2025 is here! Here's what the top 6 asset managers predict

What the world's largest asset management firms agree (and disagree) about.

As we step into 2025, the financial world is abuzz with predictions about what lies ahead. Leading asset management firms—from BlackRock to Vanguard and beyond—have laid out bold strategies to navigate the evolving economic landscape. From the transformative potential of artificial intelligence to the growing emphasis on sustainability and emerging markets, the next year promises to reshape the investment playbook in profound ways. Let's dive into the most compelling themes and strategies shaping the future of investing.

First, let’s look at what each of the top 6 firms is most optimistic about.

BlackRock: “keep buying AI and US and diversify with emerging markets”

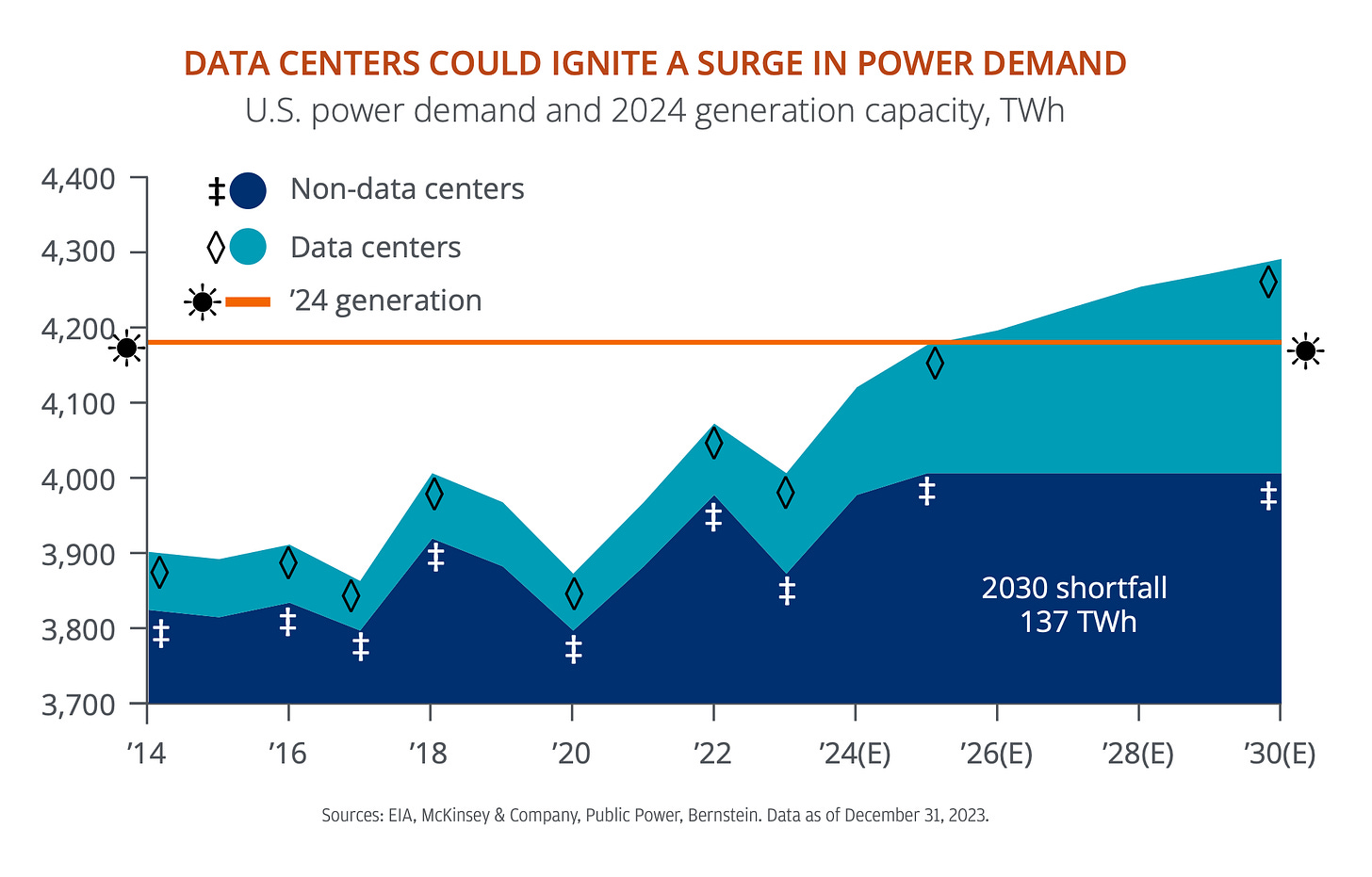

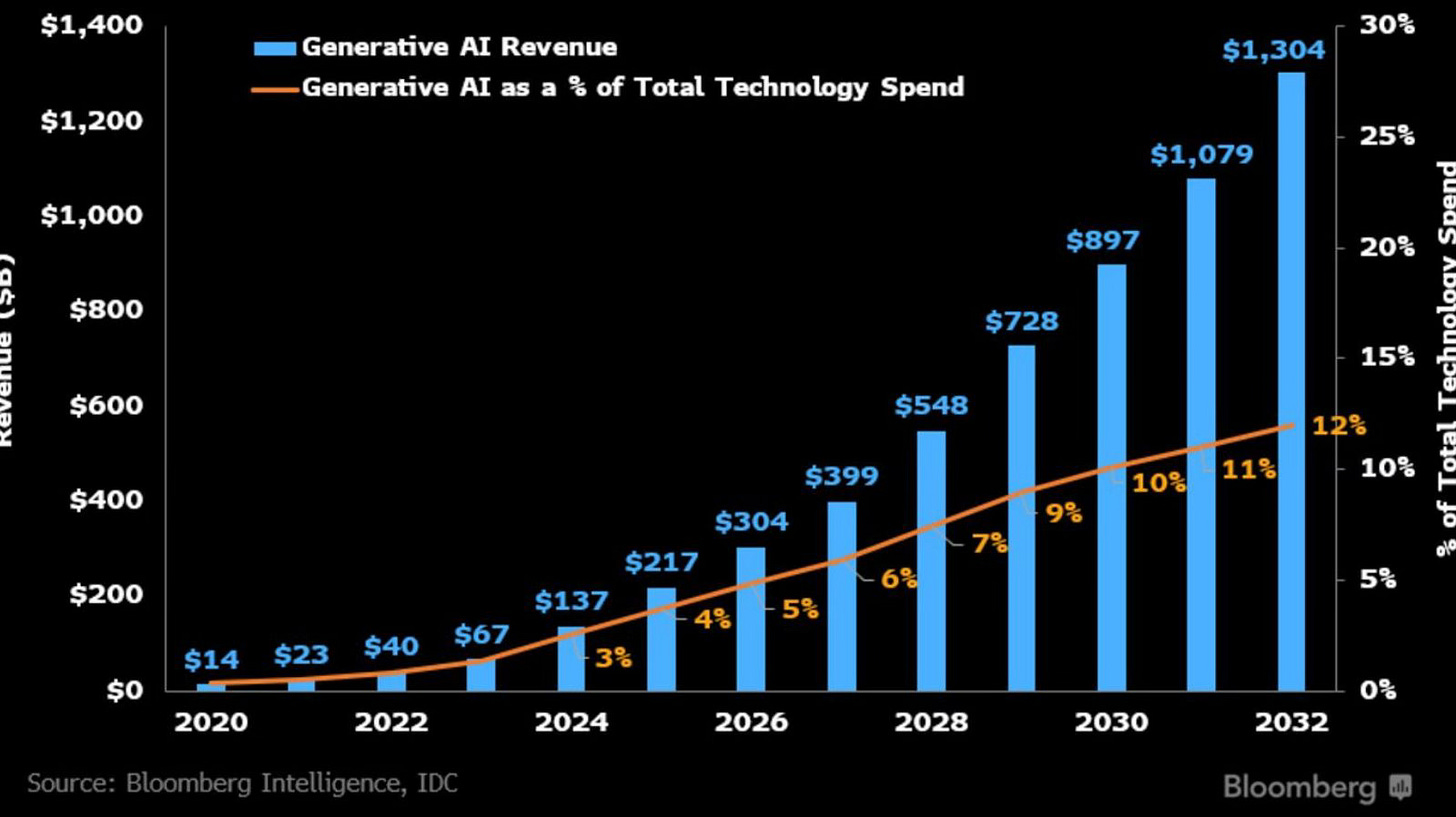

BlackRock is a big believer in AI, despite the massive run-up recently. They’re making it a top strategic priority for 2025. According to their 2025 outlook, spending on infrastructure such as data centers, semiconductors, and power systems is projected to exceed $700 billion by 2030, marking this a “mega force comparable to the industrial revolution”.

Because of this strong AI-driven earnings growth and robust corporate profits, BlackRock is also bullish on US equities. Add to the cocktail favorable tax policies and BlackRock expects US stocks to continue outperforming global peers – despite rich valuations.

If this chart makes you ask yourself “what’s the point of investing outside the US?”, BlackRock claims that 2025 might finally be the year that emerging markets can become interesting again.

For example, India and Saudi Arabia can be decent medium-priority targets due to their critical roles in the global energy transition, not to mention the economic potential and their expanding tech sectors. Both markets are well-positioned within the energy transition supply chain, making them attractive investment destinations.

Vanguard: “time to be cautious”

With valuations 25%–72% above fair value and 30% of the S&P 500 concentrated in just six firms, Vanguard seems limited upside in AI and the US – unlike BlackRock.

In fact, Vanguard’s team is most bullish on “ex-US” equities, especially when considering the attractive valuations and productivity improvements in Europe and Japan. Other opportunities are in emerging markets except China – like India and Southeast Asia, which are driven by excellent demographics and government support.

