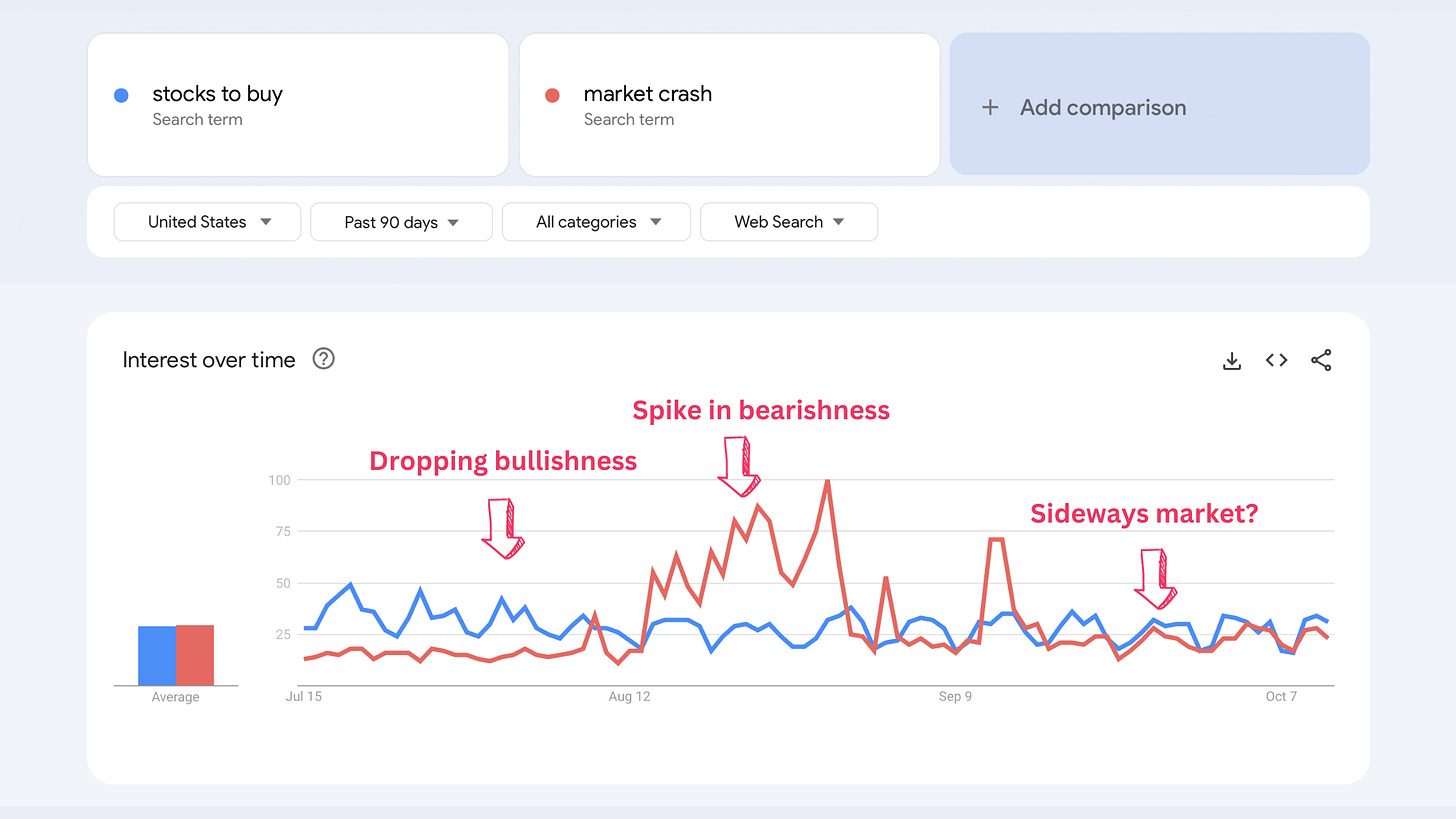

You can use it in a number of ways. For example, by trying to gauge the feeling of the whole market:

The challenge with Google Trends is that you really need to dig around for data. Plus even then you might not know how to use it.

A decent alternative is Exploding Topics.

They focus on identifying rising trends, making it easier for you to focus on specific companies or industries.

