Argentina: 130% inflation and... an investment opportunity?

We take a look – on the ground! – at one of the most interesting economies currently preparing for a dramatic change.

“There are four kinds of countries in the world: developed countries, undeveloped countries, Japan, and Argentina.” – Simon Kuznets, winner of the 1971 Nobel Memorial Prize in Economics

As it happens, I (Vincent) have been studying in Argentina for about a month. I’ve learned more about economics here than in any class I have taken before.

Triple-digit inflation, black markets, artificial exchange rates, constant price changes, trade restrictions, and political unrest – all present here.

The misuse of taxes and funds has thrown Argentina into a huge deficit, and its citizens have lost trust in their government's ability to handle their money.

As of last year, the nation experienced an astonishing 90% inflation rate and is looking at a near 130% this year.

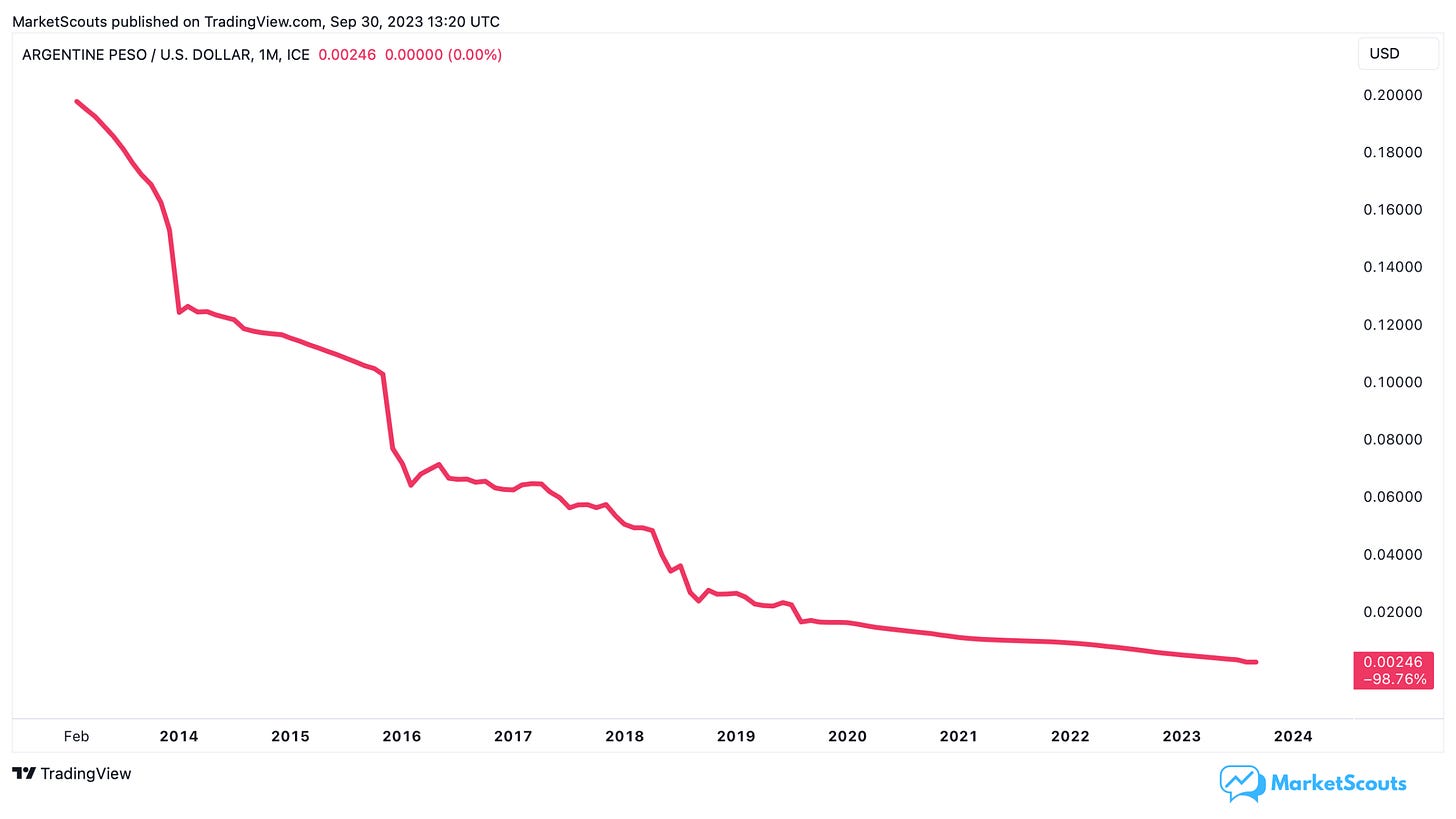

Here’s the value of an Argentinian peso (ARS) compared to one US dollar:

Well, that’s actually the “official” rate. As bad as it looks, most people can’t even use it because of capital controls – you simply can’t get as much USD as you need.