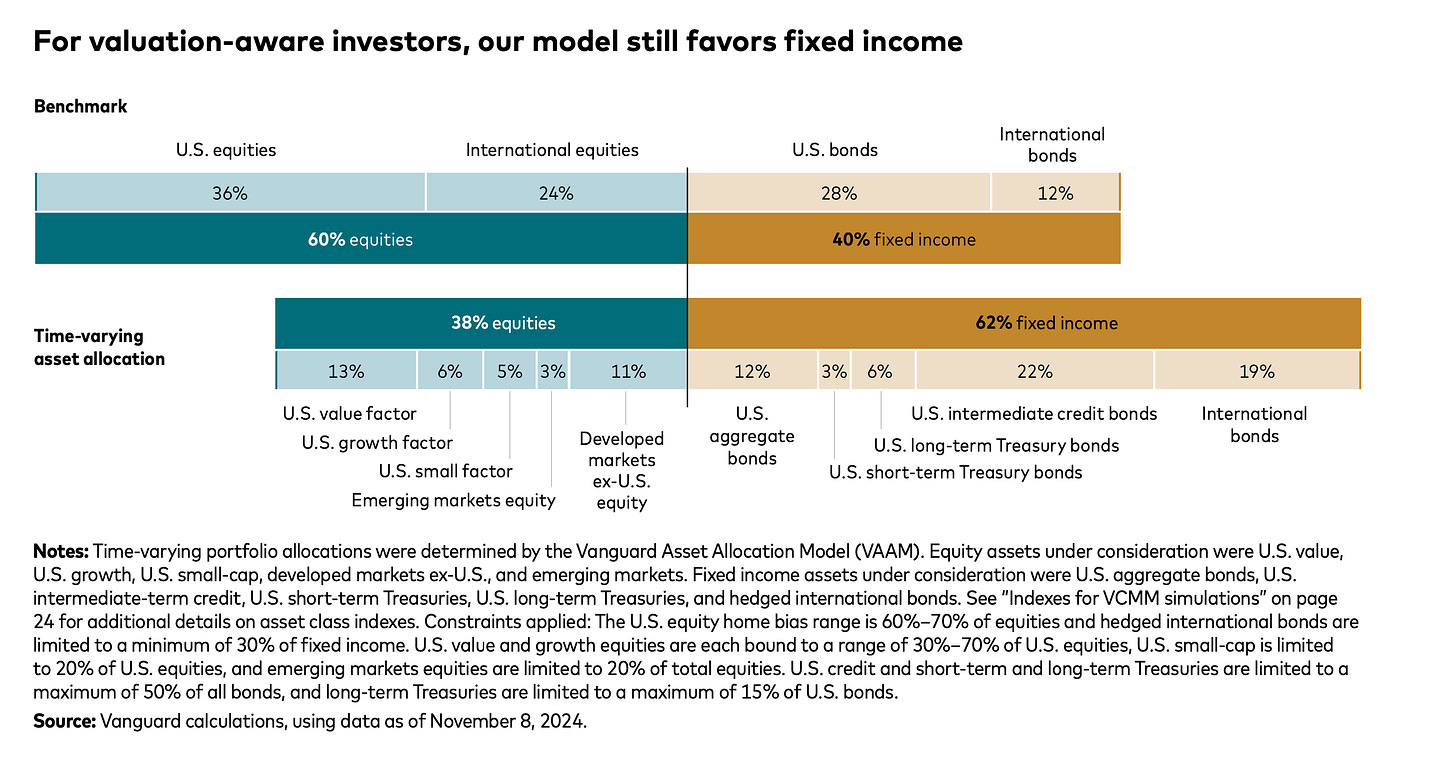

Overall, though, Vanguard would rather all of us focused more on fixed income this year, forecasting 4.3%–5.3% annualized returns. Their 2025 outlook argues that elevated yields and the “coupon wall” can be great for income generation and stability during a year of continued inflation and volatility. Also, according to Vanguard’s outlook, bonds have a 81% probability of positive returns in this environment.

Fidelity: “become resilient against inflation, focus on stable growth, and don’t ignore emerging markets”

Fidelity is somewhat in between BlackRock and Vanguard.