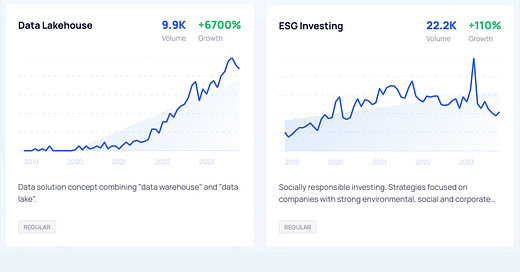

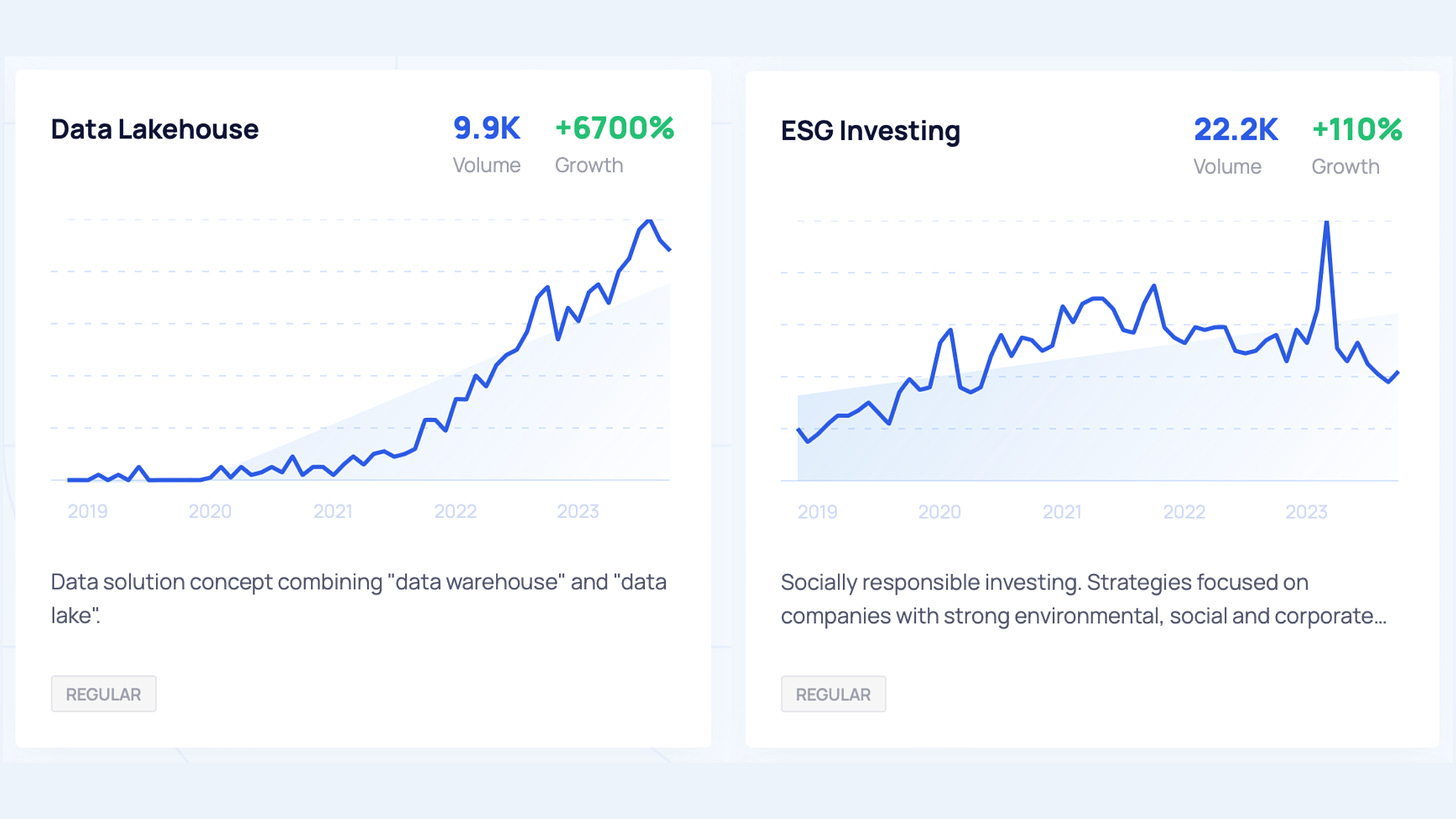

For example, here is a screenshot showing how Exploding Topics identifies both a fast-rising trend (“data lakehouse”) and one slowly starting to decline (“ESG”):

Like with all market sentiment tools, don’t try to time it.