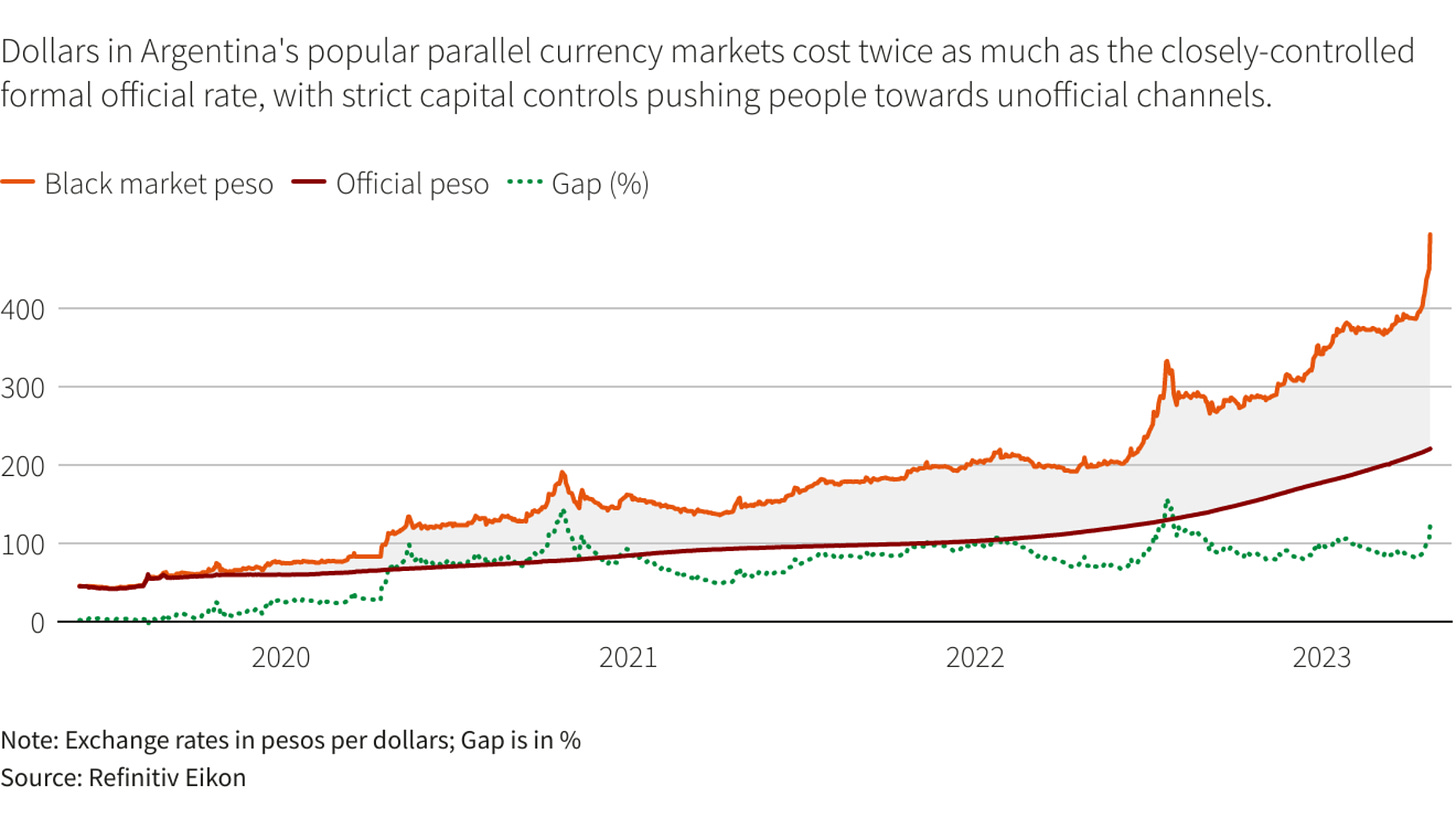

As the government tried to stop the dollarization of the economy, it created an artificial exchange rate, and accidentally gave birth to the “blue market.”

90% of USD/ARS transactions are actually made at this “blue rate” (the unofficial rate) and are off the books. While technically illegal, everybody uses it – including the police. It’s the only way to protect their savings:

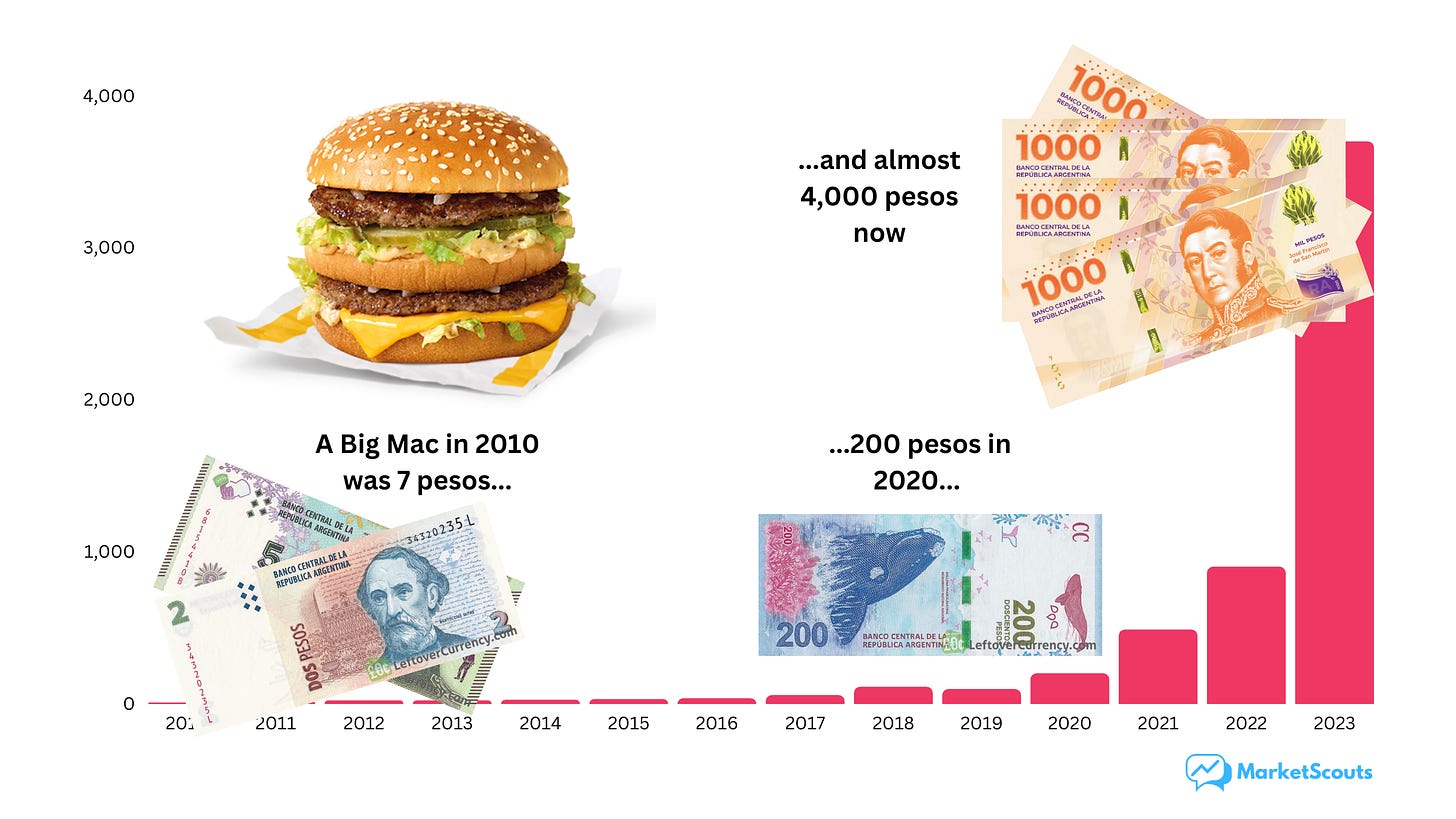

This might sound a bit abstract, so here’s what that means when we look at the price of a McDonalds’ Big Mac in Argentinian pesos (ARS):

But the wind of change is blowing in Argentina.