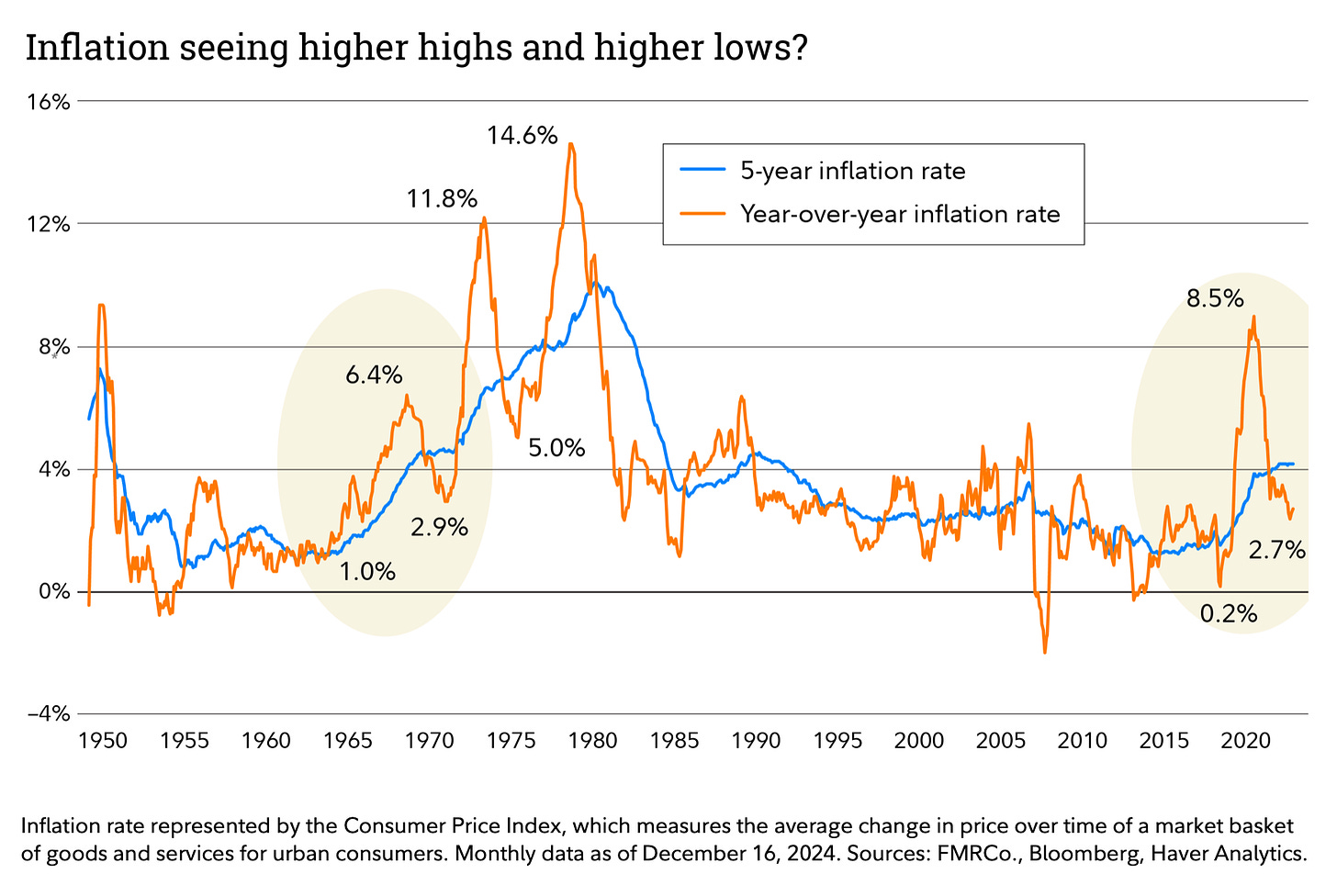

For 2025, Fidelity places high priority on real estate and commodities to counter persistent inflation, which they believe will keep running around 3%. Commodities benefit from constrained supply chains, while real estate provides steady income streams in rising-price environments.

Inflation uncertainty also means interest rate volatility. To counter this, Fidelity also recommends short- and medium-term bonds, as these durations can better mitigate duration risk in volatile markets.

Fidelity also assigns medium to high priority to the energy and healthcare sectors. Energy benefits from structural underinvestment, offering upside potential, while healthcare leverages aging demographics and technological advancements. Both offer exposure to solid, stable, predictable macro trends.

On a regional basis, Fidelity also prioritizes emerging markets like India and Saudi Arabia, given their decent valuations and earnings momentum. They’ve also started domestic reforms, investment in resources, and are less impacted by global rate fluctuations. In a bear case scenario for US stocks, India and Saudi Arabia can offer some stability and less correlation to the US.

Goldman Sachs: “focus on earnings, hedge, and look out for M&A opportunities”

