Buffett's Japan bet is up 400%. Is UK next?

Let's find UK opportunities using Buffett's criteria.

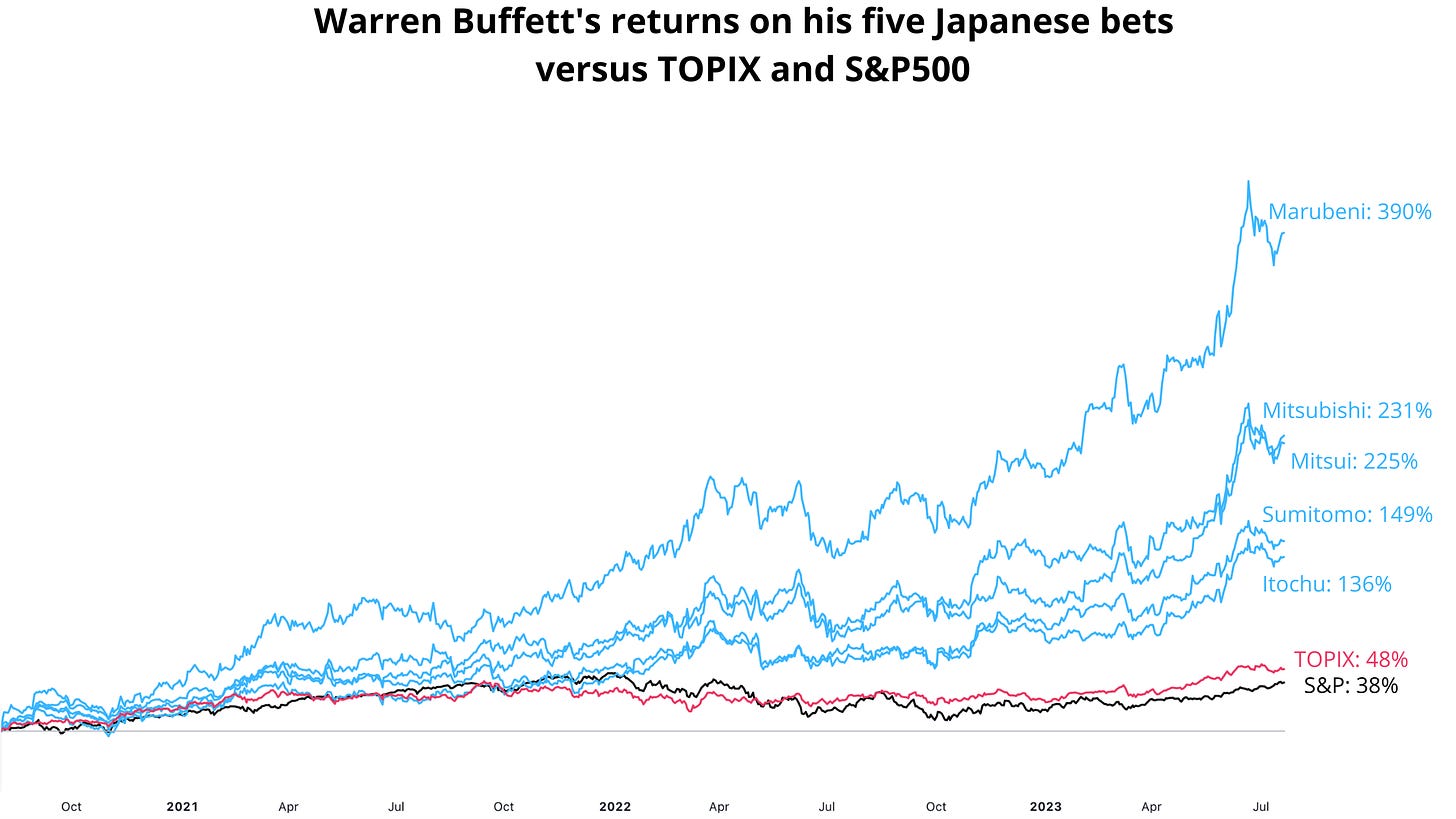

You probably know that Warren Buffett's Japan bets have nearly tripled in less than three years:

If you copied his trade, good for you. 4x return? Not bad.

Rumors are that he’s now looking at the UK stocks.