The presidential elections are next month, and the leading candidate is promising new reforms – and gaining support from a fed-up population that’s kept it together surprisingly well so far.

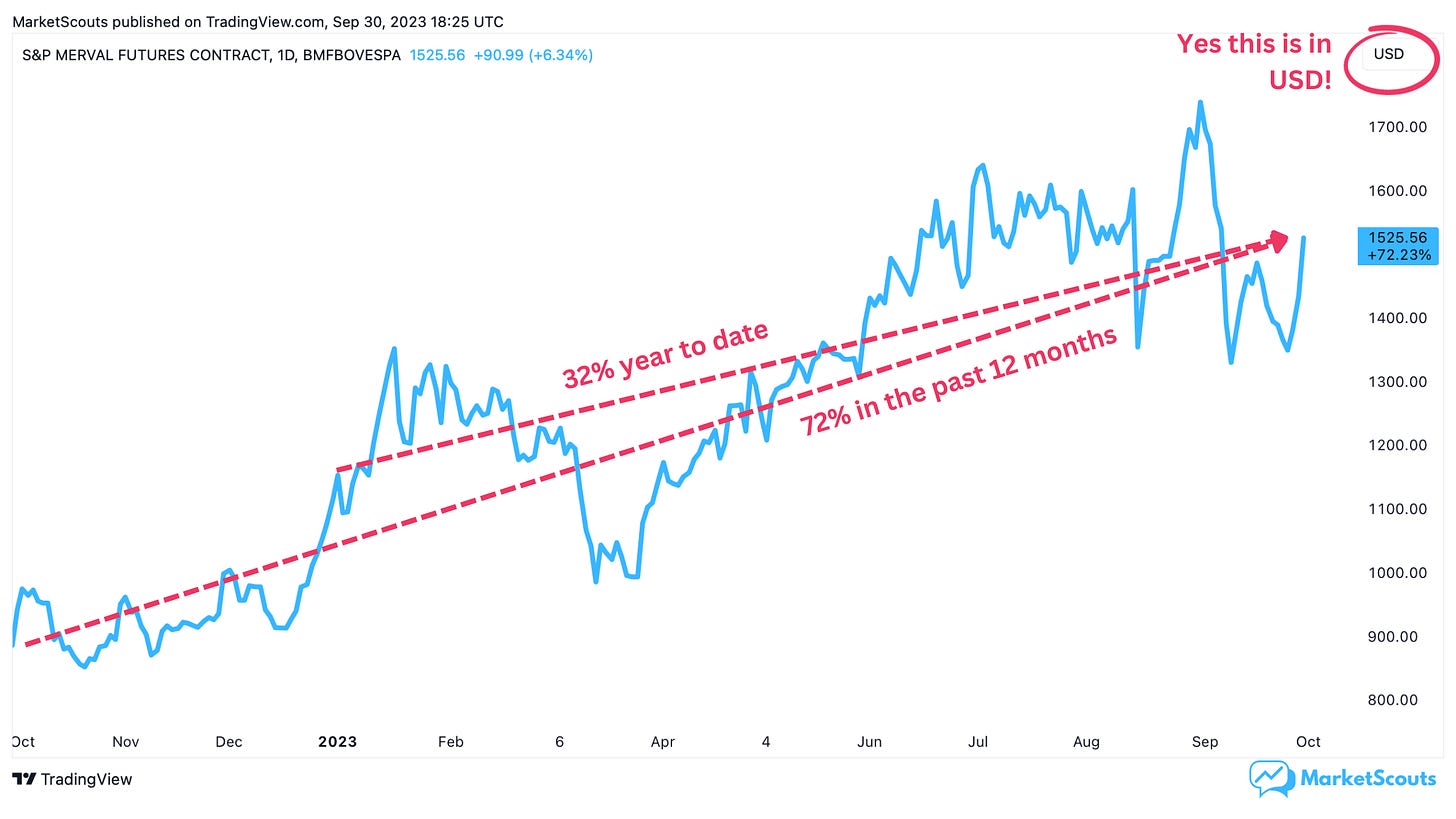

This anticipation has created interest among foreign investors. Argentina's stock market index has increased 72% in the past year – in USD.

So I thought I’d make the most of my time here and help you figure out if Argentina might finally become a “buy”!

But first: how did we get here?

An economy doesn’t nosedive overnight. It all started with an economic crisis in the 1980s, made worse as the government took on more and more debt.

Unfortunately, this debt was used to create a massive welfare state:

40% of Argentine citizens rely on social welfare programs

62% of government revenue goes to pensions, salaries, and unemployment

$25 billion goes to funding energy, transportation, and food subsidies.

Not really the most productive use of money.

On top of this, state-owned enterprises (SOEs) in Argentina run everything from oil and gas to banks and even the postal service. SOEs do not have competition, are government backed, and so have no incentive to improve and be profitable.

As a result, Argentina couldn’t generate the money it needed to pay back its debt, and defaulted on $93 billion worth of debt in 2001 – and then another $50 billion in 2018, shutting them off from most international investors.

So the only real option for the government was good old printing money.

This video from The Economist goes into a bit more detail if you’re curious:

What makes things different now?

October 22, 2023, marks the day a new leader will take the helm of the Argentine government. The arrival of a new political party, La Libertad Avanza, has caused ripple effects in the stock market.

The party’s founder and candidate, Javier Milei, is a libertarian economist who promotes free markets and limited government intervention.

What he’s planning to do:

dollarize the Argentine Economy (officially, at least)

shut down the Central Bank of Argentina (no need for one anymore)

privatize and even take public SOEs – painful in the short term (many jobs depend on them) but needed in the long term, and an opportunity for investors (we’ll talk about this in a second)

reduce government spending – no more comfy welfare programs

incentivize natural resource exploration – which, as we’ll see in a bit, Argentina has a lot of!

If Milei can make good on these promises, we expect a wave of investment – both domestic and foreign – as well as a strong boost to trade and GDP.

Can Milei pull this off?

We don’t know who will win, but polls put Milei in the lead, with 32% of the total vote. He also takes about 60% of all Google searches related to the election.

Let’s say he wins.

He’ll need more than popularity. He’ll also need time – experts estimate that his biggest proposals (such as dollarizing Argentina or abolishing the central bank) would take anywhere from 9 months to 2 years to get done.

We also expect things like abolishing the current welfare program and privatization of the SOEs to be met with heavy opposition – there’s a lot of free money and cushy jobs at stake.

Other policies could be done faster and see more popular support, like cutting taxes and creating new jobs in the exploration of natural resources.

There’s reason to be hopeful, but this is a mix bag of reforms. Then again, Milei himself is a bit of a mixed bag.