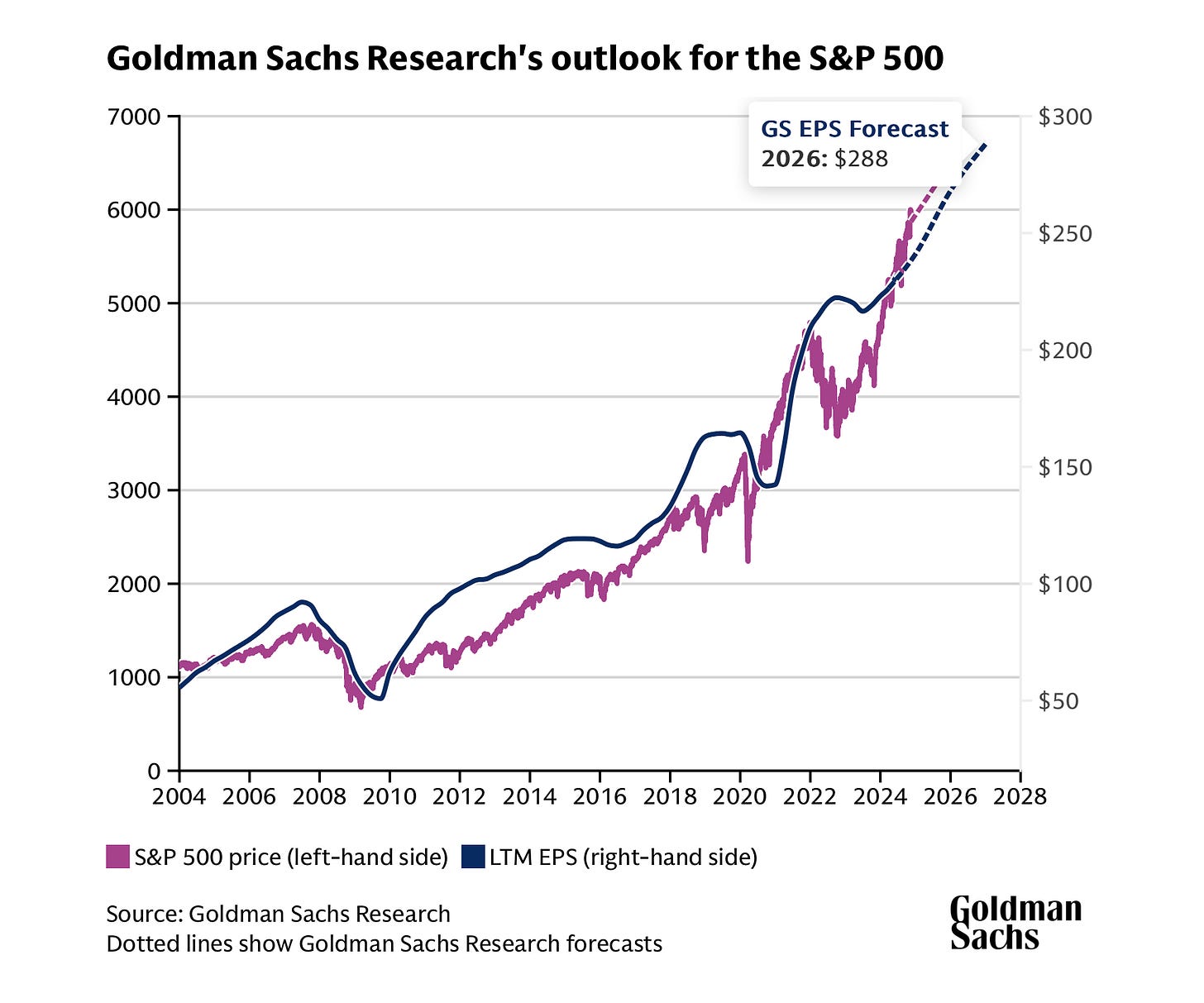

Goldman Sachs sees an expected 10% return from the stock market this year, driven by robust earnings growth.

Besides the US, Japan is a strong favorite: strong corporate earnings, domestic demand recovery, and policy normalization make it a top location this year.

GS also suggests exploring undervalued markets like the UK, emerging markets, and even some Chinese stocks. The reason? Very large valuation gaps compared to the UK, combined with a strong recovery potential amid monetary easing.

In terms of industries, cyclical sectors such as industrials and consumer discretionary, alongside AI investments, are seen by GS as the best bets this year. These areas are expected to benefit from both global economic growth and technological innovation. Software and services firms, which are probably in the best position to capitalize on AI-enabled revenues, are seen as offering durable, secular growth less reliant on economic fluctuations.

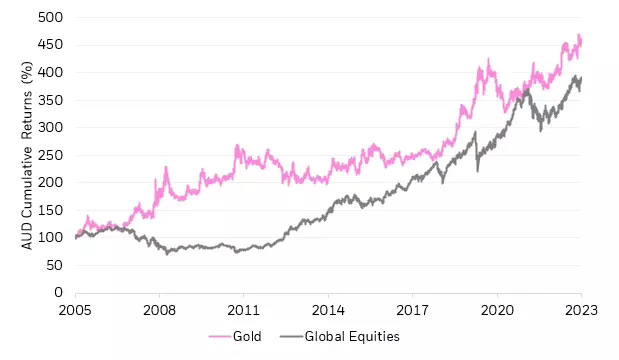

On the hedge side, Goldman Sachs recommends including oil and gold to mitigate uncertainties from potential trade tensions, inflation pressures, and supply chain disruptions.

Finally, expect quite a bit of M&A. Goldman Sachs forecasts a 25% year-on-year increase in US deals above $100 million this year. Time to pick companies that might be interesting “targets”?

J.P. Morgan: “can’t go wrong with US, AI, and energy”

J.P. Morgan sees 15% earnings growth in 2025 for US equities. That being said, they do believe that growth is going to come from more than just mega-cap tech, and they do see stabilized profit margins across all sectors.

Outside of the US, JPM’s outlook is quite negative on Europe and China, which face risks from Trump-era tariffs and cyclical challenges. Instead, they recommend looking at markets such as India, Taiwan, and Japan, where structural reforms, technology cycles, and demographic advantages can help boost earnings.

In terms of industries, JPM is very bullish on AI infrastructure ($225 billion in projected spend!) and the global energy transition.