But maybe keep your eye on Databricks’ upcoming IPO, and think twice before buying blindly an ESG ETF?

If you want to know what people are talking about on social media

If you want to know what people are talking about on social media, you need a “social listening tool”.

These are used by digital marketers to figure out how their ad or branding campaigns are doing – or to keep tabs on competitors.

Brand24 is one of the most used ones.

It’s the kind of tool that probably many investors don’t know about, but it can be quite useful. It tracks everything from news websites to Twitter, Instagram, TikTok, and pretty much all other social media.

Think of social listening tools like Brand24 as your “digital detective”.

For example, look at this screenshot showing negative versus positive mentions for Enphase Energy, a solar energy company:

Rising bullishness, perhaps?

If you don’t want to miss the next Reddit saga

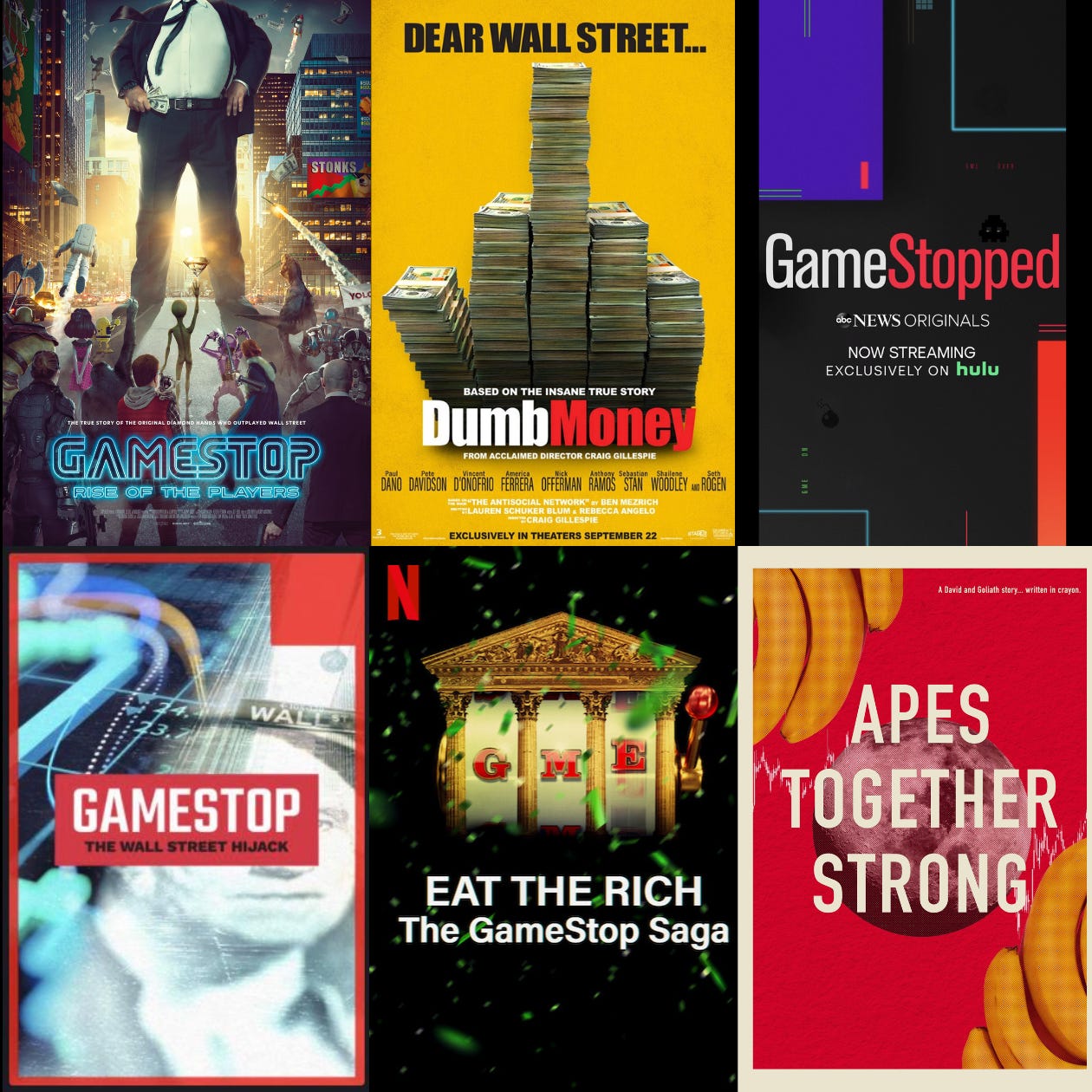

Remember the frenzy around meme stocks?

It basically involved everyday investors rallying around troubled stocks like GameStop, AMC, Blackberry, and Nokia.

The goal? To inflict maximum pain on hedge funds that were shorting these stocks, and make as much money as possible in the process – as hedge funds were forced to drive the price up by buying stocks to exit their short positions. Hence the term “short squeeze”.

If you’re curious, there’s quite a few movies and documentaries on the whole saga:

What’s important for us now is that the mania started and grew on social media and niche forums, especially Reddit's r/wallstreetbets.