Does Argentina’s economy have potential?

Despite the inflation, despite the mismanagement, in the medium-term, the prospects for Argentina are very exciting:

It has a growing and highly educated young population

The enrollment rate for post secondary education is 83%, compared with USA’s 62%

Literacy rate stands at 99% – in the USA it’s 79%

The country has the highest number of psychologists per capita in the world, with around 198 psychologists per 100,000 inhabitants! That might explain why everyone is keeping it together so well considering what the country is going through.

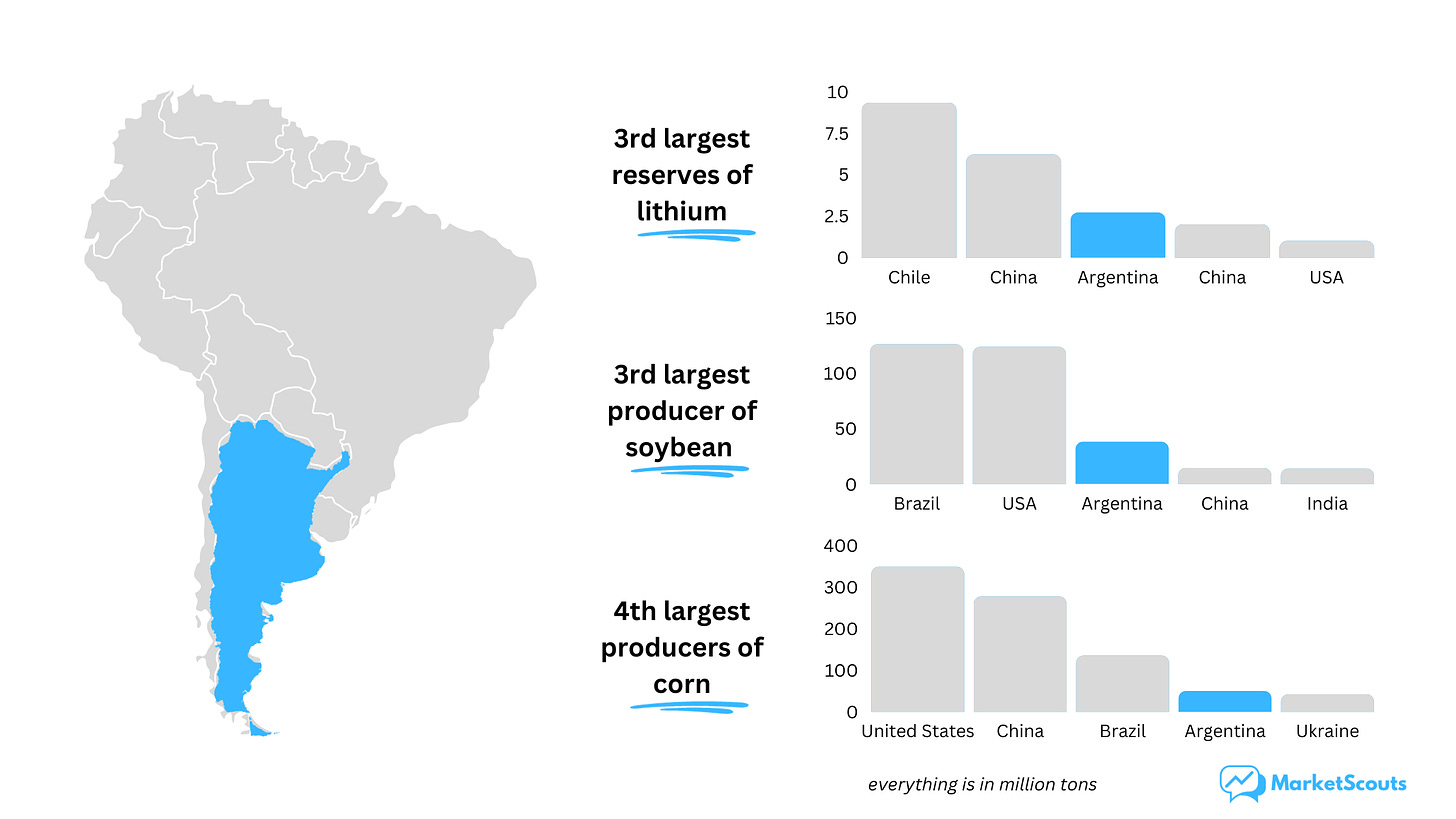

It’s one of the “world top 5” in a few natural resources and exports

Argentina has the third largest lithium deposit in the world – the stuff powering the batteries that go into everything from laptops and phones to electric cars.

Good news for Argentina, which has a ton of it – yet has done almost nothing with those reserves so far!

It’s also the third largest soybean and fourth largest corn producer in the world:

It’s also the world’s fifth producer of wine, has the fifth largest reserves of oil in Latin America, etc etc.

Bonus: tourists love it

Argentina expects to receive 6.4 million tourists by the end of this year, double that of 2022.

That’s about 139 tourists for every 1,000 locals, far more than its neighbors – Brazil only gets 25 tourists per local – and closer to the US, which receives about 190 tourists per 1,000 Americans.

Assuming reforms succeed, is Argentina’s stock market a real opportunity?

Excitement about the prospect of these reforms has already impacted the Argentinian stock market. Argentina’s main index, the S&P Merval (MERV), has almost doubled since last year – and grew 32% this year alone.

And yet, Adelmo Gabbi, the Buenos Aires stock exchange chief, has recently said that the index is trading at a "very low price".

Is it?