Amundi: “diversify, diversify, diversify”

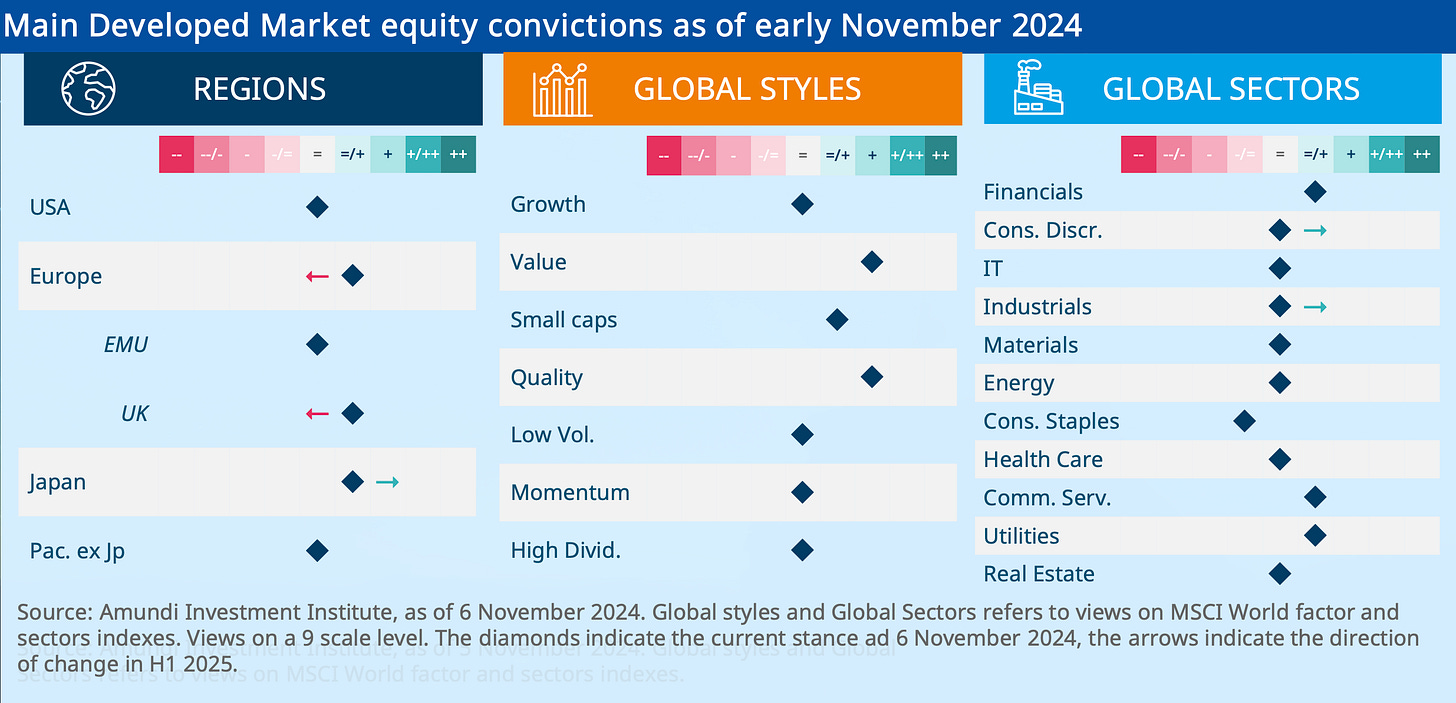

Amundi is another investing giant that sees opportunity beyond the US mega-caps. Unlike JP Morgan, though, they quite like European value stocks, mid-caps, and sectors like financials and utilities, which are poised to benefit from Europe’s economic recovery – and come with a very low price.

However, Amundi’s favourite region for equities this year seems to be Asia. Amundi assigns medium to high priority to emerging Asian economies, especially India and Indonesia. These two countries come with robust domestic demand and structural growth opportunities. The Asian opportunities doesn’t stop here – Amundi also suggests to pick (cautiously!) Chinese stocks, and to focus more on Japan, where strong momentum, policy support, and improving fundamentals seem quite good now.

What should we make of these forecasts?

Reading these “next year’s outlook” reports can be a fun (if you like charts) exercise to get us to think about how different assets can evolve. However, no bank forecasted the S&P 500 to deliver 27% (including dividends) last year. And they didn’t forecast global recessions or market crashes either. That being said, there are a few interesting bets here. Let’s look at them one by one.

The AI expansion

Despite what we might think of ChatGPT, AI infrastructure spending is not slowing down. In fact, it is projected to reach $1.3T billion by 2035, creating revenue opportunities across semiconductors, data centers, and automation.

One way to bet on this is through ETFs like the Global X Robotics & Artificial Intelligence ETF (BOTZ), which has $2.5 billion in assets under management, or the iShares Robotics and Artificial Intelligence Multisector ETF (IRBO), which has delivered a 3-year average return of 14.8%. Key stocks include NVIDIA, whose revenue surged 171% YoY in Q3 2024 due to AI demand, Microsoft, with a projected $10 billion annual revenue from OpenAI partnerships, and Palantir, which reported a 35% YoY increase in government AI contracts.