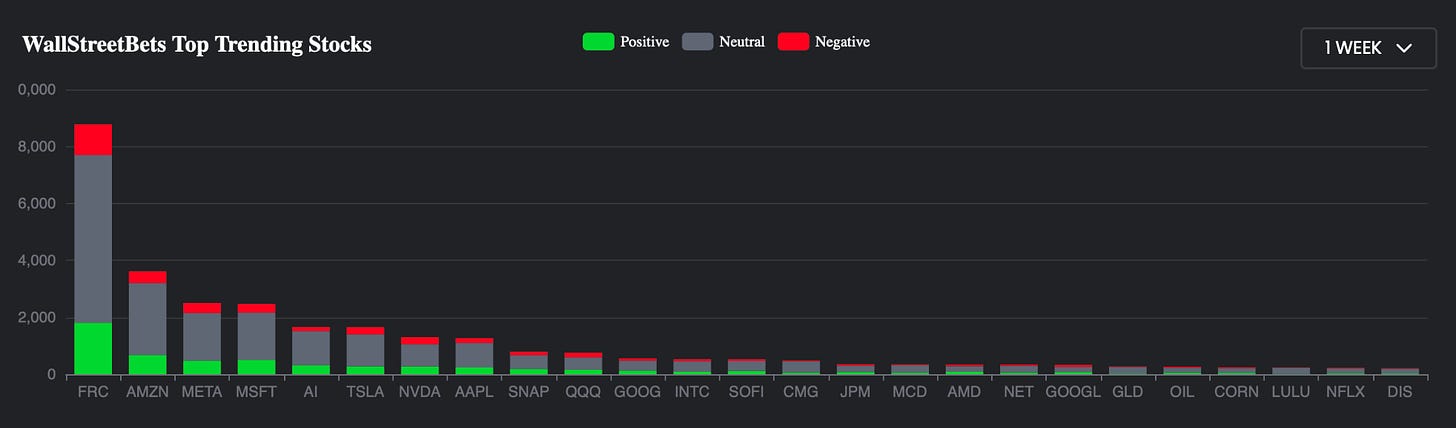

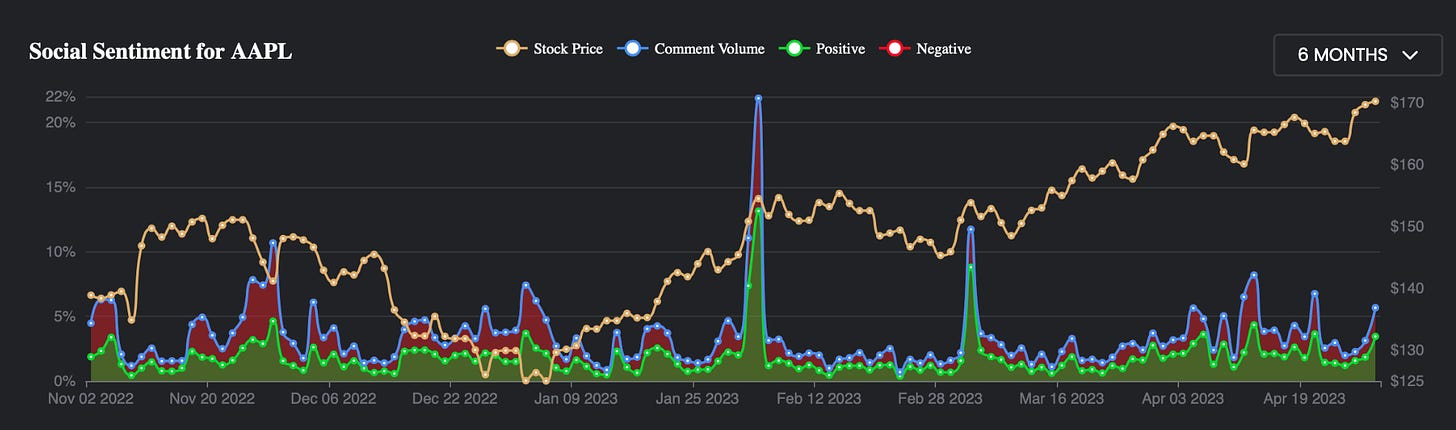

This is where Swaggystocks comes in – it can help you keep tabs on what’s happening on Reddit.

You can see which stocks Redditors like or dislike:

Or see what they feel about a specific company:

Kind of confusing, but who knows? A new “saga” might be right around the corner.

If you want to see what day traders are doing

There are also a few tools recently that track what day traders are doing. Some of them even combine trading with social media – attempting to build a “Twitter for traders”.

The reach of these tools is still fairly small. Some are even still in beta, meaning not “fully launched” yet.

But let’s have a look – they might actually provide us with some ideas.

First is Commonstock. Just like Twitter, you can hashtag, mention, post, etc. But also talk about your stocks, and make your portfolio visible to everyone.

It’s messy, I know – why finance tools think we need all this noise on the screen is beyond us.

But have a look on the screenshot there: the “most bought” and “most sold” can be pretty decent starting points if you don’t know what stocks to research.