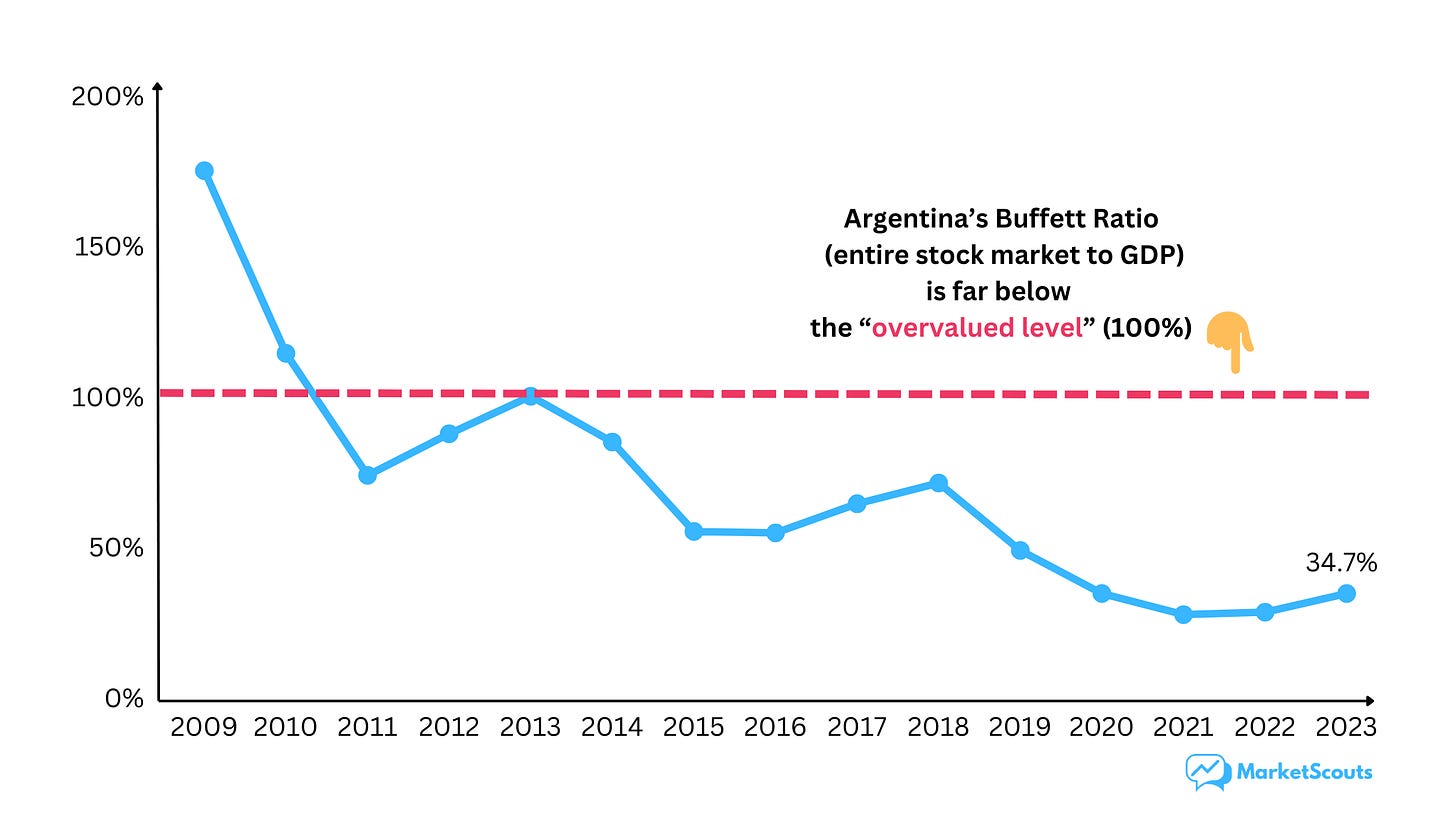

If we look at the Buffett Ratio (we compare GDP to the value of the entire stock market), The S&P Merval has a Buffett Ratio of 34.7%.

The US is at 130%. Another country plagued by high inflation, Turkey, is at 140%.

Based on this ratio alone, the index looks cheap indeed.

In fact, Argentina's Buffett ratio of 34.7% is the lowest Buffett ratio in the world out of the 100 countries that are tracked by the World Bank.

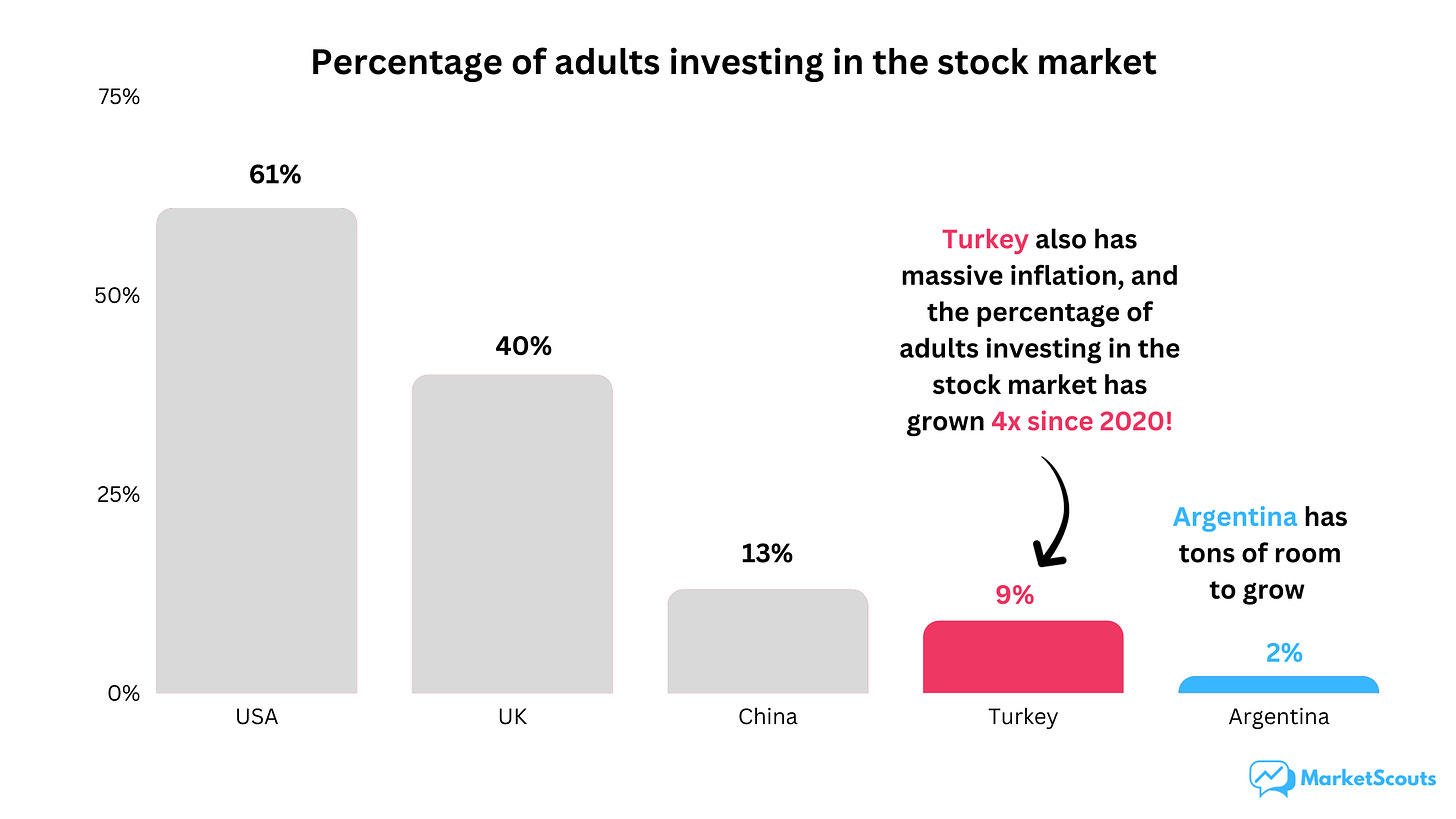

Another indicator if you want to see if a country has “room to grow”? The percentage of people who are invested in the stock market.