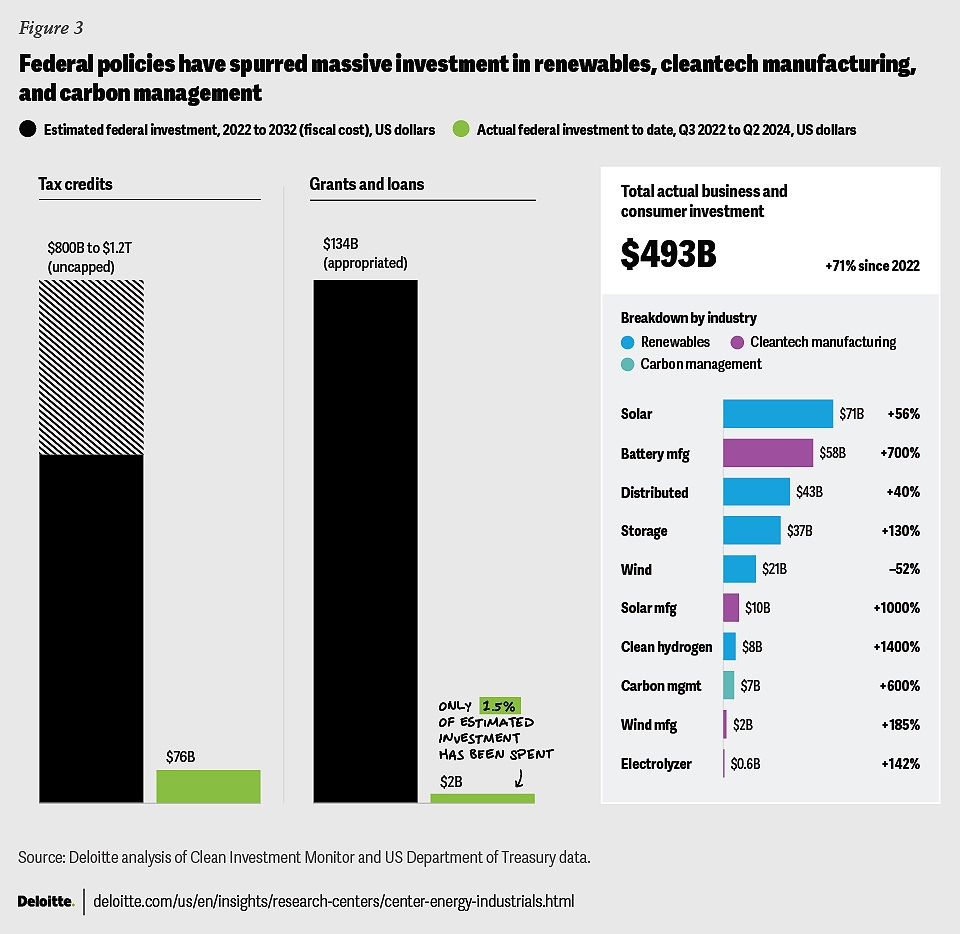

Infrastructure and renewable energy

All that AI needs power. A lot of it. But even before factoring in AI, global energy spending is projected to reach $3.5 trillion annually. On top of this, since energy is a critical input, the returns of energy investments are extremely inflation-resistant. No wonder that the $369 billion US Inflation Reduction Act prioritized renewable energy projects.

To capitalize, consider funds like the iShares Global Infrastructure ETF (IGF), with $3 billion AUM and exposure to 75+ infrastructure companies, or the Invesco Solar ETF (TAN), which has delivered a 5-year average return of 13%.

Top stocks include NextEra Energy, investing $100 billion in clean energy by 2030, and Brookfield Renewable Partners, which is targeting a ROE of 15% across hydropower and solar projects.

Emerging markets

Emerging markets have disappointed investors for a long time. However, most of the top asset management firms now agree – it’s time for a comeback. Markets like India, Indonesia, and Saudi Arabia offer undervalued equities, driven by demographic advantages, trade integration, and fiscal reforms. On top of this, India is projected to become the world’s third-largest economy by 2030, with Indonesia benefiting from a $34 billion green industrial investment pipeline.

Consider ETFs like the iShares MSCI Emerging Markets ETF (EEM), which provides exposure to over 800 emerging market equities, or the VanEck Vietnam ETF (VNM), which has gained 20% YTD. If you prefer stock picking, key players are Reliance Industries, driving India’s consumer and digital transformation, and Taiwan Semiconductor Manufacturing Company (TSMC), controlling over 50% of the global semiconductor market.

Balanced US equity exposure

US companies remain dominant in technology, healthcare, and AI-driven sectors. However, valuations are getting more stretched by the day. One way to continue having exposure to the US while reducing risk is to combine tech stocks with cyclical and value sectors. BlackRock has a product just for this – the iShares US Thematic Rotation Active ETF (THRO).

An even simpler strategy? Choosing an equal-weighted index versus the usual one. Closing the gap between the Magnificent 7 and the rest of the S&P 500 seems like a matter of time looking at this chart from Amundi.