While unconfirmed (we’ll need to wait for Berkshire Hathaway’s next official 13F filing), let’s look at his logic behind the Japanese bets – and whether there are any companies in the UK that might deliver a similar return in the next few years.

Why did Buffett invest in Japan?

First of all, he didn’t simply “buy the index” – in this case, TOPIX. If he did, he would have only gotten a 48% return. Better than 38% for the S&P 500 during the same period, but still.

What he did was he bought stakes in Japan's five biggest "sogo shosha" – or general trading companies: Itochu, Marubeni, Mitsubishi, Mitsui, and Sumitomo.

Why these five?

One, it was “classic Buffett”: his signature strategy is buying companies trading below their intrinsic values. All but one of these five companies were trading below book value – meaning their market caps were lower than their net assets.

Two, the market was ignoring their improving operations: these companies had recently taken steps to improve how they were allocating capital and generating cash.

Three, the Japanese government had also been pressing the country's listed companies to return more money to investors – so they had also started buying their own shares through buybacks.

Four, their increasing dividend (between 2.3% to 6.2%), combined with a low interest rate in Japan (0.17% to 1.1%), meant that Buffett could borrow cheap and invest at a higher rate. It was a great, simple, low-risk carry trade. At this spread between interest and dividend, the stocks would have had fall by more than 50% for him to lose money! Plus, he did it all in the same currency – yen – so he had no currency risk.

Five, they are fairly diversified, with operations in mining, energy, food, aerospace, retail, real estate, finance, consulting, and logistics. Some analysts saw a similarity to Berkshire Hathaway in this sense.

Finally, it was a contrarian bet: Japan’s stock market had been a disappointment for many years. Most analysts at the time were skeptical of this bet. They saw these companies’ diversification as lack of focus; their joint-venture structure as lack of control; and the fact that these were old (“late-stage”) companies, meaning with limited upside.

Take it from Warren Buffett himself:

“I just thought these were big companies. They were companies that I generally understood what they did. Somewhat similar to Berkshire in that they owned lots of different interests. And they were selling at what I thought was a ridiculous price, particularly the price compared to the interest rates prevailing at that time.”

Was this a pump-and-dump?

No because he only had a 5% (later increased to around 7%) in these companies.

Which UK stocks has Buffett bought so far?

The media will have you think that UK is his next opportunity:

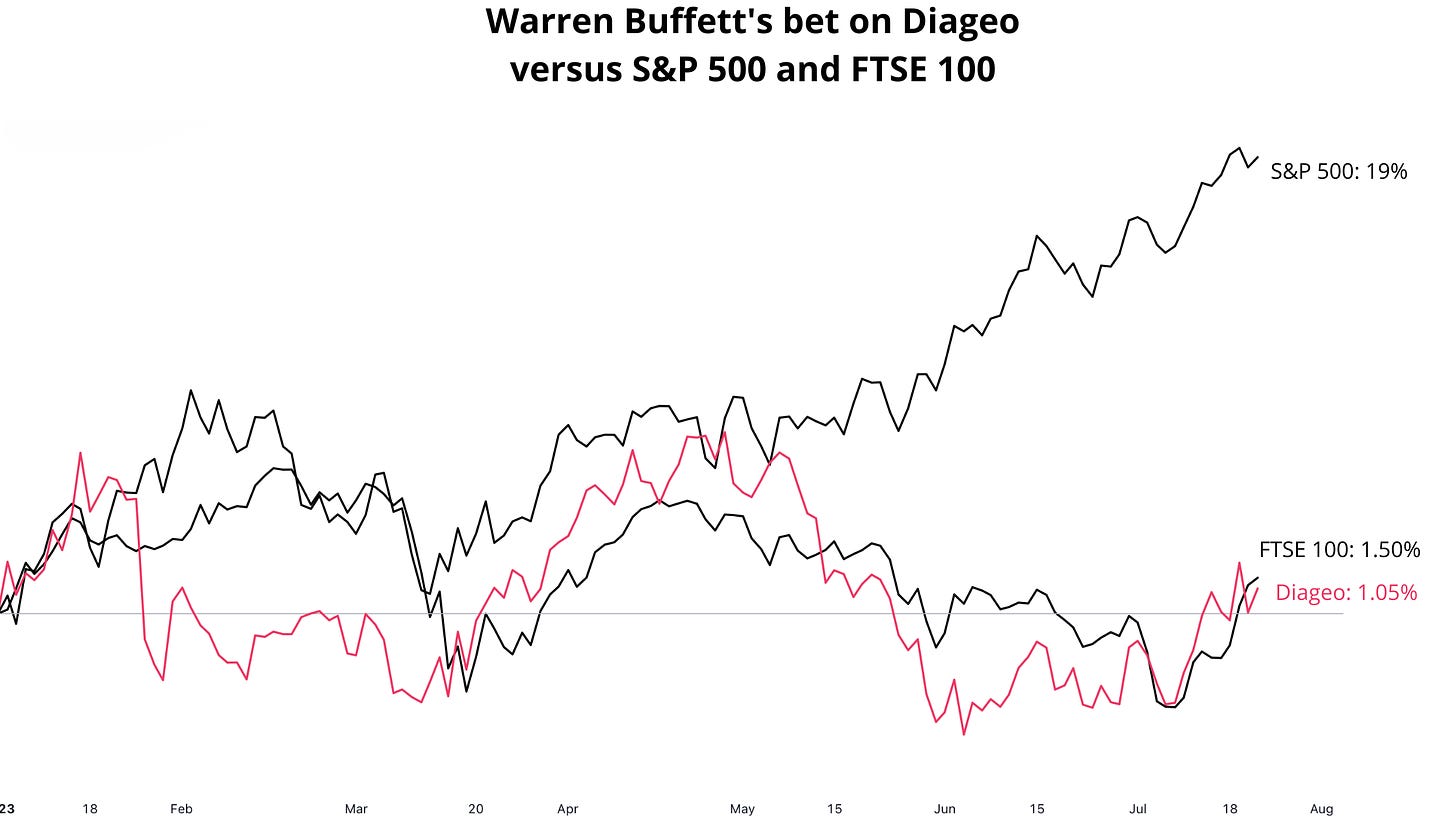

The reality is: last quarter, he placed a small bet (0.01% of his portfolio) on only one UK stock, Diageo. So far, it hasn’t done too well, lagging both the US and the UK market:

He might be looking at other companies, but we just won’t know until Berkshire Hathaway releases its next portfolio disclosure (13F filing) on August 14.

What we can do is figure out if the UK market as a whole fits his criteria – and then see which other companies would be interesting to him.

Is the UK in 2023 like Japan in 2020?

About 20 years ago, Warren Buffett put came up with an interesting way to figure out whether the stock market is under or overvalued – by comparing the market cap of all listed companies to the gross domestic product (GDP) of the country.

It’s basically price-to-earnings (P/E) for countries, so no wonder that Buffett, a value investor, loves it:

“The ratio has certain limitations in telling you what you need to know. Still, it is probably the best single measure of where valuations stand at any given moment.”

When Buffett invested in Japan, its total market cap to GDP ratio was 109%.

UK’s now is about 107%.

So the UK, just as Japan back then, seems fairly valued.

And by that same indicator, the US is overvalued – with a ratio of 153%.

So it would make sense for Buffett to look abroad a bit more, and the UK seems to fit the bill so far.

Which UK stocks could be attractive “carry trade” targets?

This is where things start to get different.

Japan had decades-low interest rates – some of the lowest in the world, in fact.

UK is at the opposite end in 2023: it’s currently dealing with a stubborn case of inflation, and as a result the Bank of England has had to raise rates aggressively, 13 times already – and is forecasted to continue doing so in the near term.

Right now the UK benchmark interest rate sits at 5%, and some analysts forecast it could go up to 6.5% by start of 2024.

Looking at dividend yields alone, there are only a few companies where Buffett could borrow in British pounds and still have a comfortable 3% margin.

Would he take significant positions in any of these?

Perhaps. At first glance 4 of these seem like interesting targets:

Let’s look at them one by one in the next post.

We’ll also look at a few UK companies with a lower dividend yield but juicy P/E ratios, wide moat, and growing earnings. It’s not always about carry trades.

Subscribe to receive it in your inbox:

And of course, if you have friends interested in becoming the next Buffett, why don’t you share this post with them?

MarketScouts is at the very beginning, so any share counts!