According to the Comisión Nacional de Valores (CNV), the Argentine securities regulator, only about 2% of Argentines invest in their stock market.

In the US, that percentage is 61%. In the UK, 40%. And even in Turkey it’s higher, as investors piled into stocks to protect against inflation:

So there’s plenty of room to grow based on this indicator as well. It all comes back again to confidence, the election, and how the reforms will pan out.

Argentina already has some “regional champion” stocks

Many Argentinian companies are also doing surprisingly well, and have operations across the region. One example, and the current hero of the Argentinian stock market, is MercadoLibre.

MercadoLibre does a bit of everything: e-commerce, lending, payments, and more. Think of it as Latin America’s Amazon, eBay, Stripe, PayPal, eBay, Experian, Revolut, and Ant Financial, all in one.

It operates all across the Latin America. In 2022, for example, revenues from Argentina accounted for only 24%.

Over the past five years, MercadoLibre has seen a 500% increase in gross profit (in USD!) and is forecasted to grow at an average of 27.3% per year.

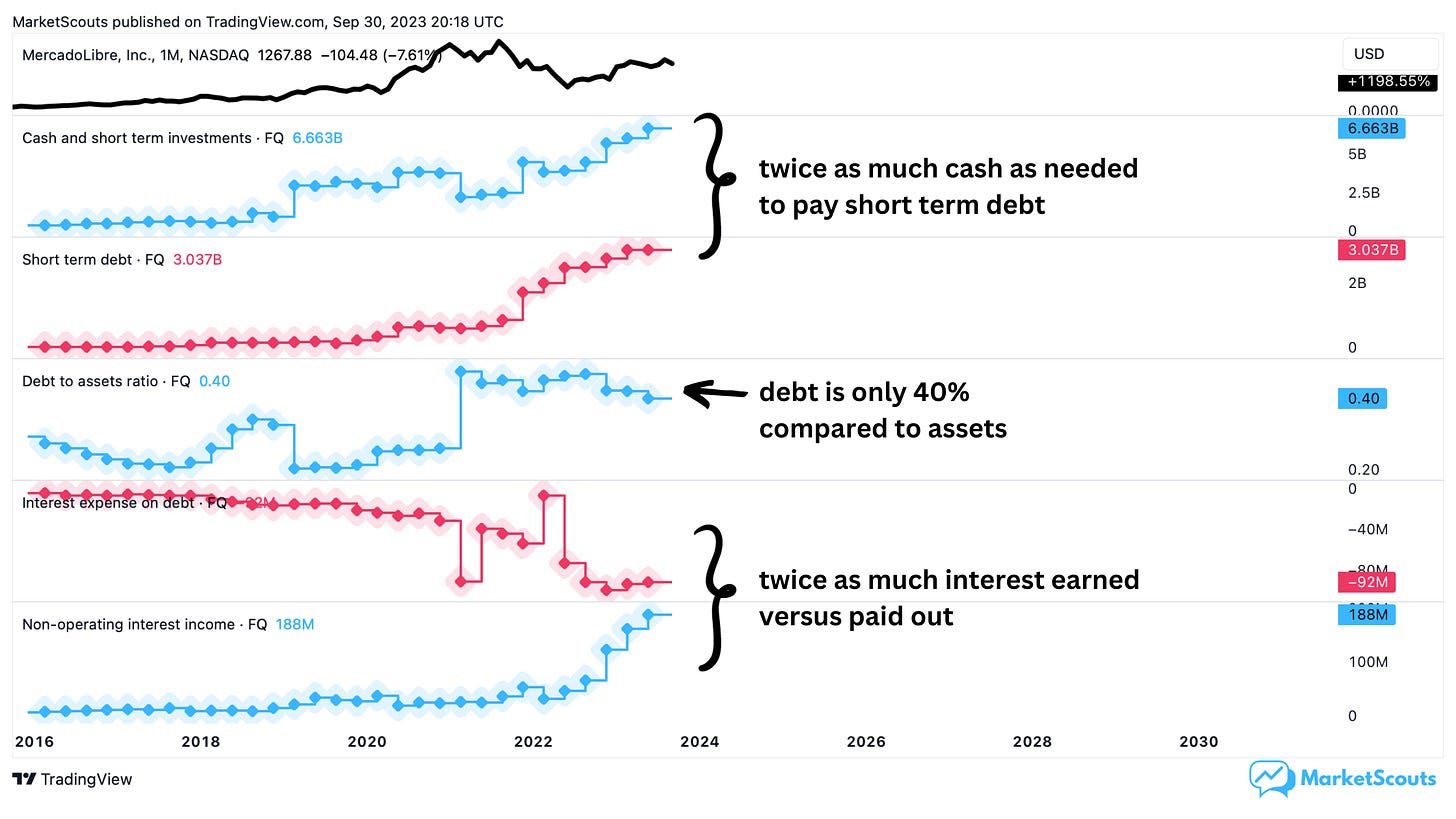

The company is also in good financial health:

This level of success also brought a high valuation, though: its Price to Earnings ratio is 86. That’s more similar to Amazon’s 100 than to other companies in Latin America – where the average P/E ratio is now at 8.

How to invest in Argentina?

There are two ways for foreigners to invest in Argentina right now:

Look into American Depository Receipts (ADR). ADRs are shares of foreign companies that are traded on American stock exchanges. You can invest in MercadoLibre, Grupo Financiero Galicia, Telecom Argentina, YPF, Pampa Energia, or Tenaris.

You could also invest in the Global X MSCI Argentina ETF (ticker: ARGT), an ETF listed on the NYSE that tracks Argentine stocks.

The time is now! (maybe)

We basically have two possible choices:

The high risk approach: invest now, before the elections.