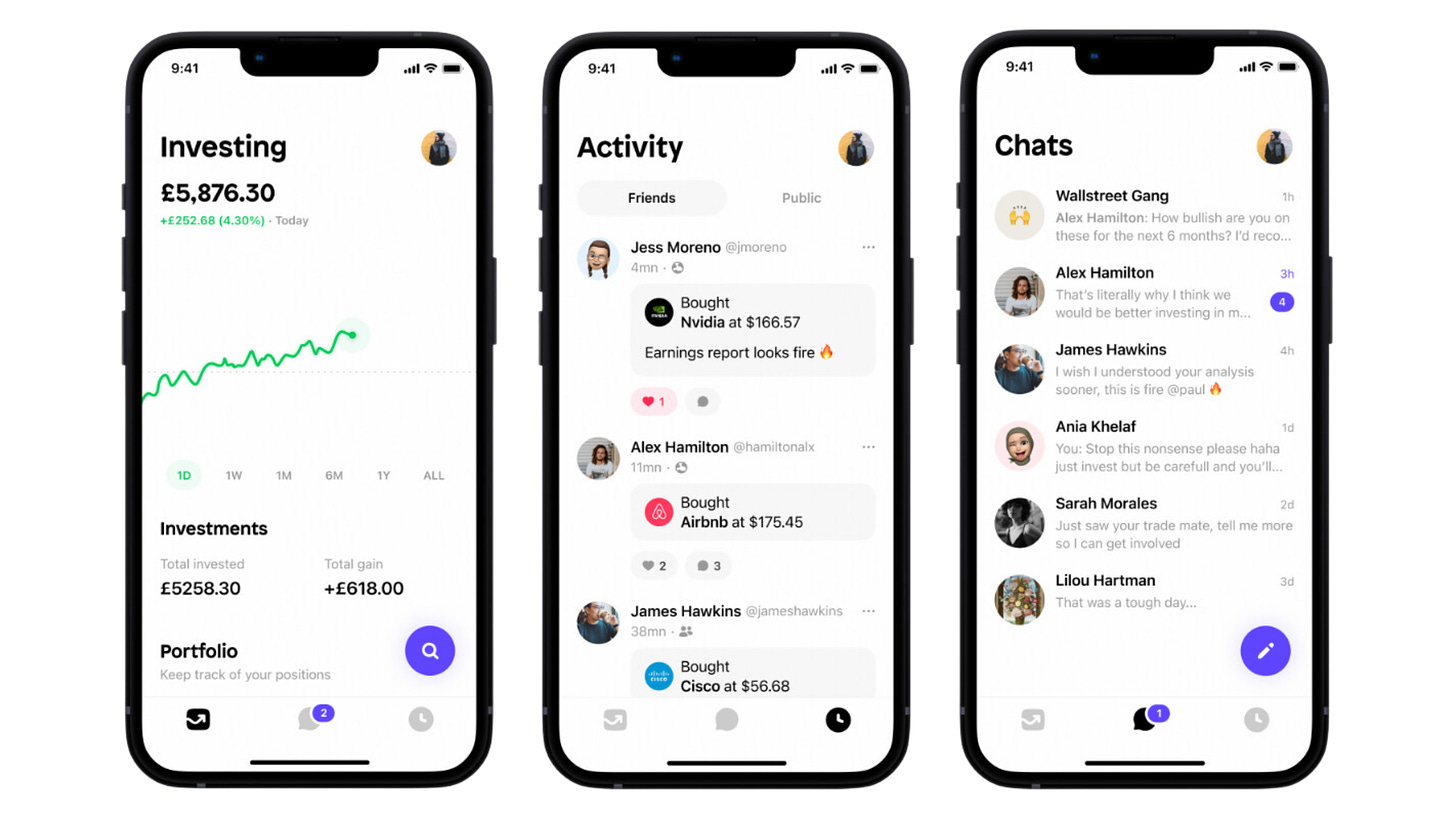

Another one is Shares.

It’s based in Europe, and it’s basically like Commonstock but with a better mobile app – and with features like chatting with and seeing what your friends are investing in.

Other apps that do pretty much the same thing:

StockTwits: Twitter-like feed plus day trading straight in the app. And lots of ads everywhere. What sets it apart is that it has “premium rooms” (about $99 a month or more) where you can chat with other degenerates. Ahem, traders.

eToro: same thing, except instead of premium rooms you can actually copy other traders. And people can also copy you, if you make your trades public.

Day traders have a terrible track record – please don’t day trade. But they are a part of the market, and understanding how other people feel about specific stocks could be useful.

How to actually use these tools

We’ll share a guide with you in the coming week, but for now our tips are:

First, use market sentiment as a starting point – but don’t rely on it too much. Timing based on hype is awful, but you can sometimes find interesting ideas.

Second, look for hype that’s building up, but not maximum hype. When people are too excited, you might want to sit that one out.

Third, strategies like “buy the rumor, sell the news” are probably best with market sentiment tools. We have actually done some great deals during the 2021 SPAC craze by looking at what SPACs people on Commonstock were excited about. Once the news about a SPAC actually buying a company was confirmed, we sold for a profit – then watched as the stock tanked.

Fourth, don’t fall for stories, and don’t be left “holding the bag”. Most of the time, people will just try to “pump their own bags” on social media. Especially if that social media is for traders only.

Finally, understand that each tool tracks a very different kind of person. Google Trends is mostly useful to see what customers do, whereas Brand24 will probably help you “hear” disgruntled voices. And Swaggystocks and the other tools are probably most useful for tracking lower-cap companies where a niche community like Redditors or day traders can actually have an impact.

More on this in our next post.

Until then, remember what John Maynard Keynes (one of the most influential economists ever) said:

“Investing is like predicting the winner of a beauty contest. Is not a case of choosing those faces that, to the best of one's judgment, are really the prettiest, nor even those that average opinion genuinely thinks the prettiest.

We have reached the third degree where we devote our intelligences to anticipating what average opinion expects the average opinion to be. And there are some, I believe, who practice the fourth, fifth and higher degrees.”

Then again, Keynes lost most of his money buying at the top.