Hedge against USD depreciation and geopolitical risks

While we don’t like to discuss politics, but many analysts expect increased geopolitical tensions and fiscal deficits – which make assets like gold and energy-transition metals quite attractive.

To reduce some of these risks, consider gold, inflation-linked bonds, and metals benefiting from the energy transition. Funds like the SPDR Gold Shares ETF (GLD) can be a good hedge against USD depreciation, with gold historically rising during geopolitical tensions. iShares TIPS Bond ETF (TIP) offers exposure to inflation-protected bonds, further shielding against rising inflation. For energy transition metals, Global X Lithium & Battery Tech ETF (LIT) focuses on lithium, crucial for EVs, with lithium prices up 150% last year. This strategy guards against USD weakness while capitalizing on commodities with strong growth potential.

Explore European equities

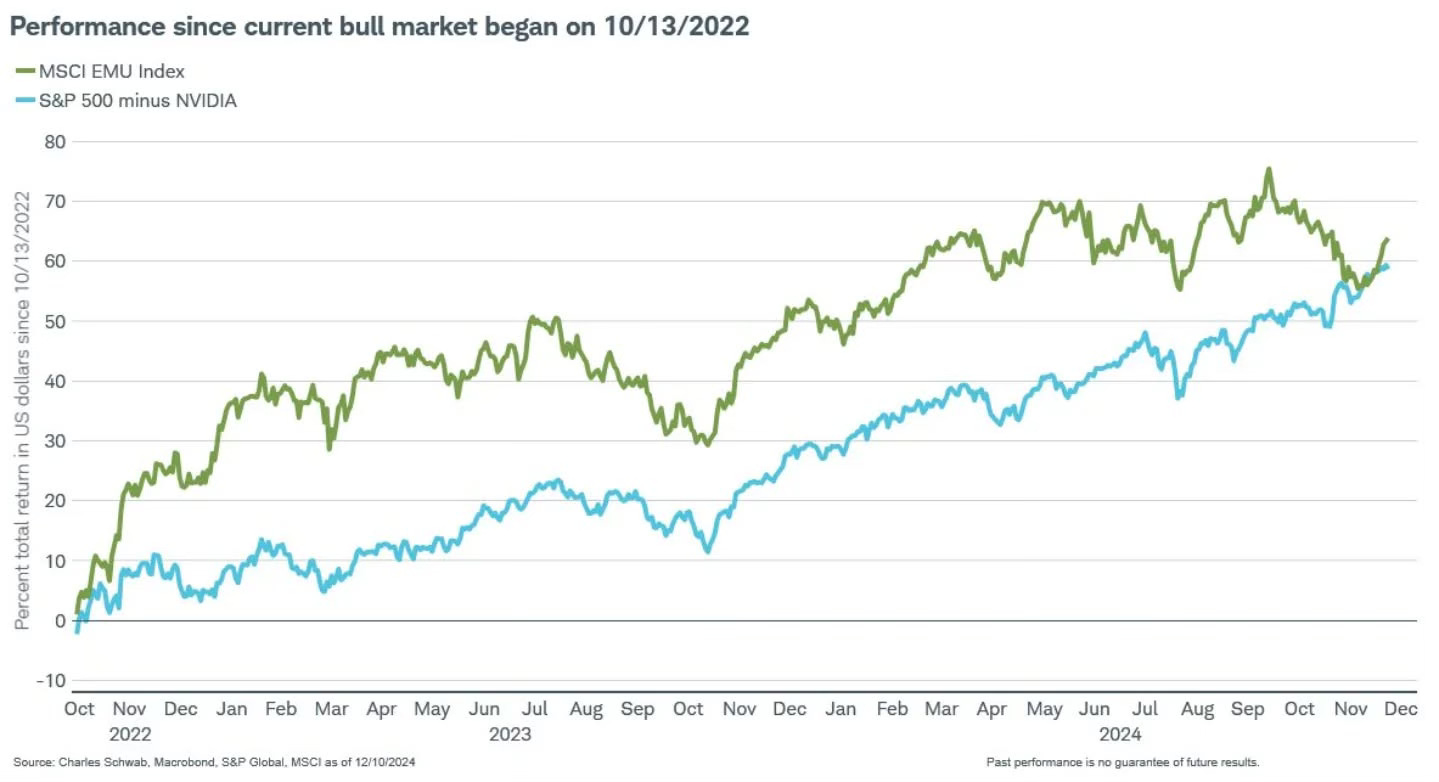

There is a narrative that the European stock market lags behind the US. However, this story conveniently forgets that for the past two years the S&P 500 has benefitted significantly from the extraordinary performance of a single company – Nvidia.

But if we remove Nvidia's contribution to the S&P 500, the narrative of US market exceptionalism takes a sharp turn. Look at the chart below: Europe's MSCI EMU Index, representing the European equity market, has outperformed the S&P 500 since the start of the current bull market (October 13, 2022). In other words, much of the US stock market's relative outperformance hinges on a small subset of companies. How long can this last?

How do you feel about what these “2025 Outlook” pdfs have to say? Useless or a decent starting point? Do you trust their expertise - or prefer to do your own research?