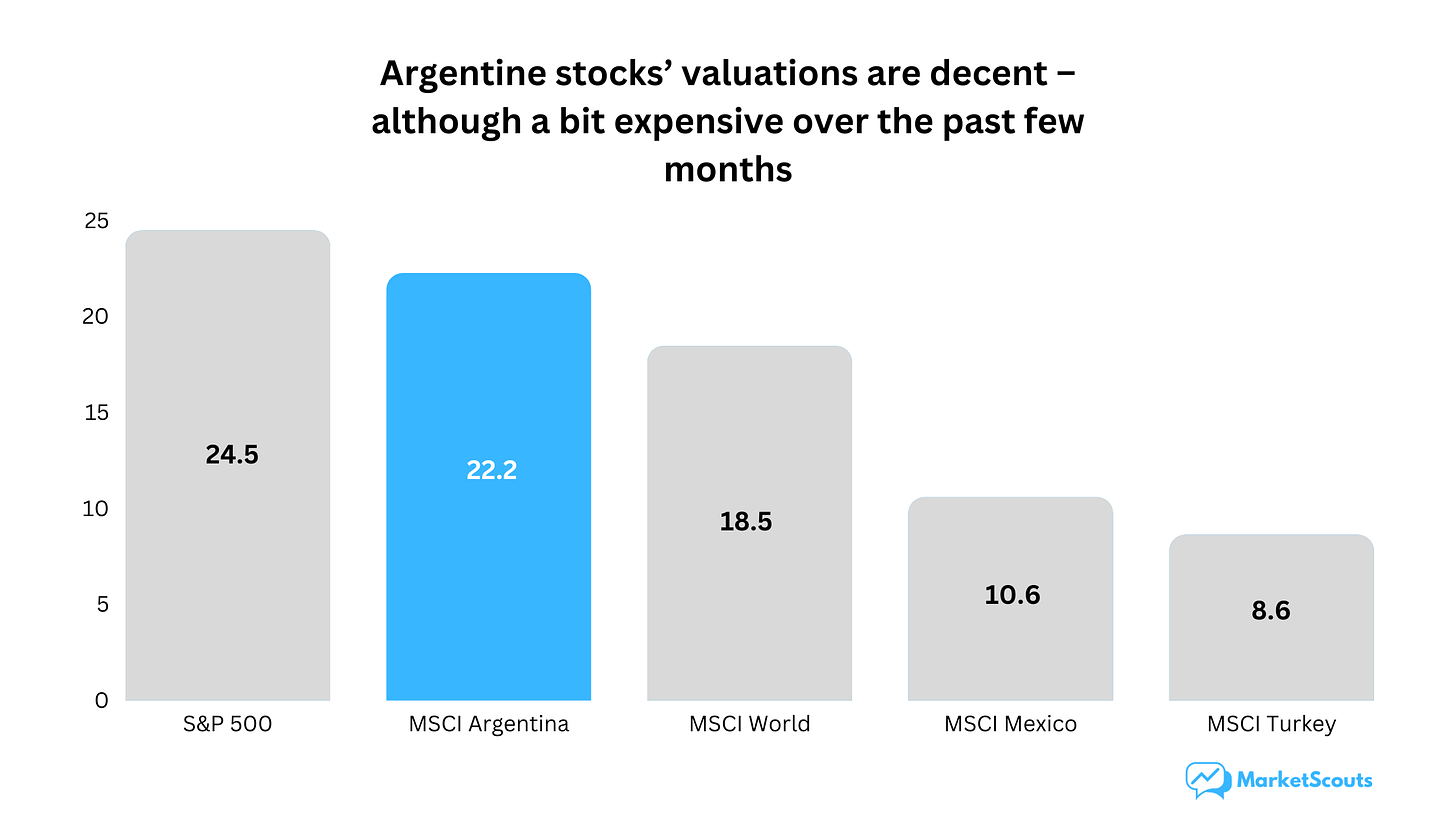

On the bright side, valuations are decent, market capitalization is low, and there’s plenty of momentum.

But timing and riding out the ups and downs of the market matter. We might very well see a “buy the rumor, sell the news” situation – excitement is already building up.

The lower risk approach: wait until Milei is elected and see how reforms pan out first

What looks particularly interesting are the future IPOs of any SOEs that the government will want to privatize.

Most IPOs tend to be a bad deal for investors – but the government racing to take these clunky companies off its books might create some “fire sale” opportunities.

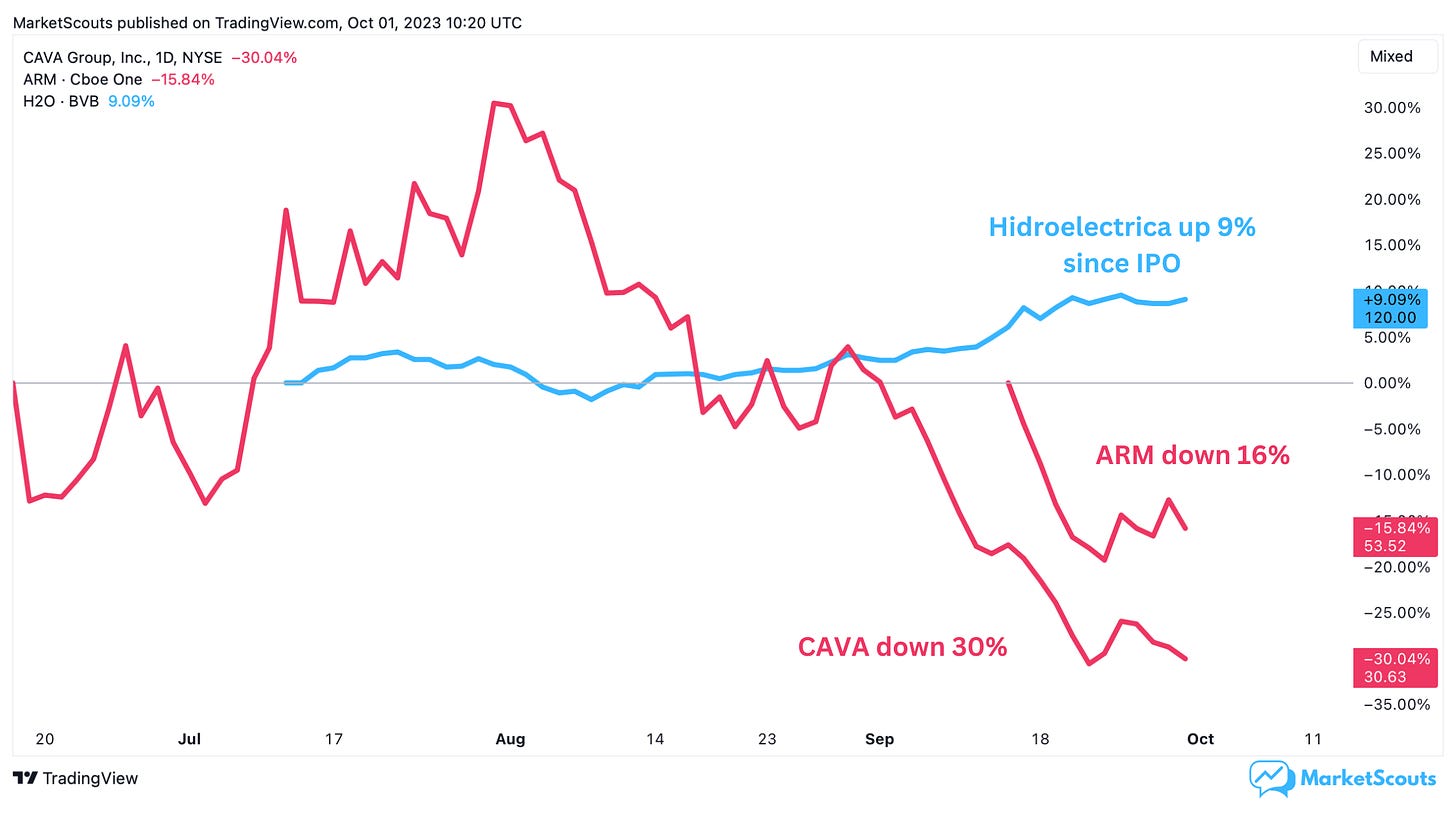

This was the case earlier this year in Romania. The Romanian government had to sell at least 15% of its state-owned utility Hidroelectrica to the public just to comply with European rules – and qualify for 6 billion euros from EU funds.

As a result, the fire sale meant that the Hydroelectrica IPO wasn’t overhyped and overpriced – and is up 9% since.

Compare that to some of the “flashy” IPOs we’ve seen this year, like the CAVA restaurant chain or the chip-maker ARM:

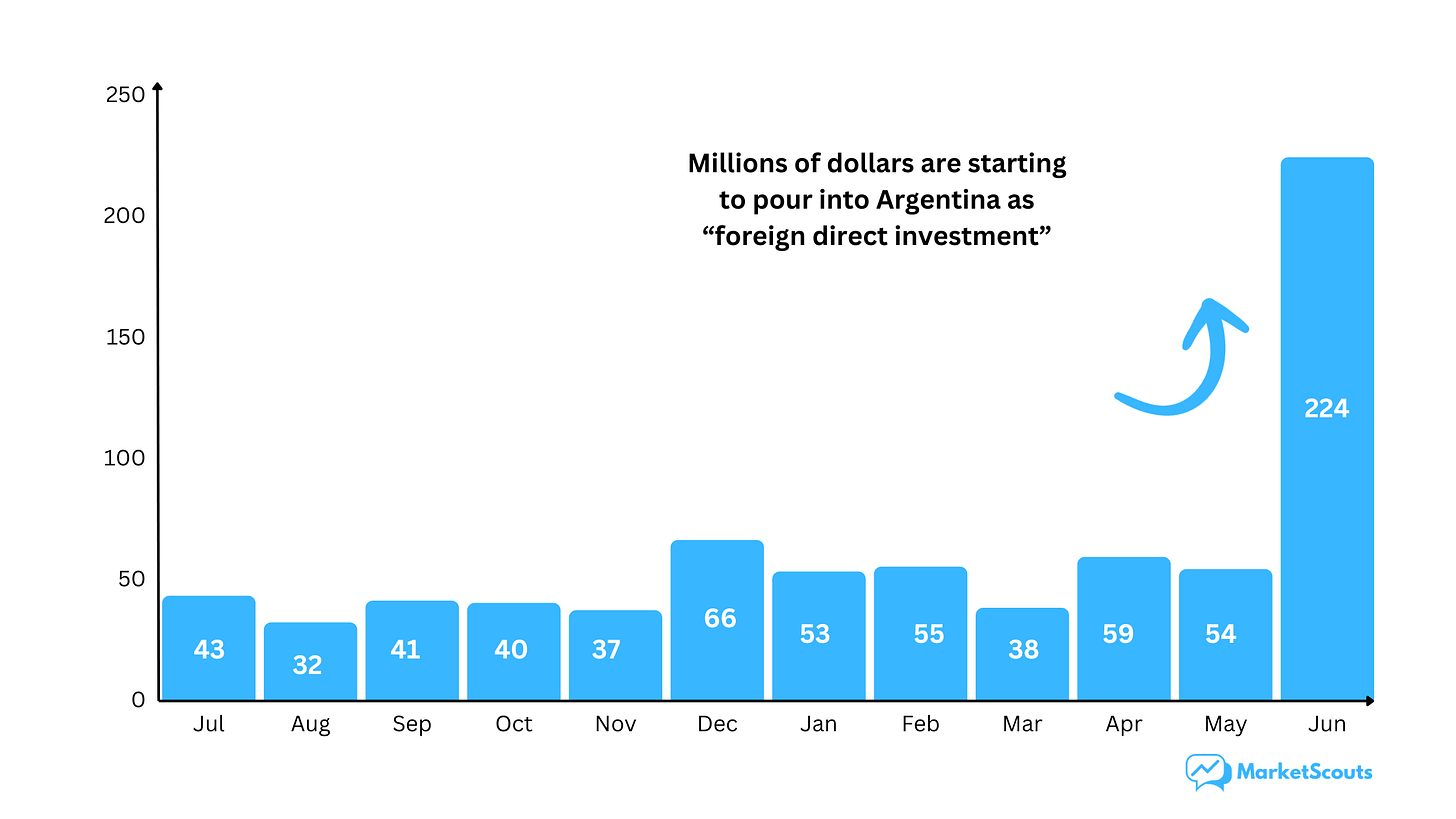

In any case, whichever strategy you pick, at least you won’t be alone. Many other investors think that Argentina is finally a buy.

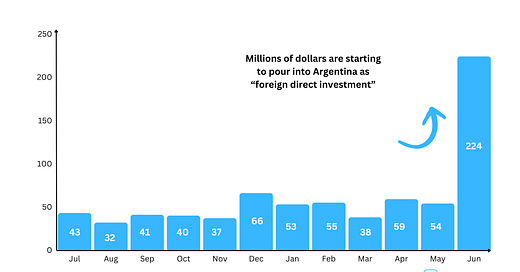

JP Morgan, Morgan Stanley, and even eBay have invested in Argentina – followed by BlackRock, Fosun, Tencent, and BTG Pactual, which in the past two months alone have poured over $6 billion into the top companies of the S&P Merval.

For now, the best thing to do is observe and learn more about what is happening within Argentina – and decide whether we can stomach this level of risk.